- Joined

- Jul 25, 2008

- Messages

- 13,876

- Points

- 113

Nearly $1 billion lost by scam victims in Singapore since 2016

SPH Brightcove VideoCheow Sue-Ann runs through the latest scourge: job scams

Wong Shiying

JAN 29, 2022

SINGAPORE - The recent phishing saga involving customers of OCBC Bank has highlighted the epidemic of scams in Singapore, where victims have lost more than $965 million in just over 5½ years, checks by The Straits Times showed.

Scammers pocketed a record high $268.4 million in total in 2020, a figure Home Affairs and Law Minister K. Shanmugam revealed last year in a written response to a parliamentary question on scams.

It was nearly triple the $89.7 million stolen in 2016.

The authorities have acknowledged the difficulties in tackling the problem - many of the perpetrators are based overseas, and when the monies have been transferred, recovery has been hard.

But the police have had some success.

Their Anti-Scam Centre said that of the 7,400 scam reports it received in the first half of last year involving losses of more than $201.7 million, the authorities were able to recover $66 million.

Internet love scams have remained one of the most lucrative scams in Singapore since 2011.

The amount duped from victims has grown from $2.3 million in 2011 to $8.8 million in 2014 and $33.1 million in 2020.

Police said 90 per cent of the scams in Singapore had originated from overseas.

They added that they have worked closely with foreign law enforcement agencies to monitor and share information on emerging scams and conduct joint operations to cripple syndicates.

The police said that last year, the Anti-Scam Division (ASD) of the Commercial Affairs Department worked with the Royal Malaysia Police, Hong Kong Police Force and the police force in Taiwan.

"Sixteen transnational syndicates perpetrating job scams, Internet love scams and impersonation scams were busted," the police said.

ASD oversees the Anti-Scam Centre.

Speaking to the media on Thursday (Jan 27), Deputy Assistant Commissioner (DAC) of Police Aileen Yap said the joint operations led to the arrest of 230 suspected syndicate members. DAC Yap is the assistant director of the Commercial Affairs Department's ASD.

SPH Brightcove Video

In Singapore, police also arrested and investigated more than 7,000 scammers and money mules last year.

Some are believed to have rented out their bank accounts to scammers or assisted them by carrying out bank transfers and withdrawals.

