- Joined

- Jul 13, 2018

- Messages

- 1,630

- Points

- 113

6% is easily 3 times more than the shitty less than 2% of fixed deposit these days.

Every financial instrument is priced at the interest-rate (market-rate) when it was issued.

Last edited:

6% is easily 3 times more than the shitty less than 2% of fixed deposit these days.

When Hyflux issued her preference shares in 2011, OCBC was paying about 5.1% for their preference shares....Hyflux paid 6% for the 2011 preference shares ………..

Then when Hyflux paid 6% for her 2016 perpetual bonds,...Julius Baer just issued 5.75% perpetual SGD bonds...……..

I think the 5.1% OCBC Pref shares was issued in 2008 (not 2011) .

The closest comparison for 2016 will be Aspial Tr at 5.34% (albeit 4 yrs ) but so do Hyflux have a call option to redeem on 2020 or pay interest at 8%

The comparison with banks like Julius Baer is not really useful as banks use these for their Basel III minimum capital ratios requirement (The minimum Tier 1 capital is 6% of Risk-weighted asset.) Most of banks assets are funded by your deposits that are paying peanuts at the moment,

I do hope this mess drags on till election day

Shipping there are several scandals too. Horrible. Its like theres no regulation at all

MESSAGE TO NOBLE GROUP’S CURRENT AND PAST SECURITIES HOLDERS WHO ARE NOT SATISFIED WITH NOBLE’S PROPOSED RESTRUCTURING AND WANT TO JOIN LAWSUITS AGAINST THE PARTIES ASSOCIATED TO THIS FRAUD FOR A BETTER FINANCIAL RECOVERY

https://iceberg-research.com/2018/0...gainst-the-parties-associated-to-this-fraud-f

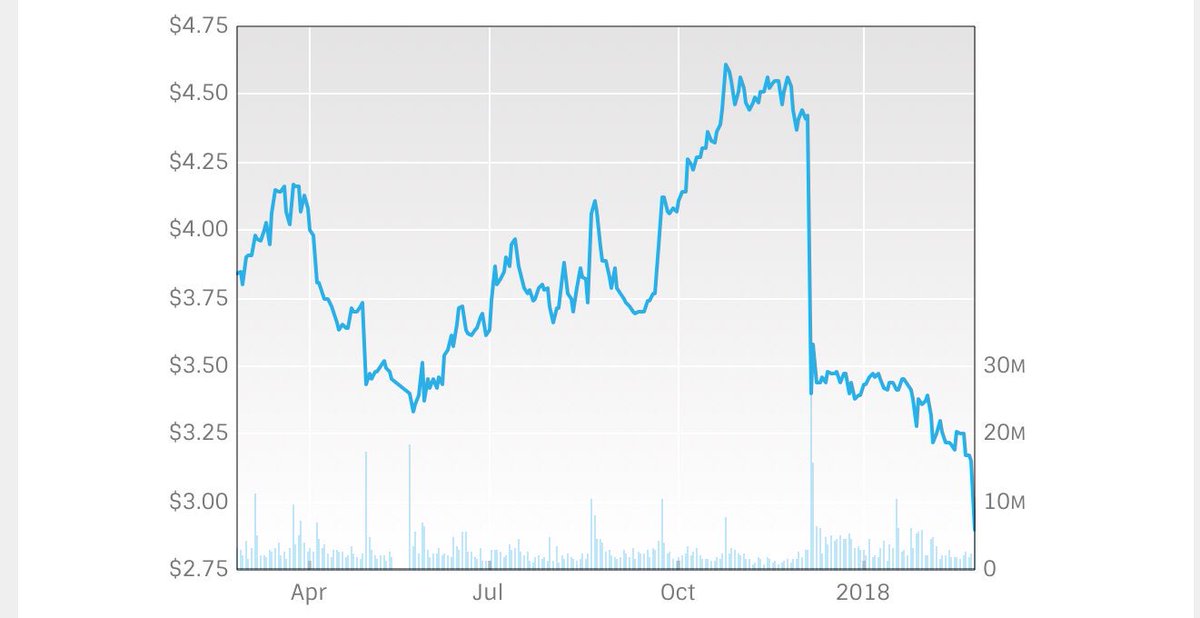

The “new Noble” as it is advertised in the restructuring proposed by Noble is a scam, exactly as the “old Noble” was a scam. It is another trick to foul investors. It will be the same company, with the same failed management. The same persons who have lied to investors for years are already lying on the viability of the new Noble. How many times did this management promise a turnaround? When was the last time Noble’s managers said the truth? In the US, Noble’s managers would have undoubtedly been charged with fraud by the SEC. As usual, Noble’s managers will pay themselves obscene salaries and bonuses. The ad hoc group will get rid of its exposure as soon as possible, leaving other investors with heavy losses.

There is only one way for Noble securities holders to recover their money: to sue the firms and persons who have organised this fraud. It is the right thing to do in terms of justice, but it is also the only viable strategy to get their money back. The restructuring proposed by Noble will direct any cash flow to management and the ad hoc group. We expect the other shareholders to lose everything.

Although Noble’s managers and the auditor E&Y are responsible for one of the largest frauds of the past twenty years, they have been allowed to operate in complete impunity. Noble’s securities holders (current and past) have the power to end this unprecedented scandal.

Actually this is a time for tan kin Lian to resurface. If he can help these investors. He can resurrect his political career n maybe become an MP. Or help him be the next president of singkieland since he is the only non pappie to qualify under the new rules.MESSAGE TO NOBLE GROUP’S CURRENT AND PAST SECURITIES HOLDERS WHO ARE NOT SATISFIED WITH NOBLE’S PROPOSED RESTRUCTURING AND WANT TO JOIN LAWSUITS AGAINST THE PARTIES ASSOCIATED TO THIS FRAUD FOR A BETTER FINANCIAL RECOVERY

https://iceberg-research.com/2018/0...gainst-the-parties-associated-to-this-fraud-f

The “new Noble” as it is advertised in the restructuring proposed by Noble is a scam, exactly as the “old Noble” was a scam. It is another trick to foul investors. It will be the same company, with the same failed management. The same persons who have lied to investors for years are already lying on the viability of the new Noble. How many times did this management promise a turnaround? When was the last time Noble’s managers said the truth? In the US, Noble’s managers would have undoubtedly been charged with fraud by the SEC. As usual, Noble’s managers will pay themselves obscene salaries and bonuses. The ad hoc group will get rid of its exposure as soon as possible, leaving other investors with heavy losses.

There is only one way for Noble securities holders to recover their money: to sue the firms and persons who have organised this fraud. It is the right thing to do in terms of justice, but it is also the only viable strategy to get their money back. The restructuring proposed by Noble will direct any cash flow to management and the ad hoc group. We expect the other shareholders to lose everything.

Although Noble’s managers and the auditor E&Y are responsible for one of the largest frauds of the past twenty years, they have been allowed to operate in complete impunity. Noble’s securities holders (current and past) have the power to end this unprecedented scandal.