- Joined

- Jul 25, 2008

- Messages

- 13,814

- Points

- 113

Woman loses over $44k after downloading third-party app to buy fish

Ms Jacqueline Khoo, 58, had chanced upon a Facebook advertisement for grouper fillets from a seafood supplier called “Fresh Market TGS” on Aug 25. PHOTO: SHIN MIN DAILY NEWS

Sherlyn Sim

SEP 25, 2023

SINGAPORE – An online order for grouper fillets that was supposed to cost $10 ended up costing one woman more than $44,000 after scammers took control of her Android phone and banking details remotely.

Ms Jacqueline Khoo, 58, lost $44,487 from two credit card accounts and three bank savings accounts from POSB in a few hours after she clicked on a link to download a third-party app, following which scammers then increased her credit limits and siphoned out her money.

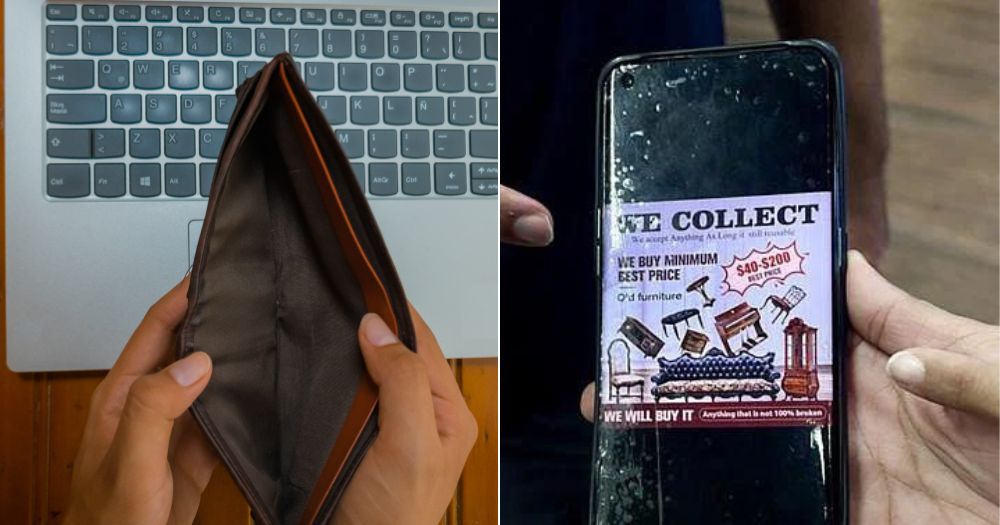

Ms Khoo had chanced upon a Facebook advertisement for grouper fillets from a seafood supplier called “Fresh Market TGS” on Aug 25.

She was attracted by a deal that offered $10 grouper fillet with free shipping and contacted the seller on Facebook.

“Although I never bought anything from Facebook before, I had previously bought fish and pork from Shopee and Qoo10. I was not suspicious of the ad and it never occurred to me that this was a scam,” she told The Straits Times.

The seller texted Ms Khoo on WhatsApp and instructed her to download a third-party app called Grab&Go on her phone. The app prompted her to make a $5 payment through PayNow as a “deposit” before her order could be placed, but she asked if she could pay when her order arrived.

The seller reassured her that he did not need her banking details and asked her to enter her name, address and phone number on the app to check out her purchase.

Ms Khoo, who works as a merchandiser at book stores, did not suspect anything until 8pm that day, when she was calling friends. She noticed that her phone felt “extremely hot” and the screen had gone blank.

When her phone restarted twice by itself, she quickly uninstalled the application and rushed to charge it, thinking it was out of battery.

Three days later, when she wanted to check if she had received her pay, she realised that she was “left with a few dollars” in her bank accounts.

The scammers had raised her transaction limit from $25,000 to $50,000 and transferred about $32,000 out of her three POSB savings accounts to a Hong Leong Bank account.

Later, when checking her POSB online banking app, she realised a further $12,000 was missing from two POSB credit card accounts.

She said she had set aside that money for her 16-year-old daughter’s school fees and insurance.

“Everything’s gone. I can’t sleep and can’t eat. This was my hard-earned money and I need to pay for my younger daughter’s school fees and insurance,” said Ms Khoo, who also has a 26-year-old daughter working as a nurse.

“My younger daughter’s insurance policy is going to expire soon and I’m worried sick that I can’t afford to renew it.”

Ms Khoo sought help from Marsiling-Yew Tee GRC MP Lawrence Wong to write appeals to POSB and the Monetary Authority of Singapore to waive the amount that was drawn from her credit card and bank accounts. She also lodged a police report on Aug 28.

The police confirmed that a report had been made and investigations are ongoing.

When contacted, DBS Bank, which runs POSB, said it has dedicated resources to “act swiftly and assist” customers who are scammed, including a dedicated fraud hotline – 1800-339-6963 (from Singapore) or (+65) 6339-6963 (from overseas). It also has a safety switch function on the digibank app, which would temporarily block access to funds.

“We will assist these customers with necessary follow-up actions, which include making a police report, or replacing their cards/re-securing their accounts,” DBS said.

“While we continue to adopt multi-pronged measures to strengthen fraud prevention and recovery, customers remain the first line of defence in safeguarding against scams.”

Ms Khoo wonders how the large sums were transferred out of her accounts without any notifications sent to her.

“I didn’t get any one-time passwords (OTPs) in SMSes sent by the bank to verify the unauthorised transactions. I am very scared and frustrated,” she added.

Scams using the same tactic – whereby “sellers” send victims payment links that download malware into their phones, enabling scammers to control their devices remotely and drain their bank accounts – have become increasingly common.

Earlier in September, a woman lost $76,000 after downloading a third-party app to buy mooncakes. Another woman lost more than $20,000 from credit card and bank accounts after downloading a third-party app to order food.

There were 22,339 scam cases reported from January to June 2023, a 64.5 per cent increase from the 13,576 cases in the same period last year. The amount lost totalled $334.5 million.