- Joined

- Jul 25, 2008

- Messages

- 13,517

- Points

- 113

Porsche, 2 Rolls-Royces among 4 cars seized from Bukit Timah bungalow in $2.8b money laundering case

(Clockwise from top left) A red Rolls-Royce Dawn, a red Porsche 911 Targa, a white Toyota Alphard and a black Rolls-Royce Cullinan were seized from a good class bungalow in Third Avenue on Oct 25. ST PHOTOS: ARIFFIN JAMAR

Nadine Chua and Andrew Wong

Oct 25, 2023

SINGAPORE – Four luxury cars linked to Singapore’s worst money laundering case were towed out of a good class bungalow (GCB) in Third Avenue, off Bukit Timah Road, on Wednesday.

At around 2.30pm, a red Rolls-Royce Dawn, a black Rolls-Royce Cullinan, a red Porsche 911 Targa and a white Toyota Alphard were removed by the police from the sprawling complex of more than 19,000 sq ft.

The cars are worth over $4.7 million, according to an affidavit filed in September by a Commercial Affairs Department (CAD) officer.

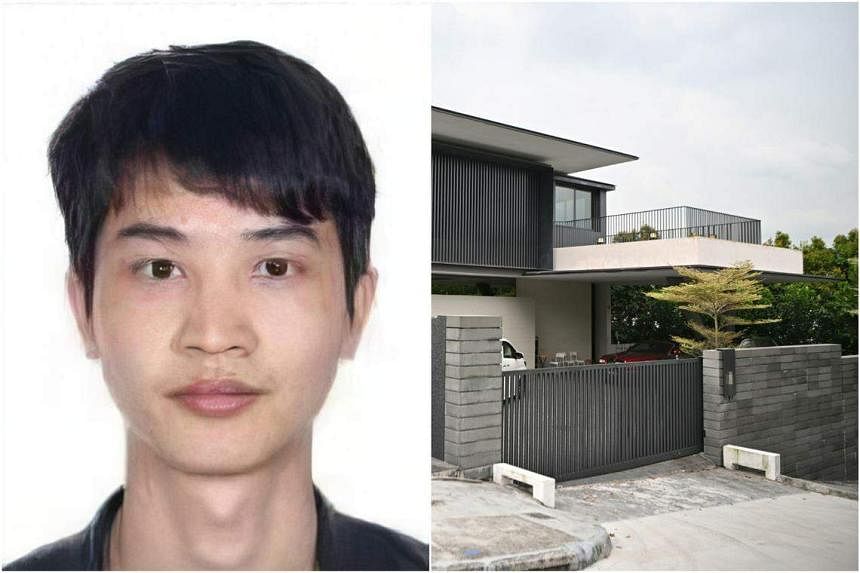

The GCB is rented by Vanuatu national Su Jianfeng, 35, who is one of the 10 accused in the case.

The Straits Times saw one police vehicle in the bungalow and four tow trucks outside the compound. At least eight police officers were also at the property.

The first to be towed out was the Cullinan, followed by the Dawn, the Alphard, and then the Targa.

Each of the four tow trucks had a police officer accompanying the driver.

The red Rolls-Royce Dawn being towed away on a truck on Oct 25. ST PHOTO: ARIFFIN JAMAR

ST followed the seized vehicles to a logistics hub near Pioneer Road, where all four vehicles were parked. There were several other luxury vehicles parked in the same area, including a light blue Rolls-Royce.

On Wednesday, the police said they seized items issued with prohibition of disposal orders relating to the money laundering case at two locations. Four cars and 56 Bearbricks ornaments were seized.

The police did not say where the other location was.

A Bearbrick – stylised as BE@RBRICK – is a collectible toy figure produced by Japanese collectible company Medicom Toy.

The toys, shaped like an anthropomorphic bear and made of plastic, come in different sizes – for instance, 100 per cent, 400 per cent or 1,000 per cent – with the percentage corresponding with the height.

The police said they seized 56 Bearbrick figurines at another location on Wednesday. PHOTO: SINGAPORE POLICE FORCE

Mr Shawn Wee, the owner of collectibles store Eye For Toys, had told ST in August that the Bearbricks seized in the raids could be worth between $450,000 and $500,000.

