- Joined

- Jul 13, 2018

- Messages

- 1,630

- Points

- 113

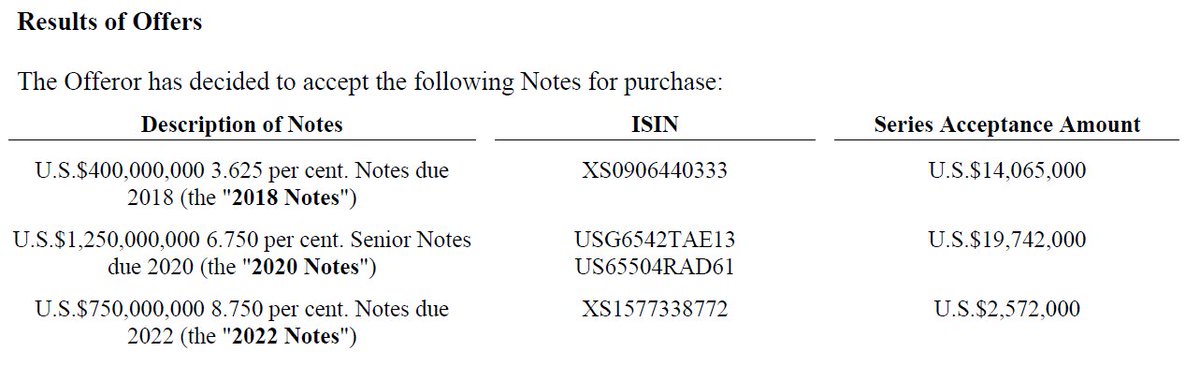

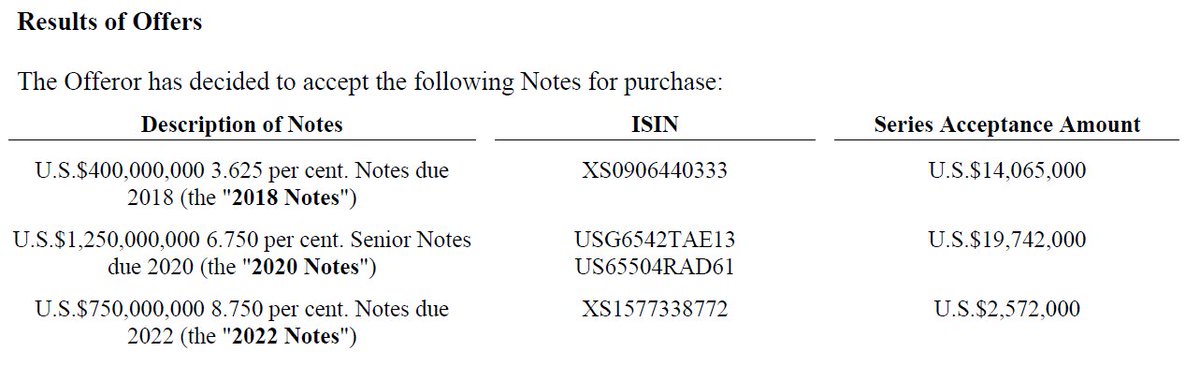

Just US$27m our of $2.4bn ($2400m) Deutsche Bank accepted the tender offer for Noble's notes

Just slightly more than 1%!!!!!

See? See? Malaysians can’t be trusted I tell you!She was a Malaysian. I wonder if she is a naturalized Singaporean but Malaysians are still proud of her.

https://www.thestar.com.my/business/business-news/2018/03/20/spores-hyflux-falls-from-grace

Actually, Singapore PAP government needs to use Temasek as a white knight to save hyflux and the 50,000 stranded retail and institutional investors because as clearly stated by Olivia Lum during the SIAS-Hyflux perpetuals meeting that her committee had acted based on PAP targets of 8million Singapore population (yes, the 6.9 million population white paper was actually a watered down version).Extracts from the article:

Cash For Hyflux Water Business Runs Dry

https://www.forbes.com/sites/forbes...eds-protection-from-creditors-as-losses-mount

In 2005, Olivia Lum debuted on the list of Southeast Asia's 40 wealthiest. The founder of water-treatment firm Hyflux saw her fortune surge to $460 million in 2011, a year in which she also became the first woman to receive Ernst & Young's World Entrepreneur Award. A year later, the self-made Lum featured on Forbes Asia 's inaugural list of Asia's 50 Power Businesswomen.

Today Lum is struggling with shocked investors after Hyflux sought and won court protection in May to tackle mounting debts and reorganize its business, which now includes power generation. For 2017, the company reported its first-ever annual loss, amounting to $85 million, with further losses in the first quarter of 2018. Total liabilities, including bank debt, are $2.1 billion.

