-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chitchat Johor Property Market Collapsed Thanks To Covid! Property Investors Can't Offload Can't Rent Out! Fucking Losers!

- Thread starter JohnTan

- Start date

- Joined

- Aug 6, 2008

- Messages

- 15,930

- Points

- 113

The lesson was already there 30 years ago for those who bother to open their minds.

You can buy cheap in Johor but you can never sell. Thank me.

That is also why yours truly will never be fucked by attractive deals that are too good to be true, when you abide by Islamic principles.

You can buy cheap in Johor but you can never sell. Thank me.

That is also why yours truly will never be fucked by attractive deals that are too good to be true, when you abide by Islamic principles.

- Joined

- Oct 30, 2014

- Messages

- 36,768

- Points

- 113

Speaking of royally fucked, I think those of us who are invested in faang stocks, tsla, crypto, etc are in the same boat too!

If you're invested in FAANG and Tesla since early 2020, you should be doing fine. I made money in Zoom, thanks to a stock tip from my kids. They were telling me about how people were into video conferencing. I was skeptical at first because Skype has been around for over 10 years, but it didn't take off. It's amazing to see how a latecomer like Zoom can do so well.

For crypto, I have my doubts about bitcoin because there's only 21 million coins out there. To me, bitcoin is more like a comic or art collectible. There's just too few of them to become a viable legal tender, even if companies accept fractional bitcoins. Perhaps dogecoin or etherum might have better chance. I'm following updates on the digital yuan. It's the closest we have right now to an actual digital currency. Facebook's virtual currency plan is probably dead because the computer illiterate senators and congressmen of US are scared of Facebook taking over the world.

- Joined

- Jul 25, 2008

- Messages

- 60,247

- Points

- 113

it means you’re cash rich now. can we go on vacation together in maui?Oh that means I am 0.01% Singaporean who sold my johor property last year and contributed five figure RPGT to Johor government. Fucking winner indeed. Huat ah!

- Joined

- Oct 30, 2014

- Messages

- 36,768

- Points

- 113

jiuhu condos usually aren't maintained to the same standards in Singapore. The jiuhu condos may look nice in their brochures and videos. But the whole place usually becomes run down and filthy within a year or two.

Does that mean its time to buy?

Yes, u dumbtwit.. buy now ....

- Joined

- Jul 10, 2008

- Messages

- 35,626

- Points

- 113

later kena CLOBed how?Yes, u dumbtwit.. buy now ....

Johor - Pining for turnaround in 2021

By HENRY BUTCHER MALAYSIA - March 2, 2021 @ 12:29pm

The symbiotic relationship between Johor and Singapore must be restored with borders reopened freely so economy can begin moving at a normal pace again. Courtesy image

Johor's property market has a symbiotic relationship with neighbour Singapore. From the weekend short drive to those finding opportunities to lower their cost of operations, Johor presents a positive story when analysed from the right perspectives. The natural distance bestowed upon the two gives it the natural advantage to tap into each other's resources. For one, Johor exemplifies a hotspot for better cost for almost everything including talent, food on the table, groceries, and even big-ticket items like property. Another is the vast space at a fraction of Singapore's cost. Does it then not make sense for suitable Singapore enterprises to have an office in Johor or even run a branch there?

Surely the numbers would stack up if business owners were to spend some time tabulating the pros and cons. But with Covid-19 having caused the biggest disruptions in modern times like this, it gets trickier simply just to welcome its nearest neighbour, much less to set up a commercial presence to spearhead their corporate mission. In this brief report, we take a look at how the market has fared and why Johor remains integrated with Singapore's demand and supply. To this, we also know full well that when the cherry is ripe for the picking, there will be foreign participants coming to take-up Johor's properties. That is how appealing Johor properties are to foreign investors which include those from China.

