-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Let's wait for RM5 = SGD 1 after the elections

- Thread starter Hangover

- Start date

- Joined

- Aug 31, 2017

- Messages

- 2,286

- Points

- 113

Malaysia is going the same path as Argentina, heavily indebted because of mega infrastructure projects with China and 1MDB and prolonged capital flight. https://www.zerohedge.com/news/2018...-rates-40-stall-currency-bond-market-collapse

Let's watch Malaysia collapse after Najib's assured victory, Johor, Sarawak, Sabah and Penang will take the chance to declare independence. Mind you, Sabah and Sarawak has more resources than Myanmar, much richer than Brunei. Poor thing that these states ended up in Malaysia Federation and got ripped off for decades.

It may be time to cry for Argentina...and Malaysia next

The Central Bank of Argentina (BCRA) just hiked its 7-day repo reference rate to 40.00% - up a stunning 1275bps in a week - in a desperate attempt to stall the collapse of the peso (and ARG bonds) this week.

BCRA hiked this week three times:

Let's watch Malaysia collapse after Najib's assured victory, Johor, Sarawak, Sabah and Penang will take the chance to declare independence. Mind you, Sabah and Sarawak has more resources than Myanmar, much richer than Brunei. Poor thing that these states ended up in Malaysia Federation and got ripped off for decades.

It may be time to cry for Argentina...and Malaysia next

The Central Bank of Argentina (BCRA) just hiked its 7-day repo reference rate to 40.00% - up a stunning 1275bps in a week - in a desperate attempt to stall the collapse of the peso (and ARG bonds) this week.

BCRA hiked this week three times:

- Joined

- Jul 25, 2008

- Messages

- 59,107

- Points

- 113

luckily all my buddies who bought properties in jb 6.9 years ago heeded my advice and liquidated them about 2 years ago. they were fortunate to sell for scratch - slight loss was only in the remodelling money they put in. now they are selling their near 4-decade old hdb flats as they use the jb-sale money to pay down on private condos before the enbloc frenzy - another of my advice, and they act accordingly. everytime i meet them, they would treat me to all you can eat sushi. but i advise them to stay away from sushi in sg. just vegetarian economy lice will do.

- Joined

- Aug 31, 2017

- Messages

- 2,286

- Points

- 113

luckily all my buddies who bought properties in jb 6.9 years ago heeded my advice and liquidated them about 2 years ago. they were fortunate to sell for scratch - slight loss was only in the remodelling money they put in. now they are selling their near 4-decade old hdb flats as they use the jb-sale money to pay down on private condos before the enbloc frenzy - another of my advice, and they act accordingly. everytime i meet them, they would treat me to all you can eat sushi. but i advise them to stay away from sushi in sg. just vegetarian economy lice will do.

You have good foresight. Iskandar is another con job like CLOB shares. Every decade, Malaysia comes up with new gimmicks to suck sinkies dry

Cheers! I believe your US property is surging now (and please find your dog a partner).