Hyflux's market cap stands at $121 million, a steep fall from the 2010 peak of $1.6 billion. The shares, which had been down 44% for the year, were suspended May 23, affecting more than 50,000 retail and institutional investors. Also halted: payments on its high-yield perpetual securities.

Actually, Singapore PAP government needs to use Temasek as a white knight to save hyflux and the 50,000 stranded retail and institutional investors because as clearly stated by Olivia Lunch during the SIAS-Hyflux perpetuals meeting that her committee had acted based on PAP targets of 8million Singapore population (yes, the 6.9 million population white paper was actually a watered down version).

Because Hyflux (and other power generation companies) had acted in concert upon the government's 8 million population target, Hyflux (and all other power generation companies) were taken aback by by the abrupt U turn by the Singapore PAP government to discontinue the 8 million population target.

Unfortunately, Hyflux and most other power generation co.s had already entered into irreversible foreign gas purchase agreements resulting in production of electricity in Singapore EXCEEDING DEMAND, thus the plummeting of electricity prices and correspondingly, negative earnings where electricity production was concerned- thus the lack lustre demand for Hyflux's Tuas Spring Power Plant because NOBODY will buy the plant at book value because there is currently an EXCESS of power production capability in Singapore because of PAP wild population target setting which the PAP is in reverse gear in (for political reasons) now.

Thus, to avoid betrayal of 50,000 Singaporean retail and institutional investors, I suggest that the AP/Temasek either do an equity injection into Hyflux to boost up the company reserves or else buy over Tuas Spring power plant at a price as if the PAP 8 million population target was met because the 50,000 have supported the PAP in it's endevors, only to be left high and dry and at a great loss when the PAP does a population policy about (U-) turn.

When will sg govt come in to bail these incompetent clowns out?

PUB could be another reason how the PAP Singapore government has pwn Hyflux security and preference share holders but is not the primary cause (which is the reckless population of 8million that PAP told Hyflux directors during the planning stages for Tuas Spring power plant). According to Olivia Lum, many other power generation companies in Singapore were also Hoodwinked by the PAP in this regard and their power generation operations are also operating currently at a financial loss, Hyflux financial war chest was small and Tuas Spring was like an investment worth S$1.5 billions iirc, so any deficit in projected electricity demand will cause severe losses on a grand scale.Good points. But it appears that PUB is hindering foreign investors from buying Tuaspring or Hyflux (pre-approvals needed).

SP Power makes $900m to $1bn profits every year. So if PUB is as greedy, will PUB consider letting Hyflux go bust by denying most foreign buyers, and takes over the assets cheaply on their own or through GLCs?

See? See? Malaysians can’t be trusted I tell you!

If Hyflux goes bust and doesn't satisfy it's redemption/ interest payable on it's unsecured securities/ preference shares to the retail investors, then the PAP would have to face easily 50,000 angry Singaporeans or supporters of Hyflux, a home grown Singapore company well part of the Singapore story. They will all know what a lousy political party the PAP is and one that will not own up to it's own greed, recklessness or population planning mistakes.Easy to save Hyflux. Just make Hyflux a subsidiary of Temasek like Olam, the cost of financing will go down, debts will be refinanced cheaply. All the troubles will be over. Even if Hyflux don't redeem the perpetual bonds or preference shares, they will trade above par value, because they are majority owned by Temasek.

But having said that, if you are Temasek or PUB, the cheapest way to own Hyflux is to let Hyflux goes bankrupt and then take over (almost for free).

PUB could be another reason how the PAP Singapore government has pwn Hyflux security and preference share holders but is not the primary cause (which is the reckless population of 8million that PAP told Hyflux directors during the planning stages for Tuas Spring power plant). According to Olivia Lum, many other power generation companies in Singapore were also Hoodwinked by the PAP in this regard and their power generation operations are also operating currently at a financial loss, Hyflux financial war chest was small and Tuas Spring was like an investment worth S$1.5 billions iirc, so any deficit in projected electricity demand will cause severe losses on a grand scale.

Since Singapore has something like a centrally controlled economy (just as population targets are set by the PAP), then perhaps like the Lehman Brothers crisis where banks mis-sold 'mini-bonds' to unsuspecting and unsophisticated citizen investors and later had to compensate the losses, the PAP government should admit that it's 8 million population target was either mistaken or terribly premature and thus should prop up Hyflux and other power generation companies with either subsidies of $ equity injections or even nationalise the companies which owe $$$ to retail/ institutional small investors in the form of preference shares or other $$$ security instruments so that at least these poor retirees etc do not have to suffer for the consequence of PAP population planning greed/ mistakes.

If Hyflux goes bust and doesn't satisfy it's redemption/ interest payable on it's unsecured securities/ preference shares to the retail investors, then the PAP would have to face easily 50,000 angry Singaporeans or supporters of Hyflux, a home grown Singapore company well part of the Singapore story. They will all know what a lousy political party the PAP is and one that will not own up to it's own greed, recklessness or population planning mistakes.

