- Joined

- Oct 5, 2018

- Messages

- 16,783

- Points

- 113

Oxley Seeks Up to US$120 Million Private Loan

https://www.bnnbloomberg.ca/singapore-builder-oxley-seeks-up-to-120-million-private-loan-1.2081713

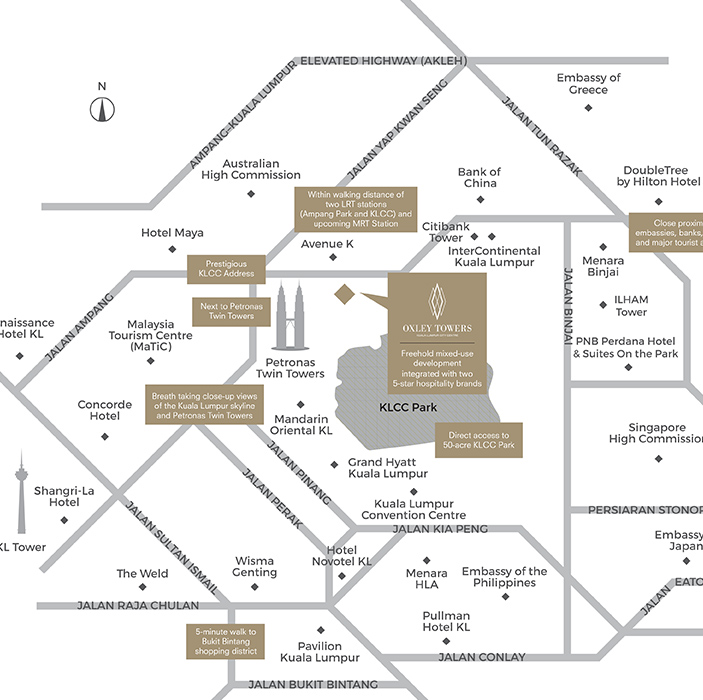

(Bloomberg) -- Oxley Holdings Ltd, a cash-strapped property developer in Singapore, is seeking a private credit loan of US$100 million to US$120 million partly to help repay a Singapore dollar bond due next month, said people familiar with the matter. The borrowing is set to be backed by Oxley’s two property projects in Kuala Lumpur and London, the people said. The deal isn’t final and terms may change, the people added.

As of Dec. 31 last year, Oxley reported a total of S$48.9 million in cash and cash equivalents and total current liabilities of S$1.4 billion, according to a Singapore Exchange filing.

BOOK FOR APPOINTMENT

BOOK FOR APPOINTMENT