-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Serious 40-59 old Coolie Genes Sinkies no $$$ high in debt!

- Thread starter Pinkieslut

- Start date

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

Until up lorryPay and pay until 不动

- Joined

- Dec 6, 2018

- Messages

- 16,782

- Points

- 113

Totally useless Sinkies. Just cannot think who put them in such situation. Majulah PAP.

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

Nation of sheep - no critical thinking, just follow orders onlyTotally useless Sinkies. Just cannot think who put them in such situation. Majulah PAP.

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

Ceca lost a lot in stock market or struck $$$$ insideOnly ceca no debt. Even tiongs have debts esp houses.

- Joined

- Apr 20, 2024

- Messages

- 499

- Points

- 43

How u know they gamble? I dunno they gamble ornot. Usually nev hear them having debts.Ceca lost a lot in stock market or struck $$$$ inside

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

https://www.businessworld.in/article/indias-middle-class-a-debt-fueled-time-bomb-waiting-to-explode-541528#:~:text=According to a recent report,30.4 per cent in 2018.How u know they gamble? I dunno they gamble ornot. Usually nev hear them having debts.

The Great Economic Impact

Experts warned that the growing reliance on instant loans among India’s middle class has significant economic implications. Elevated debt burdens shift household spending from discretionary to debt servicing, altering consumption patterns and potentially slowing demand for non-essential goods.

India's economic growth has long been driven by a virtuous cycle of investment in productive assets. This, in turn, creates jobs and increases income, boosting consumption demand and supporting GDP growth. When investments focus on improving economic efficiency, exports also get a lift, providing a sustained economic boost."Savings rates decline, reducing long-term financial security and investment capital, which could impact economic resilience. High defaults strain the banking sector, leading to cautious lending, and impacting credit availability for productive investments. While consumer credit fuels short-term growth, excessive borrowing without corresponding income growth risks undermining sustainable economic expansion," Goel stated.

However, a contrasting scenario unfolds when the virtuous cycle of the economy starts with artificial consumption through consumer loans. The investment in productive assets shall slowdown, inviting imports, affecting GDP growth, and causing inflation.

India must curb personal loans except housing and educational loans. However, emergency loans for medical support and a daughter’s marriage should be liberal. Normally, a gold loan is availed under distress. Hence, liberal repayment should be permitted to avoid the auction of gold security, especially by NBFCs, Gupta told BW."In short, India needs a model of investment and export-led economy till it becomes an upper-middle income nation. During the developing phase, India must adopt the philosophy of consuming less, saving more, investing more and exporting more. That will provide a consistent rise in the income of poor and middle-class families and avoid debt trap," said Gupta.

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

The Rich Are Splashing Out While the Middle-Class Cut Back in India

- Consumer firms expect slow growth as buyers reduce purchases

- Small borrowers are binging on debt due to weak income

Slowing wage growth and elevated inflation has resulted in financial stress for lower-income earners, forcing them to forgo or cut back on purchases, even as the rich splurge.

Photographer: Dhiraj Singh/Bloomberg

By Ruchi Bhatia and Satviki Sanjay

10 January 2025 at 7:30 AM SGT

Updated on

10 January 2025 at 12:51 PM SGT

Save

Translate

Follow Bloomberg India on WhatsApp for exclusive content and analysis on what billionaires, businesses and markets are doing. Sign up here.

While India’s 100 million wealthiest people are splurging on weddings, jewelry, and top-end apartments, over 400 million of their middle-class compatriots are cutting back on the purchases of consumables like cooking oil, soaps, and biscuits.

https://www.bloomberg.com/tips/

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

Why Has the Great Indian Shopper Gone Silent?

Urban wages and spending are slumping. The government needs to counter the malaise quickly to maintain support for pro-growth policies.5 December 2024 at 5:00 AM SGT

By Mihir Sharma

Mihir Sharma is a Bloomberg Opinion columnist. A senior fellow at the Observer Research Foundation in New Delhi, he is author of “Restart: The Last Chance for the Indian Economy.”

Spending is weaker than expected.

Photographer: Dhiraj Singh/Bloomberg

Save

Translate

India-watchers were startled by recent data showing that growth slowed last quarter — by a lot. Gross domestic product expanded only 5.4% between July and September compared to the same period in 2023. While healthy by developed-world standards, that was considerably lower than the Bloomberg consensus estimate of 6.5% or the Reserve Bank of India’s forecast of 7%.

