Electricity, petrol prices in S'pore to keep rising as global supply outlook worsens

Petrol prices are rising because of a shortage of refining capacity, says Shell's chief executive Ben van Beurden. PHOTO: ST FILE

Luke Pachymuthu

Senior Correspondent

July 2, 2022

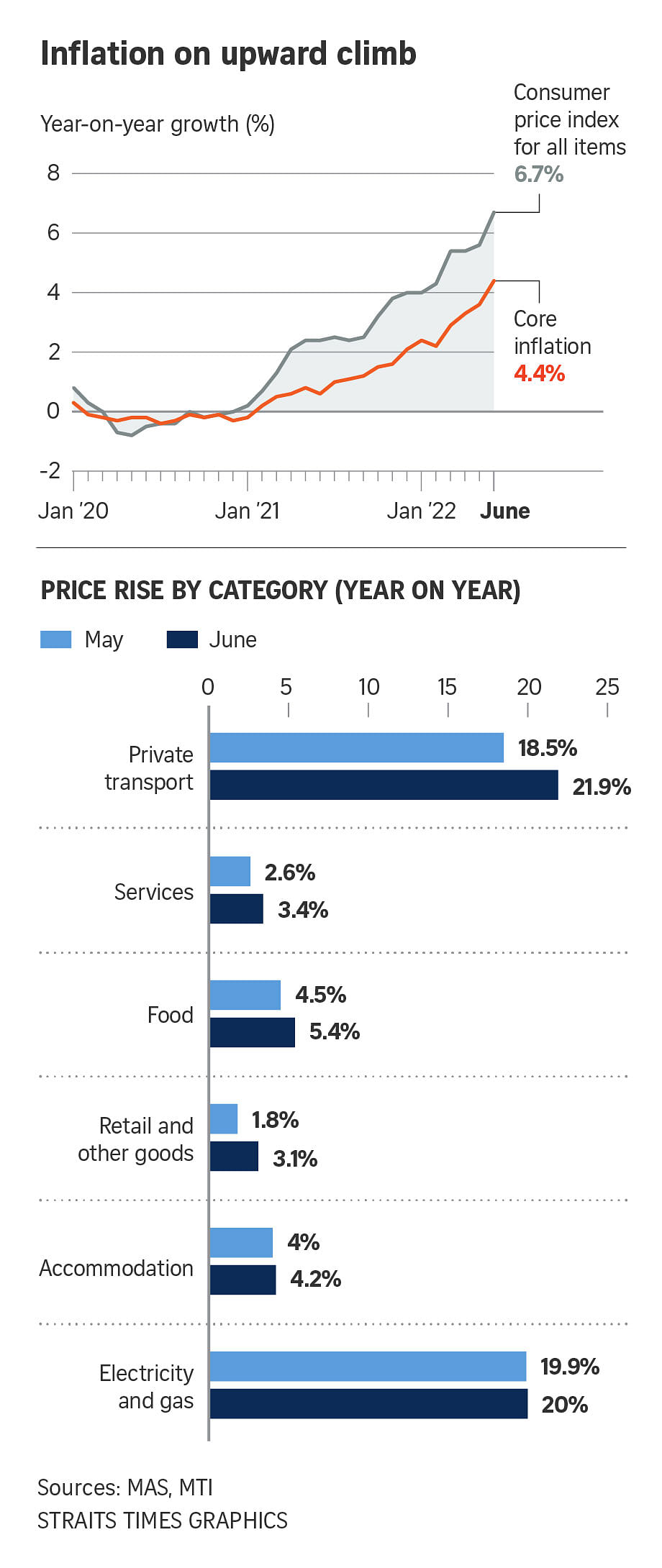

SINGAPORE - Singaporeans must brace themselves for high electricity and petrol prices over a protracted period as the global supply of motor fuels such as petroleum and diesel remains tight due to limited production capacity, while Europe scrambles to replace energy imports from Russia.

