from straitstimes.com:

Budget 2023 designed to support families, signals beginning of a new S’pore: Indranee

Minister in the Prime Minister's Office Indranee Rajah (centre) said she was happy to see strong measures for parents and young couples in the Budget. ST PHOTO: GAVIN FOO

Natasha Ann Zachariah

Correspondent

UPDATED

17 FEB 2023, 1:16 PM SGT

FacebookTwitter

SINGAPORE - Incentives for marriage and parenthood and moves to strengthen the social compact are some of the clear themes in this year’s Budget, Minister in the Prime Minister’s Office and Second Minister for Finance Indranee Rajah said on Thursday as she outlined the Budget’s significance.

Ms Indranee, who is also Second Minister for National Development, said

that paternity leave was an issue which came up more than maternity leave, when the Government was doing its feedback and engagement exercise with the public and stakeholders.

“And that is why we moved on it... This is Government signalling a shift, a change. And that change is not just Government doing it, but it is Government responding to what we see as a society,” she said.

“So, think of this as something which is an evolution taking place before your very eyes, because 20 years ago (it was not) something that you would have thought of. But our society is changing, and this is the beginning of a new Singapore as far as families are concerned.”

She was speaking at a MoneyFM 89.3 roundtable discussion with four other panellists – Mr Kurt Wee, president of the Association of Small and Medium Enterprises; Mr Suan Teck Kin, head of research at UOB; Mr Ajay Kumar Sanganeria, partner and head of tax at KPMG Singapore; and Mr Ignatius Low, editor-in-chief of lifestyle and entertainment media at SPH Media.

In his Budget speech on Tuesday, Deputy Prime Minister and Finance Minister Lawrence Wong had announced a slew of grants and schemes for parents and young couples.

These included

enhancements to the Baby Bonus Scheme, doubling government-paid paternity leave, and

