The three local banks are getting hit hard by the financial woes of Las Vegas Sands up to an amount of $2.2 bln.

UOB has lent to Las Vegas Sands $890m, DBS - $740m and OCBC is around $570m.

Learned from my source that LVS has drawn down the total approved loan of $5.4 bln and with cost over-run,

the $5.4 bln is not sufficient to cover construction cost for Marina Bay IR which works out to about $8.6 bln.

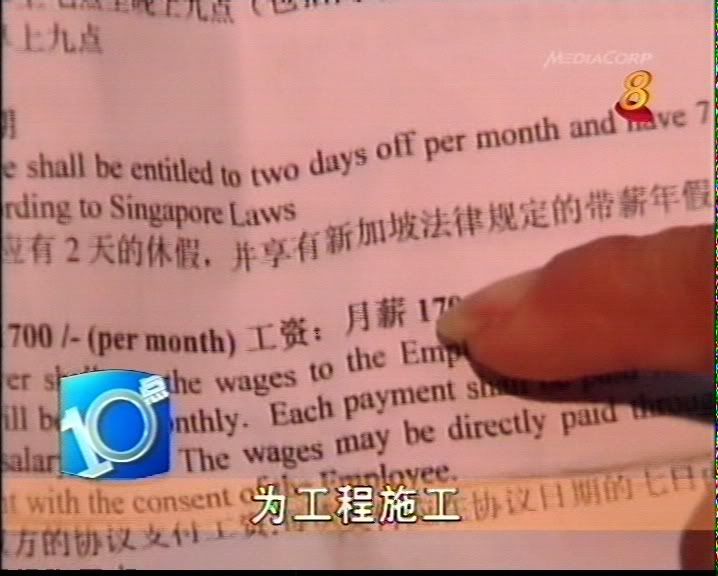

Main contractor's $20m outstanding has long been overdue and they have threatened to stop work if payment

by LVS is not made soon.

LVS share price closed at US$6.30 last Friday, falling 96% from its high of US$149 during Oct 2007.

Horseh Liao Singapore Tua Huat Arghh!

UOB has lent to Las Vegas Sands $890m, DBS - $740m and OCBC is around $570m.

Learned from my source that LVS has drawn down the total approved loan of $5.4 bln and with cost over-run,

the $5.4 bln is not sufficient to cover construction cost for Marina Bay IR which works out to about $8.6 bln.

Main contractor's $20m outstanding has long been overdue and they have threatened to stop work if payment

by LVS is not made soon.

LVS share price closed at US$6.30 last Friday, falling 96% from its high of US$149 during Oct 2007.

Horseh Liao Singapore Tua Huat Arghh!

Last edited: