Data leak reveals links between money laundering accused Su Jianfeng and sale of Dubai properties

Su Jianfeng (centre) at a ceremony alongside Fidu Properties owner Su Sihai (right) and COO Nazish Khan celebrating the opening of Fidu's office in 2019. PHOTO: FIDU PROPERTIES/FACEBOOK

Andrew Wong

May 17, 2024

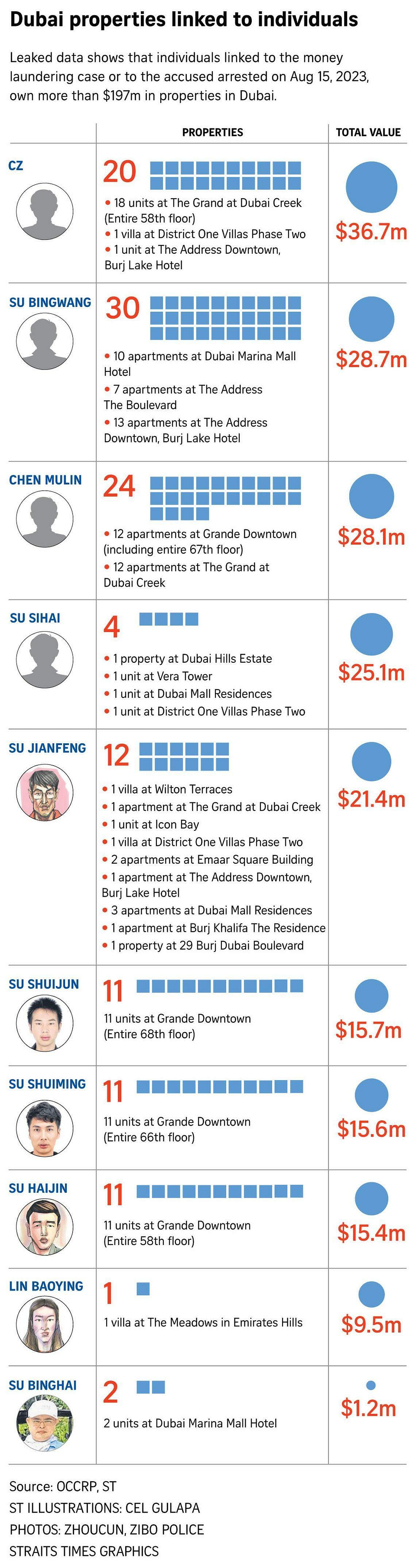

SINGAPORE – Money laundering accused Su Jianfeng had allegedly worked with a Singapore-based businessman to sell properties in Dubai worth tens of millions to foreigners in Singapore, a data leak of property transactions showed.

The investors include individuals wanted in China, three people implicated

in the $3 billion money laundering probe, others identified by the Ministry of Law (MinLaw) as their associates, and a China-born businessman who left Singapore abruptly amid the probe.

