Complaints made in US, S’pore against local firm that promised quick returns on crypto investments

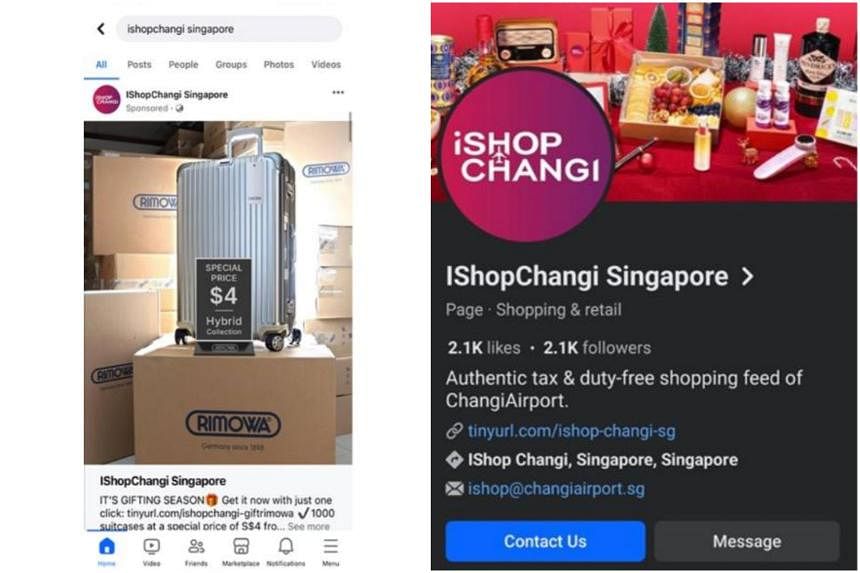

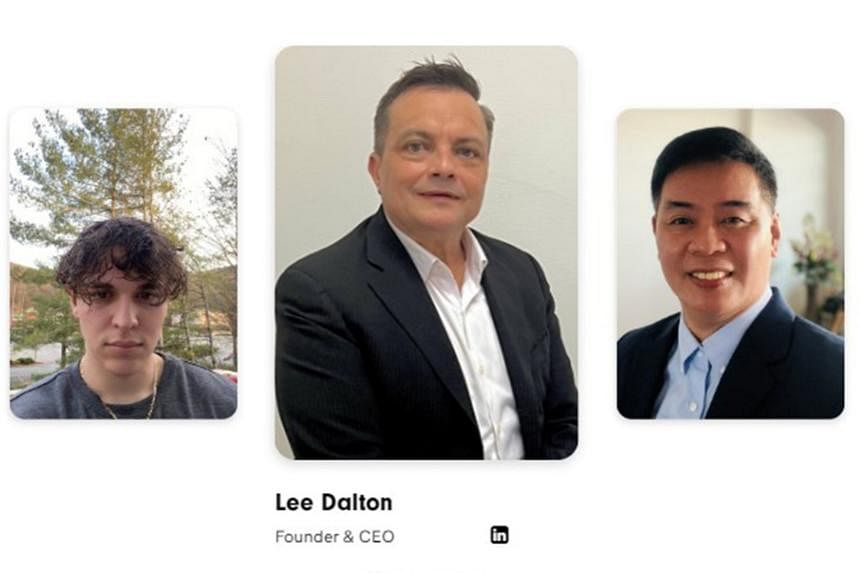

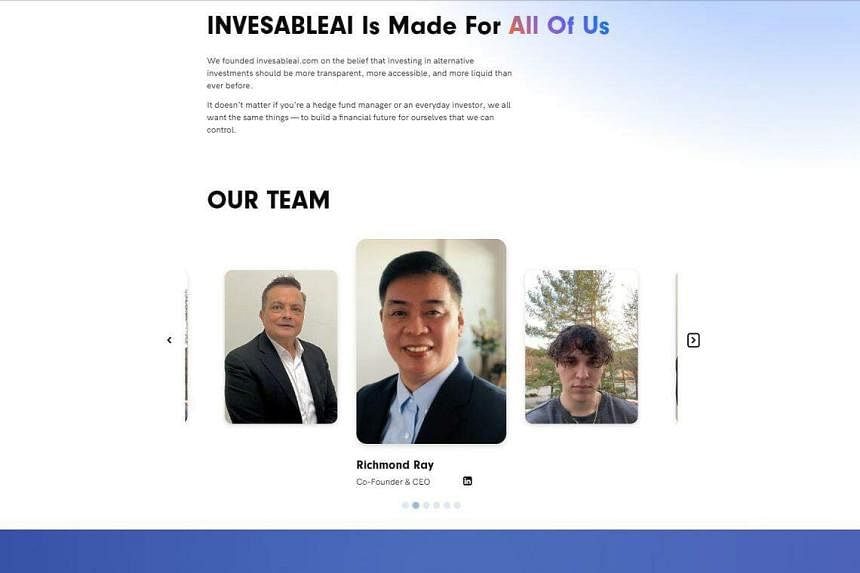

Mr Lee Dalton (centre), identified on the firm’s now-defunct website as its founder and chief executive, with co-founder Richmond Ray Gonzales (right) and marketing manager Reid Fletcher. PHOTO: INVESABLEAI/INTERNET ARCHIVE

Aqil Hamzah

MAR 24

SINGAPORE - A Singapore-registered firm is under investigation after allegedly failing to pay investors who have pumped money into its cryptocurrency investment schemes.

Reports have been filed against InvesableAI with the Singapore police, and with the United States Federal Bureau of Investigation (FBI) and Securities and Exchange Commission (SEC).

Incorporated in the Republic on June 19, 2023, InvesableAI is believed to have promised investors quick returns on cryptocurrency investments that banked on the use of artificial intelligence technology.

Its founders claimed to have sought a licence from the Monetary Authority of Singapore (MAS) and, on the firm’s now-defunct website, said it was a trustworthy business because “we are a registered company”, with a separate webpage showing its address in Singapore.

It is a “live” company or a business that is still in operation, according to Accounting and Corporate Regulatory Authority (Acra) records.

Checks by The Straits Times on the details of InvesableAI’s Acra records revealed several discrepancies, including in the company’s registered address, the nationality and address of a foreign director, and the identity of a Singaporean director.

In response to queries, an Acra spokesperson said: “Acra is unable to comment due to ongoing investigations.”

Meanwhile, the FBI and SEC said they could neither confirm nor deny that they were investigating the matter.

Several of the reports lodged with the FBI and SEC, and seen by ST, show that more than 4,000 people have invested money in InvesableAI.

The total sum allegedly sunk into the business by all investors is unclear, but a smaller group of about 150 investors have counted losses of at least US$1.5 million (S$2 million).

One of the investors, a 46-year-old woman, said she trusted the firm because it promised transparency and accessibility for investments in alternative currencies.

The woman, an American, pumped more than US$15,000 into InvesableAI on July 13, 2023, but about two months later, the firm informed her and other investors that withdrawals would be paused “temporarily”.

In a Sept 17 e-mail to investors seen by ST, the firm said there was extreme volatility in the cryptocurrency market, and asked for 40 days to recover losses.

It also offered refunds within a week to those who wanted them.

