The Peter-Piyush show at DBS hits $100 billion, and Singapore should cheer

The journey has not always been smooth, but it has eventually been rewarding for the bank.

Ravi Velloor

Senior Columnist

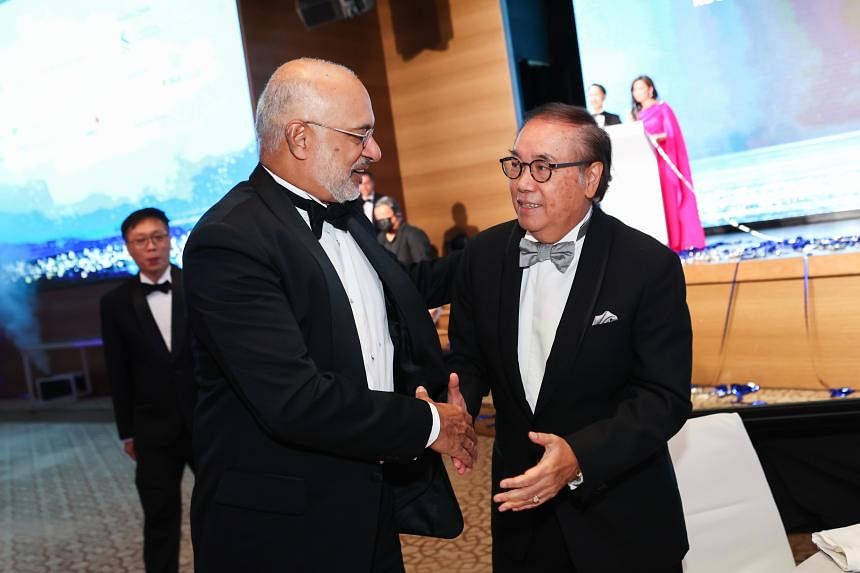

DBS CEO Piyush Gupta (left) and DBS chairman Peter Seah (right) at the Singapore Corporate Awards held at the Ritz-Carlton, Millenia Singapore on Aug 30, 2022. PHOTO: SINGAPORE CORPORATE AWARDS

MAY 02, 2024

Earlier this week, at a Peranakan restaurant near Holland Village, DBS Group Chairman Peter Seah, some board members, and the bank’s top management including CEO Piyush Gupta gathered over drinks and dinner.

Mr Seah seemed to be in a good mood, frequently inclined to break into song.

Perhaps he had good reason; DBS, he surely knew, was poised to report another stellar quarter. What’s more, the bank’s market capitalisation was within sniffing distance of attaining $100 billion -- unprecedented for a Singapore firm.

On Thursday (May 2), it crossed that key marker, when the market opened to the news that DBS had delivered

a record first quarter profit of $2.96 billion in January to March, 2024, a 15 per cent increase on year that beat estimates.

A $100 billion (US$73.5 billion) valuation is a hefty valuation for a firm sired and raised in a tiny island state, with a population of less than six million. With the high interest rate regime likely to persist for longer and MAS on April 30 lifting some curbs on the bank’s non-essential IT changes and on acquiring new business – punitive measures imposed in the wake of

technology disruptions endured by the bank last year -- those valuations could be more enduring than a day’s blip on your Bloomberg or Reuters trading screens.

Singapore is a rare, developed country where banks lead the valuations; elsewhere, in the Group of Seven developed nations, Canada seems to be the only country in a similar situation. Tech companies lead in the US and Germany, fashion firms in France, and automakers in Japan and Italy. In Britain, pharma major AstraZeneca is the most valuable firm on the stock market.

As for DBS vis a vis its Asian banking peers, only the top Chinese, Indian and Japanese banks -- all servicing significantly bigger domestic markets -- exceed its market valuations.