The police said: “As part of the investigation process, the police are moving the seized items to appropriate locations to prevent tampering, loss, destruction or any other occurence which may diminish their evidentiary value.”

The cars were among the 62 vehicles and 152 properties issued with prohibition of disposal orders by the authorities. This means they cannot be sold.

The vehicles and properties are worth more than $1.24 billion.

The case is also considered one of the world’s largest money laundering cases.

The police had said in August that Su Jianfeng was arrested at his residence in Third Avenue. He faces four money laundering charges.

The good class bungalow in Third Avenue is rented by Vanuatu national Su Jianfeng. PHOTOS: SUPPLIED, ARIFFIN JAMAR

On Oct 18, prosecutors said he had claimed to be the chief executive of a computer support firm, but did not know where his office was.

In fact, investigations show that this firm, An Xing Technology, is a shell company, said the prosecution in arguing against granting him bail.

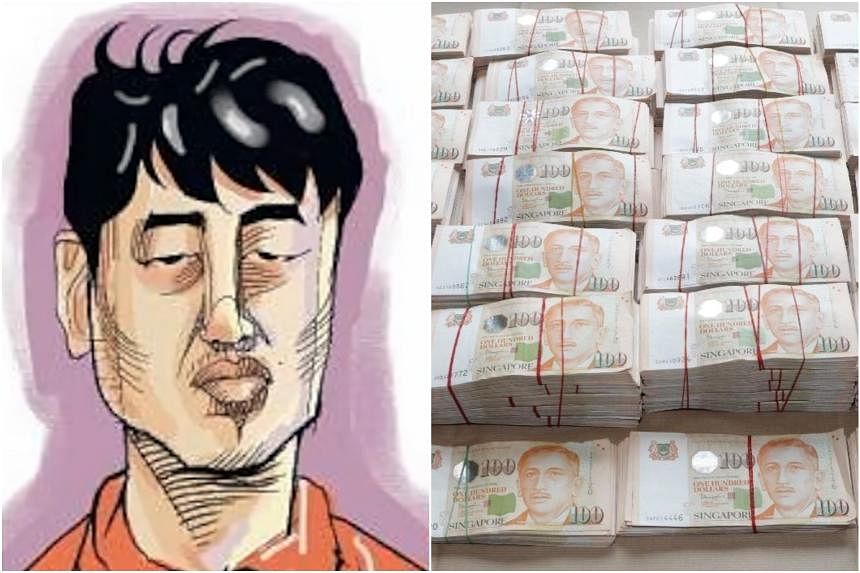

The CAD officer’s affidavit had said that more than $231 million worth of assets belonging to Su Jianfeng and his wife have been seized or subjected to prohibition of disposal orders.

They include 13 real estate properties worth over $115 million, four vehicles worth over $4.7 million, $18.4 million in cash, $66 million in bank accounts and $26 million worth of cryptocurrency.

According to an Accounting and Corporate Regulatory Authority search, Su Jianfeng has another registered address at a St Thomas Walk condominium.