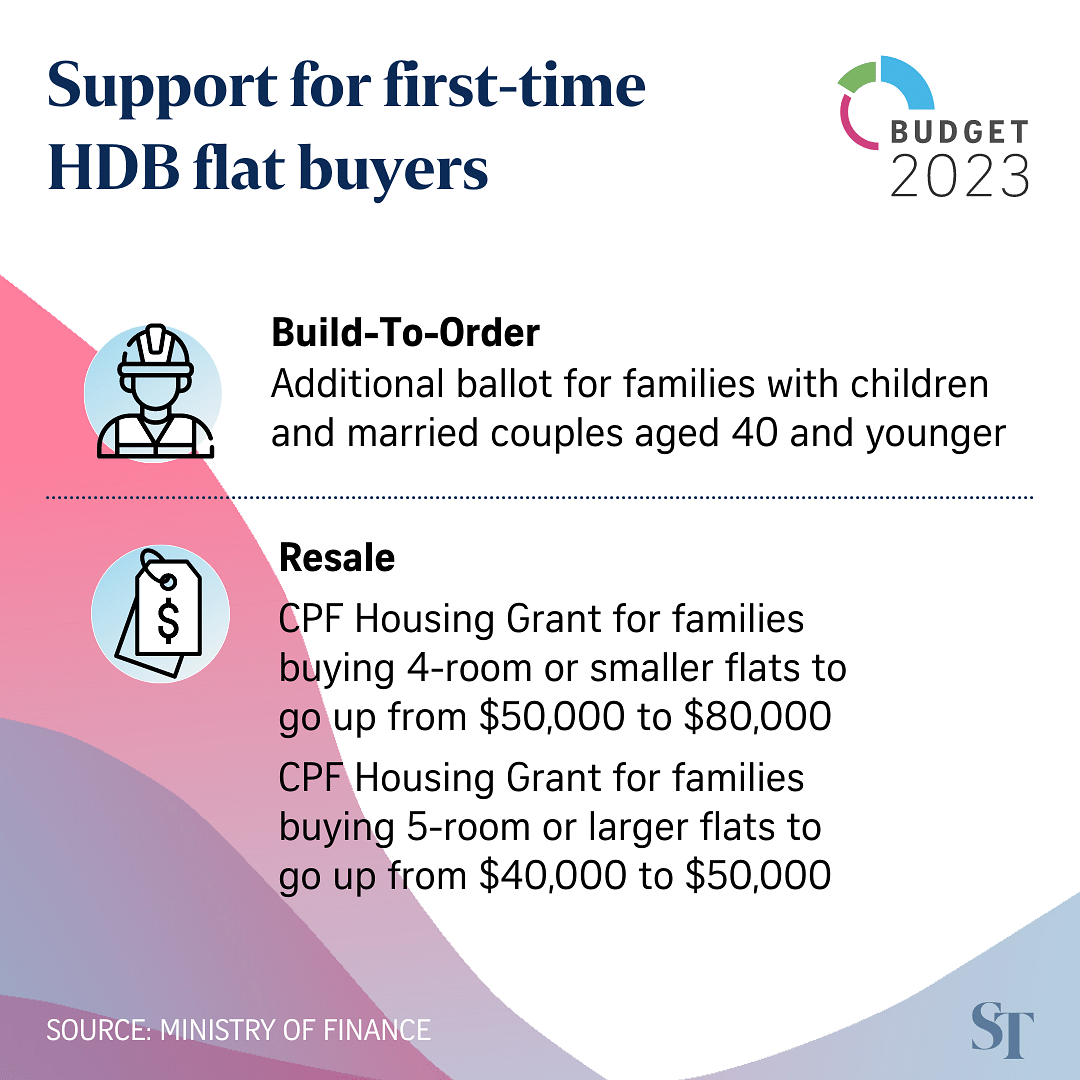

more housing grants for first-timer families with children, as well as young married couples aged 40 years old and below, among other initiatives.

Ms Indranee said she was happy to see strong measures for parents and young couples in the Budget. She added that research shows that children do better when both fathers and mothers are involved when the children are young.

Mr Low said what stood out for him was the Budget’s focus on millennials, with whom themes such as building a family and owning a home resonate, and who may not prioritise material advancement as much as previous generations.

“I think young Singaporeans are different, and they put the emphasis on certain values. I would call them more left-leaning, maybe,” he said. “And if this is the case, then the Government is absolutely on the right track in signalling to a generation who will support organisations, brands (and) people whom they feel are reflective of their values.”

Other initiatives announced in the Budget were geared towards helping Singaporeans cope with the rising cost of living, goods and services tax (GST) hike and inflation.

These include a Cost-of-Living Special Payment of between $200 and $400 for each eligible adult Singaporean, and an extra one-time payout for seniors. Singaporean households will also receive

$300 in Community Development Council vouchers in January 2024.

Ms Indranee said these measures were crafted to address short-term concerns, but emphasised the need for Singaporeans to think ahead by upskilling themselves and taking advantage of available programmes.

“We have got to invest in skills. We have to make sure there is innovation. We have to charge up the economy so that you have growth opportunities for all. So, quite a bit of money has been channelled there,” she said.

MoneyFM 89.3 presenter Ryan Huang, who was co-moderating the panel, asked if this was a “Robin Hood Budget”, given the

increased tax on luxury cars, higher-value residential and non-residential properties and tobacco products.

In response, Mr Suan said that unlike the GST hike, these measures are not so much revenue measures as they are a form of signalling by the Government that it is addressing the income divide.

Minister Indranee Rajah (centre) with (from left) Association of Small and Medium Enterprises president Kurt Wee, MoneyFM presenter Ryan Huang, UOB head of research Suan Teck Kin, MoneyFM presenter Rachel Kelly, KPMG Singapore head of tax Ajay Kumar Sanganeria and SPH Media’s editor-in-chief of lifestyle and entertainment media Ignatius Low. ST PHOTO: GAVIN FOO

To round off the discussion, the panellists were asked what else they had hoped the Budget would address.

Both Mr Suan and Mr Sanganeria said there could be more help for businesses with sustainability and to improve their environmental, social and governance standards.

Mr Sanganeria said he would like to see future Budgets support green financing, and help pivot Singapore’s real estate towards becoming more energy-efficient.

Ms Indranee said that while this year’s Budget housing measures had focused on groups with the most urgent needs, namely married couples and young families, some single Singaporeans had also asked what support they would get.

“Actually, the resale housing grant does apply to singles as well. So, that is something for them in terms of helping them to access the resale market,” she said.

“But I think in the longer term, we are also looking to see how we can make housing more accessible and affordable. That is a work in progress.”

: MOF Photo by RK)

: MOF Photo by RK)