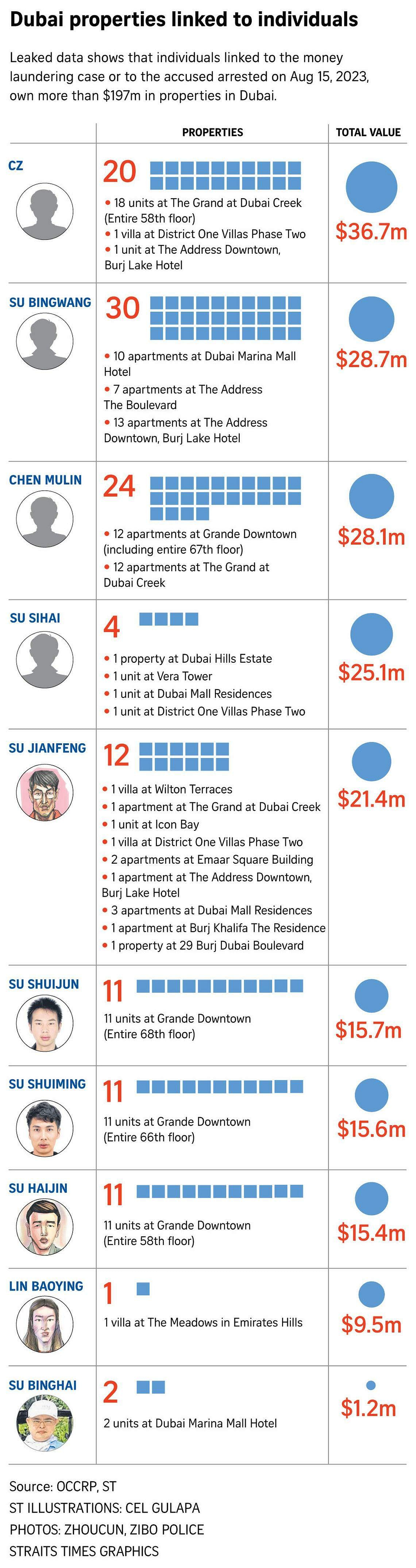

In total, they bought at least 126 properties worth more than 537 million dirhams (S$197 million).

This was verified with the use of official passport identification numbers and title deeds in the Dubai Land Registry. Only properties that have been fully verified were included in this report.

The properties were mostly marketed by Dubai real estate firm Fidu Property Real Estate Brokerage, which primarily targets buyers from China, and developed by Emaar Properties.

In 2022, the developer had a net asset value of US$37.6 billion (S$50.6 billion).

The property transactions were revealed

in a data leak uncovered by the Organised Crime and Corruption Reporting Project (OCCRP) investigative journalism group.

SPH Media Limited, its related corporations and affiliates as well as their agents and authorised service providers.

marketing and promotions.

The leak, titled Dubai Unlocked, was published by the non-governmental organisation on its website on May 14.

It revealed details of alleged money launderers around the world who own properties in Dubai worth hundreds of millions.

The data was obtained by the Centre for Advanced Defence Studies (C4ADS), a non-profit organisation based in Washington, DC that researches international crime and conflict.

It was then shared with Norwegian financial outlet E24 and the OCCRP, which coordinated an investigative project with dozens of media outlets from around the world, including The Straits Times.

ST, working with OCCRP, found links between Su Jianfeng and businessman Su Sihai. Both men are originally from China.

It showed that Su Jianfeng allegedly has a larger property holding in Dubai than what he had confessed to in Singapore, and may have played a bigger role in the real estate company he co-owns with Su Sihai.