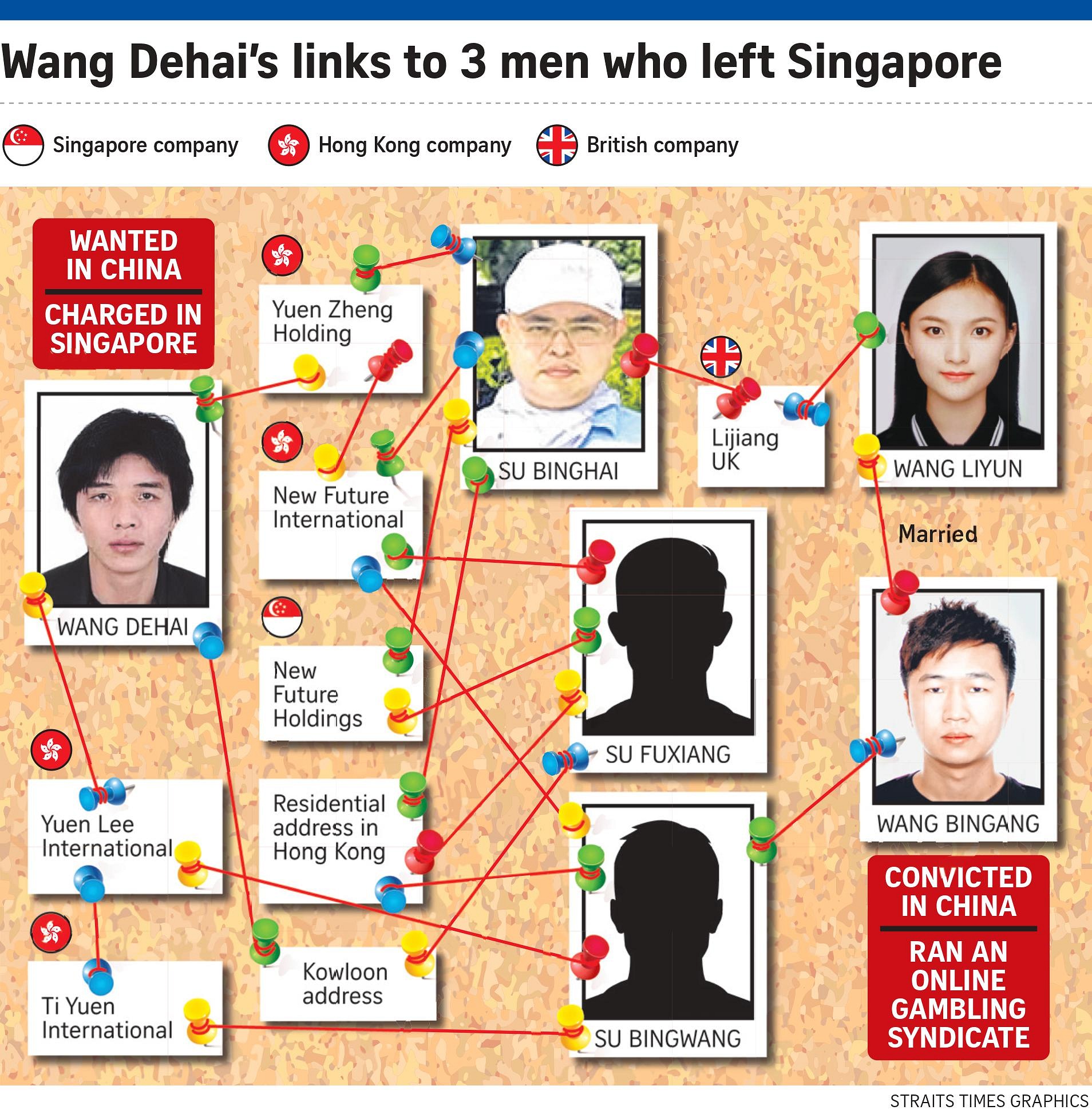

He is wanted in China for alleged links to an illegal gambling gang uncovered in 2017. Another of the accused, Cypriot national Wang Dehai, is wanted for his part in the same operation.

This is the second time this week ST has seen items being moved out from the GCBs linked to the accused individuals in the money laundering case.

On Monday at around 2pm, ST saw workers packing items into cardboard boxes at a GCB in Nassim Road. The pallets were then moved into a truck at about 6.10pm, leaving the area 10 minutes later.

Su Baolin, who faces two forgery charges, had rented the GCB in Nassim Road with his wife, Ma Ning.

The hilltop good class bungalow which was previously rented by suspect Su Baolin in Nassim Road has been vacated by his family. ST PHOTO: ZAIHAN MOHAMED YUSOF

There were several cars parked on the street during the operation. ST also saw plain-clothes police officers there.

Last Wednesday, ST saw items being removed from another GCB in Bishopsgate, off Tanglin Road, by movers. The house is rented by another accused – Vang Shuiming, or Wang Shuiming – and his wife, Wang Ruiyan.

