As Singapore Police Probe Money Laundering Ring, a Private Equity Entrepreneur Disappears

Credit: The Straits Times

by

Martin Young, Tom Allard, Yan Yan (OCCRP), and The Straits Times

22 December 2023

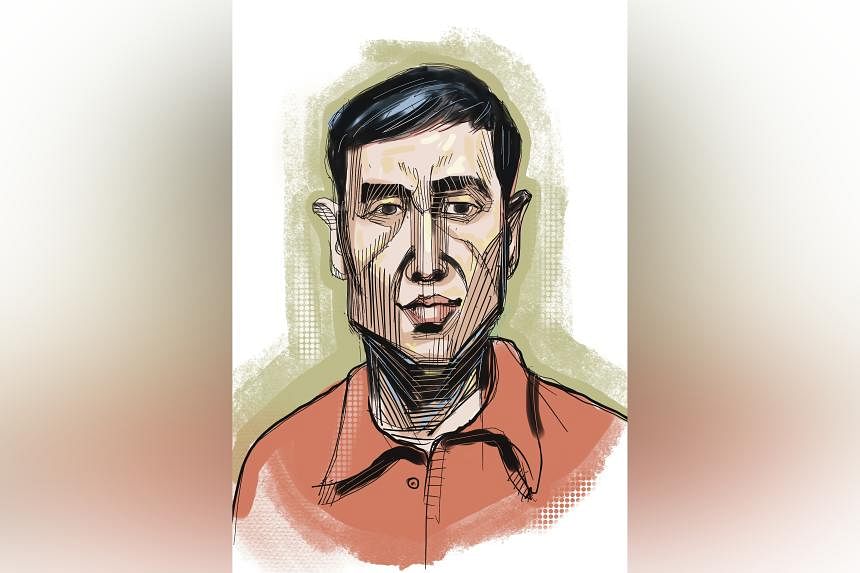

The founder of an Asian private equity firm has disappeared from his Singapore home and workplace as police sought to question him in connection to an alleged $2-billion money laundering ring busted in August this year, a Straits Times/OCCRP investigation has found.

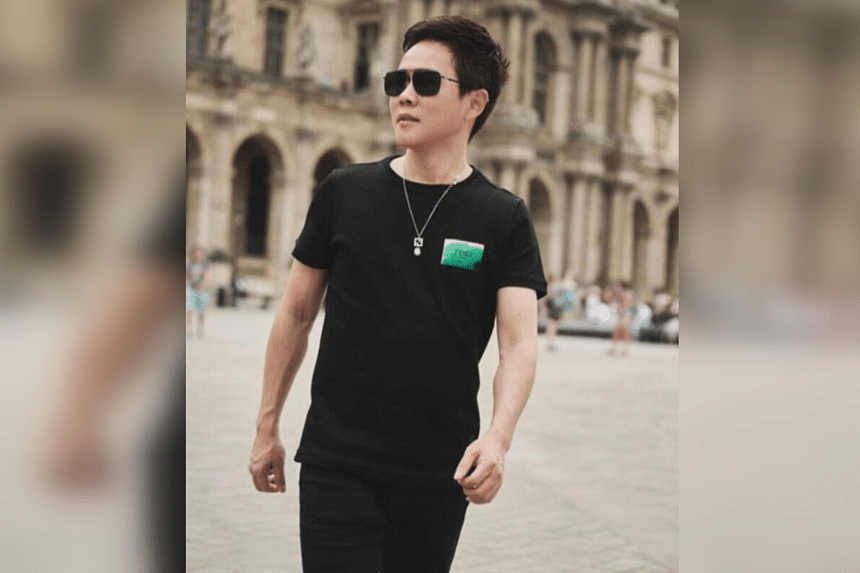

Su Binghai, an entrepreneur of Chinese origin, is a “person of interest” in an ongoing investigation into the alleged laundering ring, a source familiar with the case told the Straits Times.

The source, who spoke on condition of anonymity, did not provide further details. Su Binghai has not been formally named as a suspect, which does not happen in Singapore until after an arrest.