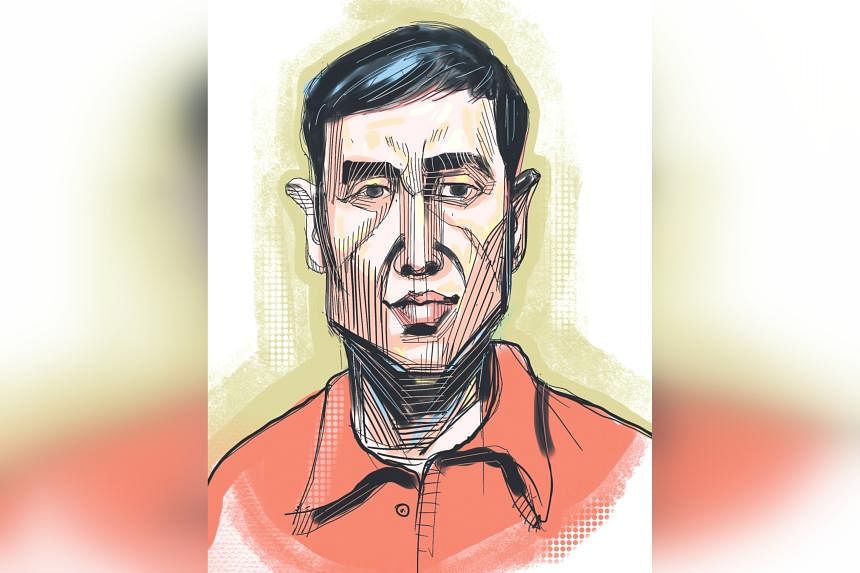

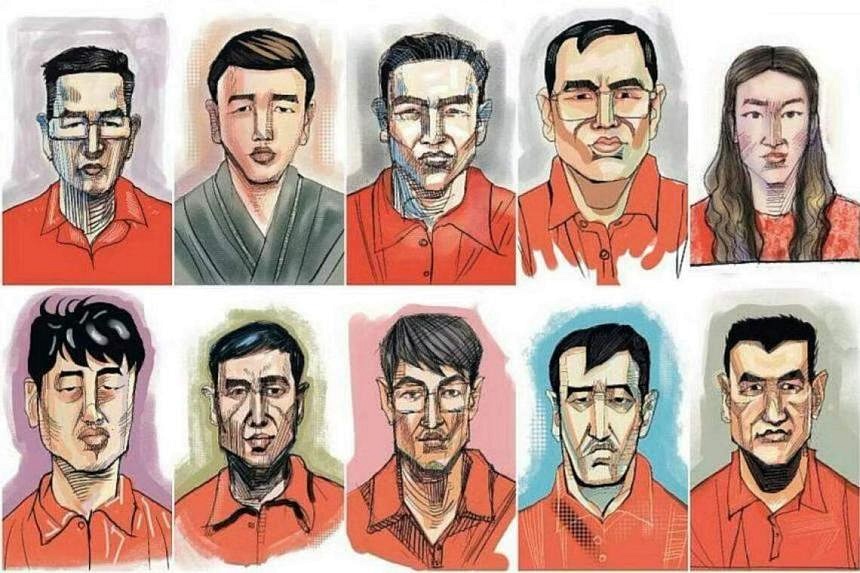

Su Jianfeng was among the 10 foreigners arrested in the August 2023 anti-money laundering probe that saw the authorities take control of $3 billion in cash and assets.

He is currently facing four money laundering charges and eight counts of forgery in Singapore.

He was

handed six forgery charges on May 16. Four of them relate to forged property sale contracts for five units in Dubai.

Su Jianfeng had allegedly submitted the forged documents to deceive banks into believing he had legitimate sources of wealth.

Checks against the leaked data showed he is the owner of at least three of the units mentioned in the charges.

Wanted in China

Su Jianfeng (centre) at a ceremony alongside Fidu Properties owner Su Sihai (left) and COO Nazish Khan celebrating the opening of Fidu’s office in 2019. PHOTO: FIDU PROPERTIES/FACEBOOK

Fidu Property Real Estate Brokerage was incorporated in Dubai some time in November 2017. According to business records, Su Sihai has been the sole owner and director of the company since 2021.

The firm shares the same name as a company in Singapore – Fidu Properties, which is located at One Marina Boulevard

.

Su Jianfeng went into a business partnership with Su Sihai in 2019, and later helped to incorporate Fidu Properties DMCC in Dubai that same year.

They are both board directors, each with 50 per cent ownership in the firm.

Su Jianfeng was a wanted man in China at the time. A notice by China’s Ministry of Public Security revealed that he was placed on the wanted list in 2017 for alleged links to an illegal gambling gang.

The same notice indicated that in 2015, the authorities were already investigating an online gambling case where Su Jianfeng, Wang Dehai, Su Wenqiang, Su Yongcan and Wang Huoqiang were named as major suspects.

They are all connected to the money laundering case in Singapore.

Su Wenqiang was convicted on two money laundering charges and

deported to Cambodia on May 6, while Wang Dehai’s case is still ongoing.

Warrants of arrest and Interpol red notices have been issued against Su Yongcan and Wang Huoqiang for money laundering offences.

Despite being a wanted man, Su Jianfeng took part in public events in Dubai.

Su Jianfeng (centre) attending the Fidu Properties annual awards alongside owner of the firm Su Sihai and COO Nazish Khan in 2019. PHOTO: FIDU PROPERTIES/YOUTUBE

On Fidu Property Real Estate Brokerage’s social media channels on YouTube and Facebook, he can be seen taking part in the firm’s annual awards in 2019.

He told investigators he was a real estate agent in Dubai. However, in the videos, he can be seen cutting the ribbon at the opening of an office in 2019, a ceremonial role usually reserved for the guest of honour.

The leak suggests that Su Jianfeng may have been the middleman who helped individuals in Singapore, linked to the money laundering case, purchase properties in Dubai, largely between 2020 and 2022.

The bulk of the properties were luxury units marketed by Fidu Properties, including The Grand at Dubai Creek and Grande Downtown Dubai.