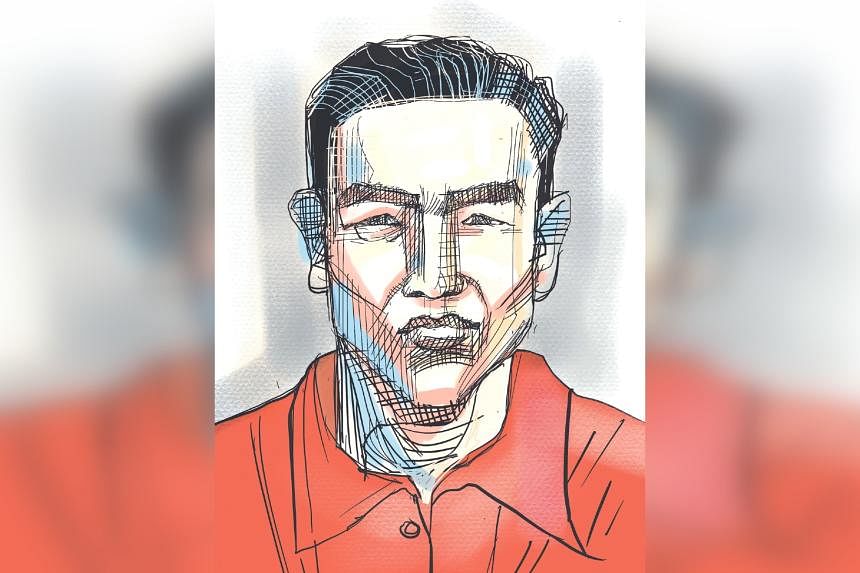

Vang faces four money laundering charges and one charge of using a forged document.