Residential - review 2020

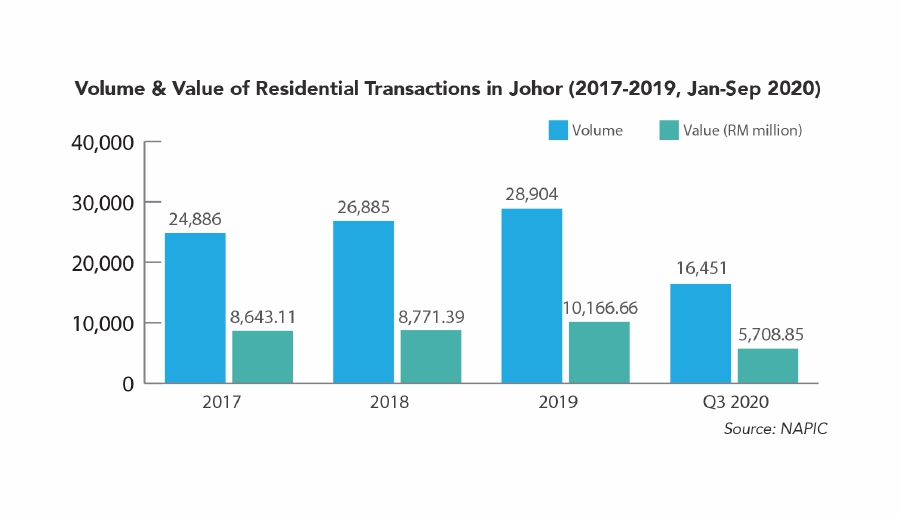

The volume and value of residential property transactions in Johor have been climbing rather steadily from 2017 to 2019. Its volume of transactions has in fact risen eight per cent in 2018 and 7.5 per cent in 2019 while the value of transactions increased albeit marginally at 1.5 per cent in 2018 but shot up by 15.9 per cent in 2019.

The Movement Control Order (MCO) imposed by the government to curb the Covid-19 pandemic starting 18 March 2020 coupled with the huge overhang of completed but unsold properties have unfortunately reversed the uptrend, with the volume of transactions declining 23.8 per cent to 16,451 units and the value of transactions eroding 24.4 per cent to RM 5.7 billion in the first nine months of 2020 compared to the same period in 2019.

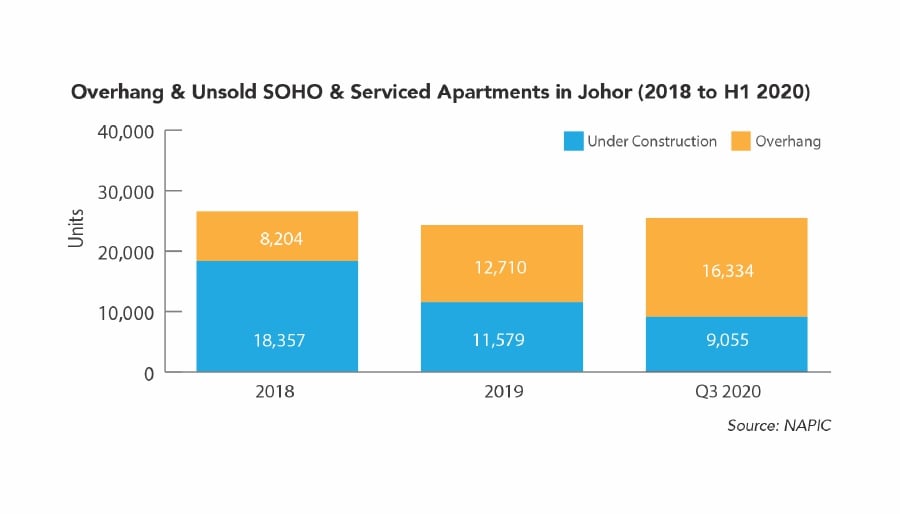

The burden for this southern Peninsular Malaysia state is also that it is perched right at the top of the overhang properties chart in the country. It contributes 19.5 per cent of overhang residential properties and 73.7 per cent of the overhang service apartments/sohos in Malaysia. In terms of units, there were 6,166 residential overhangs and 16,334 overhang service apartments/sohos, registering a whopping increase of 28 per cent from 12,710 units in 2019. Of these, approximately 34 per cent of the overhang service apartments/sohos are priced over RM1 million which were believed to have been designed specifically for foreign investors from Singapore and China since Johor has bee familiar ground with these investors in the past. But as international borders are still very much closed or restricted for travelling, it has adversely affected property sales take-up in the state.

Prices of landed residences in Johor Bahru have remained fairly stable although some new launches have seen developers raising prices by about 10 per cent to 15 per cent. The same however cannot be said with the condominiums as prices have trended downwards due to the over-built situation, specifically the high-end condominiums. But by and large, developers have become more pragmatic and begun pricing more reasonably to avoid having to carry excessive inventory to circumvent the slow sales in a sluggish market.