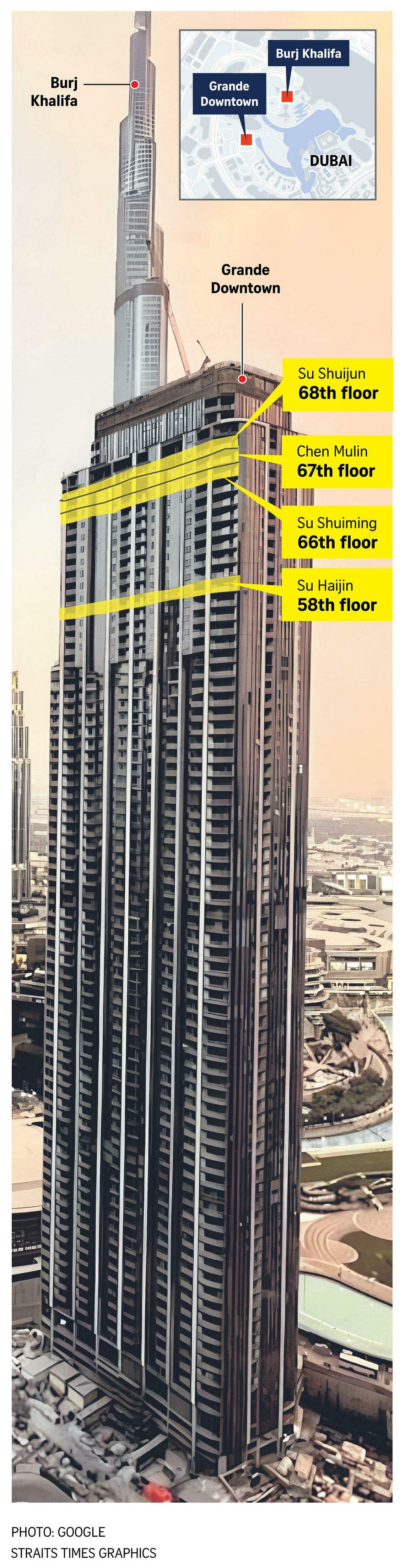

Two previously unknown Singapore-based business figures – Su Shuiming and Su Shuijun – own 11 units each at Grande Downtown that make up the entire 66th and 68th floors of the development.

They paid more than $31 million in total for the properties.

Su Shuiming and Su Shuijun were placed on China’s wanted list in September 2023 for their involvement in an online gambling syndicate. ST reported this on May 15.

Chen Mulin, one of their associates on the MinLaw list, bought the entire 67th floor of the same development.

Property agent

The leak suggested that Su Jianfeng, a Vanuatu national, had purchased 30 properties in Dubai. ST and OCCRP could independently verify only 12 properties worth more than $21 million in total.

They include apartments at the Burj Khalifa, once the world’s tallest building, and a villa in District One Villas Phase Two, just minutes away from the Crystal Lagoon.

In Singapore, Su Jianfeng told police investigators he owned 11 “condominium rooms”, two offices and a villa worth a total of 30 million dirhams.

The 35-year-old claimed that he had used his commission as a property agent in Dubai to fund his local and overseas properties.

After his arrest, more than $231 million worth of assets belonging to him and his wife were seized or subjected to prohibition of disposal orders.

They include 13 properties in Singapore worth more than $115 million, four vehicles worth more than $4.7 million, $18.4 million in cash, $66 million in bank accounts and $26 million worth of cryptocurrency.

