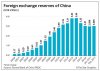

Singapore PMI March 2017

Singapore: Manufacturing PMI rebounds slightly in March

April 5, 2017

The manufacturing PMI produced by the Singapore Institute of Purchasing & Materials Management (SIPMM) edged up from 50.9 in February to 51.2 in March, the best result since November 2014. The index thus moved further above the 50-point threshold that separates expansion from contraction in the manufacturing sector.

March’s result reflected an improvement across the board. Growth in new orders, new export orders and output was faster than in the previous month, with the latter registering the best result in almost two and a half years.

Meanwhile, the electronics PMI increased from 51.4 in February to 51.8 in March.

FocusEconomics Consensus Forecast panelists expect manufacturing output to grow 0.8% in 2017, which is down 0.7 percentage points from last month’s forecast. For 2018, the panel sees manufacturing output expanding 1.5%.

Author: Massimo Bassetti , Economist

Singapore PMI Chart

http://www.focus-economics.com/coun.../manufacturing-pmi-rebounds-slightly-in-march

Singapore: Manufacturing PMI rebounds slightly in March

April 5, 2017

The manufacturing PMI produced by the Singapore Institute of Purchasing & Materials Management (SIPMM) edged up from 50.9 in February to 51.2 in March, the best result since November 2014. The index thus moved further above the 50-point threshold that separates expansion from contraction in the manufacturing sector.

March’s result reflected an improvement across the board. Growth in new orders, new export orders and output was faster than in the previous month, with the latter registering the best result in almost two and a half years.

Meanwhile, the electronics PMI increased from 51.4 in February to 51.8 in March.

FocusEconomics Consensus Forecast panelists expect manufacturing output to grow 0.8% in 2017, which is down 0.7 percentage points from last month’s forecast. For 2018, the panel sees manufacturing output expanding 1.5%.

Author: Massimo Bassetti , Economist

Singapore PMI Chart

http://www.focus-economics.com/coun.../manufacturing-pmi-rebounds-slightly-in-march