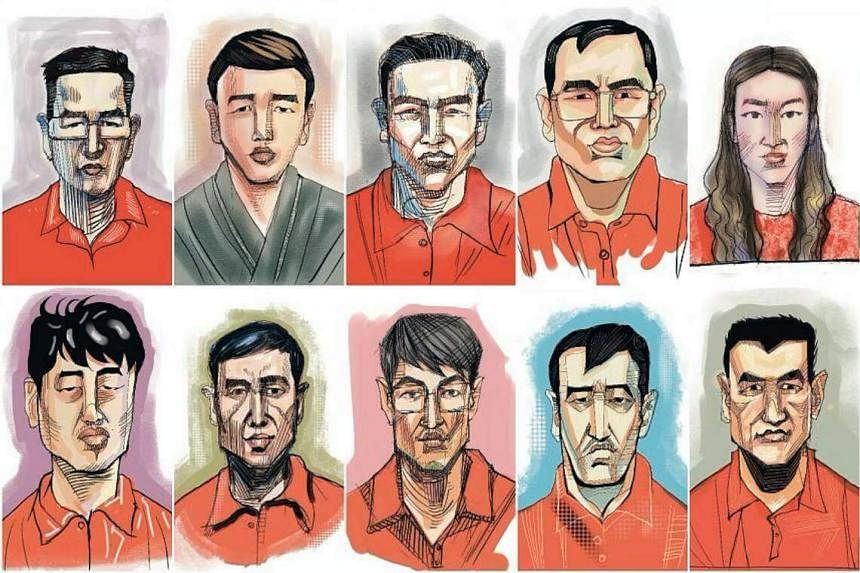

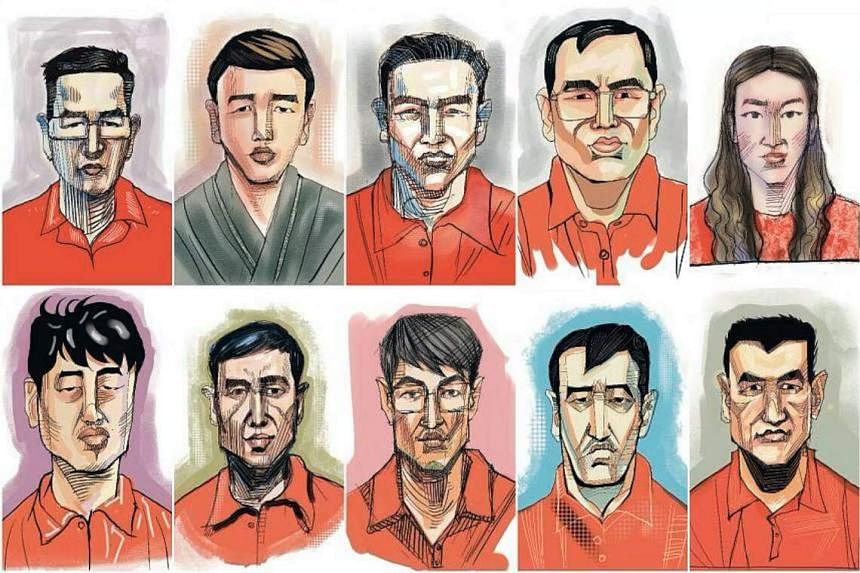

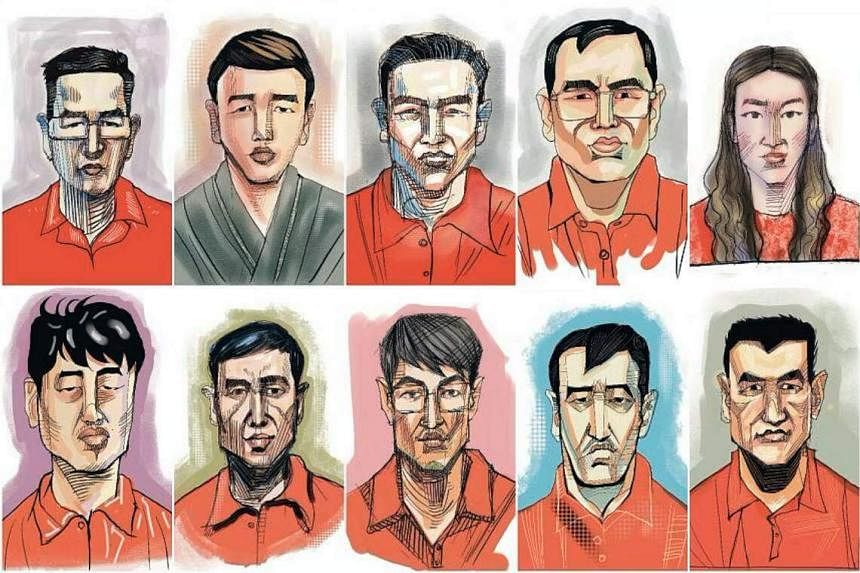

Corporate registry data shows that Su Binghai founded the private equity outfit New Future International in 2017. He became a co-owner of the firm the following year along with Wang Dehai, one of 10 people

arrested by Singapore police during the bust on August 15.

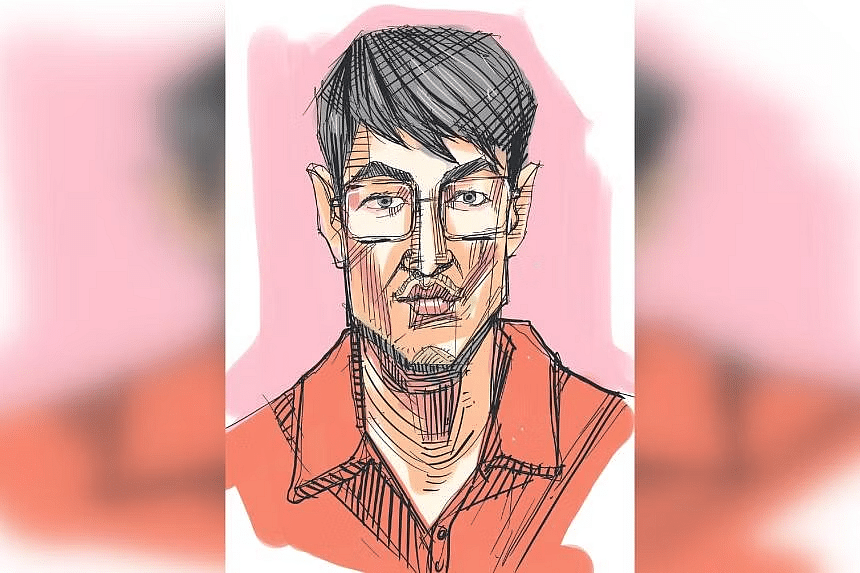

Two other New Future International directors, Su Bingwang and Su Fuxiang, are also “persons of interest,” said the source, without adding details. (It is not clear if the three Sus are part of the same family, but the three often cited the same residential address in their Hong Kong corporate filings.)

None of the Sus could be reached for comment.

Singapore’s August raids on the alleged money laundering ring sent shockwaves through the country’s political elite, and have raised questions about how lax regulations and an easily exploited residency program have contributed to a flood of dirty money into the Southeast Asian financial hub. Most of those arrested lived in upmarket areas, and many belonged to prestigious golf clubs.

Headquartered in Hong Kong, Su Binghai’s New Future has a Singapore-based offshoot and multiple subsidiaries. The company maintains offices in both cities and its website showcases a portfolio of countries and industries in which the company says it invests, though it does not provide details and reporters could find no public record of any specific investments it has made. Police have not said that New Future is subject to investigation.

The owners of New Future have been obscured since 2019, when its ownership entity was shifted from Hong Kong to the British Virgin Islands, a tax haven with high levels of corporate secrecy.

Su Binghai, who remains a director of New Future, holds multiple passports and an entree into elite social circles in Hong Kong and Singapore. He, Su Bingwang, and Su Fuxiang, each own tens of millions of dollars worth of property around the world.

When a Straits Times reporter visited Su Binghai’s Singapore residence this month, a domestic worker said that more than 10 uniformed police had visited the property in September, just weeks after the raids, looking for her employer. But Su Binghai and his wife had already left the home and did not say where they were going or when they would return, she added. The worker identified Su Binghai from a photo and confirmed he was her boss.

Credit:

Credit: The Straits TimesSu Binghai's Singapore residence.