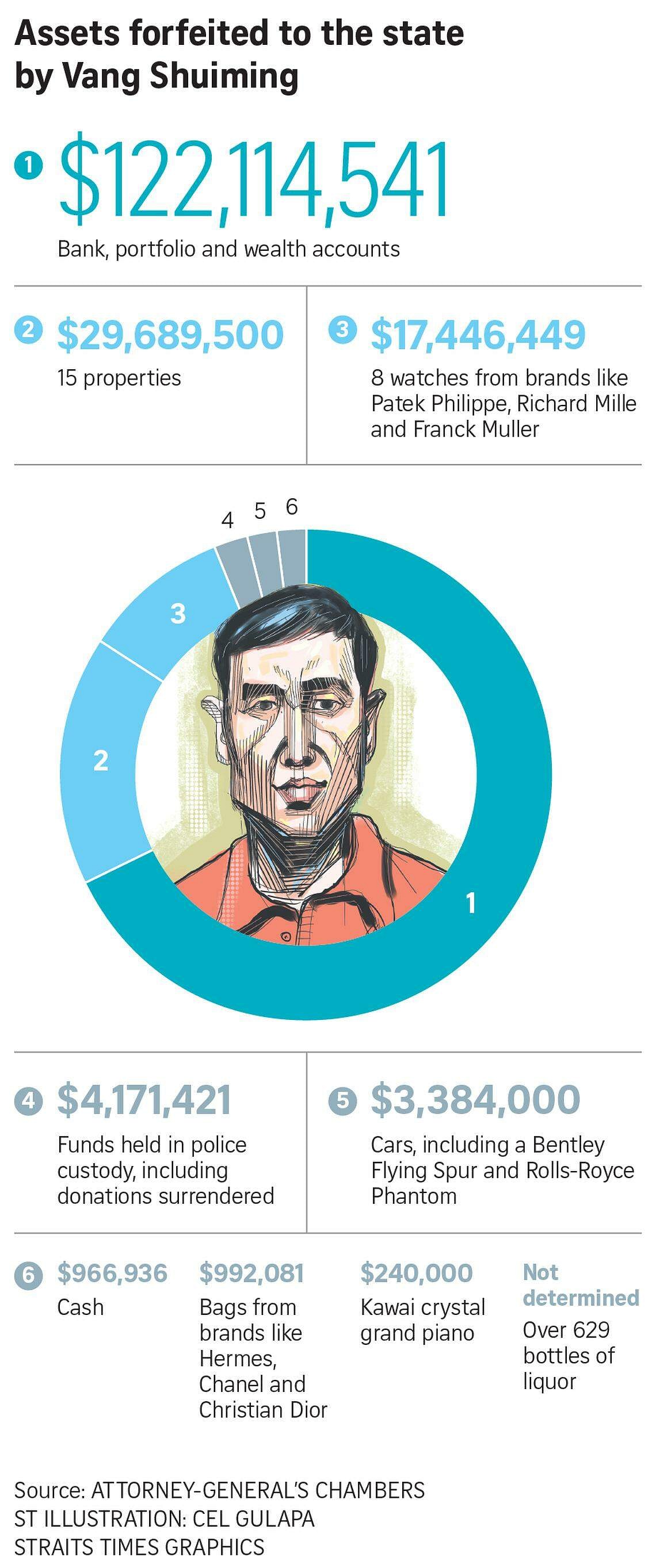

Cypriot national Su Haijin, who was

convicted and sentenced to 14 months’ jail on April 4 after forfeiting about 95 per cent of his $174 million assets in Singapore, owns 11 properties in Dubai worth more than $15.4 million.

All 11 properties are located at Grande Downtown, making up the entire 58th floor. The project was marketed by Fidu Property Real Estate Brokerage.

In an affidavit submitted by the Commercial Affairs Department, which led the anti-money laundering probe, Su Haijin admitted to having several properties overseas worth more than $14 million.

However, there was no mention of property holdings in Dubai. He instead admitted to owning a condominium unit in Cambodia, three apartments in Cyprus, one property in Oxford Street in London, and five properties in Macau.

He was convicted on April 4 after pleading guilty to one charge of resisting arrest and two money laundering charges.