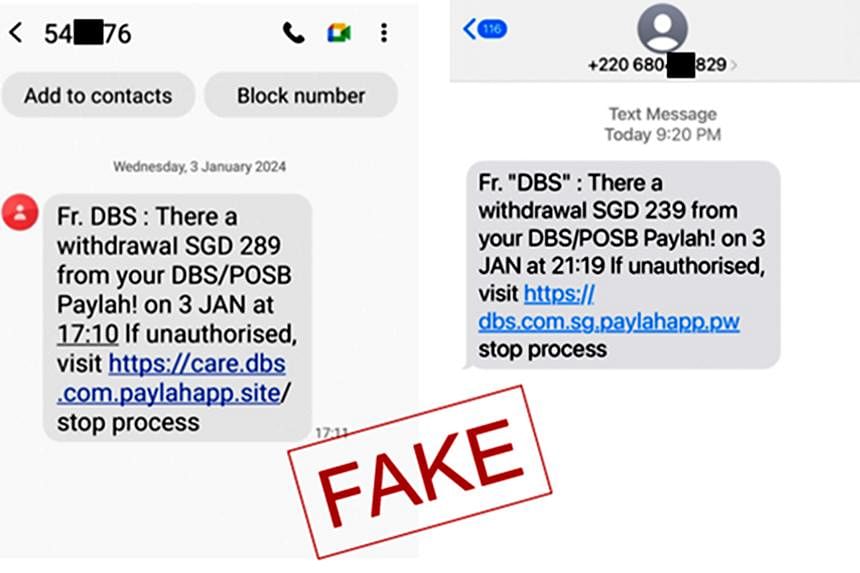

The e-mail was signed by Mr Lee Dalton, who is identified on the firm’s website as its founder and chief executive.

Six months later, investors said they have yet to get their money back.

The American woman, who holds a Master of Business Administration degree and lives in California, said: “I wish I had known how to do trades on my own, instead of depending on others. It was a bad decision… but InvesableAI seemed to hit all the marks when it came to its legitimacy.

“It being based in Singapore was assuring because of the stringent guidelines that are required there.”

ST spoke to several others in a group totalling about 150 investors – including the American woman – who have banded together to tally their losses.

The group has also compiled a spreadsheet that details the outstanding sums due to more than 60 of them.

Transaction records of more than a dozen investors showed that some managed to make withdrawals ranging from US$25 to almost US$25,000 until September 2023.

However, it is unclear if any of the investors have gotten back their original investments, which ranged from US$500 to more than US$50,000, according to the spreadsheet and transaction records seen by ST.

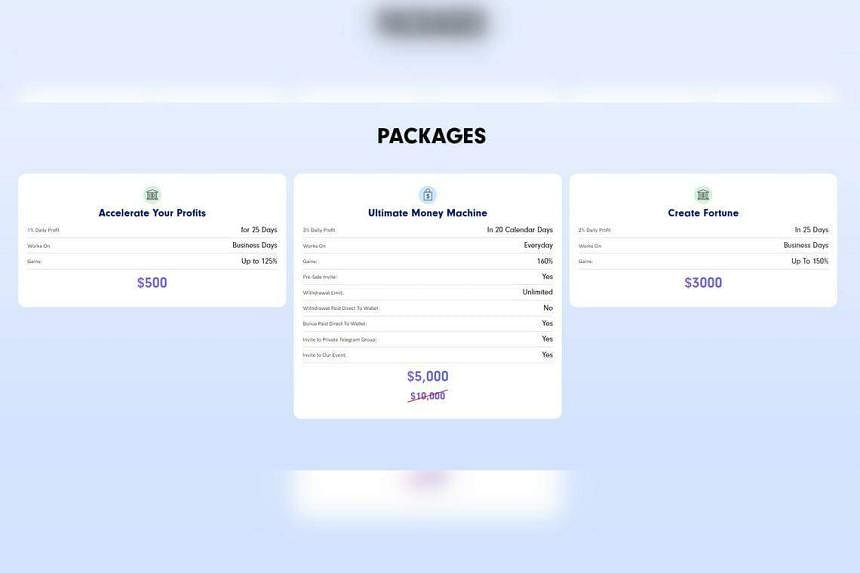

An archived version of InvesableAI’s now-defunct website lists the minimum investment at US$500, with packages that promise returns of up to 160 per cent of the principal amount in 20 days for a US$10,000 investment.

Claiming to have more than 14,000 members, the firm also had a referral programme where investors could earn higher interest rates on certain deposits if they roped in others successfully.

When ST visited the Woodlands address listed in InvesableAI’s Acra records on March 12, a firm that deals in water treatment and engineering design was found to be occupying the space instead.