- Joined

- Aug 31, 2017

- Messages

- 2,286

- Points

- 113

Malaysia's youth have power they won't use

By Mayuri Mei LinBBC News, Kuala Lumpur

4 hours ago

http://www.bbc.com/news/world-asia-43985834

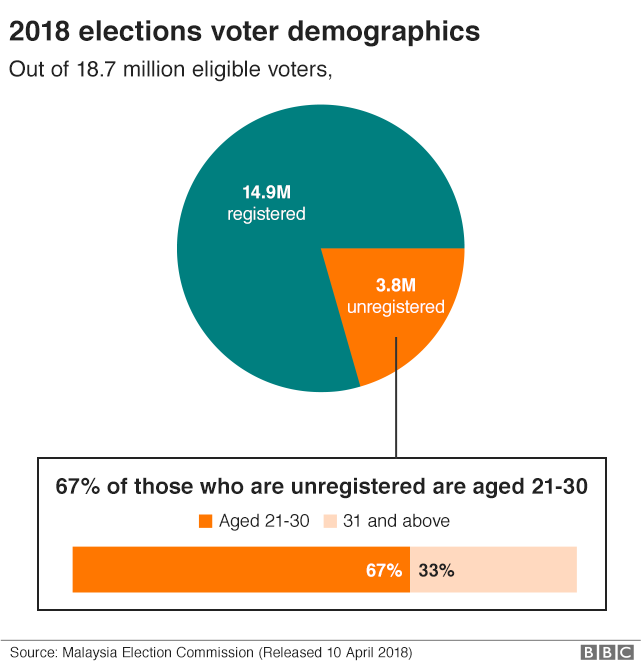

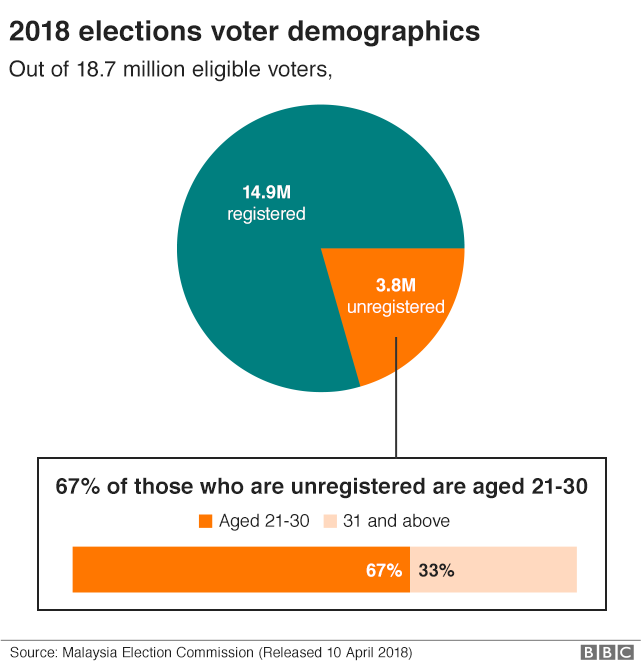

When Malaysia goes to the polls next week, millennials could wield the most power at the ballot box. But what about the large number of young people who didn't even register? The BBC turned to the numbers - and the youth - to see if they understand and or even care about their influence.

By Mayuri Mei LinBBC News, Kuala Lumpur

4 hours ago

http://www.bbc.com/news/world-asia-43985834

When Malaysia goes to the polls next week, millennials could wield the most power at the ballot box. But what about the large number of young people who didn't even register? The BBC turned to the numbers - and the youth - to see if they understand and or even care about their influence.

- Joined

- Aug 31, 2017

- Messages

- 2,286

- Points

- 113

oil price going up ... najis is lucky ...

no lah, Venezuela also go bust despite recovering oil prices.

Due to the election, Najib is trying hard to support ringgit for another month before letting go.

- Joined

- Oct 30, 2014

- Messages

- 36,768

- Points

- 113

no lah, Venezuela also go bust despite recovering oil prices.

Due to the election, Najib is trying hard to support ringgit for another month before letting go.

Oppies have been saying the same about the PAP for decades. Oppies say that our reserves are depleted, our treasury is empty, CPF is nearly empty, the PAP leaders are secretly plundering the country, we are propping up property prices and our currency by cooking books, printing money, blah blah blah... In the end, all these are proven lies! Singapore is doing well financially, the reserves are plentiful and we have more than enough money to meet CPF obligations.

After Najib wins, I expect the mudland to continue to do well. Mudland will do badly if oppies like PAS win and form the government. They have no idea how to run a decent state and should not even be trusted with a lemonade stand, let alone the state or a country. They've run Terengganu and Kelantan into the ground, making it so poor that it is a breeding ground for religious militancy and extremism like Aceh today.

- Joined

- Aug 31, 2017

- Messages

- 2,286

- Points

- 113

Oppies have been saying the same about the PAP for decades. Oppies say that our reserves are depleted, our treasury is empty, CPF is nearly empty, the PAP leaders are secretly plundering the country, we are propping up property prices and our currency by cooking books, printing money, blah blah blah... In the end, all these are proven lies! Singapore is doing well financially, the reserves are plentiful and we have more than enough money to meet CPF obligations.

Singapore is artificially suppressing SGD strength to slow down the speed of MNCs moving to lower cost centres.

- In recent years the largest manipulators have been Singapore and Switzerland, with average annual purchases in 2016 and 2017 of about US$90 billion and US$80 billion, respectively. Singapore had the world's largest net official flows in 2017. Singapore's manipulation derives primarily from CPF, which collects high payroll taxes from workers and invests them entirely overseas through a sovereign wealth fund to back future pension obligations. https://piie.com/blogs/trade-investment-policy-watch/currency-manipulation-update-2015-17 April 3, 2018

- Singapore has run a general government surplus every year since 1990. Singapore has a long history of managing its currency heavily—and not always showing its intervention in the most transparent way. Eg. the sharp rise in government deposits abroad looks and feels like backdoor intervention—just in a way that doesn’t register on the central bank's balance sheet. https://www.cfr.org/blog/singapores-shadow-intervention May 18, 2017

- Joined

- Aug 31, 2017

- Messages

- 2,286

- Points

- 113

After Najib wins, I expect the mudland to continue to do well. Mudland will do badly if oppies like PAS win and form the government. They have no idea how to run a decent state and should not even be trusted with a lemonade stand, let alone the state or a country. They've run Terengganu and Kelantan into the ground, making it so poor that it is a breeding ground for religious militancy and extremism like Aceh today.