Residential outlook 2021

The recent revival of the Johor Bahru-Singapore Rapid Transit System (RTS) has given the property industry a reason to cheer as it will add positively to the buying sentiments in Johor especially for properties located closest to the RTS station even if a tangible impact on property prices will not be felt immediately. Market sentiments will also enjoy another boost when the borders are open completely to traffic from Singapore again but the rising numbers of infectious Covid-19 cases have posed a dilemma to immigration checkpoints as both sides of the divide seek to safeguard their respective territories. Given the latest imposition of the MCO which began on 13 January 2021, a recovery of the residential market which would originally be predicted for the second half of 2021 may now see it delaying to early or some time in 2022.

Going forward, the residential subsector is expected to remain the key driver of Johor's property market. Landed terraced houses can safely be singled out as the segment that will see the state through the pandemic era seeing that it had performed well in the past few years.

For the service apartments/sohos category, it will take some time for the market to absorb the overhang stock to a reasonable level, more so when international travel is still a challenge. All things considered, the reintroduction of the Home Ownership Campaign (HOC) 2020-2021 will offer the market some semblance of hope to stir market interest again.

Residential - Factors to watch in 2021

● Current low-interest rates have brought down the cost of home financing.

● Continuation of HOC 2020-2021.

● Policies to attract foreign investors to Johor will boost economic activities.

● Opening up of the borders between Johor and Singapore once the pandemic is contained may increase sales take-up for housing in Johor.

● Digitalising property transactions/viewings may be the new normal.

● The consent given to the RTS project will boost buying interest from Singaporeans.

Residential bright spots for 2021

● The availability of an effective Covid-19 vaccine will improve overall confidence and boost economic activities, thus benefiting the property market.

● Selected properties such as terraced houses in Johor will remain in demand.

● Attractive promotions and rebates from developers will attract buyers.

Office overview

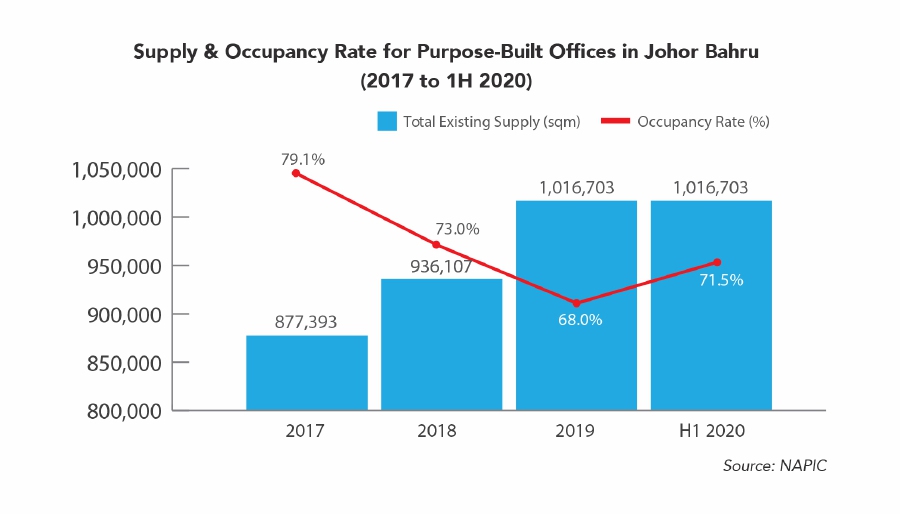

Unlike Klang Valley, Grade A offices are not easily available in Johor and this may be amongst the reasons which has deterred multinational companies, particularly those from Singapore, to set up offices or relocate although operations costs are much lower. Further, the lack of demand drivers has also not been helpful in raising demand but things may begin to turn around with the upcoming Grade A office towers being built in Medini 10 under the Iskandar Malaysia project. The successful completion of these offices may help change the storyline and attract more foreign companies to set up a base in Johor.

As of 1H 2020, the supply of purpose-built office (PBO) space in Johor remained unchanged but in terms of occupancy, it has improved by 3.5 per cent compared to 2019. Economic pressures arising from Covid-19 have however compromised any further interest to take up additional space or to expand existing operations. And like the rest of the country, demand for office has also declined thanks to the Work From Home (WFH) culture that has now become part of the new normal. Faced with a shrinking and more competitive landscape, business owners became more preoccupied with rethinking office spaces as they strive to survive between increasing productivity and cutting costs. And so the last thing on their minds would be acquiring the best office space that money can buy or rent. Such ambition will have to hold for now.