There are plenty of possible reasons. In particular, many economists point to lower spending by the government. For some years now Indian growth numbers have been pumped up by continually increasing federal capital expenditures.

http://bloom.bg/dg-ws-core-bcom-m1

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

https://www.etnownews.com/companies...al-currency-loan-reason-article-116930531/amp

$3 billion debt: India’s largest conglomerate led by billionaire Mukesh Ambani – Reliance Industries – has raised a big-ticket debt from as many as 11 banks. The oil to telecom giant has raised a whopping $3 billion loan from several lenders, in its biggest such deal in almost 2 years.

India's largest corporate by revenues RIL has raised this dual currency loan and is learnt to have already drawn down about $700 million of the amount, Economic Times reported. The five-year loan was priced at 1.20 per cent over the three-month secured overnight financing rate (SOFR) last month.

$3 billion debt: India’s largest conglomerate led by billionaire Mukesh Ambani – Reliance Industries – has raised a big-ticket debt from as many as 11 banks. The oil to telecom giant has raised a whopping $3 billion loan from several lenders, in its biggest such deal in almost 2 years.

India's largest corporate by revenues RIL has raised this dual currency loan and is learnt to have already drawn down about $700 million of the amount, Economic Times reported. The five-year loan was priced at 1.20 per cent over the three-month secured overnight financing rate (SOFR) last month.

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

Tata Sons Redefines Debt Strategy, Asks Companies to Pay Liabilities Independently

Outlook Business Desk

Updated on: 6 January 2025 12:48 pm

Tata Sons, the holding company of the Tata Group, has directed the management of all the companies to manage debts and liabilities independently. As the companies are going to take a new financial route to manage liabilities, they will no longer follow the old way of providing letters of comfort and cross-default clauses to lenders, the Economic Times reported, citing official sources.

ADVERTISEMENT

Tata Sons has reportedly told lenders that going forward, all capital allocation into new businesses will be through equity investments and internal accruals largely contributed by dividends from the conglomerate’s listed company, Tata Consultancy Services (TCS).

Each portfolio of the salt-to-software conglomerate, including steel, power, chemicals and technology’s listed firm, will act as a holding company and not Tata Sons.

The older listed companies like Tata Steel, Tata Motors, Tata Power and Tata Consumer have been taking care of their debts independently, while the new businesses of the Tata Group, such as Tata Digital, Tata Electronics and Air India, have relied on Tata Sons for capital allocation.

Also Read: Tata’s Green Power Play

“Once they achieve significant scale, these companies, too, will manage their own capital requirements,” the ET report, citing an official.

Additionally, Tata Sons has been taking strides to make its new businesses more profitable. Speaking at the Global Alumni Meet of NIT Trichy last week, Tata Sons chairman N Chandrasekaran said the parent company of Air India is completely devoted to transform Air India into a top-class airline rooted in exceptional services and performance on an international level. Air India was acquired by the Tata Group in 2022.

