- Joined

- Jul 25, 2008

- Messages

- 13,128

- Points

- 113

Number of major MRT breakdowns doubles even as overall rail reliability remains high

There were seven major breakdowns in 2022, which is the second-highest in the past five years. ST PHOTO: RYAN CHIONG

Christopher Tan

Senior Transport Correspondent

Mar 21, 2023

SINGAPORE – Serious MRT disruptions, each lasting over 30 minutes, more than doubled in 2022 from 2021 even as the frequency of total delays dipped.

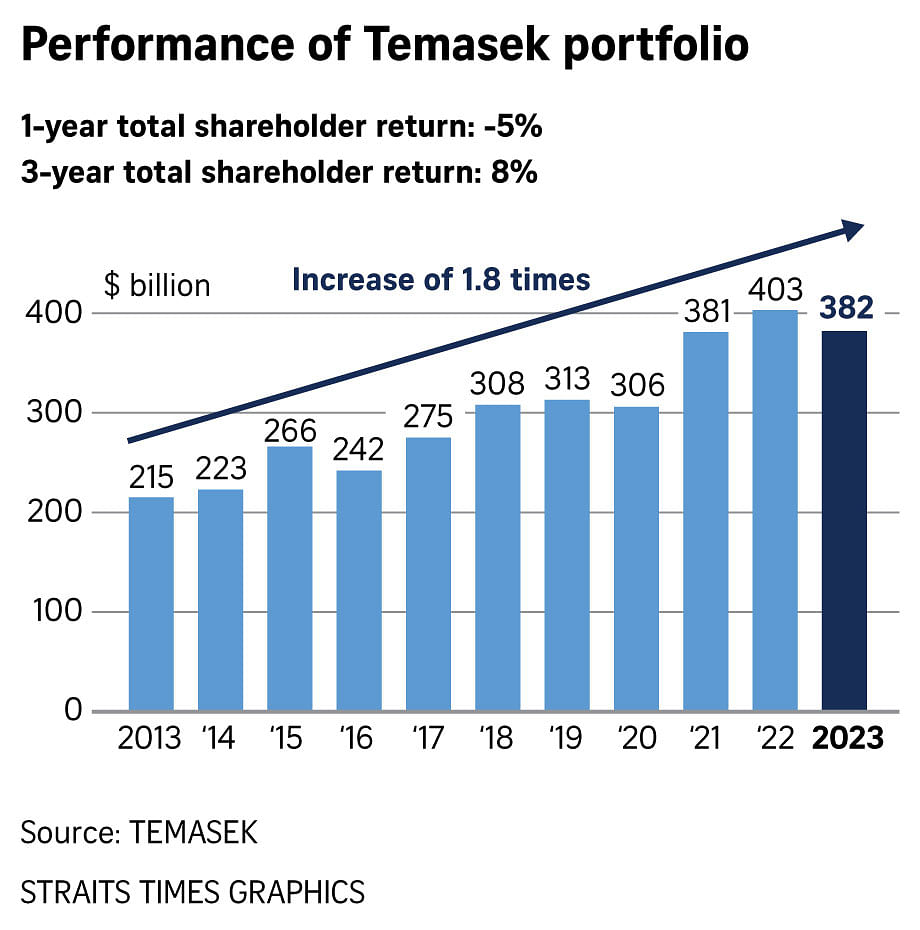

According to rail reliability statistics just released by the Land Transport Authority (LTA), the mean kilometres before failure – an engineering measure of reliability – rose from 1.994 million train-km in 2021 to 2.09 million train-km in 2022.

That means there was one disruption of more than five minutes for every 2.09 million km clocked by Singapore’s MRT trains during the year, making the system one of the more dependable in the world.

The best-performing MRT line was the newish Downtown Line, operated by SBS Transit, while the worst-performing one was the North-South Line, operated by SMRT. But even the latter clocked more than 1.6 million train-km before a failure.

The newest Thomson-East Coast Line (TEL) operated by SMRT – which had suffered several delays since it opened three years ago – was not tallied.

Separately, there were seven major breakdowns (defined as those lasting more than half an hour) in 2022 – more than double the three in 2021, and is the second-highest figure in the past five years.

This contrasted against the number of major LRT glitches, which halved to just two in 2022.

Singapore University of Social Sciences Associate Professor Walter Theseira, an economist, said it was difficult to gauge reliability from year-on-year statistical changes.

“We do know the system is more than 10 times as reliable as it was in the mid-2010s,” he said. “Whether these gains are being reversed is difficult to tell from just one year of performance, just as it took several years for improvements in rail reliability to become apparent.”

While admitting that a recent spate of major delays across several MRT lines “are of concern for commuters”, he said the glitches were “distributed across the lines and hence do not suggest yet that there are systemic reliability issues... which were the problem plaguing our MRT in the past”.

Prof Theseira added that it was “common for reliability to change over time, since it’s a function of equipment age, maintenance, utilisation, operating tempo”.

“What is important is that since reliability is a choice, expectations are clearly communicated to operators, and operators have the resources to meet those expectations.”

Observers said the number of disruptions in the first quarter of this year has increased. There were five breakdowns on the Thomson-East Coast Line for the year up to early March, three others on the North-South Line and one on the East-West Line during that period.

In a Parliamentary reply to Mr Melvin Yong (Radin Mas) on Monday, Transport Minister S. Iswaran said there were five faults on the Thomson-East Coast Line since Stage 3 of the line opened four months ago. Two were owing to software issues, which have since been resolved, and three were caused by faulty components, which have since been replaced.

“Prior to opening a new stage of a line, the LTA and the rail operators conduct extensive testing to minimise the risks of service disruption or delay,” Mr Iswaran said. “Nevertheless, as rail systems contain many interlinked hardware and software elements, certain issues may only surface during the early phases of full-scale operation before the system stabilises.”

Responding to queries, the LTA and SMRT said in a joint statement that the TEL faults are unrelated, and detailed investigations to identify the root causes are ongoing.

LTA and SMRT added that they are working with the original equipment manufacturers to investigate and rectify the faulty components of the TEL trains to prevent a repeat of similar incidents.

The four faults on the North-South and East-West lines were also unrelated, they said – one was a train-related fault, one was caused by a train-borne signalling issue, one was a track fault, and the last was a track point fault.

SMRT said the train-related fault involved an older train from the first three generations of trains, which are being replaced.

Commuters polled said they are satisfied with the MRT.

Mr Eugene Mok, 37, a programme manager, said: “I am on hybrid work arrangement. On days that I return to office, there are no significant delays and the system seems to be running quite smoothly, even better than before Covid days, although the trains are as crowded as ever.”

IT consultant Davis Li, 39, said: “I use the Downtown Line, and so far no breakdown. The frequency of trains is within expectations too – two to three minutes during peak periods and three to six minutes during non-peak.”

In the 2022 annual commuter satisfaction survey conducted by the Public Transport Council, satisfaction over reliability slipped by 0.5 percentage point – dragged down by a 2.4 percentage point drop in bus service reliability and partially offset by a 1.5 percentage point rise in MRT service reliability.