When contacted, a representative of the water treatment firm said he was unaware of the existence of InvesableAI, and that the space had not been leased out to other firms.

The water treatment firm’s Acra file showed it has been occupying the Woodlands space since February 2022, before InvesableAI was registered.

InvesableAI’s business records showed its office address to be at 12 Woodlands Square. However, when ST visited on March 12, the unit was occupied by another company. ST PHOTO: NG SOR LUAN

Checks showed that HeySara, a digital corporate service provider, handled InvesableAI’s incorporation.

Foreigners who want to incorporate a business in Singapore must engage a registered filing agent, which can be a corporate service provider.

Asked about InvesableAI’s use of the Woodlands address in Acra’s records, HeySara associate director Chew Shin Yee said the address in the application was provided by Mr Dalton, who is listed as a director in the Acra records.

She said: “We received the order online and conducted our due diligence based on our internal procedure, policy and control.”

But HeySara did not conduct any checks on Mr Dalton’s financial background, she added, as he wanted to incorporate the company with only a $1,000 paid-up capital. She did not elaborate on how the company vetted the information.

MORE ON THIS TOPIC

‘I will die if crimes were committed’: S’porean man unaware he is director of 4 firms, files police report

AI can write, but is it any good at picking stocks?

Acra’s guidelines for registered filing agents on anti-money laundering and countering financing of terrorism – published in January 2023 – put non-resident customers in a higher-risk category.

In such situations, registered filing agents must get more information on the source of customers’ funds, for example.

Ms Chew also said there is no information about InvesableAI’s business model, as the staff who handled the account had already quit HeySara.

She did not respond to follow-up e-mails from ST seeking clarification, including on the discrepancy between HeySara’s vetting of InvesableAI and Acra guidelines.

Mr Dalton is listed as an American citizen in the Acra records, with a home address in Texas.

Checks against publicly available property records and data brokers found that an elderly couple with no relation to Mr Dalton have been living at the address since 2009.

Three packages that InvesableAI offered to investors. PHOTO: INVESABLEAI

Mr Dalton’s photo features on the firm’s website, with a marketing video for InvesableAI showing him speaking with an Australian accent against the backdrop of the Kuala Lumpur Tower at night.

In phone video footage filmed last July, Mr Dalton is seen announcing the extension of a promotion and asking individuals to select a particular package and “just start making money”.

In an article published on Yahoo Finance on June 24, 2023, it is stated that Mr Dalton was formerly from the Australian navy and came from Malaysia. ST has contacted Yahoo for comment.

Meanwhile, a Singaporean man is named in the Acra records as the firm’s other director, although he was not listed on InvesableAI’s website.

Instead, its other co-founder was listed online as Mr Richmond Ray Gonzales, whose now-deleted LinkedIn account said he is based in Singapore.

According to that account, an archived version of which was seen by ST, he is the channel sales leader for a multinational corporation dealing in business consulting services.

Queries have been sent to the company asking for more details about Mr Gonzales.

Although he is not listed in the business record of InvesableAI, Mr Richmond Ray Gonzales was said to be the co-founder and chief executive on its website. PHOTO: INVESABLEAI/INTERNET ARCHIVE

Both Mr Dalton and Mr Gonzales were named in the FBI and SEC reports.

Attempts to contact Mr Gonzales through his last-known phone number were unsuccessful, while a social media account in Mr Dalton’s name turned out to be a fake with a Nigerian phone number.

In separate YouTube videos that have since been deleted, the two men said the firm was “in the process of getting” a licence from the MAS, describing it as one that is recognised globally.

In response to queries, an MAS spokesperson said anyone who provides a payment service in Singapore requires a licence.

Otherwise, he will need to be exempted from the Payment Services Act to operate.

The spokesperson said: “InvesableAI is not licensed nor exempted from licensing by MAS.

“Regardless of whether an entity is regulated by MAS, it is an offence to run a fraudulent or deceptive business in Singapore.”