Prices were already elevated due to increased economic activity amid the post-pandemic recovery before

Russia invaded Ukraine on Feb 24.

But, since mid-March, fuel costs for end users around the world have spiked, following the deep rippling effects of the war.

Wide ranging sanctions targeting Russia's energy exports, including crude oil, diesel and piped gas, have forced European nations to scan the globe for alternatives, putting them in direct competition with other sovereign buyers - including Singapore.

With no end in sight for the war, Russia digging in for the long haul, and Russian President Vladimir Putin announcing on June 25

he would be supplying Belarus with missiles capable of carrying nuclear warheads, geopolitical and geo-economic tensions are now at a boiling point.

It is understandable, then, why the Energy Market Authority (EMA) - Singapore's regulator - announced on June 16 it was

extending measures it had previously rolled out to secure Singapore's energy supply and stabilise energy prices to the end of March 2023.

At the time, EMA had also stressed that it would be unable to shield consumers from higher electricity prices. And the outlook for gas prices through 2023 is on the uptrend, according to industry sources.

Mr Ciaran Roe, global director of LNG at S&P Global Commodity Insights, said according to forward curve prices for liquefied natural gas (LNG) and wholesale gas, market fundamentals look strong not just in the West but in Asia too, where prices have traditionally been linked to crude prices.