In terms of office rental, Johor Bahru City Centre is currently letting offices from about RM2.50 to RM3.50 per sq ft whilst those in the city fringes are between RM2.50 and RM3.00 per sq ft. Offices in Iskandar Puteri which are more modern and possess up-to-date specifications including M&E infrastructure are fetching higher rents of about RM3.50 to RM4.00 per sq ft.

Office outlook 2021

With a weakened economy due to the Covid-19 pandemic, the office subsector in Johor is expected to face a challenging period until businesses begin recovering once the vaccines to prevent Covid-19 become widely available in the country. Until that happens, the office market in Johor will remain subdued for 2021 unless there are incentives for companies to expand their footprint into Johor.

For existing office tenants due for lease renewals, they may negotiate to reduce the rental rates so as to lower their expenses in a winded economy. While negotiations take place, the market could also see a higher rate of vacancy should more companies operate on a WFH basis.

The completion of a number of better quality office buildings in 2021 including the future RTS may help to change foreign investors' perception and draw companies from Singapore and elsewhere to set up offices in Johor.

Retail - review 2020

Generally, the retail sub-sector is expected to remain soft this year with Johor the most affected due to its reliance on regional tourism and in particular Singaporean shoppers. According to the July 2020 Malaysia Retail Industry Report, results for Q2 2020 were better than the -18.8 per cent estimate made in April but suffice to say, 2020 has been the worst period for retailers since 1987.

In better times, the geographical proximity between Johor and Singapore meant Johor's retail market had reasons to thrive when the borders were open to free-flow traffic. Singaporeans could make Johor their closest getaway for a weekend holiday or just unwind sampling Malaysian shopping at cheaper prices. But these were totally absent during MCO and many retailers in Johor Bahru experienced a massive 70 per cent drop in business compared to the previous year. In light of the loss of income, mall owners have compassionately extended rental discounts of more than 50 per cent during MCO (when shops were closed) and between 15 per cent to 30 per cent during the Recovery MCO (depending on the sector). But prior to the Covid-19 season, Johor's retail market was already laden with an oversupply of retail space and the lockdown imposed through MCO just worsened the situation further, with city centres shopping centres aggravated more than the neighbourhood malls in the residential areas.

It is expected that the retail industry in Johor will remain stagnant until the border with Singapore fully reopens. In the meantime, with border restrictions still in place, most retailers are experiencing a very lean season as they struggle to make ends meet. This has also led them to consider cost-cutting measures which include factors such as rental rates, workforce, and supplier cost readjustments, not forgetting the inevitable push to go online, undertaking digital marketing, and exploring e-commerce.

Retail outlook 2021

The announcement of Budget 2021 made provisions for tax incentive extension, confirmation and continuation of construction, and improvement of the transportation system to the region will have a positive impact on the property market in Johor and help boost demand again after being hampered by the MCO.

Shopping centres targeting to open doors in 2021 will however face an uphill task to fill up the vacant lots in the malls and to attract permanent tenants, landlords will have to lower their rental rates and/or offer a longer rent-free period. Simultaneously, retail landlords will also need to seek temporary tenants to fill up empty lots especially those located in prime locations.

As the world has already congregated in cyberspace when Covid-19 began hitting almost every nation on earth, retailers may have to think out of the box, and think fast too, about how to get online and at the same time entice customers to visit their physical stores.

Office & retail - factors to watch in 2021

● A fourth-wave pandemic and additional movement restrictions will hurt the entire retail industry and office market.

● Foreign tourists, especially Singaporeans in the case of Johor, have been an important contributor to Malaysia's retail industry. The reopening of Johor's border with Singapore early next year is critical for many in the local retail businesses.

● A broad-based economic recovery shall boost retail spending and more economic activities will lead to higher take-home pay for ordinary Malaysians. This in turn will generate a higher income range and lead to more purchases of retail goods and services. A sustained improvement in business also helps generate increased demand for both retail and office spaces.

● The uncertain political environment will reduce consumers' confidence and in turn, lead to lower spending.

Office & retail bright spots for 2021

● Key governmental policies to attract overseas companies to set up a base in Johor will boost demand for office space.

● The RTS project may make it more attractive for Singaporean companies to set up offices in Johor Bahru.

● KIDEX (Kulai Iskandar Data Exchange) is set to attract RM17.5 billion and become an alternative data hub for Singapore and the Southeast Asia region.

