That is very good news. Now you can rent them cheap cheap.

Btw, do you know what is the launching price?

Launching List price: RM450 psf. It is S$150 psf. That is before early bird discount, Dibs.

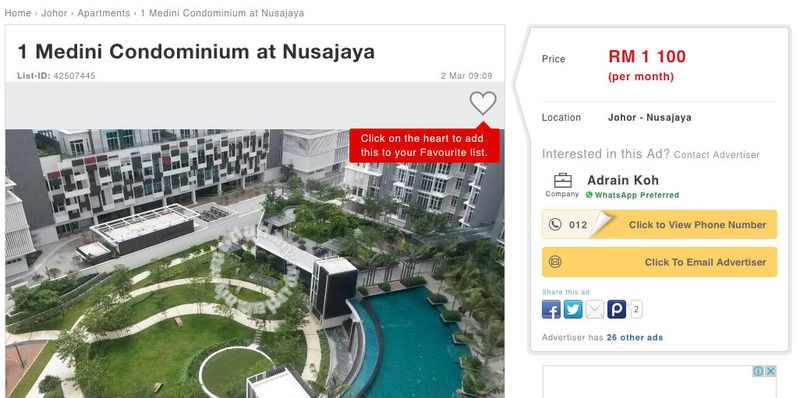

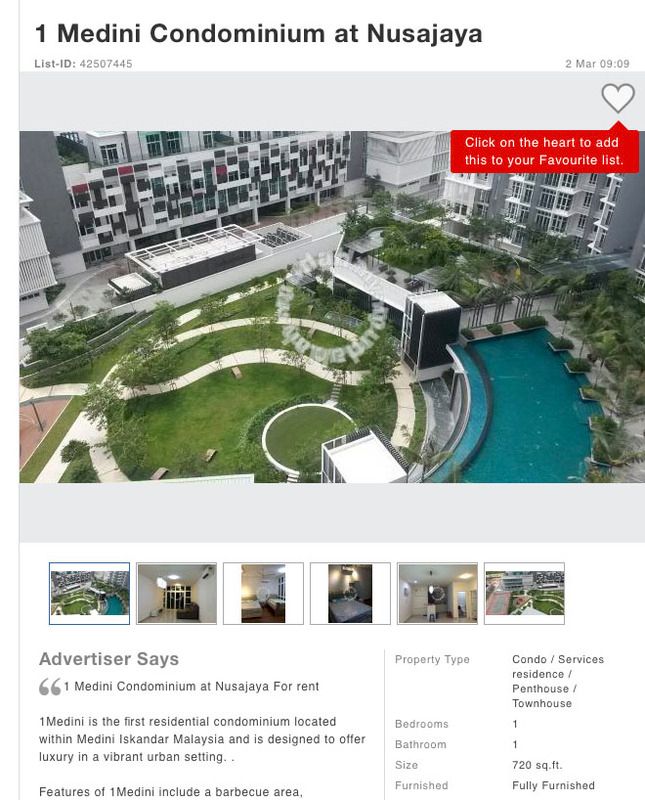

720 sq ft cost only less than RM300,000 or S$100,000.

So if the owner paid cash, renting out at rm1100 will get roughly 4 - 4.4% return?