Which is why ain't think the best way is for Temasek to do a cash for equity injection into Hyflux. Of course they can make Olivia Lum very happy by buying Tuas Spring at an inflated price (extrapolated to as if the PAP population target of 8 million were met) but that would be much too obvious and obtuse and be too much of an admission/ revealation of how ridiculously greedy the PAP was to plan for 8 million population in Singapore. As us said, maybe Olivia Lum should receive some pain and maybe revalue Hyflux shares at 10 to 21¢ a piece since she too must have been sleeping somewhat because even though Singaporeans trashed the 6.9 million population white paper, she was still partly in lala land and even started the stupid oxygenated drinking water company which I feel is a scam (might as well sell hydrogen peroxide cos there will be far more oxygen in it), let Temasek own say 90% of Hyflux after that, but the perpetual Honda and preference share uncle's and aunties should not lose 1¢.Selling Tuaspring will not solve Hyflux's default issues on the bonds, preference shares and perpetual bonds because Hyflux has no means to getting cheap costs of funds because her reputation sinks because of the defaults.

There is two ways to nationalize Hyflux (not just Tuaspring). One is to take over Hyflux like Olam, no need for haircut for bondholders and bank lenders, just make it a subsidary of PUB or Temasek. Another way is to let Hyflux collapse, PUB nationalize Tuaspring or Hyflux at low-costs, because Singspring and Tuaspring cannot shut down.

Either way, PUB will not lose money because any extension of the water concession for Hyflux's Tuaspring and Singspring has no tangible cost to PUB. It is just how ruthless policymakers want to be.

So u are saying that OCBC is trying to make a quick $$$ by campaigning for perpetual holders to vote for company to liquidate by declaring bankrupt? I don't really care about OCBC because as u said, they bought their perpetuals at "40-60 level". OCBC is a trusted bank and thus the responsible thing to do is to make the Singapore government pay for the business damages consequent of it's spreading fake news that a population target of 8 million was a reasonable target or even achievable. Maybe replace Olivia Lum and the board if they are deemed incompetent because they were also inside their ivory towers and ignorant of the citizenry outcry over the 6.9 million population white paper. Maybe Temasek offer to pay for new Hyflux shares @ 5-10¢ a piece, enough to redeem all the perpetual securities when due as well as maybe end up with 80-90% ownership of company. At least shareholder still get 5-10¢ per share (with some upside and tradable on STD) rather than like peanuts for Nobel shares, so I think Hyflux shareholders would agree and definitely holders of perpetuals if they stand to retrieve a significant proportion if not 100% of their investment in the negotiations. Many retail Hyflux shareholders may also look forward to a new CEO/board and maybe Olivia Lum can occupy the COO/ CSO(chief strategy officer) position and still perform well.For $900m to $1billion of perpetual bonds + preference shares and another huge chunk of investors for a few hundred millions worth of plain bonds from Hyflux, the average losses are huge. This is the biggest corporate collapse in the history of Singapore and you are right, it got nothing to do with cheating on accounts like Noble (flagged by Iceberg) but policy failures.

Another conspiracy got to do with a widely circulated internal memo from OCBC after Chinese New Year that caused Hyflux to nose-dive after CNY holidays. Industry members point out that Hyflux was a DBS bond darling, and OCBC is very jealous of DBS dominating the local bond scene. So OCBC sank it and bought the bonds cheaply at 40-60 level.

Hyflux retail bonds are worth more than 40-60 during liquidation and this group are now plotting in the steering committee to make Hyflux investors go for loss-absorption (which will be rejected) and eventually liquidation and make a killing because they bought the debts cheaply.

Which is why ain't think the best way is for Temasek to do a cash for equity injection into Hyflux. Of course they can make Olivia Lum very happy by buying Tuas Spring at an inflated price (extrapolated to as if the PAP population target of 8 million were met) but that would be much too obvious and obtuse and be too much of an admission/ revealation of how ridiculously greedy the PAP was to plan for 8 million population in Singapore. As us said, maybe Olivia Lum should receive some pain and maybe revalue Hyflux shares at 10 to 21¢ a piece since she too must have been sleeping somewhat because even though Singaporeans trashed the 6.9 million population white paper, she was still partly in lala land and even started the stupid oxygenated drinking water company which I feel is a scam (might as well sell hydrogen peroxide cos there will be far more oxygen in it), let Temasek own say 90% of Hyflux after that, but the perpetual Honda and preference share uncle's and aunties should not lose 1¢.