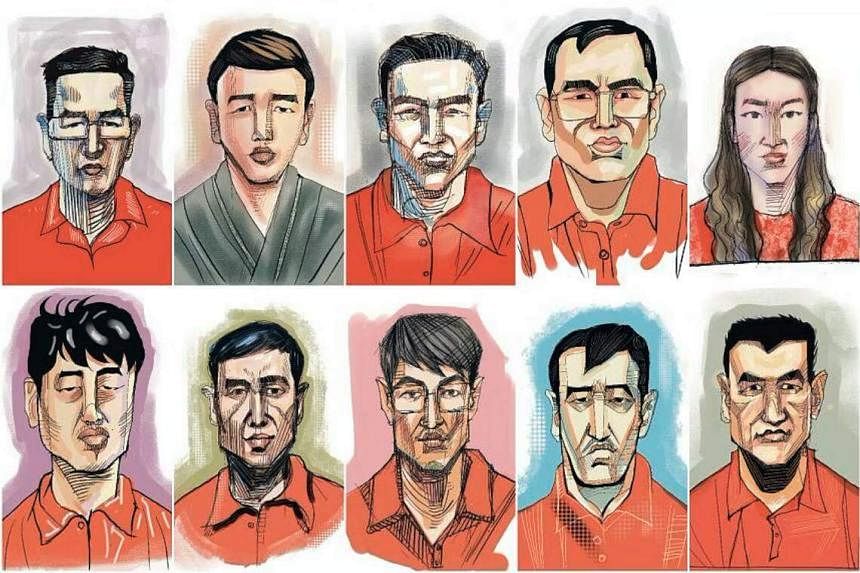

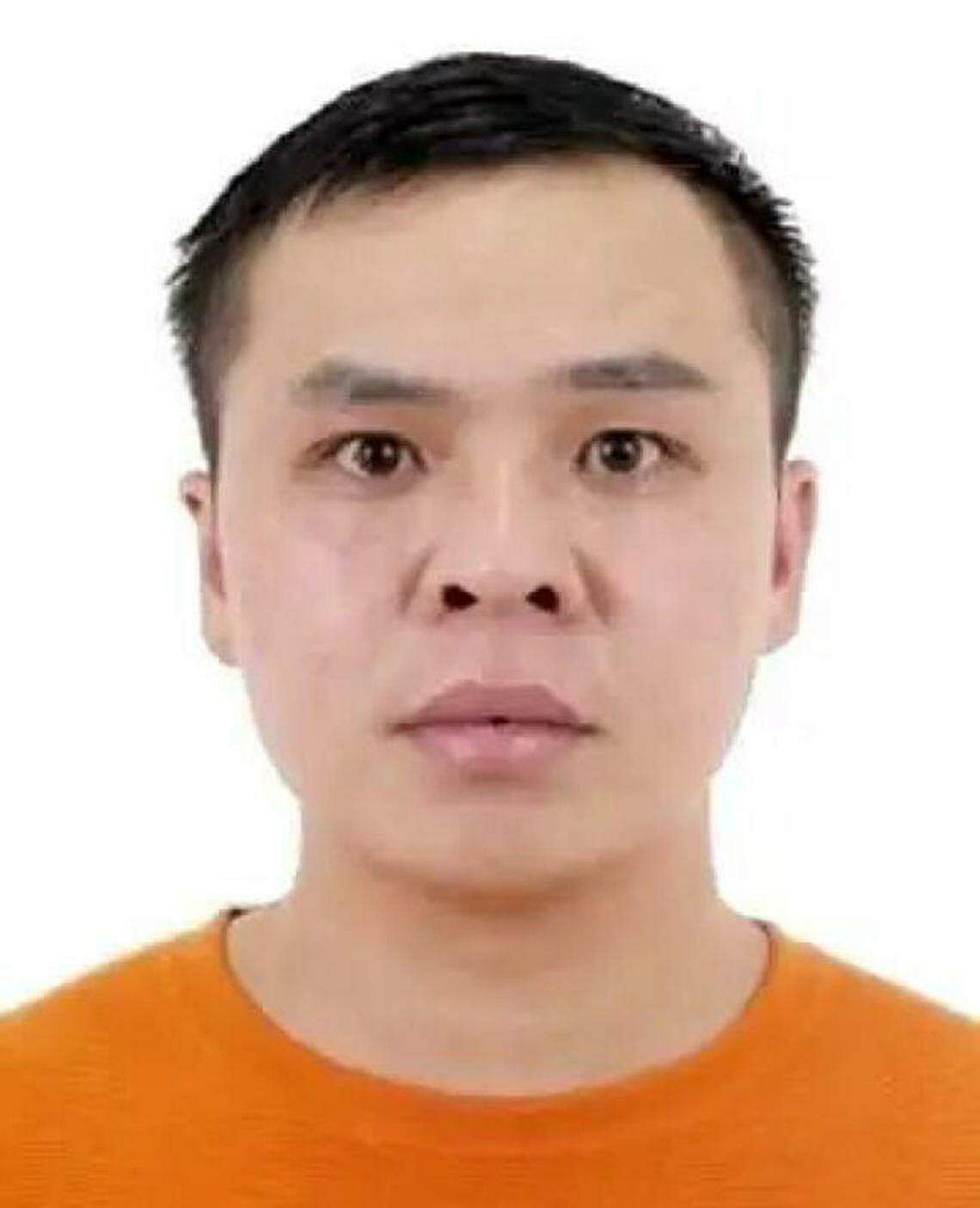

Vang Shuiming, or Wang Shuiming, faces four money laundering charges and one charge of using a forged document. PHOTO: SINA.COM

The items, which included one pallet of about 50 bottles of Macallan 25 Years Sherry Oak whisky, were loaded into an air-conditioned truck. Each bottle of the whisky costs between $4,000 and $5,000.

The truck, which was escorted by the same car present in Nassim Road on Monday, then travelled to Le Freeport Singapore, a high-security storage facility in Changi North Crescent. It is touted as the safest area in Singapore for wealth protection.

The cars involved in the money laundering case were seized and transported to a logistics warehouse for storage, on Oct 25. ST PHOTO: ARIFFIN JAMAR

Shin Min Daily News had reported last Friday that a number of other assets, including a Rolls-Royce and a Bentley, were also transported from the Bishopsgate house.

Plain-clothes police officers entered the property and remained there for about four hours.

The anti-money laundering operation on Aug 15 involved more than 400 police officers and saw raids at properties in areas such as Tanglin, Bukit Timah, Orchard Road, Sentosa and River Valley.

Ten foreigners, all originally from China, were charged the next day with offences including money laundering, forgery and resisting arrest.