- Joined

- Oct 30, 2014

- Messages

- 36,768

- Points

- 113

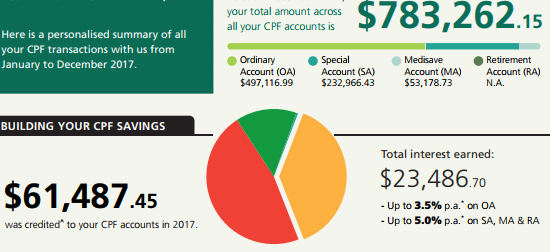

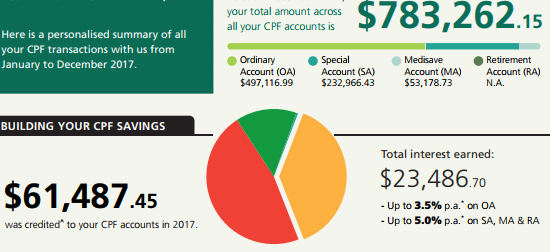

You could retire well if you know how to use your CPF to grow your egg nest. This sinkie shows other sinkies how to make use of compound interest to grow their cpf retirement fund. You could choose to follow his methods or forever whine and stay a loser.

http://singaporeanstocksinvestor.blogspot.com/2018/01/have-your-cpf-pie-and-eat-it-eventually.html

http://singaporeanstocksinvestor.blogspot.com/2018/01/have-your-cpf-pie-and-eat-it-eventually.html