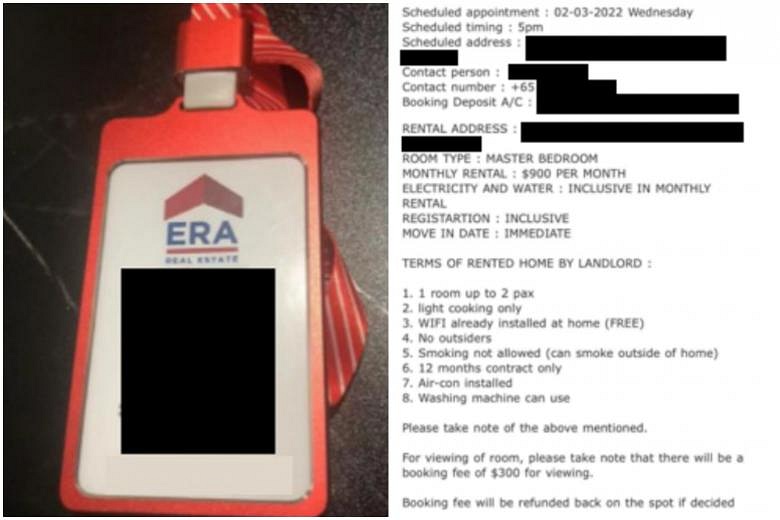

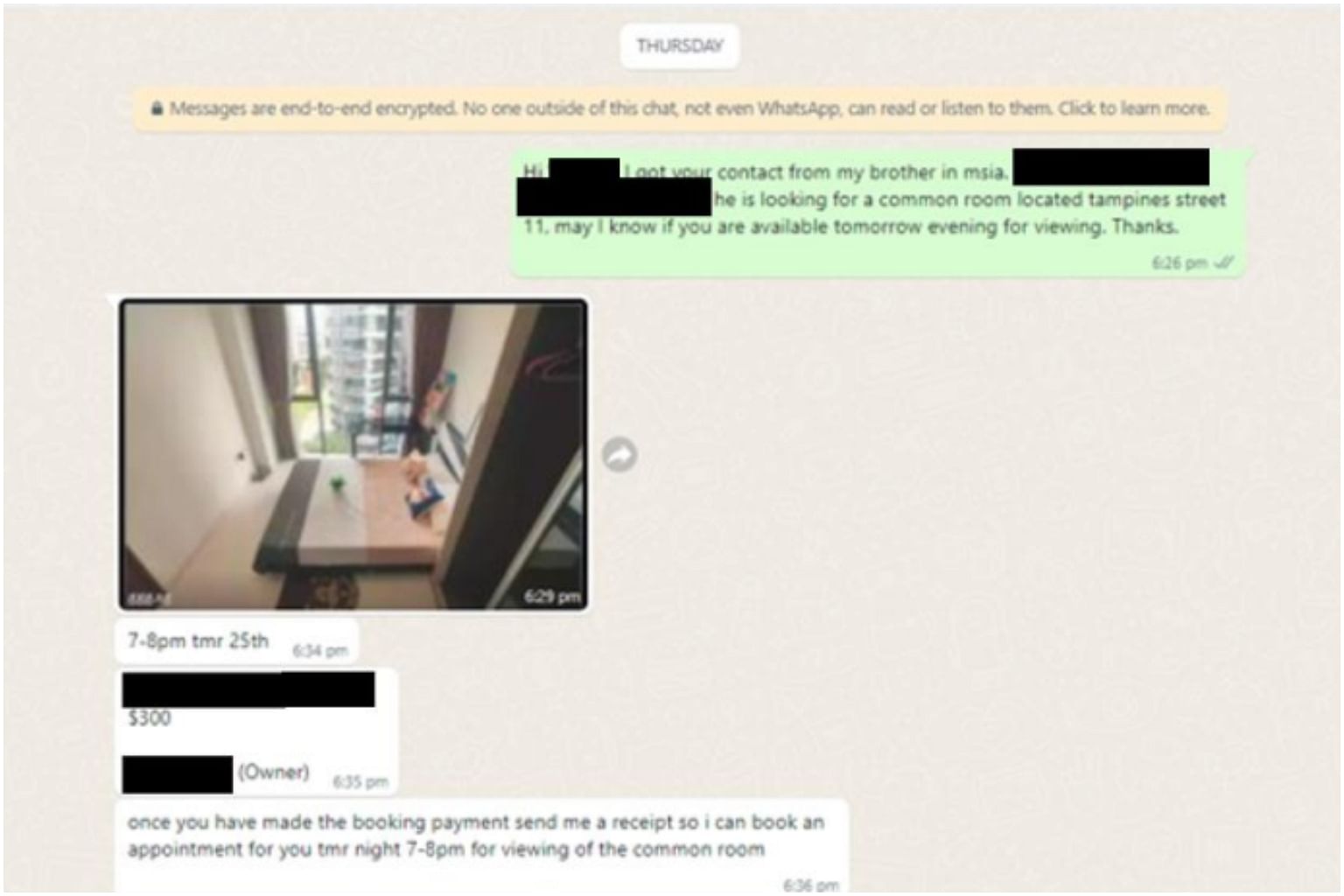

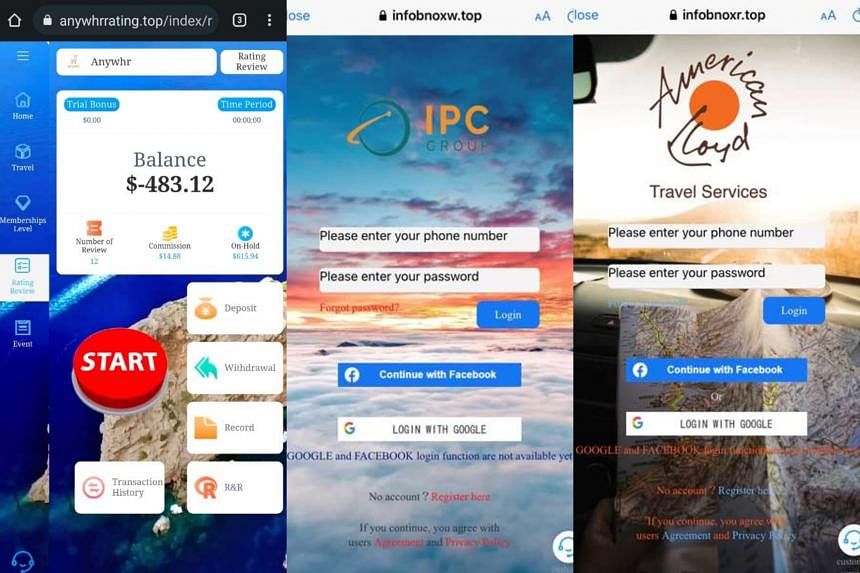

The Covid-19 pandemic has not slowed down the syndicates, with more victims falling for job scams, the Anti-Scam Centre said.

Police's Anti-Scam Division busts 16 transnational syndicates

Some victims refuse to believe they have been scammed, think cops are the bad guys

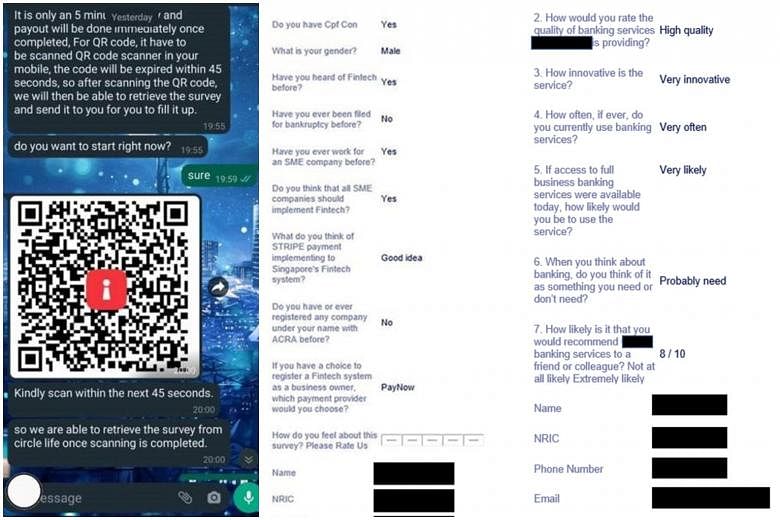

In the first six months of last year, there were 658 cases of job scams - a 16-fold increase from just 40 in the same period in 2020.

"Scammers are quick to adapt their tactics and scripts to keep up with the current climate.

"During the pandemic, scammers have impersonated government officials to phish for personal particulars from victims," police said.

Criminologist Olivia Choy, from Nanyang Technological University's psychology department, said financial and emotional stress triggered by the pandemic could have made people more vulnerable to scams.

"Such stressors can lead to poorer decision-making, and with more people going online for work and leisure, there is an influx of potential victims for opportunistic scammers," she added.