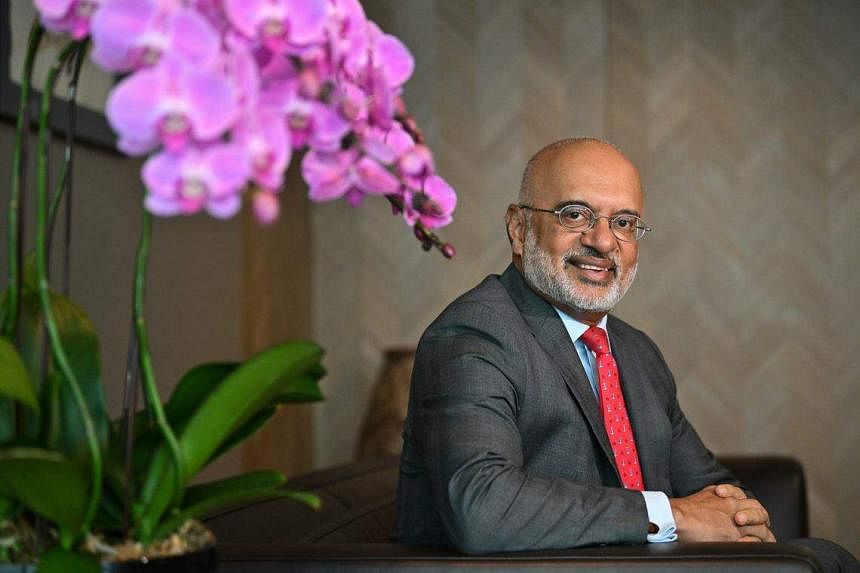

“Crossing $100 billion in market capitalisation is a seminal moment for DBS and Singapore,” an exultant Mr Gupta told me. “It is testament to the value we have been able to unlock through the multi-year structural transformation of our franchise. We are also proud to fly Singapore’s flag high on the international stage. Our Return on Equity and Total Shareholder Return are now in the top decile of the world’s 100 largest banks.”

Pieces fall in place

It is a moment to look back, and consider how DBS got here.

It was only in November, 2017 that the label of Singapore’s most valuable company, long held by SingTel, passed on to DBS, then worth a little more than $62 billion.

Both companies had started their overseas thrust around roughly the same time and SingTel too had built up a sizeable regional footprint; owning Australia’s No. 2 telco, and significant stakes in telcos in booming India and Indonesia, as well as in the Philippines and Thailand. While the two companies operate in different market circumstances, their fortunes have diverged significantly. DBS has gone on to make significant advances in value creation, but SingTel is worth less than $40 billion today.

By any yardstick, therefore, this has been an extraordinary corporate journey for DBS, a lender that began as a development bank spawned in the groves of the Economic Development Board.

The seeds for its current eminence were probably laid during the Asian Financial Crisis when the government forced banking consolidation, and POSB was folded into DBS, giving it added bulk.

On Mr Lee Kuan Yew’s prodding, DBS also began casting its net worldwide for talent, leading to John Olds coming in as the bank’s first non-Singaporean CEO.

Not all the CEOs who followed proved equally meritorious but in 2009, the board, led by then-Chairman Koh Boon Hwee and including the redoubtable tech entrepreneur NR Narayana Murthy of India’s Infosys, picked veteran Citi banker Piyush Gupta as CEO.

The DBS board, led by then-Chairman Koh Boon Hwee and including the redoubtable tech entrepreneur NR Narayana Murthy of India’s Infosys, picked veteran Citi banker Piyush Gupta as CEO in 2009. ST PHOTO: LIM YAOHUI

Mr Koh possibly saw in Mr Gupta a familiarity for and aptitude for technology that might prove useful for DBS’s future. It would prove an inspired choice.

A year later, the DBS Chair passed into the hands of Mr Peter Seah, the former President and CEO of OUB bank who had made his mark in an earlier era by famously buying the credit-card business of Chase Manhattan Bank as it exited retail in Asia – a purchase that would lead to a windfall for OUB.

Big personalities both – Mr Seah was known to haze juniors during his student days at University of Singapore and in the 1990s gave OUB a profile way in excess of its standing as the smallest of Singapore’s four big banks of the time-- the two seem to have settled into a mutually comfortable relationship.

Both are known to carry a fine understanding of the imperatives of balancing between short-term results and investing for the long term.

Mr Peter Seah assumed the role of chairman at DBS on May 1, 2010. PHOTO: DBS BANK

Together, they famously called on Chinese tech entrepreneur Jack Ma in 2014, as Alibaba prepared to list in New York. The meeting put terror into the pair that platforms like Alibaba could disrupt banking eventually.

“If it walks like a duck, and talks like a duck, it is a bank,” Mr Gupta once quipped to me.

It left Mr Gupta convinced that if DBS did not disrupt its own bank, some other entity, such as Alibaba’s Ant Financial, would do so.

The DBS board swiftly handed Mr Gupta $200 million to pursue a digitalisation strategy. That strategy would have three key pillars: being digital to the core, embedding the bank in the customer journey, and thinking and acting like a startup.

Overcoming disruptions

The results are plain to see, and the early start on digitalisation proved especially beneficial amid the disruptions brought by the pandemic.