So u are saying that OCBC is trying to make a quick $$$ by campaigning for perpetual holders to vote for company to liquidate by declaring bankrupt? I don't really care about OCBC because as u said, they bought their perpetuals at "40-60 level". OCBC is a trusted bank and thus the responsible thing to do is to make the Singapore government pay for the business damages consequent of it's spreading fake news that a population target of 8 million was a reasonable target or even achievable. Maybe replace Olivia Lum and the board if they are deemed incompetent because they were also inside their ivory towers and ignorant of the citizenry outcry over the 6.9 million population white paper. Maybe Temasek offer to pay for new Hyflux shares @ 5-10¢ a piece, enough to redeem all the perpetual securities when due as well as maybe end up with 80-90% ownership of company. At least shareholder still get 5-10¢ per share (with some upside and tradable on STD) rather than like peanuts for Nobel shares, so I think Hyflux shareholders would agree and definitely holders of perpetuals if they stand to retrieve a significant proportion if not 100% of their investment in the negotiations. Many retail Hyflux shareholders may also look forward to a new CEO and maybe Olivia Lum can occupy the COO position and still perform well.

Sorry Bro, maybe "scam" is too critical, just that scientifically, that's the way I feel cos there is no way that u can keep the 'oxygen' inside and hydrogen peroxide contains way much more oxygen than their oxygen water which I feel is terribly overpriced and probably just providing placebo effect where it's anti-cancer properties are concerned. A lousy product (flash in the pan business) as far as I am concerned.Hi bro, the oxygenated company is not a scam. According to Maybank's internal memo, this is a profitable business.

1. Olivia didn't expect Maybank to Margin-Call her on Tuaspring. So she happily gave the dividends in the form of the Oxygenated water business.

2. Because Olivia announced dividends for that FY, preference shares dividends must be paid, which they did.

3. Then came along the CD and then XD for the perpetual bonds dividends which required mandatory payment of coupon when dividends are paid to ordinary shareholders. Then then then Maybank margin-called her. It resulted in the first time in modern Singapore history that a listed company did not pay after XD.

Imagine u sold a share after XD but u didn't get the dividends. This is a disruption to orderly pricing in market. Perpetual bondholders can now sue Hyflux for this breach and make them equal to most lenders. This issue is huge and regulators took no action till date.

Sorry Bro, maybe "scam" is too critical, just that scientifically, that's the way I feel cos there is no way that u can keep the 'oxygen' inside and hydrogen peroxide contains way much more oxygen than their oxygen water which I feel is terribly overpriced and probably just providing placebo effect where it's anti-cancer properties are concerned. A lousy product (flash in the pan business) as far as I am concerned.

If the Maybank loan allowed for Maybank to make a margin call on Hyflux, then why didn't the CFO see that coming or even the board feel a tad bit worried about that eventuality since the population white paper was published in January 2013 https://en.m.wikipedia.org/wiki/Population_White_Paper with the back lash happening soon after. The terrible SMRT debacles soon followed proving that Singapore infrastructure was no where as ready for productivity as expected and now GST needs to increase to fund elderly healthcare costs which is LIMITLESS as far as technology is concerned. And Hyflux solution to our new economy is what, oxygen water? At their road show, they admitted that they had not even tested or proven their product on humans, just a few mice in a corner iirc.

They should have been negotiating behind close doors for Temasek to make some capital injection or to buy Tuas Spring at a price in accordance with the PAP electricity demand and corresponding price estimations based on their target 8 million population. Instead they were meddling with what 'oxygen' water. They think their reputation so good is it? Now that they are next to bankrupt and the PAP Singapore government is Scot free after making such greedy and ruinous targets and projections, I support neither Olivia nor the PAP government.

Only solution I thus think is for Temasek to do a cash for equity injection at an agreeable price, end up owning a majority of Hyflux, repay every single cent to the perpetual security holders and review the board. Maybe Olivia Lum may stay behind as the company mascot or even CEO job but she CANNOT BE CHAIRMAN and the CFO, that silly overpaid and incompetent charbo must go.

Still is PAP fault for HOODWINKING EVERYBODY into buying into their PONZI 8 million population scam.OCBC did not spread false news. They spread fears. Look, OCBC is maximum buay gan when compared to DBS's dominance in SGD bond scene. It was done out of jealousy and triggered Maybank's credit assessment to whack Hyflux. Nothing changed in Hyflux except that creditworthiness crashed because her debts are trading 40-60% of pay.

Olivia's board is incompetent to a certain extend, eg the CFO had no prior experience with listed companies, so she defaulted on the XD terms of perpetual bonds. Olivia was known to be subborn because she did so well in every project including risky countries, and couldn't believe that her downfall is in home-ground.

Of course, if Temasek owns Hyflux, investors retain my Hyflux ordinary shares and even buy more because Hyflux's troubles are over. Hyflux just got killed by her inability to get cheap sources of funding, their business model is sound. There is nothing wrong for an infrastructure company to have high level of debts, what matters is the cost-of-financing.