Industrial - review 2020

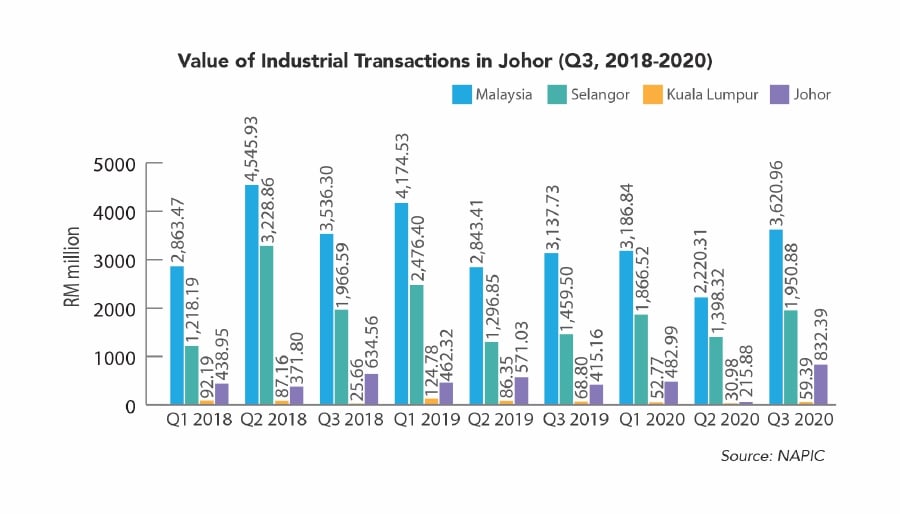

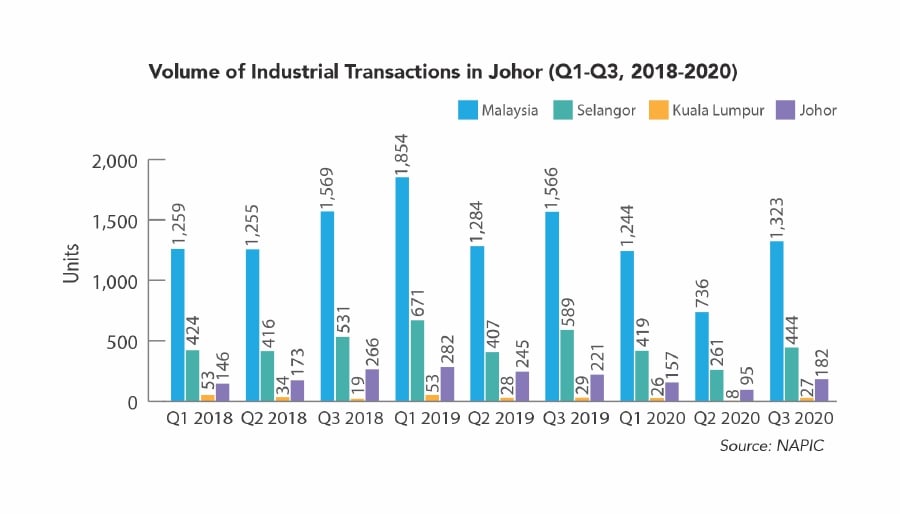

The volume of industrial property transactions in Johor registered a nearly 26 per cent decline for the first nine months of 2020 compared to the same period in 2018 and nearly 42 per cent compared to 2019. The drop in value of the transactions nevertheless was much lower with only a 5.9 per cent and 5.7 per cent decline compared to the corresponding period in 2018 and 2019 respectively, indicating that the average value of the transactions was more substantial.

Industrial outlook 2021

Budget 2021 announced that a sum of RM85 million will be allocated for the Causeway and Second Link to alleviate traffic congestions at the two checkpoints. This traffic solver would be a boon to not only Johor's retail but also benefit the industrial sub-sectors. The reduced time stuck in traffic congestion for transporters and shoppers from Singapore will only encourage more investors to invest in Johor in sectors such as manufacturing, retail, and F&B services. And if the Rapid Transit System (RTS) linking Singapore with Johor Bahru will also commence work, it shall boost economic activities in the state and benefit the manufacturing sector in return.

Another exciting development is the Kulai Iskandar Data Exchange or KIDEX. From an announcement made in October 2020, the 301-hectare data-driven industry will be served by dark fibre connection to Singapore and presents itself as a perfect alternative data hub in Southeast Asia. It is set to attract RM17.5 billion of investment and create 1,600 job opportunities. - Henry Butcher Malaysia

Fake degree learn as u earn ahneh Hub in KL...