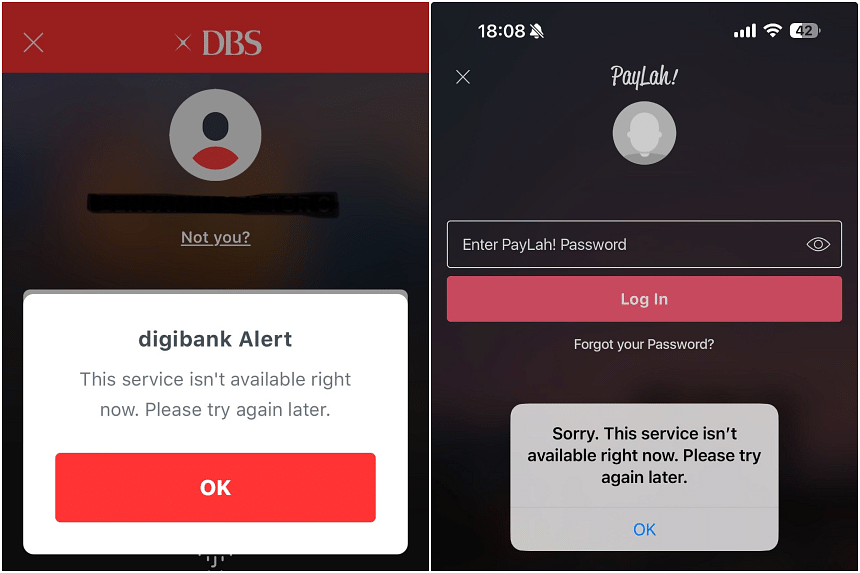

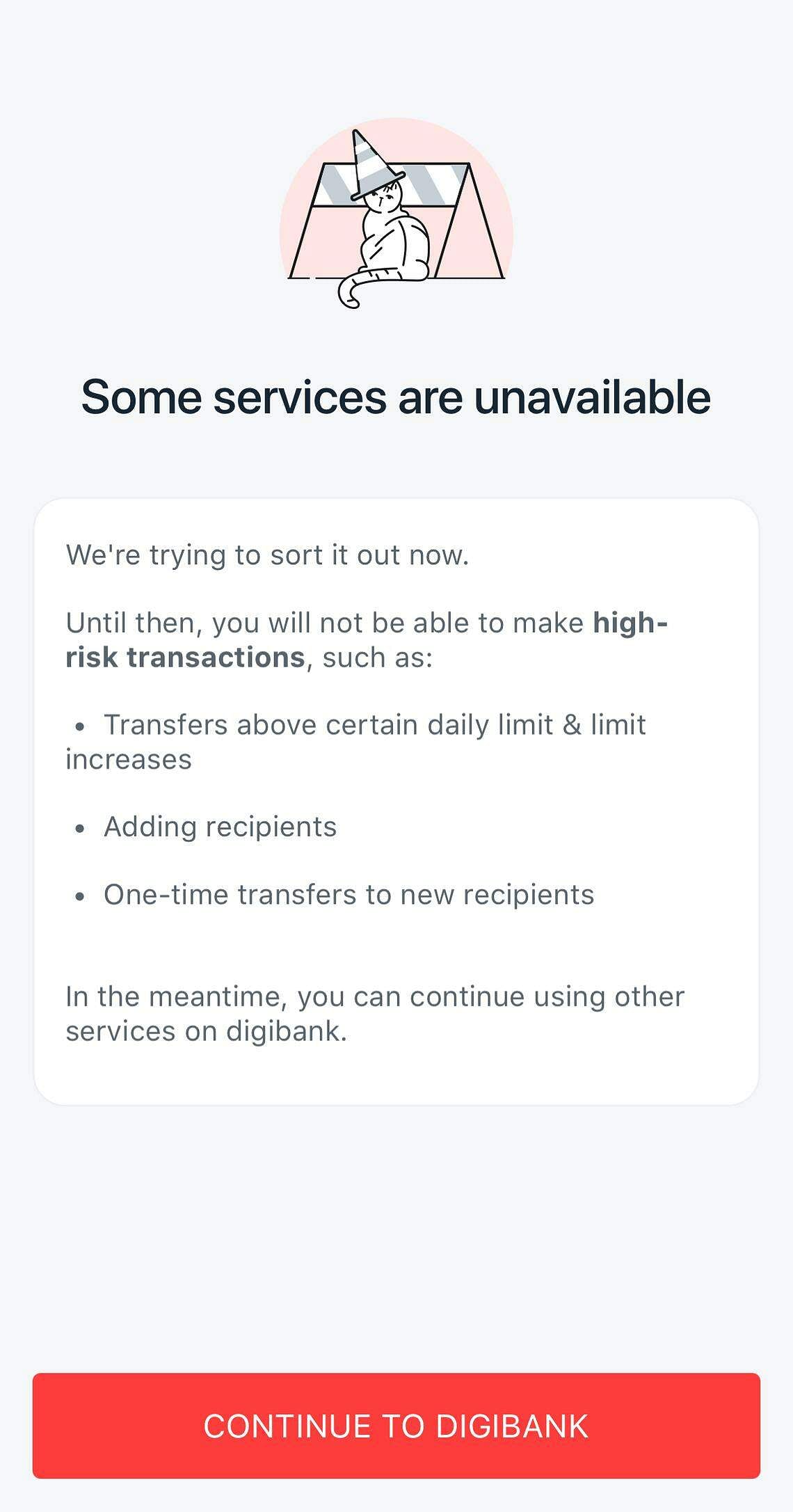

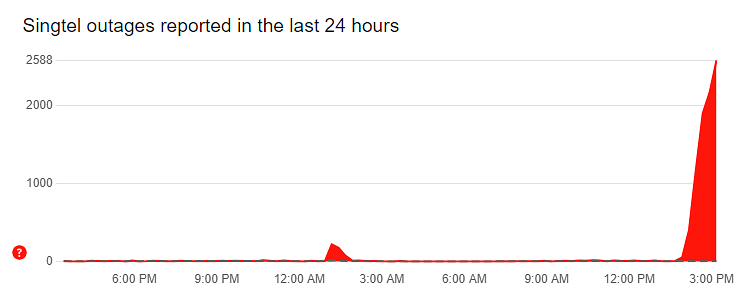

The haste to digitalise also brought issues. Disruptions to DBS’s digital banking and ATM services -- in 2023, there were issues in March and May -- vexed thousands of Singaporeans and put the bank in an unfavourable light.

Even as the bank had a record year, the board

cut Mr Gupta’s compensation by more than a quarter because of this, and several in top management also saw their packages trimmed.

The tech hiccups, some bank insiders tell me, were on account of too many technological pieces being moved too fast at the same time along the various businesses.

DBS also

revealed last November that it had financed property purchases by individuals or companies that are being investigated by Singapore authorities for money laundering.

Those issues aside, there is little doubt that DBS is now operating with a remarkable degree of efficiency and investors are responding.

In 2015, DBS was 46th for return on equity (ROE) -- 11.2 per cent -- among the world’s Top 100 banks. At the end of 2023, it had jumped to No. 7 on this measure, with an ROE of 18 per cent.

This out-performance was not on account of NIM, or net interest margin, but structural improvements and a soaring deposit franchise led by digital capabilities. High return businesses such as wealth management and global transaction services also contributed.

By end-2023, its price to book was among the highest globally, outstripping local peers and global institutions such as HSBC, Citi and Deutsche Bank.

The bank seems confident it can continue this solid performance.

A slide presentation made to analysts following full year 2023 results asserted that “we are confident of achieving medium term ROE of 15 per cent to 17 per cent despite normalisation of interest rates and credit costs, as well as changing tax regimes.”

Disruptions to DBS’s digital banking and ATM services in 2023 had vexed thousands of Singaporeans and put the bank in an unfavourable light. ST PHOTO: AZMI ATHNI

Wider industry also acknowledges the transformation at DBS.

