- Joined

- Jul 13, 2018

- Messages

- 1,630

- Points

- 113

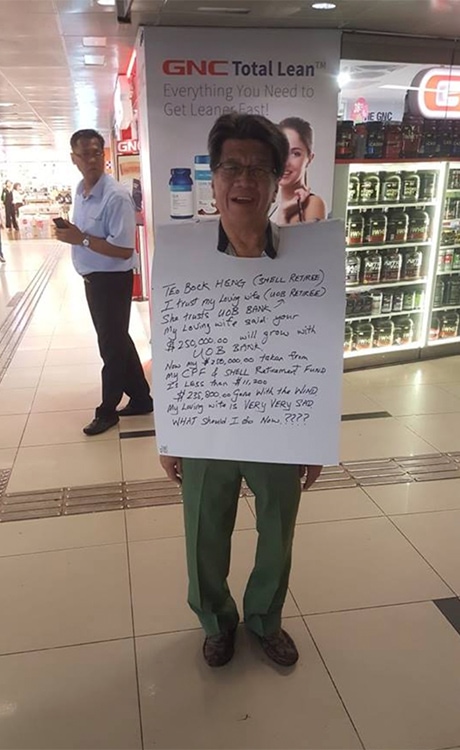

Someone protesting at Xchange Mall.

https://sg.news.yahoo.com/man-found-wearing-sandwich-board-113204816.html

I salute this uncle. People slapped him and he voiced out.

Others?

Someone protesting at Xchange Mall.

https://sg.news.yahoo.com/man-found-wearing-sandwich-board-113204816.html

Please highlight to your RC, I bet many grassroots leaders affected

"material faults and defects" in almost every Hyflux asset.

Some of my grassroots leaders and local residents were affected.They've promised to remain calm and rational even as their savings have been wiped out. This was supposed to be a safe, blue chip investment.

Kill your wife then superman, you cuck

Someone protesting at Xchange Mall.

https://sg.news.yahoo.com/man-found-wearing-sandwich-board-113204816.html

Hyflux investors will not die in vain if Singapore changes government.

In fact, if there is a new government, there's always a chance to re-consider helping these investors since the current one is indifferent.

Weekend Thoughts:

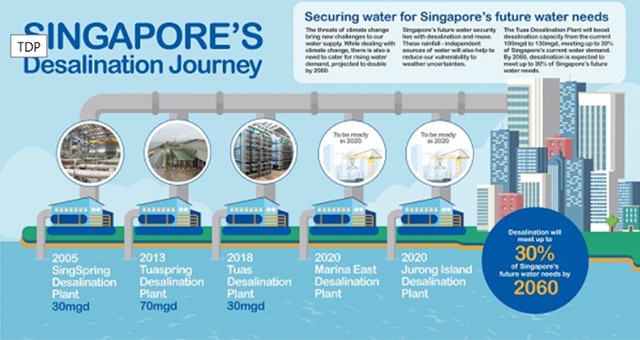

Will NEA be willing to issue a 3%-bonds to exchange all of Hyflux's debts to take over the whole company?

In Aug 2018, PUB issued bonds 3.01% bonds due 2032:

- While these bonds have a long-maturity date, they trade near 100-par because these are quasi-sovereign. Retail investors can offload them at fair prices when needed and Insurers / financial institutions need a lot of these investment-grade bonds in their portfolios

- NEA sets the rules for the utilities scene in Singapore; this is most transparent way of taking over Hyflux swiftly, without prejudice or need to argue over assets valuations with bankers and less-interpreted as a government bailout as existing creditors will still suffer some losses on the unpaid-interests and (new) lower-yields for the proposed NEA bonds.

- Local investors are badly wounded by the Offshore & Marine counters, Noble Group and Hyflux bonds in the past two years. To be a global bond-centre, Singapore needs a massive issue of investment-grade bonds to inject liquidity and attract global financial institutions.

Reference from UOB:

https://www.uobgroup.com/web-resources/uobgroup/pdf/research/MSN_180221.pdf

The Singapore Budget 2018 statement lists 3 specific projects that may be funded by Infrastructure Bonds are, i.e. the National Environment Agency (NEA) will look at borrowing to finance the upcoming Integrated Waste Management Facility, the Land Transport Authority (LTA) will also look at borrowing for upcoming projects such as the KL-Singapore High Speed Rail and the JBSingapore Rapid Transit System Link and Changi Airport Group (CAG) will look at borrowing for construction of Changi Airport Terminal 5 (T5). Bear in mind that the above three highlighted projects is by no means exhaustive. Furthermore, projects to be funded via bonds need not just be of “marquee” undertaking. Thus even upgrades to existing infrastructure may also be included and thereby ensuring a continuous supply of Infrastructure Bonds.

Government cannot just rely on SGS Bonds. pursuant to the Government Securities Act and Local Treasury Bills Act, SGS issuance proceeds are paid into a Government Securities Fund, and outward payments from this fund are generally limited to the paying of interest and repayment of principal associated with SGS issuance only. In other words, the existing laws and regulations do not allow the government to spend the proceeds nor returns from SGS issuance. As such, an alternative avenue of funding has been identified and the proposal to issue Infrastructure Bonds instead of issuing more Singapore Government Bonds will increase the variety of bonds in the local market as well as increasing the transparency and accountability of such infrastructure projects.

