Mothership Explains: Why most S'poreans own their homes instead of renting

Home ownership is a largely-unquestioned norm in S'pore, but how did it come about?

Nigel Chua |

September 28, 2021, 11:16 AM

The vast majority of people in Singapore own their homes —

87.9 per cent as of 2020, to be precise. This makes home ownership rates here among the highest in the world.

Singapore is also an outlier in the way that over 80 per cent of the population lives in public housing, in the ubiquitous high-rise Housing and Development Board (HDB) blocks built by the government, on land owned by the government.

Over the years, some have questioned whether HDB owners truly own their flats, given that if and when HDB 99-year leases do run down, they have to be returned to the government with

no compensation, and no extensions — a point aptly driven home with the expiry of 60-year leasehold terrace houses at Geylang Lorong 3 in Dec. 2020.

But the state of housing in Singapore is still

widely lauded as

a success story, with one observer calling it "the best public housing program in the world" in an

article for the World Bank.

After all, in many countries, public housing projects can become ghettoes, as they tend to be the "last resort" option for those who cannot afford anything better.

In contrast, countless examples of immaculately renovated HDB apartments suggest that public housing can indeed be quite liveable.

But there is a type of public housing in Singapore that

does not buck the trend of being the "last resort" — public rental housing.

A worrying trend in public rental housing

Prime Minister Lee Hsien Loong highlighted a

worrying trend in public rental housing in his National Day Rally speech last month: The proportion of Malay households in rental flats has increased, according to the Census 2020 survey.

PM Lee flagged this as an issue, saying that there was a need to "help more households in rented flats recognise that

renting is only a temporary housing solution" (emphasis ours).

Masagos Zulkifli, Minister-in-charge of Muslim Affairs, told the media after PM Lee's speech that the government was concerned over the possibility that families living in rental flats might "get used to it", and not aspire to own their homes,

TODAY reported.

He was further quoted saying that the message from the authorities to these homeowners was that they "must aspire to own homes, because this is an asset that every Singaporean should have and should not give up on".

These latest comments reflect a long-standing government policy geared toward encouraging people in Singapore to own their homes, rather than renting.

It's a policy that has resulted in home ownership being much more feasible for the average Singaporean, as compared to renting permanently.

How did this come to be the case?

History of home ownership policies in Singapore

As with many of Singapore's longstanding government policies, the story of this one starts more than 50 years ago, with none other than founding Prime Minister Lee Kuan Yew.

As Lee Kuan Yew wrote in his memoirs:

"My primary preoccupation was to give every citizen a stake in the country and its future. I wanted a home-owning society."

He explained two reasons why home ownership was a priority:

Political stability, and a sense of ownership in Singapore's future.

The

political stability consideration was explained as such:

"I had seen how voters in capital cities always tended to vote against the government of the day and was determined that our householders should become homeowners, otherwise we would not have political stability."

As for giving people

a sense of ownership, Lee Kuan Yew pointed to the fact that Singapore's new society had "no deep roots in a common historical experience".

He ventured that if a soldier's family did not own their home, "he would soon conclude he would be fighting to protect the properties of the wealthy."

Thus, he wanted to "give all parents whose sons would have to do national service a stake in the Singapore their sons had to defend."

Home ownership is about nation building

Today, echoes of the founding PM's sentiments are still heard.

HDB 2013/2014 annual report — which also marked the 50th anniversary of the Home Ownership for the People Scheme — reads:

“Ownership meant that they are now an asset-owning class, with a stake in the nation’s prosperity.

Ownership of an HDB flat has also given Singaporeans a physical as well as an emotional anchor, deepening their sense of rootedness to home and country. The push for home ownership was an important factor in nation building 50 years ago, and remains equally vital today.”

Home ownership takes care of retirement needs

Ultimately, there was also a pragmatic concern behind getting people to own their homes: Retirement adequacy.

The Central Provident Fund (CPF) Board

describes home ownership as one of two "twin pillars of retirement adequacy", since retired homeowners would not need to make use of their retirement funds to pay rental fees.

