#1

At least 70 police reports filed against Singaporean-run crypto trading platform Torque

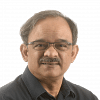

Torque is run by Singaporean businessman Bernard Ong.

PHOTOS: TORQUESUPERWALLET.ASIA, YOUTUBE

Joyce Lim

Senior Correspondent

MAR 24, 2021

SINGAPORE - At least 70 police reports were lodged against online cryptocurrency trading platform Torque, run by Singaporean businessman Bernard Ong, with investors claiming millions lost in cryptocurrencies.

Three days before the Chinese New Year holidays last month, retail investors were told that one of Torque's employees had apparently violated the company's rules and that his unauthorised trading activities had led to significant losses in their trading accounts.

In a letter to investors, Torque Group Holdings, which is incorporated in the British Virgin Islands (BVI) and owns the cryptocurrency trading platform, told investors that their accounts had been suspended to prevent further losses. Once the investigations were concluded, investors would be able to withdraw their remaining balances and have the option to close their accounts or resume trading on the platform, said Torque's chief executive Bernard Ong.

But Mr Ong subsequently applied to the BVI Courts to wind up the company.

The application was granted last week (Mar 18) and Mr Philip Smith and Mr Jason Kardachi from restructuring and insolvency specialist firm Borrelli Walsh were appointed as joint liquidators.

A preliminary review of Torque's record and investor database by Borrelli Walsh estimated creditor claims at US$325 million (S$436 million) as at March 2 (2021), while crypto assets under the control of the liquidators are valued at about US$9.1 million (S$12 million) as of Mar 14.

Mr Smith told The Straits Times that investigations were still at an early stage and he is unable to confirm yet how many of Torque's more than 14,000 investors from more than 120 countries, reside in Singapore.

Mr Ong, 33, chief executive of Torque, told ST that he has filed a police report in Singapore against the employee who, he alleges, is responsible for the losses. He said that the employee is not based in Singapore and has not been contactable.

Police confirmed reports were lodged by both Mr Ong and investors and said that they are looking into the matter.

Mr Ong said that Torque, which was incorporated in 2019, has about 80 employees based in Vietnam and Singapore, of which 20 are Singaporeans.

"The cost is too high to run a 24-hour operation in Singapore. And the reason why I registered my company in BVI is because it does not have a regulatory framework towards cryptocurrency. I wanted a place that is more friendly towards crypto space," said Mr Ong.

A search on the Accounting and Corporate Regulatory Authority portal showed that Mr Ong is the director and shareholder of 12 companies in Singapore.

Mr Ong said: "Borrelli Walsh has taken over (the company). I am no longer in power of the company. I know that investors are frustrated and angry. As a company, we are doing all we can to help anyone and I am ready to cooperate with any authority."

In an email to ST, Mr Ong's lawyer Sarbrinder Singh of Sanders Law said the purpose of engaging Borrelli Walsh was "to trace and locate the misappropriated funds" by the employee in question, "so that the losses to Torque would be minimised".

Mr Singh added that Mr Ong has been harassed by debt collectors demanding payments for which he is not liable. He is also aware of a potential class action against Mr Ong by a group of investors.

One investor, who has 350 accounts with Torque said he was attracted to Torque's reward scheme which could reward an investor between 0.15 and 0.45 per cent of the amount traded in a day.

The investor who wanted to be known as only Mr Lim, said he opened his first account with Torque in January last year(2020) and invested US$50,000 (S$67,000) in cryptocurrency. In the past one year, he has traded a total of US$350,000 (S$470,000) in cryptocurrency with Torque.

He claimed that at one point he was getting daily rewards of about US$2,000.

The self-employed man, who is in his 30s, said he will wait for the liquidators to conclude their investigations and hoped that he could eventually withdraw his remaining balance of some US$800,000 (S$1.07 million) from his Torque account.

At least 70 police reports filed against Singaporean-run crypto trading platform Torque

Torque is run by Singaporean businessman Bernard Ong.

PHOTOS: TORQUESUPERWALLET.ASIA, YOUTUBE

Joyce Lim

Senior Correspondent

MAR 24, 2021

SINGAPORE - At least 70 police reports were lodged against online cryptocurrency trading platform Torque, run by Singaporean businessman Bernard Ong, with investors claiming millions lost in cryptocurrencies.

Three days before the Chinese New Year holidays last month, retail investors were told that one of Torque's employees had apparently violated the company's rules and that his unauthorised trading activities had led to significant losses in their trading accounts.

In a letter to investors, Torque Group Holdings, which is incorporated in the British Virgin Islands (BVI) and owns the cryptocurrency trading platform, told investors that their accounts had been suspended to prevent further losses. Once the investigations were concluded, investors would be able to withdraw their remaining balances and have the option to close their accounts or resume trading on the platform, said Torque's chief executive Bernard Ong.

But Mr Ong subsequently applied to the BVI Courts to wind up the company.

The application was granted last week (Mar 18) and Mr Philip Smith and Mr Jason Kardachi from restructuring and insolvency specialist firm Borrelli Walsh were appointed as joint liquidators.

A preliminary review of Torque's record and investor database by Borrelli Walsh estimated creditor claims at US$325 million (S$436 million) as at March 2 (2021), while crypto assets under the control of the liquidators are valued at about US$9.1 million (S$12 million) as of Mar 14.

Mr Smith told The Straits Times that investigations were still at an early stage and he is unable to confirm yet how many of Torque's more than 14,000 investors from more than 120 countries, reside in Singapore.

Mr Ong, 33, chief executive of Torque, told ST that he has filed a police report in Singapore against the employee who, he alleges, is responsible for the losses. He said that the employee is not based in Singapore and has not been contactable.

Police confirmed reports were lodged by both Mr Ong and investors and said that they are looking into the matter.

Mr Ong said that Torque, which was incorporated in 2019, has about 80 employees based in Vietnam and Singapore, of which 20 are Singaporeans.

"The cost is too high to run a 24-hour operation in Singapore. And the reason why I registered my company in BVI is because it does not have a regulatory framework towards cryptocurrency. I wanted a place that is more friendly towards crypto space," said Mr Ong.

A search on the Accounting and Corporate Regulatory Authority portal showed that Mr Ong is the director and shareholder of 12 companies in Singapore.

Mr Ong said: "Borrelli Walsh has taken over (the company). I am no longer in power of the company. I know that investors are frustrated and angry. As a company, we are doing all we can to help anyone and I am ready to cooperate with any authority."

In an email to ST, Mr Ong's lawyer Sarbrinder Singh of Sanders Law said the purpose of engaging Borrelli Walsh was "to trace and locate the misappropriated funds" by the employee in question, "so that the losses to Torque would be minimised".

Mr Singh added that Mr Ong has been harassed by debt collectors demanding payments for which he is not liable. He is also aware of a potential class action against Mr Ong by a group of investors.

One investor, who has 350 accounts with Torque said he was attracted to Torque's reward scheme which could reward an investor between 0.15 and 0.45 per cent of the amount traded in a day.

The investor who wanted to be known as only Mr Lim, said he opened his first account with Torque in January last year(2020) and invested US$50,000 (S$67,000) in cryptocurrency. In the past one year, he has traded a total of US$350,000 (S$470,000) in cryptocurrency with Torque.

He claimed that at one point he was getting daily rewards of about US$2,000.

The self-employed man, who is in his 30s, said he will wait for the liquidators to conclude their investigations and hoped that he could eventually withdraw his remaining balance of some US$800,000 (S$1.07 million) from his Torque account.