Investor confidence on quasi-sovereign bonds are high and there should not be any uncertainty surrounding the Singapore government’s guarantee since Singapore’s has AAA credit rating accorded by various international credit ratings agencies. Specifically, there are now less than 10 countries globally that have long term AAA credit rating across all three major rating agencies Moody’s, S&P and Fitch.

Good evening kind people of Singapore. Just back from drinks after attending tonight's meeting. it was too depressing. I just want to tell you three things:

1. Singaporeans are hopeless. The attendance was small tonight but many are contemplating the idea of letting of everything, in exchange of getting 5-10% back. It is ashamed that our citizens have no pride. Singaporeans deserve the shit that we got stuck in.

2. Nothing special tonight except SIAS telling us to go beg our government. Beg. And everyone is waiting for others to go and beg. Why not change the government? Easier right?

3. Ok, if you believe that all these while, I did not write any nonsense here, please don't trust SIAS anymore, don't trust the government, don't trust Hyflux. SIAS is just trying to brainwash us into accepting the >90% write-offs and be grateful for getting a few percent back. The whole objective is to keep Hyflux alive, not you. You stupid serfs understand?

Which is a greater evil?

Thieves or Cops who don't catch thieves?

Easy for me to say since I'm not vested in this, but u all need to show iron balls and go for liquidation.

That is the only card left to play.

Good luck gentlemen and gentlewomen.

3. Ok, if you believe that all these while, I did not write any nonsense here, please don't trust SIAS anymore, don't trust the government, don't trust Hyflux. SIAS is just trying to brainwash us into accepting the >90% write-offs and be grateful for getting a few percent back. The whole objective is to keep Hyflux alive, not you. You stupid serfs understand?

Which is a greater evil?

Thieves or Cops who don't catch thieves?

Someone protesting at Xchange Mall.

https://sg.news.yahoo.com/man-found-wearing-sandwich-board-113204816.html

Good evening kind people of Singapore. Just back from drinks after attending tonight's meeting. it was too depressing. I just want to tell you three things:

1. Singaporeans are hopeless. The attendance was small tonight but many are contemplating the idea of letting of everything, in exchange of getting 5-10% back. It is ashamed that our citizens have no pride. Singaporeans deserve the shit that we got stuck in.

2. Nothing special tonight except SIAS telling us to go beg our government. Beg. And everyone is waiting for others to go and beg. Why not change the government? Easier right?

3. Ok, if you believe that all these while, I did not write any nonsense here, please don't trust SIAS anymore, don't trust the government, don't trust Hyflux. SIAS is just trying to brainwash us into accepting the >90% write-offs and be grateful for getting a few percent back. The whole objective is to keep Hyflux alive, not you. You stupid serfs understand?

Which is a greater evil?

Thieves or Cops who don't catch thieves?

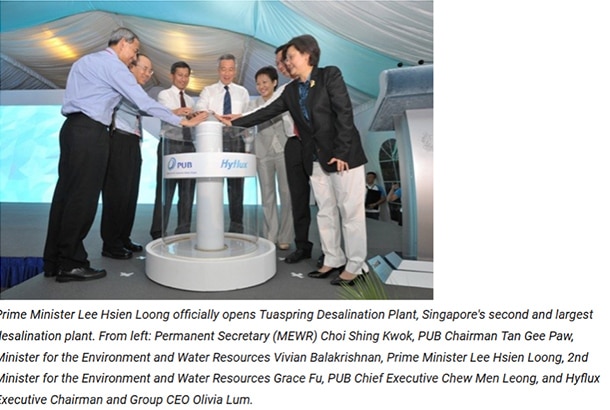

Hyflux is a strategic national asset that supplies Singapore with treated water. Singapore needs water more than it needs useless serfs. We can always replace sinkies, we couldn't replace Hyflux.

Sinkies need to look at the big picture instead of being myopic and fight over pennies. Hyflux must be saved!

Want to die, also die with OL and Hyflux.

Thank you John, for confirming that liquidation is the outcome feared by management.

This is indeed empowering for the retail investors.

A Final Word Yet, oh dear, for the 34,000 families affected by Hyflux, we hope you managed to parachute your way to a cheaper and happier Chinese New Year and we pray that Temasek or GIC will change their minds

Yes, say goodbye. Even Ed Chan also think that only government can solve the problem.

Hope the affected investors open their eyes big and at least know who ruined their lives.

Lawyers and auditors are not going to help you.

Tell your story to people around you, ask your friends and relatives to amplify your voice in the next election.

Don't give up, get a new government to help.

Yes, say goodbye. Even Ed Chan also think that only government can solve the problem.

Hope the affected investors open their eyes big and at least know who ruined their lives.

Lawyers and auditors are not going to help you.

Tell your story to people around you, ask your friends and relatives to amplify your voice in the next election.

Don't give up, get a new government to help.