-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Let's talk about Indians

- Thread starter LITTLEREDDOT

- Start date

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Members of Britain’s richest family get jail terms for exploiting Indian staff at Swiss mansion

Ajay Hinduja (left) and his wife Namrata arriving with lawyer Robert Assael at the courthouse in Geneva on June 10. PHOTO: EPA-EFE

Updated

Jun 22, 2024

GENEVA – A Swiss court handed jail sentences to four members of Britain’s richest family on June 21 for exploiting the Indian staff at their Geneva mansion.

The Hindujas – who were not present in court – were acquitted of human trafficking, but convicted of other charges in a stunning verdict for the family, whose fortune is estimated at £37 billion (S$63.4 billion).

Prakash Hinduja and his wife Kamal each got four years and six months, while their son Ajay and his wife Namrata received four-year terms, the presiding judge in Geneva ruled.

The cases stem from the family’s practice of bringing servants from their native India and included accusations of confiscating their passports once they were flown to Switzerland.

Prosecutors argued the family paid their staff a pittance and gave them little freedom to leave the house.

The family denied the allegations, claiming the prosecutors wanted to “do in the Hindujas”.

The family reached a confidential out-of-court settlement with the three employees who made the accusations against them.

Despite this, the prosecution decided to pursue the case because of the gravity of the charges.

Geneva prosecutor Yves Bertossa had requested a custodial sentence of 5½ years against Prakash and Kamal Hinduja.

Aged 78 and 75, respectively, both had been absent since the start of the trial for health reasons.

In his closing address, the prosecutor accused the family of abusing the “asymmetrical situation” between powerful employer and vulnerable employee to save money.

Household staff were paid a salary of between 220 Swiss francs (S$330) and 400 Swiss francs a month, far below what they could expect to earn in Switzerland.

“They’re profiting from the misery of the world,” Mr Bertossa told the court.

‘Not mistreated slaves’

But the family’s defence lawyers argued that the three plaintiffs received ample benefits, were not kept in isolation and were free to leave the mansion.“We are not dealing with mistreated slaves,” Mr Nicolas Jeandin told the court.

Indeed, the employees “were grateful to the Hindujas for offering them a better life”, his fellow lawyer, Mr Robert Assael, argued.

Lawyers Yael Hayat (centre right), Robert Assael (third from right) and Nicolas Jeandin (second from right) arriving at court with their clients Ajay Hinduja (second from left) and his wife Namrata (centre left). PHOTO: EPA-EFE

Representing Ajay Hinduja, lawyer Yael Hayat had slammed the “excessive” indictment, arguing the trial should be a question of “justice, not social justice”.

Namrata Hinduja’s lawyer, Mr Romain Jordan, also pleaded for acquittal, claiming the prosecutors were aiming to make an example of the family.

He argued that the prosecution had failed to mention payments made to staff on top of their cash salaries.

Mr Assael said: “No employee was cheated out of his or her salary.”

Some staff even asked for raises, which they received.

With interests in oil and gas, banking and healthcare, the Hinduja Group is present in 38 countries and employs around 200,000 people. AFP

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

India college entrance exam scandal spreads with criminal probe

A student shouts as she protests outside the Ministry of Education at New Delhi on June 20. PHOTO: REUTERS

Jun 24, 2024

NEW DELHI – India’s government launched a criminal investigation into allegations of cheating and corruption in national entrance exams for medical colleges and removed the head of the agency in charge of handling the tests as student protests over the growing scandal continued to mount.

The Central Bureau of Investigation said on June 23 that it will probe alleged irregularities, “including conspiracy, cheating, impersonation, breach of trust, and destruction of evidence by candidates, institutes, and middlemen”.

A day earlier, the government replaced the director-general of the National Testing Agency, Mr Subodh Kumar Singh, with immediate effect.

The decision follows mounting pressure from opposition parties and protests by thousands of students demanding a cancellation of the National Eligibility-cum-Entrance Test for admission into undergraduate medical programmes for the current academic year, which are set by the federal government.

Some 2.4 million students took the exam in May, competing for the more than 100,000 seats in state-run and private medical colleges.

An unusual high number of students scored perfect scores in the exam, prompting allegations of cheating and the possible leaking of exam papers.

The scandal presents Prime Minister Narendra Modi’s government with its first real challenge since taking office after elections ended in June.

