$3b money laundering case: 10 convicted, 17 on the run; police are after the rest

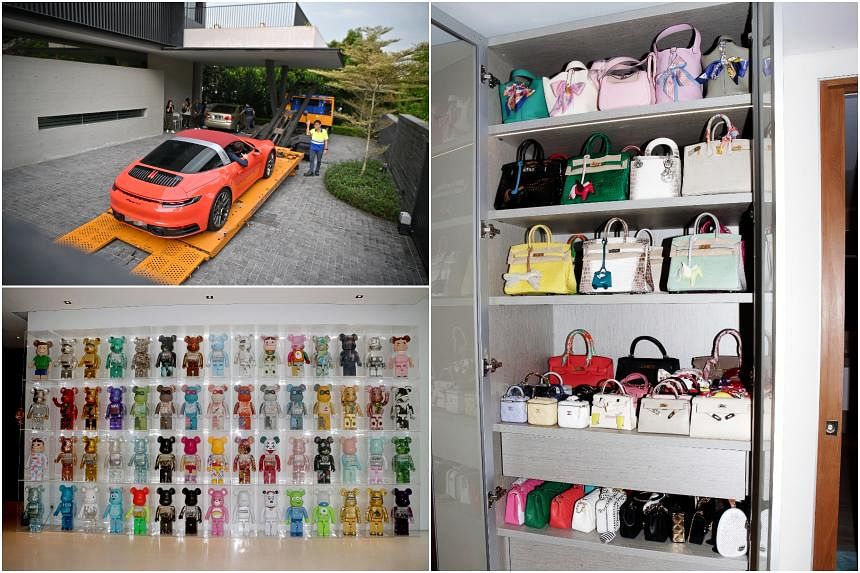

The police seized and issued with prohibition of disposal orders for $3 billion in cash and assets belonging to the 27 individuals. PHOTOS: SINGAPORE POLICE FORCE

Andrew Wong and

Nadine Chua

Jun 09, 2024

SINGAPORE - Investigations into the $3 billion money laundering case and the wider network of people linked to it will continue, with the police flagging to their foreign counterparts financial information of the suspects on the run for possible action.

On June 7, Cypriot national Wang Dehai

was sentenced to 16 months’ jail over one money laundering charge. He is the last of the 10 foreigners arrested in connection with the case to be convicted.

The authorities are now turning their attention to

the 17 individuals who fled the country amid the probe, and others, including Singaporeans, who helped facilitate the nation’s largest money laundering case.

In a reply to queries from The Straits Times, the Singapore Police Force (SPF) said that while their enforcement powers are limited to Singapore’s jurisdiction, they do proactively work with foreign law enforcement agencies (LEAs) when tackling transnational crimes.

“In relation to the ongoing $3 billion anti-money laundering probe, the SPF has been actively sharing information through global policing networks, including seeking assistance on the whereabouts of the wanted persons, two of whom currently have Interpol red notices issued against them,” said an SPF spokesman.

The police previously identified the two wanted individuals as Su Yongcan and Wang Huoqiang.

Su Yongcan, 33, is both Su Jianfeng and Wang Dehai’s brother-in-law. Wang Huoqiang, 29, is Wang Dehai’s cousin.

SPH Media Limited, its related corporations and affiliates as well as their agents and authorised service providers.

marketing and promotions.

The authorities have seized or frozen around $161 million tied to Su Yongcan, and around $5.2 million from Wang Huoqiang.

(Clockwise from top left) Su Shuiming, Su Shuijun, Su Yongcan, Wang Huoqiang, Su Binghai and Wang Bingang are among the 17 individuals who are on the run. PHOTOS: ZHOUCUN, ZIBO POLICE, SINGAPORE POLICE FORCE, THE PEAK

SPF said the Commercial Affairs Department’s (CAD) Suspicious Transaction Reporting Office (STRO), which is Singapore’s financial intelligence unit, is also sharing information with foreign counterparts.

“STRO had also worked with foreign counterparts to exchange financial information on the wanted persons, which could be helpful for investigations by local LEAs.

“The STRO had disseminated analyses of financial information on the same persons to local LEAs for possible enforcement or regulatory action,” said the SPF spokesman.

ST understands the police will also investigate individuals who helped the 10 foreigners and their associates register shell companies, and those who conspired with the convicted money launderers to falsify sources of wealth and legitimacy.

Other individuals who failed to flag suspicious transactions, including those working for real estate companies, will also be questioned.

ST understands that since August 2023, some of the

nearly 60 real estate agents suspected to be involved in the sale or rental of the 207 properties related to the case have already been interviewed by the police.

Meanwhile, the Monetary Authority of Singapore (MAS) will review the actions of financial institutions that held deposits linked to the 10 foreigners and their associates.