Those crypto currencies are bound to fail. Last month, Bitcoin had been artificially played up by that crook Elon Musk. Now he starts to backtrack after probably having already earned a lot from it. During the weekend, he starts to hype up again by saying that Tesla may begin to accept Bitcoins again if it's proven that crypto miners use more clean energy. This is tantamount to saying that rain water is not coming from the evaporation of sea water.For crypto, I have my doubts about bitcoin because there's only 21 million coins out there. To me, bitcoin is more like a comic or art collectible. There's just too few of them to become a viable legal tender, even if companies accept fractional bitcoins. Perhaps dogecoin or etherum might have better chance. I'm following updates on the digital yuan. It's the closest we have right now to an actual digital currency. Facebook's virtual currency plan is probably dead because the computer illiterate senators and congressmen of US are scared of Facebook taking over the world.

Soon to come, countries around the world will introduce their own digital currencies. These are legitimate and guaranteed by the issuing countries' central banks. Bitcoins will then be discarded by the financial communities and Kathie Woods will have to eat her words and sell her pussy (if it's still worthy) to pay to those who had invested in her funds.

Forget Bitcoin, Digital Currencies Can Only Work With Government Backing:

https://vulcanpost.com/739734/digital-currencies-can-only-work-with-government-backing/

Last edited:

The Johor property market is dead.later kena CLOBed how?

- Joined

- Sep 22, 2008

- Messages

- 80,419

- Points

- 113

Muhyiddin should build HSR from jb sentral instead of jurong.

- Joined

- Sep 22, 2008

- Messages

- 80,419

- Points

- 113

It can be revived by changing gomen policies and regulation.The Johor property market is dead.

JB was killed by najib single handedly. And butchered by dr m.

It was during badawi's days that jb boomed. And sll he did was to remove restrictions that hampered foreign buyers and investor and developers.

- Joined

- Nov 9, 2010

- Messages

- 80,748

- Points

- 113

i am so pleased with my life circumstances now without a mortgage indeed.it means you’re cash rich now. can we go on vacation together in maui?

- Joined

- Dec 6, 2012

- Messages

- 28,963

- Points

- 113

KNN my uncle say when you put fucking winner indeed it makes my uncle think the jb whore house is leelee a whore house used for fuckingOh that means I am 0.01% Singaporean who sold my johor property last year and contributed five figure RPGT to Johor government. Fucking winner indeed. Huat ah!

KNN

KNN- Joined

- Dec 6, 2012

- Messages

- 28,963

- Points

- 113

Also please share how you managed to 摇 your 鸡 there to sell the whore house since border has been closing KNN you quarantined your 鸡 both ways ? KNNOh that means I am 0.01% Singaporean who sold my johor property last year and contributed five figure RPGT to Johor government. Fucking winner indeed. Huat ah!

- Joined

- Aug 29, 2008

- Messages

- 26,620

- Points

- 113

Talk cock lah. He say it's a retirement home and yet complain he can't flip it. WTFJOHOR BAHRU: When Singapore business owner Jonathan Gan purchased a four-room condominium at Lovell Country Garden in 2018, he thought he had clinched his dream retirement home.

- Joined

- Jan 16, 2014

- Messages

- 6,672

- Points

- 113

If you're invested in FAANG and Tesla since early 2020, you should be doing fine. I made money in Zoom, thanks to a stock tip from my kids. They were telling me about how people were into video conferencing. I was skeptical at first because Skype has been around for over 10 years, but it didn't take off. It's amazing to see how a latecomer like Zoom can do so well.

For crypto, I have my doubts about bitcoin because there's only 21 million coins out there. To me, bitcoin is more like a comic or art collectible. There's just too few of them to become a viable legal tender, even if companies accept fractional bitcoins. Perhaps dogecoin or etherum might have better chance. I'm following updates on the digital yuan. It's the closest we have right now to an actual digital currency. Facebook's virtual currency plan is probably dead because the computer illiterate senators and congressmen of US are scared of Facebook taking over the world.

towkay john, go buy 10kg of gold and some jb farmland

- Joined

- Jun 27, 2018

- Messages

- 30,086

- Points

- 113

If singkies want to buy mudland property,,always think of it as buying a lifestyle,,not as investment,,dont even consider making a buck or rent etc etc,,,but if buy and enjoy it to live and if goes up shit creek,,just walk away,,,,if not one is in a world of hurt,,,later kena CLOBed how?

Similar threads

- Replies

- 33

- Views

- 1K

- Replies

- 5

- Views

- 416

- Replies

- 0

- Views

- 260

- Replies

- 71

- Views

- 2K

- Replies

- 11

- Views

- 2K