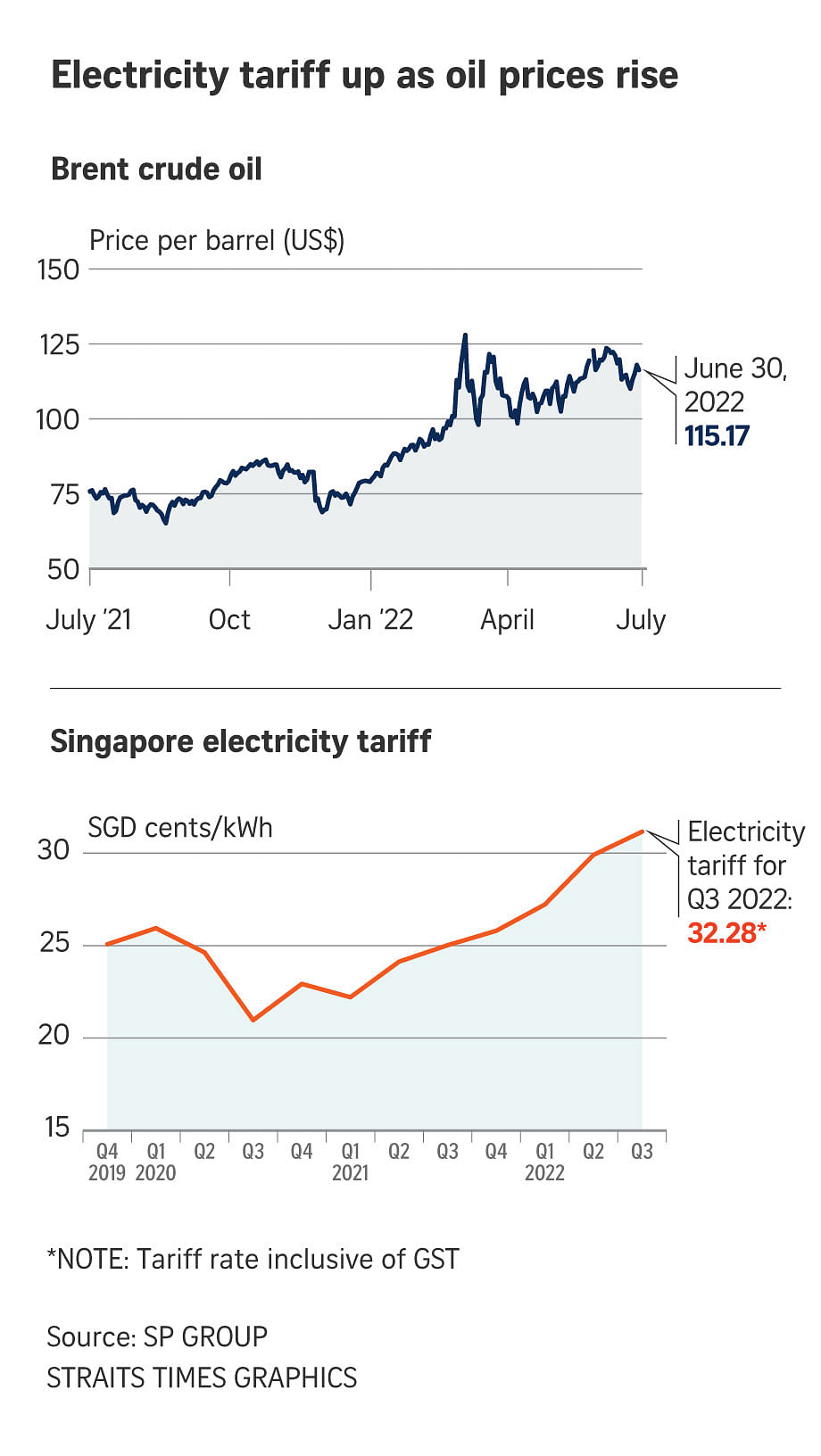

Benchmark Brent crude oil was trading close to US$116 a barrel on Thursday (June 30), while around the same time last year markets were dealing with prices around US$75-$76 a barrel.

This is a rise of around 52 per cent over a period of 12 months, according to data from traders and brokers.

Spot LNG prices in Asia, meanwhile, have been trading in the second half of June at round US$38 per million British thermal units (MMBtu), with the forward curve reflecting the anticipation that the market will easily cross US$40 per MMBtu as seasonal demand kicks in.

Mr Roe said: "In short, the world is in a structurally higher energy price environment."

He added: "Looking at the causes of the stronger gas and LNG prices, which include Europe's policy shift away from Russian gas and towards LNG, the current pricing situation is unlikely to change to the downside until either demand is destroyed through high prices or there is a supply reaction. The supply reaction can take several years."

Dr David Broadstock, senior research fellow and head of the energy economics division at the National University of Singapore's Energy Studies Institute, said that competition for a limited pool of spot LNG cargoes in the market would only drive prices higher.