A report by Bloomberg showed the deposits were held in 16 banks, with Credit Suisse having the largest portion at $79.6 million, and Citigroup a close second at $79.3 million.

Local bank UOB was third, with $41.6 million.

A spokesman for MAS said the regulatory body is conducting “detailed supervisory reviews and inspections of the financial institutions” linked to the case.

“We will assess if the financial institutions have implemented adequate and appropriate controls against money laundering and terrorism financing risks, and will take action if they have fallen short of MAS’ requirements, as we have done in past cases,” added the spokesman.

Banks in Singapore are obliged to file reports to the STRO if they are unable to verify the source of wealth, have suspicions about the transactions, or suspect the transactions could be linked to a crime.

Under the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act, it is an offence to fail to file a suspicious transaction report.

The offence carries a fine of up to $250,000 and a jail term of up to three years for individuals. For entities, the penalty is a fine not exceeding $500,000.

The bank employee

Wang Qiming, a former relationship manager at Citibank, is among those in the crosshairs.

Court documents show he allegedly helped Su Baolin, one of the 10 foreigners convicted, liquidate his cryptocurrency holdings and transfer more than $657,000 into the convict’s Standard Chartered account in December 2020.

The authorities previously said that the first signals of the money laundering network were picked up some time in 2021, after some suspicious transaction reports were filed by financial institutions and companies.

Wang Qiming was also linked to Vang Shuiming, another one of the 10 foreigners convicted in the case. Police investigators found that he was Vang’s relationship manager at Citibank in 2021.

In August 2021, Wang Qiming allegedly helped Vang submit a forged bank statement from China Merchants Bank to Citibank as proof of the source of his wealth.

Vang did not possess a China Merchants Bank account, investigations showed.

In October 2021, Wang Qiming was called in by the police and subsequently arrested.

He has been on bail since Nov 16, 2021, but the CAD does not consider him a flight risk as Wang Qiming does not have substantial assets at his disposal and foreign connections that could help him abscond.

As the authorities dug deeper into the network of people around Wang Qiming, they found Su Haijin.

The Cypriot national was linked to Su Baolin via two companies in Singapore. They were also part-owners of a luxury yacht.

The two men, who are originally from China, came from the same area in Xiamen where Lin Baoying lived. Lin is

the only woman out of the 10 convicted in the case.

Police learnt the group was close. Su Haijin and his wife Wu Qin, Su Baolin and his wife Ma Ning, Lin Baoying and her boyfriend Zhang Ruijin, who was also convicted, had even travelled overseas together on holiday.

Investigators also found links between Su Haijin, Su Baolin and Vang.

While it was clear they had unexplained wealth, it was less obvious how they got their fortune.

(From left) Su Haijin, Su Baolin, Vang Shuiming and Lin Baoying. PHOTOS: COURT DOCUMENTS

Gambling syndicate

As the authorities widened the dragnet, links to criminal syndicates were discovered.

Su Jianfeng, Wang Dehai and Su Wenqiang – all three convicted in the case – had worked at the same online gambling syndicate in the Philippines from 2015.

China’s Ministry of Public Security also investigated Su Yongcan and Wang Huoqiang. They were all put on the wanted list in 2017 for alleged links to the gambling syndicate.

The gambling connection continued with Wang Baosen, who was also convicted in the Singapore case.

He had worked with his cousin, Wang Bingang, at Hongli International Entertainment, a gambling site operating from the Philippines and Cambodia.

Meanwhile, digging deeper into Wang Dehai revealed he was a director at Cambodian company S.C.W.D. Construction, which shares the same address as Chen Qingyuan’s Cambodian company Skykey International.

Wang Dehai (left) was a director at Cambodian company S.C.W.D. Construction, which shares the same address as Chen Qingyuan’s Cambodian company Skykey International. PHOTOS: COURT DOCUMENTS

Chen was also listed as wanted for fraud in 2019 by the authorities in Anxi, Fujian.

It was also clear the network of money launderers was large. While 10 foreigners

were arrested on Aug 15, 2023, 17 others managed to get away.

But the police seized and issued prohibition of disposal orders for $3 billion in cash and assets belonging to all 27 of them.