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

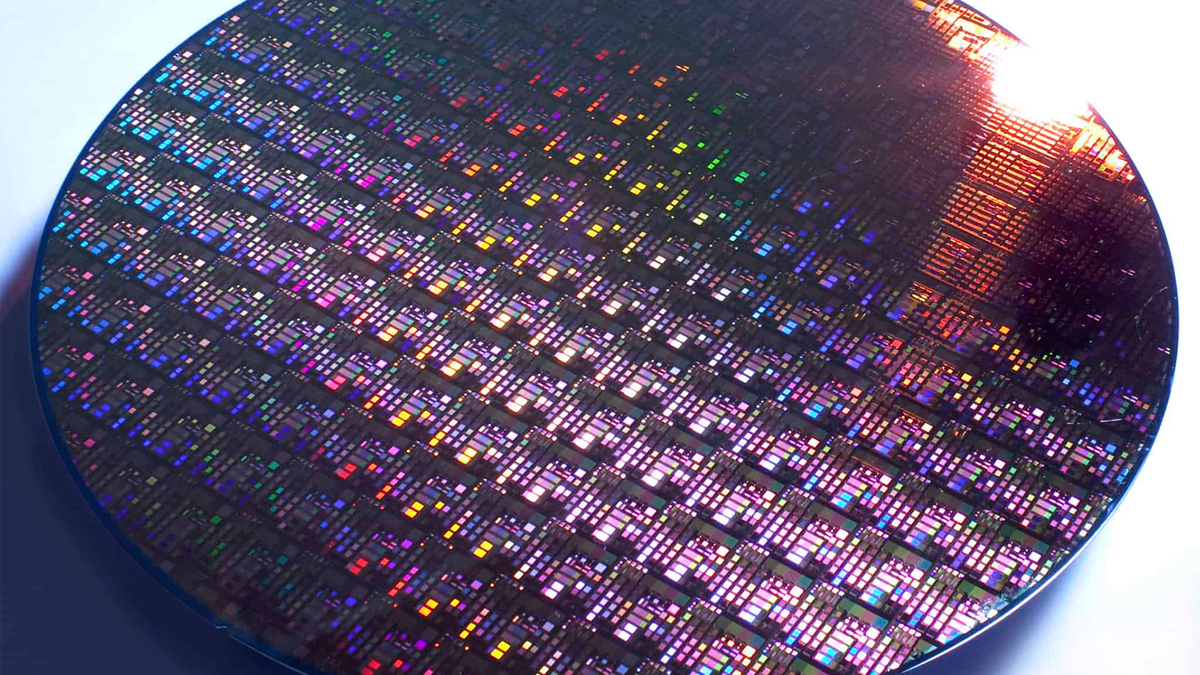

Now the billion dollar question is where Bengali squeeze $$$$ and brain power for their new 28nm fab

India set to launch its first semiconductor chip based on 28nm this year

NewsBy Kunal Khullar

published January 24, 2025

India's semiconductor market is poised for rapid growth, with projections estimating its value to reach $63 billion by 2026

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

(Image credit: GlobalFoundries/iStock)

India is gearing up to make a dramatic leap in the global tech arena, as the country’s first domestically manufactured semiconductor chips are slated to debut in 2025. Ashwini Vaishnaw, the Minister for Rail

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

India is gearing up to make a dramatic leap in the global tech arena, as the country’s first domestically manufactured semiconductor chips are slated to debut in 2025. Ashwini Vaishnaw, the Minister for Railways, Communications, Electronics, and Information Technology, made the announcement during the World Economic Forum in Davos.

Advertisement

“Our first ‘Made in India’ chip will be rolled out this year and now we are looking at the next phase, where we can get equipment manufacturers, material manufacturers and designers in India. For materials, from parts per million purity, we need to go to parts per billion purity levels. This requires huge transformative changes in the process and the industry is working to achieve this,” Vaishnaw stated to the media.

Advertisement

“Our first ‘Made in India’ chip will be rolled out this year and now we are looking at the next phase, where we can get equipment manufacturers, material manufacturers and designers in India. For materials, from parts per million purity, we need to go to parts per billion purity levels. This requires huge transformative changes in the process and the industry is working to achieve this,” Vaishnaw stated to the media.

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

India Smallcap Gauge Narrowly Misses Bear Market as Rout Extends

A months-long selloff in Indian stocks is showing few signs of abating, as a gauge of smallcap shares stretched its losses from a September peak to 20% before dip-buying helped it pare some decline.

BloombergPublished28 Jan 2025, 04:46 PM IST

A months-long selloff in Indian stocks is showing few signs of abating, as a gauge of smallcap shares stretched its losses from a September peak to 20% before dip-buying helped it pare some decline.

The NSE Nifty Smallcap 250 Index narrowly missed entering a bear market as it slumped as much as 3.9% on Tuesday before closing 1.8% lower. The gauge had dropped 3.7% the previous day. The NSE India Volatility Index, also known as the fear gauge, rose to the highest level since August on Monday.

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

https://www.business-standard.com/a...ion-in-broadbased-selloff-125012701151_1.html

India market rout deepen in recent weeks

India market rout deepen in recent weeks

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

They dun gamble Toto, but they like to do private loan - high risk n very non-transparentHow u know they gamble? I dunno they gamble ornot. Usually nev hear them having debts.

- Joined

- Aug 6, 2008

- Messages

- 5,852

- Points

- 83

"Similarly, there was a 64 per cent rise in the share of applications from mid to high income borrowers — those who earn above S$84,000 a year."

Since when earning more than 84k is considered mid to high income earner....

I earn more than that, but I still feel poor as fuck due to the cost of living. No car and no kids some more.

Since when earning more than 84k is considered mid to high income earner....

I earn more than that, but I still feel poor as fuck due to the cost of living. No car and no kids some more.

- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

Even combined income above 160k will feel hand tight tight if u have 2 kids and live in a new condo with a maid and drive a SNA car plate GLA180…."Similarly, there was a 64 per cent rise in the share of applications from mid to high income borrowers — those who earn above S$84,000 a year."

Since when earning more than 84k is considered mid to high income earner....

I earn more than that, but I still feel poor as fuck due to the cost of living. No car and no kids some more.

Similar threads

- Replies

- 49

- Views

- 2K

- Replies

- 15

- Views

- 623

- Replies

- 2

- Views

- 144

- Replies

- 5

- Views

- 358