- Joined

- Jun 21, 2010

- Messages

- 34,810

- Points

- 113

CDL is rubbish let the 2nd gen run to the ground with no significant progress. Unlike their Malaysian cousins

2nd generation is on the way down.CDL is rubbish let the 2nd gen run to the ground with no significant progress. Unlike their Malaysian cousins

BOH Bian….CDL is rubbish let the 2nd gen run to the ground with no significant progress. Unlike their Malaysian cousins

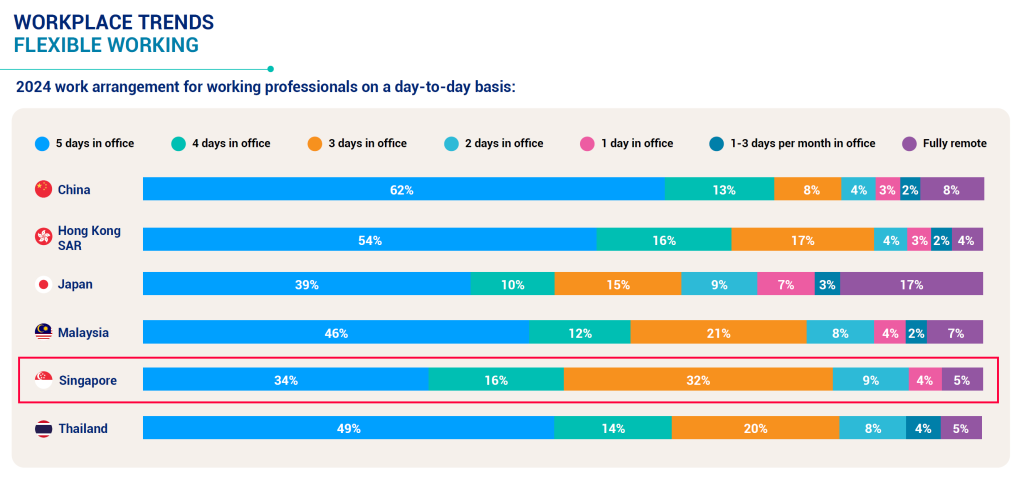

While many companies in America are pushing for full return to office of all of their employees for five days a week, including tech giants like Amazon, with Elon Musk recently extending his demands to all federal employees currently evaluated by his Department of Government Efficiency (DOGE), Singapore seems to be bucking the trend.Disclaimer: Unless otherwise stated any opinions expressed below belong solely to the author.

Image Credit: Hays

Image Credit: HaysMr Kwek said this was not the first time Sherman’s decisions have put CDL in a “precarious position”.

He went on to cite the Chinese developer Sincere Property Group debacle that led to a $1.9 billion loss for CDL in 2020; poor investment decisions in the UK property market which resulted in significant financial losses and contributed to a 94 per cent drop in profit the first-half of 2023; as well as the underperformance of CDL’s share price since Sherman assumed leadership in 2018.

Cecilia Kwek, the wife of Kwek Leng Beng and mother of Sherman Kwek, did not mince her words in her first public comments on the incident. “It hurt my husband, it hurt my elder son, it hurt me. It was a big letdown,” she said.Mr Kwek Leng Peck was right and he was the prudent one.

https://www.scmp.com/week-asia/peop...split-within-singapore-tycoon-kwek-leng-bengs

It's always like that. The extended family risk being ruined when daughter-in-laws start to get involved, and wash their dirty linen in public to defend their kids.

Blackrock had been reducing their CDL stake for a few years since Sherman buanged in China.

Blackrock had been reducing their CDL stake for a few years since Sherman buanged in China.

Sherman has been influenced by bad companyBlackrock had been reducing their CDL stake for a few years since Sherman buanged in China.

Sherman lost his pants in China a few year ago.

He wants to double down now

1 November 2024

CDL JOINTLY ACQUIRES RARE MIXED-USE DEVELOPMENT SITE IN DOWNTOWN SHANGHAI

FOR RMB 8.94 BILLION WITH PRC PARTNER LIANFA GROUP