How did the government achieve 80 per cent home ownership?

The government wielded a few key policies since the 1960s to nudge Singaporeans towards home ownership.

These include allowing retirement savings to be used for housing needs, "Asset Enhancement" which made HDB homes attractive investments, extensive subsidies for new homeowners, as well as restricting the development of the rental market through compulsory land acquisition and other controls.

Allowing retirement savings to be used for housing needs

Today, using one's CPF savings to pay for a home is a common practice.

It originated in 1968, and was a policy rolled out to — you guessed it — help more people in Singapore own homes, by allowing them to dip into their locked-away mandatory retirement savings to finance the purchase of a HDB flat. Now, CPF savings can be used to help finance both public and private housing.

Those who use their CPF for housing would have less retirement savings when they do actually retire, meaning that the policy was a tradeoff between the twin aims of retirement adequacy and promoting home ownership.

However, this was an acceptable compromise, given that retirees who owned their homes would not need to spend on accommodation, bringing their retirement expenditure down.

"Asset Enhancement Programme"

The value of homes have consistently risen over time, also under the influence of government policy.

In 1990s, an "Asset Enhancement Programme" was rolled out by then-Prime Minister Goh Chok Tong.

Goh

said, in 1995:

"In the 1960s and 1970s, we struggled to provide a roof for all Singaporeans. In the 1980s, Singaporeans were able to own their homes. Now, in the 1990s, we embark on a new phase where the Government increases your asset value through the Assets Enhancement Programme."

Enhancement of Singaporeans' assets would take place via upgrading programmes which would increase the value of HDB flats, and resale flat prices thus rose steadily.

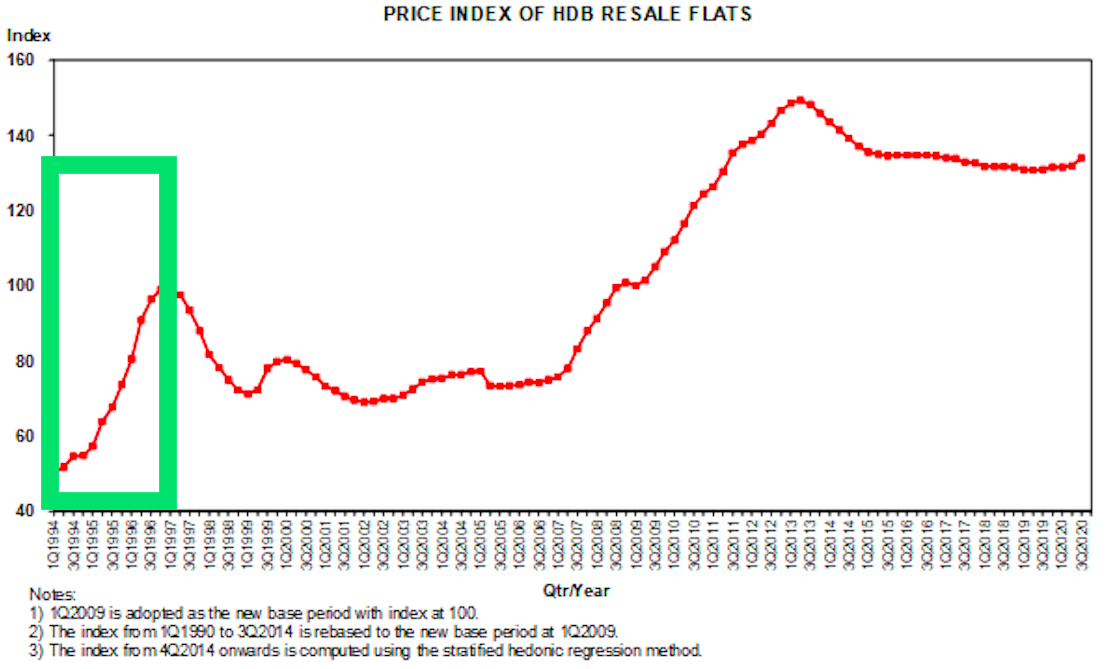

HDB resale prices rose in the 1990s, up till the Asian Financial Crisis in 1997. Image via HDB website.

