https://likedatosocanmeh.wordpress....-more-temasek-must-disclose-ceos-pay-package/

$20 million or probably more, Temasek must disclose CEO’s pay package

March 22, 2015 by phillip ang

As stakeholders of Temasek Holdings, all citizens have the right to know not only the bonus of its CEO but the annual pay package of all its directors.

PAP is obligated to disclose the amount of

reserves used to remunerate Temasek directors. Instead, PAP has privatised public funds and Temasek has no statutory obligation to disclose any information it prefers to conceal.

Last year, Temasek and the PMO refused to reply to my query on Temasek directors’ remuneration. Why? Is the remuneration so highly embarrassing if disclosed? After some research, I estimate Temasek CEO’s pay package to be at least

$20 million. This is based on the following:

– In 2012, the compensation of DBS Group CEO Piyush Gupta hit a record of $9.33 million.

– In 2011, Keppel Corp CEO’s package totaled at least $11.6 million.

According to a post in 2010, Alex Au inferred from Temasek CEO-designate Charles Goodyear’s compensation at BHP and his highly educated guess was that Ho Ching was paid between $8 million and $24 million. That was more than a year after global stock markets had hit bottom in March 2009.

Based on Temasek’s portfolio increasing by $133 billion, group shareholder equity increasing $122 billion and Temasek operating on a commercial basis, Ho’s leadership role should earn her at least $20 million.

Recall the

PAP rewarded its ministers with 19-month bonuses in 2008 (Link:

https://likedatosocanmeh.wordpress....rded-theselves-with-20-month-bonuses-in-2008/) after global stock market had collapsed. Since Temasek operates on a commercial basis, its CEO bonus should be nothing less than PAP’s 19 months.

Annual pay/monthly salary – 13 months = bonus

Similar to PAP, Temasek has an even more complicated remuneration structure which basically

reveals NOTHING. Stated under its ‘Remuneration Philosophy’:

1 “Our base salaries reflect market benchmarks” – There are no benchmarks in dollar terms.

2 “..volunteered up to 25% pay reductions” – Again there are no specifics. Perhaps the CEO took only a 5% pay cut? Then again, if the base pay was reduced from a stratospheric level, similar to our ministerial pay, wouldn’t that be still high?

Temasek’s complicated bonus payout (similar to PAP’s policies in housing, CPF, etc) comprises the following:

1 Annual Cash Bonuses

2 Rolling S$ total shareholder return (%)

3 Wealth Added (WA) Bonus Bank – medium term incentive

4 Co-ownership Grants – long-term incentive

5 Co-ownership Alignment in Practice

6 WA Incentives of key team

After so much disclosure on its remuneration philosophy, Temasek has still not stated how much of our reserves have been paid to all its 500 employees and directors. $500 million? $1 billion? What exactly is Temasek trying to conceal from the public by publishing totally irrelevant information?

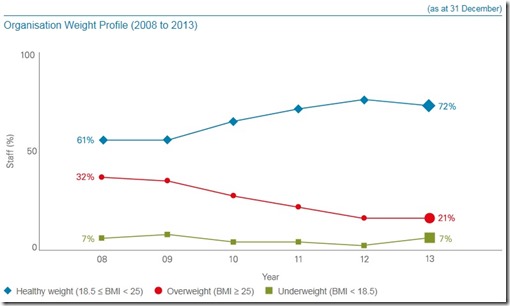

Totally irrelevant information even includes the

weight profile of its staff ! Would any investor require this sort of information from the fund manager?

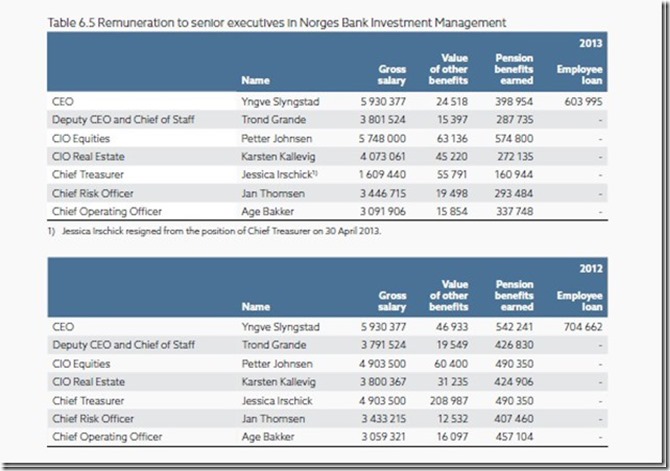

Why is Temasek unable to disclose remuneration figures when Norway’s Government Pension Fund Global (GPFG) publishes all the remuneration details of its directors? (below)

When GPFG, which manages

more than $1 trillion, can afford to be totally transparent, does it not raise suspicions that Temasek has been concealing what’s probably embarrassing information?

In Temasek Review 2014, Temasek claims to have delivered annualised returns of 15% for investments made after 2002 whereas investments made prior to March 2002 delivered an annualised 11% since 2002. Coincidentally, Ho Ching became a director in May 2002 and CEO in January 2004.

It appears the stage has been set to reward its CEO par excellence with a generous amount of our reserves. Temasek could clarify but of course it wouldn’t.

In Kenneth’s article, he highlighted the construction of Changi Airport Terminal 5, which if transferred to Temasek for a nominal sum, will subsequently reap a huge gain for Temasek. He also mentioned that should Temasek CEO receive even “1% of the value accretion from floating CAG, this could be worth up to

$500 million at some point in the future”.

Through zero effort, unless outstretched arms to receive our family jewels count, should any bonus be accrued to Temasek CEO or any directors?

If my grandfather gives me a house be bought for $50,000 40 years ago and the house was recently valued at $5 million, I can boast of a 12.2% annualised return or a $4,950,000 profit which is of course untrue. Alternatively, I could be humble and admit I never made the money because it was actually ‘Ah Kong’ money.

Conclusion

Temasek manages our reserves and every citizen has a stake in them. The remuneration of Temasek CEO should not be kept secret.

PAP has been totally opaque where the transfer of national assets to Temasek is concerned. Temasek has also gone to great lengths to prevent public knowledge of its CEO’s remuneration.

The poor corporate governance and PAP’s opacity are a cause for concern.

Based on PAP’s history of obscenely rewarding itself with out-of-this-world salary and bonuses, Temasek CEO’s pay package is estimated to be at least $20 million, probably more.

Temasek’s disclosure of its CEO’s pay package should not be seen as a favour to citizens or the Singapore parliament will risk becoming a laughing stock.