Mr Modi’s Bharatiya Janata Party is forced to share power in a coalition government after losing its outright majority in the parliament.

The Indian National Congress, the country’s main opposition group, has vowed to raise the exam scandal in the first session of the new parliament, which began on June 24.

Exam paper leaks are not uncommon in India. However, the alleged irregularities this time have taken centre stage in the country and raised questions about the entire testing system.

Education Minister Dharmendra Pradhan told reporters last week that the government scrapped entrance tests for doctorate programmes after an inquiry revealed the exam paper was available on the “dark net”. BLOOMBERG

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Excessive when millions are living in poverty in India.

Drummers perform as staff members of the house of Indian businessman Mukesh Ambani dance on the day of Anant Ambani's wedding in Mumbai, on July 12.

Jul 18, 2024

When Beyonce performed at a pre-wedding party for Ms Isha Ambani in 2018, India was agog. Merely receiving an invitation conferred bragging rights on status-obsessed business leaders and politicians. The cost of the nuptials, with countless ancillary events, was said to be in excess of US$100 million (S$134 million).

That is a staggering sum for almost anyone – but not the Ambani family, which owns a controlling interest in Reliance Industries, the country’s most valuable company, dominating everything from telecommunications to oil refining. Despite some anti-rich finger-wagging, many Indians appear to have viewed the event, which even the maharajas of yore would envy, as evidence that India – and Indian business – could once again glitter.

You might therefore have expected the months-long wedding celebrations of Ms Isha’s brother Anant, which concluded on July 14, to provoke a similarly positive response. It featured even more international stars (Katy Perry, Justin Bieber and Rihanna), more bling (outfits embroidered in gold along with enough golf ball-size rubies, diamonds and emeralds) and a higher price tag (the figure US$600 million has been bandied about).

It contributed handsomely to India’s booming matrimony business, which generates perhaps US$130 billion a year in revenues (only food makes up a bigger share of Indians’ retail spending). Behind the innumerable beautiful saris at the Ambani wedding were thousands of designers, tailors and seamstresses; behind the dances and elaborate backdrops were thousands of choreographers, musicians and carpenters. The wedding filled hotels, private jets, a fleet of golf carts and at least one cruise ship.

Yet instead of awe and pride, the reaction this time was considerably more mixed. As the Juggernaut, an online publication, summed it up, it “shows us the power of Asia’s richest family. But it also gave us the ick”.

A decorated Rolls-Royce car carrying guests leaves Antilia, the house of Indian businessman Mukesh Ambani, on the day of Anant Ambani’s wedding in Mumbai, on July 12. PHOTO: REUTERS

It was not just the Juggernaut that felt a bit icky. India’s Prime Minister Narendra Modi did make an appearance at one of the events leading up to the ceremony. But the Gandhi family, which leads the left-of-centre political opposition, pointedly did not. Foreign political leaders who attended were mostly former ones (Mr Tony Blair, Mr Boris Johnson) or seemed an odd fit. Mr John Kerry, America’s former climate envoy, was rubbing shoulders with Mr Amin Nasser, chief executive of Saudi Aramco, the world’s biggest oil company, at an event bankrolled by wealth derived primarily from Reliance’s giant petrochemicals operation that, to complicate matters further, refines oil from Russia.

Indeed, Mr Anant’s extravaganza looks likely to be the last of its kind for a while. That is not just because he was the last unwed child of Mr Mukesh, the Ambani clan’s patriarch, and because no one (with the possible exception of the family of Mr Gautam Adani, India’s second-richest industrialist) can match the Ambanis’ deep pockets. Mr Modi’s government has become increasingly aware of voters’ distaste for rising inequality, which may have cost his Bharatiya Janata Party its absolute majority in a general election earlier in 2024.

Strong gross domestic product (GDP) growth and a soaring stock market have created more wealth for India’s rich, but not that many new jobs or wage gains for its poor. Between Ms Isha’s and Mr Anant’s weddings, India’s GDP per person rose from US$2,000 to US$2,500 (not adjusted for inflation). By comparison, in the same period, the Ambani family fortune swelled from US$47 billion to US$122 billion.