Another domestic worker answered the phone at a Dubai number registered to Su Binghai, and told OCCRP that “Mr Su” was not there. She was unable to provide information on his whereabouts.

Like Su Binghai, the two other New Future directors suddenly left their Singapore homes and workplaces in September, two colleagues and a neighbor told the Straits Times. (Singapore’s police did not respond to requests for comment about the Sus’ links to Wang Dehai or whether they had left the country.)

The plush home of one of the company’s directors, Su Bingwang, is located on Singapore’s Rochalie Drive, close to embassies and other grand homes. When the Straits Times visited this month, it was empty.

A neighbor confirmed that a Su Bingwang had lived there for about a year, and added that movers had turned up in September to remove items from the home. The home is currently being advertised on real estate websites as a rental for $33,800 per month.

When the Straits Times visited New Future’s Singapore office on December 1, a staff member asked unprompted if the reporter was there about “the money laundering case.”

“Is this about the Sus? I am not sure they will want to speak to you,” the employee added.

The staff member, who asked not to be identified, confirmed that Su Binghai and Su Fuxiang were involved in the firm and were frequent visitors to the Singapore office, but hadn’t been seen there “for a while.”

On a second visit on December 13, the employee affirmed that both men worked at the Singapore office, adding they had not been seen since September. The employee declined to respond to questions about where the two were.

New Future International did not respond to questions about the Sus and its operations. Wang Dehai’s lawyer did not respond to questions.

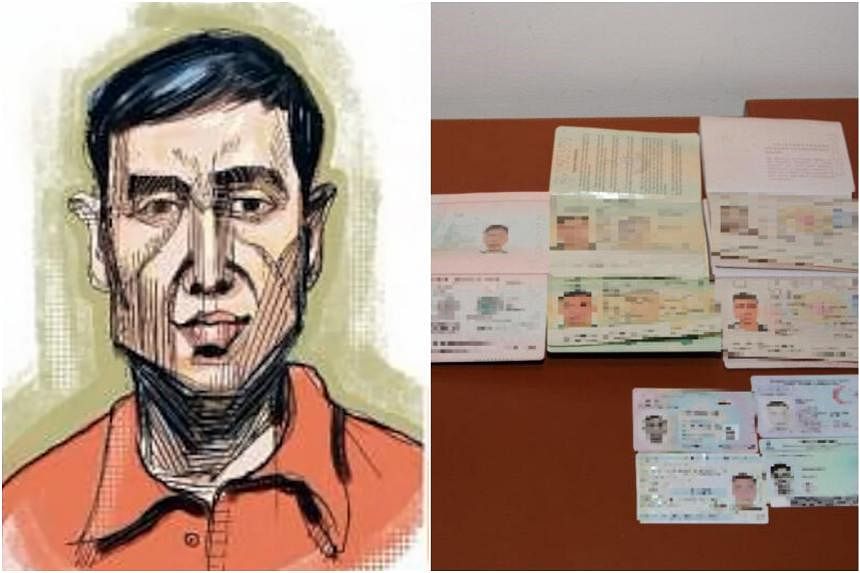

More than 150 properties have been confiscated by Singapore authorities in connection with the crackdown on the alleged money laundering ring so far. Some 68 gold bars, cryptocurrencies, millions in cash, 546 pieces of jewelry, and 62 vehicles were also impounded during the raids.

