-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

kraft and bro Run..need your advice

- Thread starter SNTCK

- Start date

- Joined

- Jul 25, 2013

- Messages

- 17,813

- Points

- 113

etf u need to sign up for a broker....physical just go to a shop or ur local MAXI cash....

what are ur reasons for buying gold?

what are ur reasons for buying gold?

- Joined

- Apr 5, 2014

- Messages

- 3,304

- Points

- 63

etf u need to sign up for a broker....physical just go to a shop or ur local MAXI cash....

what are ur reasons for buying gold?

.. Diversify my investment.

Gold is quite cheap now. Can buy to keep.

Stock market almost peak liao..

So choose to park my money in commodities

- Joined

- Jul 25, 2013

- Messages

- 17,813

- Points

- 113

.. Diversify my investment.

Gold is quite cheap now. Can buy to keep.

Stock market almost peak liao..

So choose to park my money in commodities

good reason,stocks are clearly overheated,but im not sure what direction gold is going,usually u can tell when something is in a bubble or in a crash,but gold has just ended a bubble streak of 8 years....its kinda hard to tell what direction it is going.....

what type of investments u hold?

- Joined

- Jul 10, 2008

- Messages

- 64,774

- Points

- 113

.. Diversify my investment.

Gold is quite cheap now. Can buy to keep.

Stock market almost peak liao..

So choose to park my money in commodities

Why don't you invest in your own talents rather than in some inert metal? I invested $5000 in my photoshop / illustrator skills and sold that business for $50,000 18 months later. Just identify what you're good at and you can do the same.

And how do you know the stock market has peaked? Can you see into the future?

- Joined

- Feb 17, 2009

- Messages

- 13,736

- Points

- 113

http://www.forbes.com/sites/afontevecchia/2011/11/15/is-gld-really-as-good-as-gold/

read this and understand gold etf and owning physcial gold, you will need place to store. that's the disadvantage i can see.

anyway, heard that sti etf quite good, can consider and choose right timing to go in.

read this and understand gold etf and owning physcial gold, you will need place to store. that's the disadvantage i can see.

anyway, heard that sti etf quite good, can consider and choose right timing to go in.

- Joined

- Apr 5, 2014

- Messages

- 3,304

- Points

- 63

Why don't you invest in your own talents rather than in some inert metal? I invested $5000 in my photoshop / illustrator skills and sold that business for $50,000 18 months later. Just identify what you're good at and you can do the same.

And how do you know the stock market has peaked? Can you see into the future?

I have my own reason and do not need to tell you

- Joined

- Apr 5, 2014

- Messages

- 3,304

- Points

- 63

good reason,stocks are clearly overheated,but im not sure what direction gold is going,usually u can tell when something is in a bubble or in a crash,but gold has just ended a bubble streak of 8 years....its kinda hard to tell what direction it is going.....

what type of investments u hold?

Unit trust. Share. FD. Saving plan. Annuity.

Preferences share. Bond.

Here a bit. There a bit...

- Joined

- Jul 10, 2008

- Messages

- 64,774

- Points

- 113

Unit trust. Share. FD. Saving plan. Annuity.

Preferences share. Bond.

Here a bit. There a bit...

That's pathetic.

- Joined

- Jul 25, 2013

- Messages

- 17,813

- Points

- 113

Why don't you invest in your own talents rather than in some inert metal? I invested $5000 in my photoshop / illustrator skills and sold that business for $50,000 18 months later. Just identify what you're good at and you can do the same.

And how do you know the stock market has peaked? Can you see into the future?

stock market (IVV) has returned 160% since 2009,lets project this into the future.....in order for stock market to repeat its sucess from the past 5 years and return 160% within the next ten years....S&P has to reach a all time high of 4988(it has been hovering around 1200 to 1500 in the last decade)......that is like the equivalent of US economy growing to 48 trillion in the next 10 years and repaying all its 16 trillion debt.....do u think thats feasible?

stocks have not just peaked,they are due for a crash......S&P will never break 2200 i can bet on that.it will crash long before that.

- Joined

- Apr 5, 2014

- Messages

- 3,304

- Points

- 63

That's pathetic.

Yes. Not rich as you

I am happy with what I have!

- Joined

- Jul 10, 2008

- Messages

- 64,774

- Points

- 113

Yes. Not rich as you

I am happy with what I have!

If you're happy with what you have, why are you bothering to ask for further investment advice? Just follow your tried and tested strategy that got you to where you are today.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Thinking to buy gold and silver.

You think etf and physical gold/ silver.

Which one is good?

Let's not talk about timing but you should avoid physical

physical gold is less liquid in Singapore with crazy spreads from rouge-middlemen, except UOB. last year, when investors were stuck with highly-reputable Pamp physical gold due to Genneva Gold's collapse, even UOB refuses to buy these Pamp gold (because they were originally not sold by UOB). In the end, pawnshops took them for 20% discount below spot. This is worst than fiat, my gold is different from your gold, it is like saying $100 from DBS is different from $100 from OCBC. The same goes for physical silver.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

.. Diversify my investment.