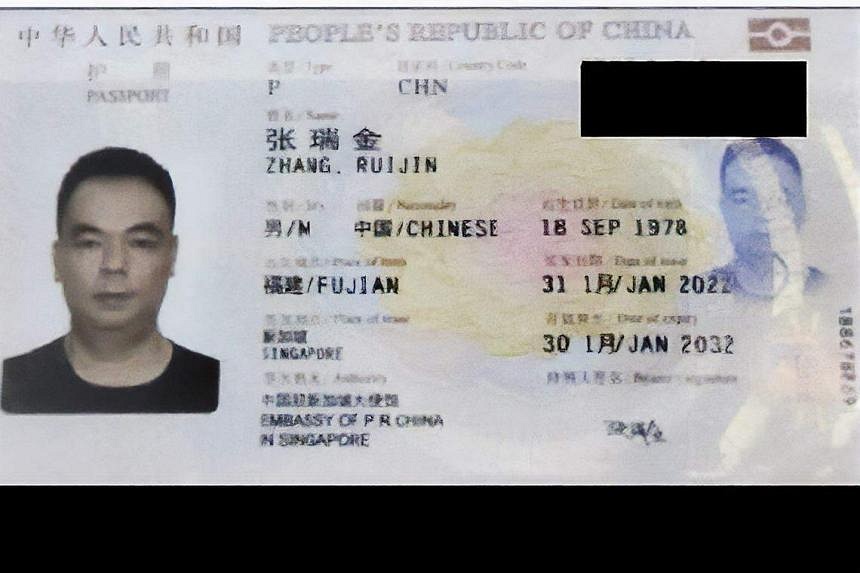

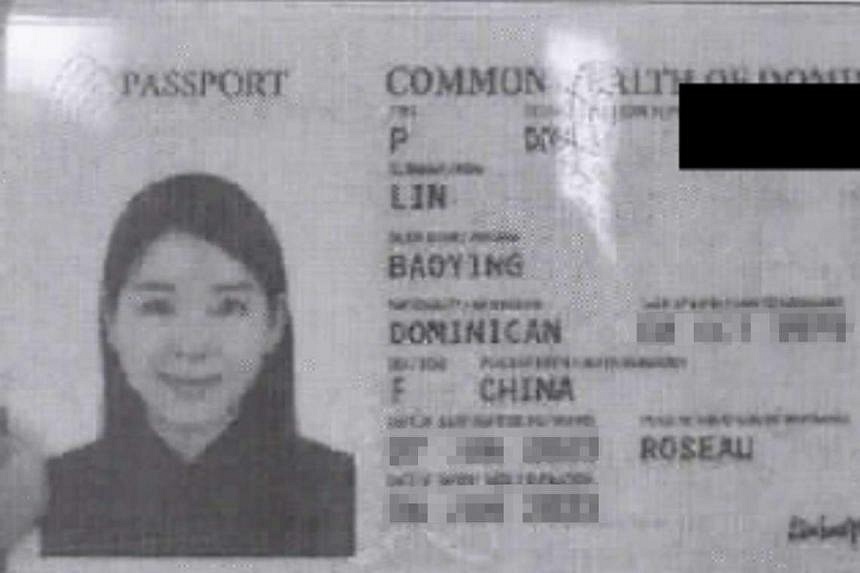

The 10 suspects in the $3 billion money laundering case (clockwise from top left): Su Baolin, Su Haijin, Chen Qingyuan, Su Wenqiang, Lin Baoying, Zhang Ruijin, Wang Dehai, Su Jianfeng, Vang Shuiming and Wang Baosen. ST ILLUSTRATIONS: CEL GULAPA