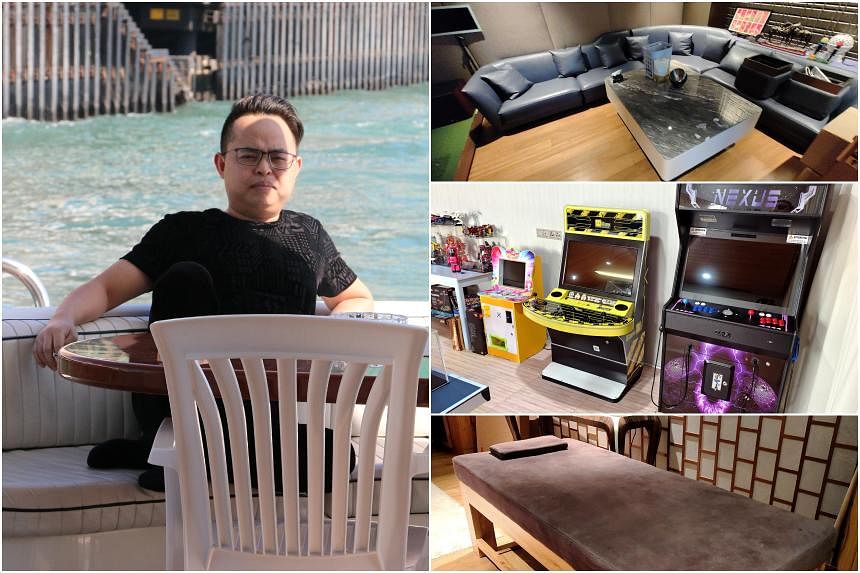

Foreign nationals Su Shuiming and Su Shuijun, who presented themselves as successful businessmen, were among those who fled from Singapore.

The pair alone are responsible for more than $530 million of the cash and assets seized in the case.

The two men have been on the run from the authorities in China since September 2023, for their alleged links to an online gambling syndicate.

But they have considerable means. ST earlier reported that Su Shuiming and Su Shuijun

own more than $31 million in properties in Dubai.

Others on the run include Su Binghai, a close friend of Su Jianfeng, and Su Fuxiang.

Shell companies

Corporate service providers who helped the network register a series of shell companies to explain their wealth have also been hauled in by the police.

Among them is naturalised Singaporean Wang Junjie, whom ST first

exposed in September 2023 for his links to three of the convicts.

At one point, Wang Junjie held director or secretarial roles in 185 companies, including nine which were linked to Su Haijin, Su Baolin and Vang.

The Accounting and Corporate Regulatory Authority (Acra) sanctioned him in January, cancelling his registration as a qualified individual and filing agent, but his troubles do not end there.

He was named in charges related to Su Haijin and Su Baolin, for allegedly conspiring with the two men separately to make false and inflated representations to the Inland Revenue Authority of Singapore.

Acra also cancelled the licences of Mr Jackson Lim Wei, another corporate service provider, as well as his company, Sprout Corporate Services.

He was listed as the secretary in five of Su Binghai’s companies, but checks by ST found Mr Lim is also linked to companies tied to Su Jianfeng’s wife Chen Qiuyan, Chen Qingyuan’s girlfriend Wang Qiujiao, Wang Dehai’s wife Su Caihuang, Su Haijin’s wife Wu Qin and Su Lihong, one of the associates named by the Ministry of Law.

Meanwhile, Philippine national Quevada Jennifer Racasa has left Singapore.

She had given her details to be registered as the director of seven companies linked to Su Shuiming and Su Shuijun.

The money launderers had amassed a substantial portfolio of assets overseas. Su Haijin alone admitted to owning 10 properties in London, Cambodia, Cyprus and Macau, worth more than $14 million.

ST in May reported on a data leak which showed he also owns 11 properties in Dubai worth more than $15.4 million.

Lawyer Victoria Ting, associate director at Setia Law, said Singapore’s Attorney-General (AG) can request foreign authorities to enforce any confiscation orders made by a Singapore court to confiscate overseas properties.

Said Ms Ting: “Even before such an order is made, the AG can also request foreign authorities to freeze that property pending the conclusion of the court case.”

“The AG’s discretion in this regard is regularly exercised, but like all inter-state dealings in the realm of mutual legal assistance, its effectiveness depends on certain conditions, such as the extent of reciprocity of assistance.”

Former director of the Corrupt Practices Investigation Bureau Soh Kee Hean, who is currently associate professor at the Singapore University of Social Sciences, said Singapore may work with foreign jurisdictions if there is information showing a link between the two countries.

“For example, if money from a suspect in Singapore was transferred to Country X for his business venture, whether legal or illegal, the Singapore authorities may get involved,” said Prof Soh, adding that foreign counterparts could similarly ask for assistance from the authorities here.

He added: “So far, Singapore is the only country to take action.

“As this is a transnational crime, it would be good to see other countries take action against the 10 money launderers and other people for predicate crimes and money laundering in their jurisdictions.”

Tighter laws

Meanwhile, the Ministry of Home Affairs is

looking to strengthen the law to enhance the authorities’ abilities to track down and prosecute money launderers.

This will be done through a Bill to amend the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act, under which all 10 foreigners in this money laundering case have been convicted.