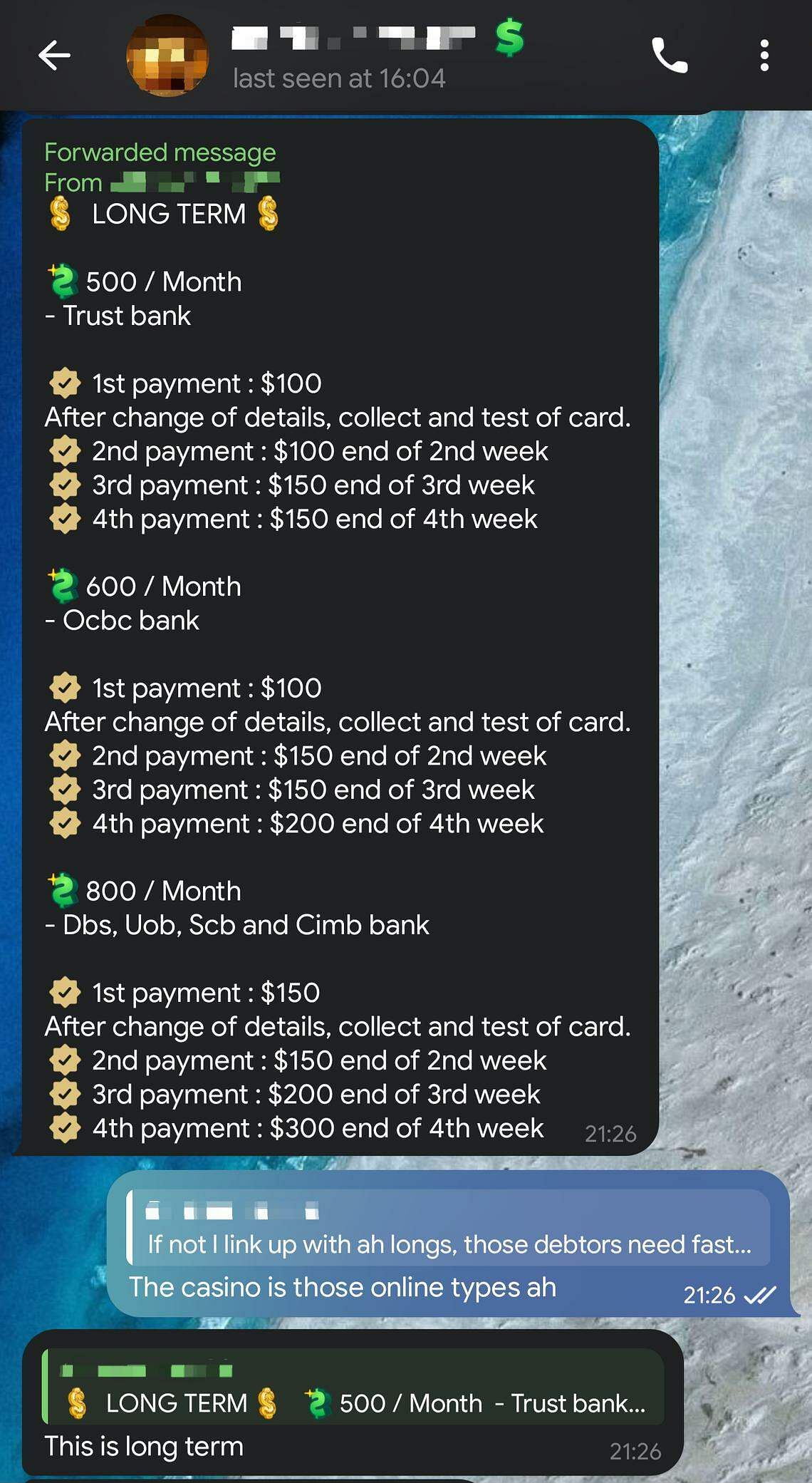

Online, Then on the Run

Even before he fell afoul of Singapore authorities, Wang Dehai was a wanted man. In February 2018, Chinese authorities published an arrest warrant alleging he was involved in illegal gaming.

Along with Wang, two others arrested in Singapore in August had a background in online gaming. According to authorities, this was not a coincidence: A large amount of the funds laundered in Singapore, police said, was generated by online casinos and telecommunications scam factories.

Southeast Asia is in the midst of a lucrative cybercrime spree, much of it targeting Chinese citizens. China’s Ministry of Public Security has estimated illegal gambling by mainland Chinese amounts to 1 trillion yuan a year, or about $140 billion.

The scam and online casino industry in Cambodia alone has been estimated to be worth between $7.5 billion and $12.5 billion a year, Jeremy Douglas, head of Southeast Asia operations at the United Nations Office on Drugs and Crime, told OCCRP.

Wang was at the forefront of the online gambling revolution in the region, working in the Philippines between 2012 and 2016, according to media accounts of court testimony he has given since his arrest. The industry was legal in the Philippines but, because the casinos targeted bettors in China where gambling is illegal, he was breaking Chinese laws.