This policy continued into the 2000s and 2010s, and even ageing, short-lease HDB flats were being sold at high prices.

This prompted a warning from then-Minister for National Development, Lawrence Wong in March 2017, who said that HDB flat prices would inevitably start to fall at some point, as their leases run down.

But the consistent promises of asset enhancement from the 1990s, and even up till the 2010s (before Wong's warning) signalled to the public that the government's intentions were for HDB flats' value to continue increasing.

In response, homeowners would probably have believed that the sooner one purchased a flat, the better, since its value would likely go up with time. This has turned out to still be true in most cases, as the vast majority of HDB flats have yet to see their resale value decrease due to age.

The policy of asset enhancement thus made it that much more attractive to purchase a flat as soon as possible.

Arguably, this policy could also work

against home ownership as it made properties more and more expensive over the years, disadvantaging future generations of would-be homeowners.

Thus, the government also introduced policies to keep homes affordable, favouring younger people who were starting new families in particular.

Subsidy town

HDB home ownership is supported by grants and subsidies for new owners, with higher grant amounts for those who earned less.

Even those who purchase resale flats on the open market may be eligible for grants.

Further encouraging home ownership from a young age, Build-to-Order (BTO) flats are priced according to

market value, with a subsidy applied.

This makes them cheaper than any other comparable option in the market.

The subsidy has been so significant that getting a BTO in a prime location has been compared to winning the lottery, and described as a "windfall" — terminology that has even been

adopted by the government.

Compulsory land acquisition and restrictions on rental market

One could say that the success of government policies generally depends on their adoption by the population.

However, in the case of home ownership policies, the government also introduced policies that restricted the development of a market for those who might have wanted to rent their homes permanently, by controlling most of the housing market.

A key policy which anchored the government's control over most of the housing market was compulsory land acquisition since 1967.

By 1985, the government owned 76.2 per cent of Singapore's land, up from 31 per cent in 1949.

By virtue of the fact that the government owned most of the land in Singapore, and retained close control over how even private land could be used, it was able to make public housing the norm.

The government has also restricted the supply of homes available for rent, by imposing controls on how and when HDB units can be rented out.

For example, there is a Minimum Occupation Period (MOP) during which even flats purchased on the open market cannot be rented out. Even after the MOP, only Singapore Citizens are allowed to rent out their HDB flats, among

other criteria.

In order for there to be privately-owned homes offered for rent, there have to first be homeowners with spare residences.

But it is difficult to own multiple properties in Singapore. For one, HDB owners are not allowed to own multiple flats, and must dispose of their flat within six months of purchasing another one.

Even wealthy private homeowners might thinking twice about buying more property to earn rental income.

This is because increased stamp duties since 2018 mean that Singaporeans have to fork out a hefty 12 per cent of the purchase price of a second residential property, and 15 per cent for the third one. The rates are even higher for PRs and foreigners.

As a result, the supply of homes available for rent has remained very limited, compared to the supply of homes available for sale.

Home ownership a no-brainer

Looking back at Singapore's history thus far, it is rather clear that there was no room for rental homes to ever become the dominant mode of housing — mostly due to government policy.

The combined effect of the policies described above was such that home ownership is almost a no-brainer — provided that you fell into the majority group that was able to afford it.

Even for those outside of the majority, the government's intent is clear: To support, incentivise, and even cajole them toward eventual home ownership, so that they can one day join the 88 per cent majority.

Here are some of the

measures toward that end:

- A Home ownership Support Team (HST) in HDB which advises rental tenants on their options for purchasing a home, and helps to "guide them through their journey to home ownership".

- Providing grants of S$35,000, and priority allocation, to purchase flats on short leases (from 45 to 65-year leases) under the Fresh Start Housing Scheme.

- Not raising rental rates for those who have made a downpayment for their own flat, while they save up for their new homes.

High home ownership rates, the stability they bring, and even the way they work together with government policy in other areas (like retirement adequacy), look set to be here to stay.

Top image via unsplash