Thanks to them Terengganu and Kelantan will keep supplying us cheap durians. KNN only those ah beng jiuku durian sellers keep conning us.

https://www.yearofthedurian.com/2013/02/durian-fraud-10-tricks-that-may-deceive.html

- Joined

- Aug 31, 2017

- Messages

- 2,286

- Points

- 113

https://www.todayonline.com/world/currencies-weaken-asias-original-sinners-go-classic-defence

To deal with a familiar combination of falling currencies and uncertainty about economic growth, Asian central banks are reverting to their classic policy playbook. They are intervening in currency markets while concurrently injecting cash into their economies.

Despite paring a big chunk of their holdings in the past 6 to 8 months, foreigners still hold 40 per cent of Indonesian government bonds and 45 per cent of Malaysia's.

To deal with a familiar combination of falling currencies and uncertainty about economic growth, Asian central banks are reverting to their classic policy playbook. They are intervening in currency markets while concurrently injecting cash into their economies.

Despite paring a big chunk of their holdings in the past 6 to 8 months, foreigners still hold 40 per cent of Indonesian government bonds and 45 per cent of Malaysia's.

- Joined

- Dec 27, 2017

- Messages

- 1,446

- Points

- 63

If a currency is strong artificially deflated its a good thing..bcos the market is own yr side..spending to get more. If yr currency is weak and u prop it up than u r fucked as u are throwing money down the drain.Singapore is artificially suppressing SGD strength to slow down the speed of MNCs moving to lower cost centres.

- In recent years the largest manipulators have been Singapore and Switzerland, with average annual purchases in 2016 and 2017 of about US$90 billion and US$80 billion, respectively. Singapore had the world's largest net official flows in 2017. Singapore's manipulation derives primarily from CPF, which collects high payroll taxes from workers and invests them entirely overseas through a sovereign wealth fund to back future pension obligations. https://piie.com/blogs/trade-investment-policy-watch/currency-manipulation-update-2015-17 April 3, 2018

- Singapore has run a general government surplus every year since 1990. Singapore has a long history of managing its currency heavily—and not always showing its intervention in the most transparent way. Eg. the sharp rise in government deposits abroad looks and feels like backdoor intervention—just in a way that doesn’t register on the central bank's balance sheet. https://www.cfr.org/blog/singapores-shadow-intervention May 18, 2017

- Joined

- Jul 25, 2008

- Messages

- 59,107

- Points

- 113

where ever tiongs throng property price will rise as they have market-messing mob mentality. manila properties are booming because 100k tiongs migrate there to “park” their ill gotten cash due to building of casinos.You have good foresight. Iskandar is another con job like CLOB shares. Every decade, Malaysia comes up with new gimmicks to suck sinkies dry

Cheers! I believe your US property is surging now (and please find your dog a partner).

- Joined

- Aug 31, 2017

- Messages

- 2,286

- Points

- 113

Asia is hitting iceberg soon

http://icecapassetmanagement.com/wp-content/uploads/2018/04/2018.05-IceCap-Global-Market-Outlook.pdf

http://icecapassetmanagement.com/wp-content/uploads/2018/04/2018.05-IceCap-Global-Market-Outlook.pdf

- Joined

- Jul 19, 2011

- Messages

- 27,848

- Points

- 113

Oppies have no chance to win in Singapore and Malaysia. The parties that brought us to merdeka will rule forever. Oppies will just show up to get beaten. Hidup UMNO!

The takedown of PAP will be violent. Dogs like you will be hung up for public flogging and humiliation. You relatives will spit on you. Your children will do too.

Repent now before it is too late.

- Joined

- Oct 30, 2014

- Messages

- 36,768

- Points

- 113

The takedown of PAP will be violent. Dogs like you will be hung up for public flogging and humiliation. You relatives will spit on you. Your children will do too.

Repent now before it is too late.

We spat on a relative who dared to support the disloyal oppies. He and his ilk are no longer welcome to our family gatherings.

- Joined

- Aug 19, 2008

- Messages

- 38,230

- Points

- 113

https://www.xe.com/currencyconverter/convert/?Amount=1&From=MYR&To=SGD

1 MYR =0.338248SGD

Malaysian Ringgit1 MYR = 0.338248 SGD

↔

Singapore Dollar1 SGD = 2.95641 MYR

2018-05-12 09:55 UTC

1 MYR =0.338248SGD

Malaysian Ringgit1 MYR = 0.338248 SGD

↔

Singapore Dollar1 SGD = 2.95641 MYR

2018-05-12 09:55 UTC

- Joined

- Dec 27, 2017

- Messages

- 1,446

- Points

- 63

I think the m&d economy will improve and the ringgit will go up. End of cheap shopping in mudland. But if the ringgit continues to increase than mudland will no long be competitive and it's economy might slow down. The miss working in Singkieland will also no happy as not worth working in Singkieland..and good news is can ship them back.

Similar threads

- Replies

- 20

- Views

- 3K

- Replies

- 10

- Views

- 964

- Replies

- 8

- Views

- 2K

- Replies

- 1

- Views

- 976