Just a few months after Wang’s 2018 Chinese arrest warrant was publicized on police social media accounts, he and Su Binghai incorporated a company called Yuen Zheng Holding Limited, splitting ownership equally, Hong Kong corporate registry data shows.

That same year, Yuen Zheng took over 100 percent of the shares of New Future International Limited, the private equity firm which Su Binghai had founded a year earlier.

In 2019, New Future was again taken over by another company registered in the British Virgin Islands: “Yuan Zheng Holding Limited,” which is spelled exactly the same as the Hong Kong entity’s Chinese characters in standard pinyin transliteration. Because of the territory’s corporate secrecy rules, it was not possible to determine who owns Yuan Zheng. (Su Binghai and Wang Dehai’s Hong Kong-based company, Yuen Zheng, was dissolved in 2021.)

Despite the change of the ownership entity, the three Sus remain directors of New Future, according to a 2023 corporate filing in Hong Kong. Singapore corporate records also show Su Binghai and Su Fuxiang are the majority shareholders of New Future’s Singapore subsidiary. Su Binghai, meanwhile, features prominently on New Future’s corporate website, where he is pictured sitting at the center of a group of suited professionals.

Credit:

Credit: New Future InternationalScreenshot of New Future International's website showing Su Binghai seated at center.

New Future’s Singapore arm also nominated Wang Dehai for membership of the deluxe Sentosa Golf Club, according to a list of defaulting members reviewed by the Straits Times this month.

The three Sus are all natives of Anxi County, an inland mountainous area of Fujian province on China’s southeastern coast. Otherwise known only for its tea plantations, Anxi has become a hotbed of online scams and illegal gambling.

The Sus also hold multiple passports. All three are citizens of Cambodia, and at least two — Su Binghai and Su Fuxiang — hold citizenship of the Caribbean nation of St. Kitts and Nevis. Su Binghai also listed a Vanuatu passport in the documents seen by reporters.

They have used these citizenships to set up dozens of companies in Hong Kong and Singapore. Many of those in Hong Kong reported just one Hong Kong dollar in registered capital, the minimum required to set up a company.

Sudden Rise of the Sus

New Future does not publish financial results, but boasts on its corporate website that “the Founding Partners have, separately or jointly as co-investors, made over $2 billion of private equity investments in Greater China during the five-year period prior to founding New Future.”

The website also lists a portfolio of industries — including “Environmental Material Technology and Applications,” “Digital Mobile Payment Service,” and “VR Immersive Solutions” — in which it says it invests in Hong Kong, China, Singapore, and Indonesia. But it does not provide details of those investments and reporters could find no evidence of them in public records.

In Hong Kong company registries, the three Sus list high-end residential addresses as their correspondence addresses. In Singapore, the last known addresses for both Su Binghai and Su Bingwang were ultra-luxury bungalows — Su Bingwang’s just a stone’s throw from embassies and the Ministry of Foreign Affairs.

Credit:

Credit: The Straits TimesSu Bingwang’s Singapore residence.

Su Binghai bought a Hong Kong luxury flat for $13.8 million in late 2017. In the U.K., Su Binghai is also listed as the founding shareholder of two active holding companies, Su Empire Limited and Su Group Limited.

The three Sus also appear to have splashed out significant sums on prestige and personal status.

Rubbing shoulders with Hong Kong’s elite at the Hong Kong Jockey Club, Su Binghai is listed as a registered member of “Gin,” “Happy Mission,” and “The Easy Ride” –– syndicates that offer joint ownership of racehorses.

In Singapore, the Sus are members of at least one expensive golf club and have been top donors to several charitable causes, including a 2022 golf event organized by the Singapore Disability Sports Council.

Su Fuxiang helped sponsor a classical music concert in May attended by the country’s deputy prime minister, Heng Swee Keat, in the prestigious Esplanade Hall. The concert, held by the Orchestra of the Music Makers, would make Singapore a “more refined, sophisticated and vibrant place to live,” Su Fuxiang said in the program notes.

A spokesperson for the charity said Su Fuxiang had cleared its due diligence process.

“He said he was keen to set up a foundation to increase his contributions to the community after settling down with his family in Singapore for more than three years,” he said.

Orchestra of the Music Makers is in the process of lodging a precautionary suspicious transaction report regarding the donation, the spokesperson added.