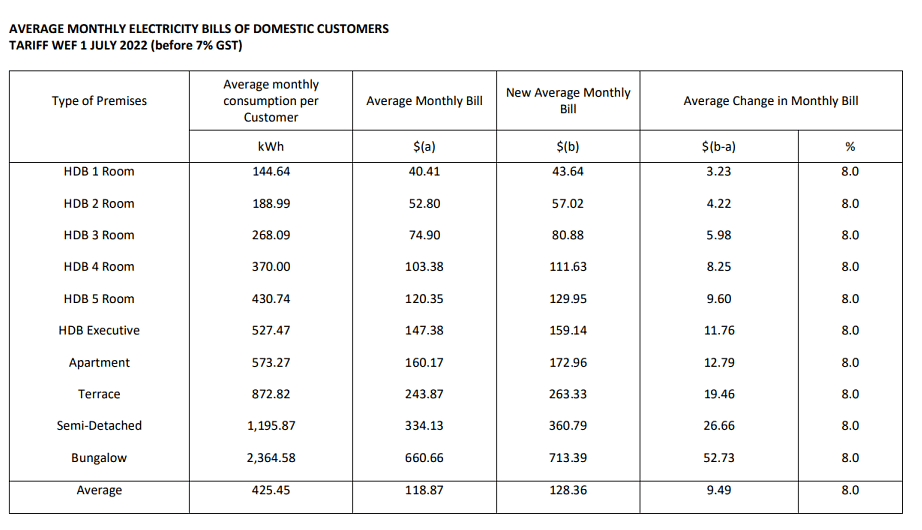

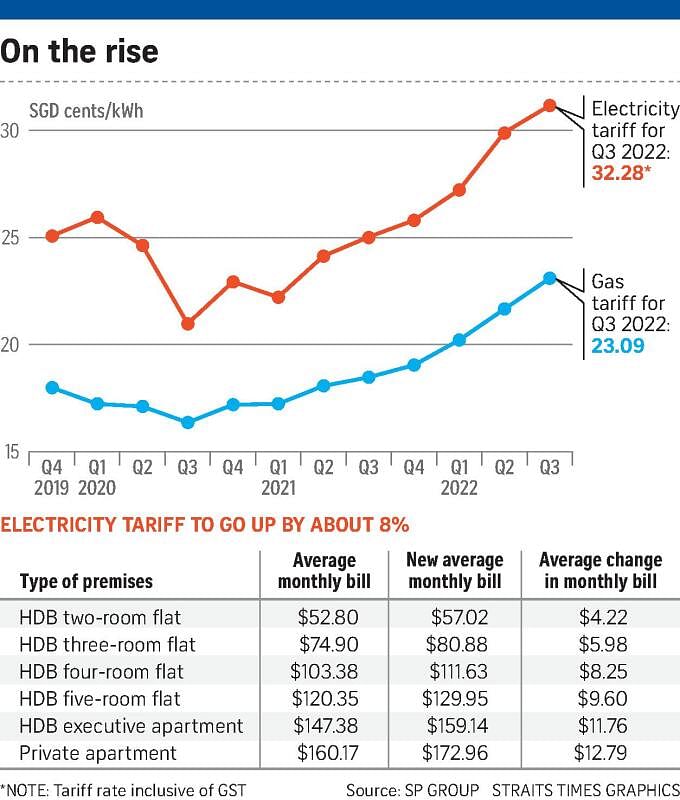

On Thursday, Singapore grid operator SP Group announced that

it would be hiking the electricity tariff for the period of July 1 to Sept 30 to 30.17 cents per kilowatt-hour (kWh), excluding the goods and services tax (GST). This is up by around 8 per cent from the current rate of 27.94 cents per kWh.

The electricity tariff has been rising since the first quarter of last year.

Dr Broadstock also noted that the full demand picture remained uncertain, especially since LNG demand from China had been relatively muted for much of the year due to widespread Covid-19- related lockdowns throughout the country.

"Let's also remember that we have not yet factored in Chinese demand. But that could change very quickly. Over the past few days, they have been coming out with refreshed measures to show they are making moves to open up," he said, warning that the return of this demand could very quickly change price dynamics.

"We should also keep an eye open for high levels of seasonal demand, which have been impacting regional energy markets heavily in the past few years," he added.

A liquefied natural gas tanker off Singapore’s coast. Industry sources say the outlook for gas prices until the end of 2023 is on the uptrend. PHOTO: REUTERS

Pump prices

Even as Singaporeans grapple with fast rising electricity prices, another aspect of daily life they have had to contend with is higher petrol prices.

In a media briefing here on Wednesday (June 29), global energy giant Shell's chief executive Ben van Beurden

said petrol prices were rising because of a shortage of refining capacity.

A reason for this, he said, was that many companies had started to shut refineries partly to convert them into biofuel facilities, in an effort to lower their carbon footprint and produce cleaner fuels.

The views expressed by Mr van Beurden are similar to those of many senior oil executives, who have bemoaned the confusion caused by the urgency to reduce carbon emissions.

In May, Mr Amin Nasser, chief executive of the world's largest oil producer, Saudi Aramco, said at the World Economic Forum in Davos that green energy pressures have led to companies not investing in expanding refining capacity.

The International Energy Agency (IEA) noted in a report in May that global refinery margins have surged to extraordinarily high levels due to depleted product inventories and constrained refinery activity.