The Bill will also allow sectoral regulators to access suspicious transaction reports filed by their regulated entities, to better detect money laundering activities.

To further tighten scrutiny on the close to 3,000 companies providing corporate services, the Ministry of Finance and Acra have proposed a new Corporate Service Providers Bill to tighten the scrutiny on corporate service providers.

Under this law, failure to comply with anti-money laundering or countering the financing of terrorism obligations could see companies and their senior management fined up to $100,000 per breach if convicted.

On the real estate front, property agencies and agents have been reminded to conduct due diligence checks on their clients when they are engaged to facilitate property transactions.

According to the Council for Estate Agencies, agents are

required to verify the identity of their clients and assess the risk of their clients being involved in money laundering activities.

The fallout has been significant. Those dealing with luxury real estate said the market for such homes has slowed down.

Sales of commercial shophouses saw their worst quarter

in 13 years in the final three months of 2023, as the market turned cautious after the money laundering case came to light.

Caveats were filed for just 15 transactions that quarter, compared with 37 deals between July and September.

In terms of transaction value, the deals valued at $95 million from October to December 2023 represented a 70 per cent plunge from nearly $321 million recorded in the same period in 2022.

In January, ST reported that

10 shophouses purchased by Su Binghai and Su Fuxiang were put on the market by DBS Bank, which was trying to recover repayments of its loans.

In October 2023, Second Minister for Home Affairs Josephine Teo said the Government

is under no illusion that dirty money can always be kept out, adding that Singapore needs to respond decisively when such activities are uncovered.

“This case is a reminder that even the most stringent preventive measures can be circumvented by determined criminals.

“But it also shows that our system is able to detect suspicious individuals and activities, and that when we do, we have the resolve and capabilities to track them down, and take them to task,” she added.

Those convicted

Nine of the 10 convicted in the case have been sentenced to between 13 and 16 months’ jail.

Su Jianfeng, the man who is said to have helped broker property deals for a number of the convicts and their associates in Dubai, will be sentenced on June 10.

He pleaded guilty to one charge of money laundering and one count of forgery on June 6.

Su Wenqiang, 32

- Cambodian national, held passports from China and Vanuatu

- Pleaded guilty on April 2 to two money laundering charges

- Sentenced to 13 months’ jail

- Forfeited around $6 million worth of assets to the state

- Deported to Cambodia on May 6

Su Haijin, 41

- Cypriot national, held passports from China and Saint Lucia

- Pleaded guilty on April 4 to one charge of resisting arrest and two money laundering charges

- Sentenced to 14 months’ jail

- Forfeited more than $165 million worth of assets to the state

- Deported to Cambodia on May 28

Wang Baosen, 32

- Chinese national, held a passport from Vanuatu

- Pleaded guilty on April 16 to two charges of money laundering

- Sentenced to 13 months’ jail

- Forfeited his assets worth $8 million to the state

- Deported to Cambodia on May 6

Su Baolin, 42

- Cambodian national, held a passport from Vanuatu

- Pleaded guilty on April 29 to two charges for money laundering and one for conspiring to make false representations

- Sentenced to 14 months’ jail

- Forfeited about $65 million to the state

- Deported to Cambodia on May 25

Zhang Ruijin, 45

- Chinese national, held a passport from Saint Kitts and Nevis

- Pleaded guilty on April 30 to one money laundering charge and two forgery-related charges

- Sentenced to 15 months’ jail

- Forfeited about $118 million of his assets to the state

Vang Shuiming, 43

- Turkish national, held passports from China, Vanuatu

- Pleaded guilty on May 14 to two counts of money laundering and one forgery-related charge

- Sentenced to 13 months and six weeks in jail

- Forfeited about $180 million worth of assets to the state

- Deported to Japan on June 1

Chen Qingyuan, 34

- Cambodian national, held passports from China, Dominica

- Pleaded guilty on May 23 to two money laundering charges and one forgery-related charge

- Sentenced to 15 months’ jail

- Forfeited around $21 million worth of assets to the state

Lin Baoying, 44

- Chinese national, held passports from Cambodia, Dominica and Turkey

- Pleaded guilty on May 30 to two forgery-related charges and one money laundering charge

- Sentenced to 15 months’ jail

- Forfeited around $154 million worth of assets to the state

Su Jianfeng, 36

- Vanuatu national, held passports from China and Saint Kitts and Nevis

- Pleaded guilty on June 6 to one charge of money laundering and one forgery charge

- Forfeited over $178 million worth of assets to the state

- Sentencing adjourned to June 10

Wang Dehai, 35

- Cypriot national, held passports from China, Cambodia and Vanuatu

- Pleaded guilty on June 7 to one money laundering charge

- Sentenced to 16 months’ jail

- Forfeited around $49 million worth of assets to the state