“Contemporary banking is about technology and of course, the traditional skill of risk mitigation,” a senior figure in the consulting industry told me recently. “DBS did the tech part well and there have been no blowups on the risk side. You are looking at the results.”

DBS staff talk of a CEO who runs a tight ship, is completely involved in the business, and communicates effectively -- both directly and through a formidable communications team.

Most importantly, Mr Gupta “gets” technology, they say. Although his degrees are in economics and management, tech staff whom he confronts go well-prepared into meetings expecting to be asked penetrating questions.

Some of that dates back to 1985, when, in his early days at Citi, he was asked to lead the transformation when the bank’s India operations started automating its manual-based ledgers.

“What outsiders and customers see in DBS today is just the lipstick,” a senior figure in the bank told me this week. “The real story is backstage – how the technology platform is used and managed, the agility of the technology engine, and how it is used to extract data. Every serious discussion in the bank inevitably includes technology.”

DBS’ market capitalisation was within sniffing distance of attaining $100 billion - unprecedented for a Singapore firm. ST PHOTO: LIM YAOHUI

Mr Gupta once told me that his mission and vision is to “make DBS invisible… to hide DBS inside everything else you want to do with your life.”

As for Mr Seah, who is 77 this year, he can look back on this moment as cresting a long and distinguished career in finance, and helping to shape the industry here.

Back in 1997, as the Asian Financial Crisis swirled, then-Deputy Prime Minister Lee Hsien Loong had asked him to chair the Sub-committee on Banking and Finance which was part of the larger Committee on Singapore’s Competitiveness.

In doing so, Mr Lee had thrown Mr Seah’s committee the longest rope he could have wished for: “I have told them that if all their proposals are accepted, it probably means that they have not been radical enough.”

Mr Seah’s committee returned with 55 proposals to place Singapore at the heart of the Asian financial services industry. Not all were accepted.

Today, as Prime Minister Lee prepares to leave office, Mr Seah can look him in the eye and say he has delivered in more ways than one.