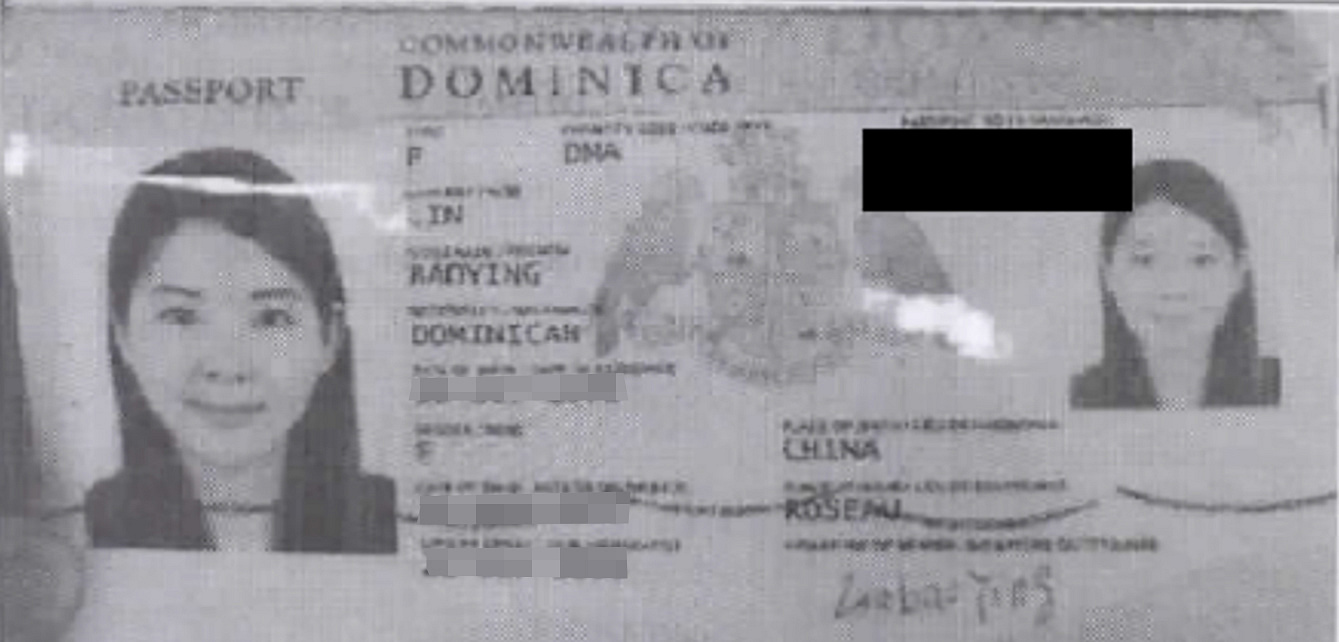

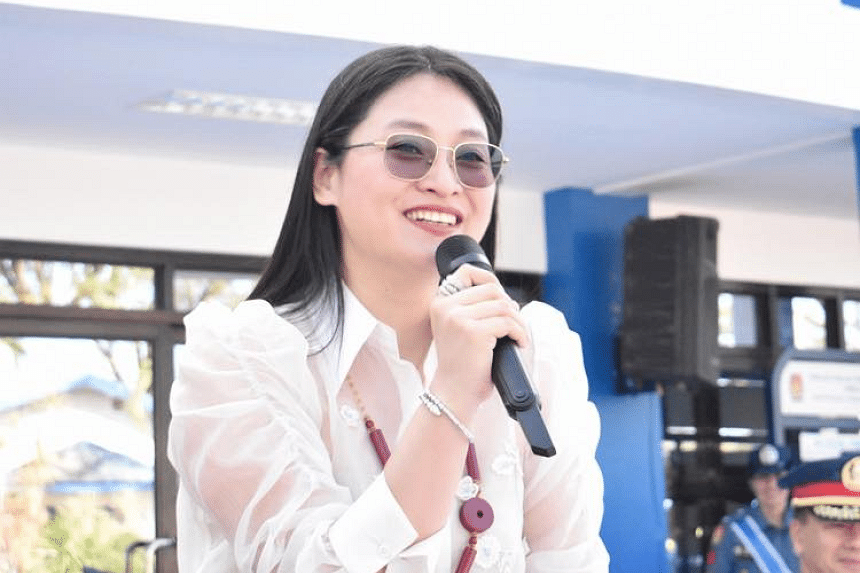

Lin Baoying, the only woman implicated in the money laundering case, owns a property in Dubai. The villa in The Meadows in Emirates Hills is worth around $9.5 million.

The Chinese national, who is facing two forgery charges and one count of perverting justice, had confessed to owning five properties worth more than $72 million in Singapore.

She also has six properties in Britain worth $10 million and a property in the Philippines worth $5.7 million.

Luxury units

The data leak suggests that Su Jianfeng may have helped several others purchase properties in Dubai.

Cypriot national Chen Mulin owns 24 properties in Dubai, worth more than $28 million, at The Grand at Dubai Creek and at Grande Downtown.

Chen, who was identified by MinLaw as one of 24 known associates of the money launderers, shares his home address at Gramercy Park in Grange Road with Su Haijin and Su Baolin’s wife, Ma Ning.

Su Baolin, who faced 13 charges related to forgery, fraud and money laundering,

was sentenced to 14 months’ jail in April, after forfeiting about $65 million, or 90 per cent of his seized assets.

Chen was listed as the director of Mulin Technologies, a software development firm, where another individual identified by MinLaw as an associate, Su Lihong, was a shareholder.

None of the associates has been charged with any offence.