Mr Yaw Yanchong, director of oil research at Refinitiv, a unit of the London Stock Exchange Group, said supplies of diesel and petrol have gotten worse in recent months after first showing signs of tightening late last year, when the post-pandemic demand recovery started.

He noted that this came at the same time that refineries across Asia's top refining centres in China, India, Japan and South Korea were operating at below-average capacity.

MORE ON THIS TOPIC

Ukraine war fallout: Polarised global economy could break into distinct blocs

Pump prices in S'pore fall for first time since April

While India and South Korea are now running their refineries at near capacity, Mr Yaw noted that China, one of the largest refining countries after the United States and Russia, was still operating well below peak capacity.

Mr Yaw said: "We do not expect China to revert to being a major exporter of diesel and petrol as the move (to reduce carbon footprint) is government-driven and part of its effort to achieve carbon neutrality by 2060."

He added that China's exports of diesel and petrol fell drastically from the second half of 2021, with diesel falling to an average of about 530,000 tonnes per month on average between July 2021 to May of this year, versus a pre-lockdown monthly average of around 1.7 million tonnes.

Chinese petrol exports averaged around 900,000 tonnes a month, down from 1.5 million tonnes a month.

The loss of exports from China has added to the support of prices said Mr Yaw.

Energy efficiency

During his briefing, Mr van Beurden said that significant measures would be needed to mitigate the current crisis, with consumers needing to be more conscientious about energy savings.

This is something that even the EMA has repeatedly called for among consumers in Singapore, with the most recent occasion being on June 16, when it announced the extension of the Temporary Electricity Contracting Support Scheme (Trecs).

The scheme cushions the impact of volatile prices in the wholesale electricity market on large electricity users, which include shopping malls and coffee shops.

Trecs

was rolled out in January to help non-residential users consuming at least 4 megawatt-hour (MWh) of electricity get fixed-price plans from power generation companies.

One such consumer who has been proactively trying to find ways to manage rising electricity costs is Mr Ansari, chief executive of Singapore-listed recycling and environmental services company Shanaya.

He said that his company had reduced electricity consumption by improving its efficiency, such as by upgrading to using LED lights and installing day light sensors at certain areas of the firm's facility in Tuas.

He said: "We will be adding solar panels on our roof tops to generate our own energy and we also have plan to harvest biogas from our food and organic waste treatment plant and convert it to energy for our own use."

According to Trung Ghi, Head of Energy and Utilities for Asia-Pacific at consulting firm Arthur D. Little, sustainability efforts can not only support cost savings but also open up new revenue streams for some businesses.

"We have seen that some of our clients who have adopted energy efficiency solutions have saved costs in the long run, and have even created energy efficiency solution services to offer the industry, which also creates new revenue streams," he said.

"From a case we conducted, we tracked 24 initiatives and saw a range of between five and 30 per cent in annual cost savings through adopting energy efficiency solutions."

Hoping to take advantage of such solutions, popular Indian eatery Springleaf Prata's founder and director S.V. Gunalan said that he and his team are still working on finding the right solutions for his chain of restaurants.

"We had recently carried out a trial on a solution to help us save on electricity, but after three months we found that it was not really helping us save costs, so we stopped that and are now running a different solution that is supposed to help us reduce excess electricity produced at the DB box," he said.

He added that he had managed to lock in a few fixed priced contracts for some of his eateries, which has helped cap price increases through the end of the year and has also delayed upgrades to his cooking equipment.

Mr S.V. Gunalan of Springleaf Prata said that he and his team are still working on finding energy-efficient solutions. PHOTO: ST FILE

One such upgrade that his cooks were looking forward to, was a switch from gas-fired hot plates to electric ones. This is where they make their prata.

"The gas fired hot plates are very hot, and my staff have to constantly check the fire and manage it manually at the cylinder... it's not very comfortable in terms of work operations," he said.

"The electric hotplates does not generate much heat other than from the hotplate, and working around it is more pleasant.

But I guess for the moment there's no choice, my staff have to endure the pain until things settle."