Gold is quite cheap now. Can buy to keep.

Stock market almost peak liao..

So choose to park my money in commodities

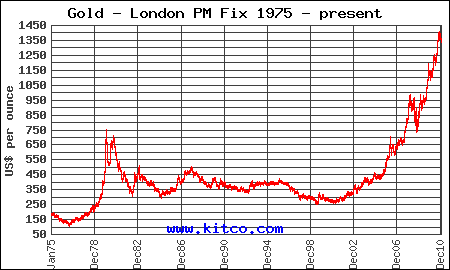

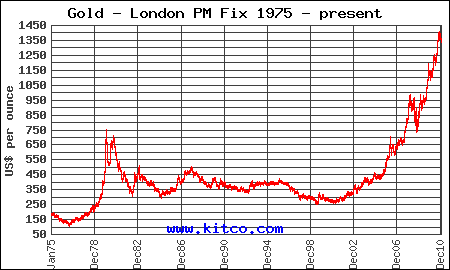

No such thing as cheap. The last 1980 gold downturn took twenty years to recover.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Why don't you invest in your own talents rather than in some inert metal? I invested $5000 in my photoshop / illustrator skills and sold that business for $50,000 18 months later. Just identify what you're good at and you can do the same.

And how do you know the stock market has peaked? Can you see into the future?

Sir, you run a very successful online business. You will be a perfect learning example if you eventually forgo the ad-revenue from vices. You still have plenty of advertisers to choose from. If you start as an investment subsection like "A Singaporean's guide to Living In JB" , plenty of remisiers, banks and credit card companies will be keen to advertise with you. paiseh just kaypoh

- Joined

- Jul 10, 2008

- Messages

- 64,774

- Points

- 113

No such thing as cheap. The last 1980 gold downturn took twenty years to recover.

This reinforces my belief that there is nothing better than investing in oneself. It gives you absolute control over your investments. You'll know before anyone else when the going is good and you'll be forewarned if things are not doing well.

- Joined

- Jul 25, 2013

- Messages

- 17,813

- Points

- 113

so why u say its highly illiquid when all the gold pawnshops will take ur gold anytime anyday for 10 or 20% off spot price?they need the discount lets face it,theres no telling what gold price will do during the next 3 to 6 months while ur trying to repay ur debt.and i dont understand what the fuck does the collapse of Genneva gold have to do with the value of the gold bars....gold is fucking gold,its not like u have to go to genneva to redeem ur gold like its some kind of NTUC voucher.if i found some gold made by australian mint in 1882,it will still be fucking gold.

Let's not talk about timing but you should avoid physical

physical gold is less liquid in Singapore with crazy spreads from rouge-middlemen, except UOB. last year, when investors were stuck with highly-reputable Pamp physical gold due to Genneva Gold's collapse, even UOB refuses to buy these Pamp gold (because they were originally not sold by UOB). In the end, pawnshops took them for 20% discount below spot. This is worst than fiat, my gold is different from your gold, it is like saying $100 from DBS is different from $100 from OCBC. The same goes for physical silver.

- Joined

- Jul 25, 2013

- Messages

- 17,813

- Points

- 113

No such thing as cheap. The last 1980 gold downturn took twenty years to recover.

its not a recovery,gold is meant to be that price....any spikes in gold price above $400 to $600 is just a bubble.gold has been around $200 to $400 over the last 100 years....it only started going up like crazy in late 1990s because of crazy stock market inflation.

- Joined

- Jul 10, 2008

- Messages

- 24,581

- Points

- 0

Unit trust. Share. FD. Saving plan. Annuity.

Preferences share. Bond.

Here a bit. There a bit...

Those are insurance and derivatives .. prepare to lose your money.. that is not investment.

you are better off investing in your own ass. That is what sinkies do daily.. You might get extra incentives beside the daily rewards you are getting.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

http://www.forbes.com/sites/afontevecchia/2011/11/15/is-gld-really-as-good-as-gold/

read this and understand gold etf and owning physcial gold, you will need place to store. that's the disadvantage i can see.

anyway, heard that sti etf quite good, can consider and choose right timing to go in.

Good brother, RUN is puzzled. RUN suspects SNTCK fell for you.

- then u buy one for me. ok?

http://sammyboy.com/showthread.php?...t-9-iPhone-event-report&p=1964338#post1964338

- you can go geylang to find kokokeh

http://sammyboy.com/showthread.php?...ught-sad-feelings-to-me&p=1963887#post1963887

- you thought you who?

home no mirror can go public toilet to look at yourself. phew.

http://sammyboy.com/showthread.php?...an-Make-Getting-Married&p=1964409#post1964409

- Krafty u think too much liao...

i think you are in depression....

http://sammyboy.com/showthread.php?...ught-sad-feelings-to-me&p=1963869#post1963869

Similar threads

- Replies

- 13

- Views

- 652

- Replies

- 92

- Views

- 4K

- Replies

- 5

- Views

- 406

- Replies

- 21

- Views

- 1K

- Replies

- 7

- Views

- 932

D