The data leak showed that several other businessmen in Singapore bought properties in Dubai also marketed by Fidu Property Real Estate Brokerage.

They include Su Binghai, who is from China. The 34-year-old has at least two properties in Dubai, worth nearly $1.2 million in total.

In December 2023, ST revealed that he is a person of interest in the money laundering case. Su Binghai is close to Su Jianfeng, and they spent an overseas holiday together with their families in tow.

Su Binghai is the businessman who used his Singapore-registered firms to buy 10 shophouses for more than $100 million in 2023. He did this with another businessman, Su Fuxiang, who is also from China.

The firms were put into receivership in September 2023 after the owners failed to repay debts, and the shophouses were put on the market by DBS Bank some time in December 2023.

Su Binghai’s associate, Su Bingwang, is linked to 34 properties in Dubai, the data leak showed. ST and OCCRP verified sales transaction records for 30 of the properties, worth more than $28.7 million in total.

Su Binghai, Su Bingwang and Su Fuxiang

left Singapore abruptly after the anti-money laundering raid. All three are understood to be persons of interest to the police in relation to the ongoing case.

The leak also showed that a businessman based in Cambodia, with links to Su Jianfeng, has at least 20 properties worth more than $36.7 million.

They include the entire 58th floor of The Grand at Dubai Creek, and a villa in the same estate as Su Jianfeng.

ST reported on the links in September 2023, and identified the businessman as CZ. The Cambodian national, who is originally from China, is also linked to money laundering accused Wang Dehai and Su Yongcan, a suspect in the case.

Su Sihai

An archived page of Fidu Properties’ website in 2019, showing Su Sihai (front row, centre, in lighter suit) and Su Jianfeng (right of Su Sihai) along with the team at Fidu. PHOTO: FIDU PROPERTIES

Su Jianfeng’s partner, Su Sihai, is linked to six properties in Dubai. Four properties, worth more than $25 million, have been verified.

This includes a villa in the same location as properties owned by Su Jianfeng and CZ.

When ST visited Su Sihai’s home in Clementi on May 9, his maid answered the door and said her employer had not been in Singapore for around a year since leaving for Dubai.

Wearing a uniform with the word “Su” emblazoned on her shirt pocket, the maid said his wife and two children were at home but were too tired to talk.

Business records show that Su Sihai is a director of Foursea Wealth Holding and Foursea Family Office, both in Singapore.

ST visited the offices and found a corporate service provider at the registered addresses of Su Sihai’s companies at Duo Tower, which houses office towers, luxury residences and a five-star hotel.

An employee confirmed that Foursea Wealth Holding and Foursea Family Office are its clients. She also confirmed that Su Sihai is currently not in Singapore.

At Fidu Properties’ listed address at One Marina Boulevard, ST found cloud service provider EdgeNext. An employee said the company moved in some time in February 2023.

Fidu Properties remains active, according to company records.

The employee said the address was also previously used by Runyi Investment, whose business records show that it is owned by Su Jianfeng.

Fidu Properties lists Singaporean Goh Yu Siang as one of its directors. According to regulatory requirements, companies incorporated here must appoint at least one Singaporean as a director.

Checks showed that Mr Goh is also the director of DA Luxury, a company where Su Jianfeng was formerly a shareholder.

ST visited his home in Clementi on May 9 and May 14, but Mr Goh was not around.

Fidu Properties did not reply to queries by OCCRP and ST.

ST also contacted the United Arab Emirates’ Executive Office of Anti-Money Laundering and Counter Terrorism Financing to request an interview, but was referred to the Dubai police.

The Dubai police did not reply to ST’s requests.

The director-general of the anti-money laundering agency, Mr Hamid Al Zaabi, who was in Singapore in November 2023, had praised Singapore’s handling of the money laundering probe here, describing the operation as a case of global significance.

When asked by ST about links between the 10 implicated in the money laundering probe in Singapore and their links to property purchases in Dubai, Mr Al Zaabi said then that the Emirati authorities were taking it seriously.

“What I can say is that the Emirati authorities have a close cooperation with their Singaporean partners and will do their utmost to bring criminals to justice,” he said.

Mr Al Zaabi noted that as money laundering is typically done across jurisdictions, it is necessary to build international cooperation to deal with the problem.