More gallingly to many Indians, it has shot up by US$10 billion in the past month alone. Reliance’s share price rose by 8 per cent after the company’s Jio telecoms business raised prices for its 470 million customers. To the Ambanis, this may have made their US$600 million celebrations look like a bargain. To almost everyone else, it makes them look disconnected from India’s economic and social reality. © 2024 THE ECONOMIST NEWSPAPER LIMITED. ALL RIGHTS RESERVED

What a US$600 million wedding says about India’s attitude to wealth

The Ambani nuptials enticed everyone, from Justin Bieber and Shah Rukh Khan to John Kerry.

The Economist

Drummers perform as staff members of the house of Indian businessman Mukesh Ambani dance on the day of Anant Ambani's wedding in Mumbai, on July 12.

Jul 18, 2024

When Beyonce performed at a pre-wedding party for Ms Isha Ambani in 2018, India was agog. Merely receiving an invitation conferred bragging rights on status-obsessed business leaders and politicians. The cost of the nuptials, with countless ancillary events, was said to be in excess of US$100 million (S$134 million).

That is a staggering sum for almost anyone – but not the Ambani family, which owns a controlling interest in Reliance Industries, the country’s most valuable company, dominating everything from telecommunications to oil refining. Despite some anti-rich finger-wagging, many Indians appear to have viewed the event, which even the maharajas of yore would envy, as evidence that India – and Indian business – could once again glitter.

You might therefore have expected the months-long wedding celebrations of Ms Isha’s brother Anant, which concluded on July 14, to provoke a similarly positive response. It featured even more international stars (Katy Perry, Justin Bieber and Rihanna), more bling (outfits embroidered in gold along with enough golf ball-size rubies, diamonds and emeralds) and a higher price tag (the figure US$600 million has been bandied about).

It contributed handsomely to India’s booming matrimony business, which generates perhaps US$130 billion a year in revenues (only food makes up a bigger share of Indians’ retail spending). Behind the innumerable beautiful saris at the Ambani wedding were thousands of designers, tailors and seamstresses; behind the dances and elaborate backdrops were thousands of choreographers, musicians and carpenters. The wedding filled hotels, private jets, a fleet of golf carts and at least one cruise ship.

Yet instead of awe and pride, the reaction this time was considerably more mixed. As the Juggernaut, an online publication, summed it up, it “shows us the power of Asia’s richest family. But it also gave us the ick”.

A decorated Rolls-Royce car carrying guests leaves Antilia, the house of Indian businessman Mukesh Ambani, on the day of Anant Ambani’s wedding in Mumbai, on July 12. PHOTO: REUTERS

It was not just the Juggernaut that felt a bit icky. India’s Prime Minister Narendra Modi did make an appearance at one of the events leading up to the ceremony. But the Gandhi family, which leads the left-of-centre political opposition, pointedly did not. Foreign political leaders who attended were mostly former ones (Mr Tony Blair, Mr Boris Johnson) or seemed an odd fit. Mr John Kerry, America’s former climate envoy, was rubbing shoulders with Mr Amin Nasser, chief executive of Saudi Aramco, the world’s biggest oil company, at an event bankrolled by wealth derived primarily from Reliance’s giant petrochemicals operation that, to complicate matters further, refines oil from Russia.

Indeed, Mr Anant’s extravaganza looks likely to be the last of its kind for a while. That is not just because he was the last unwed child of Mr Mukesh, the Ambani clan’s patriarch, and because no one (with the possible exception of the family of Mr Gautam Adani, India’s second-richest industrialist) can match the Ambanis’ deep pockets. Mr Modi’s government has become increasingly aware of voters’ distaste for rising inequality, which may have cost his Bharatiya Janata Party its absolute majority in a general election earlier in 2024.

Strong gross domestic product (GDP) growth and a soaring stock market have created more wealth for India’s rich, but not that many new jobs or wage gains for its poor. Between Ms Isha’s and Mr Anant’s weddings, India’s GDP per person rose from US$2,000 to US$2,500 (not adjusted for inflation). By comparison, in the same period, the Ambani family fortune swelled from US$47 billion to US$122 billion.

More gallingly to many Indians, it has shot up by US$10 billion in the past month alone. Reliance’s share price rose by 8 per cent after the company’s Jio telecoms business raised prices for its 470 million customers. To the Ambanis, this may have made their US$600 million celebrations look like a bargain. To almost everyone else, it makes them look disconnected from India’s economic and social reality. © 2024 THE ECONOMIST NEWSPAPER LIMITED. ALL RIGHTS RESERVED

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Violet Oon and children reach out-of-court settlement with business partner, end partnership

Violet Oon (seated) with her son Tay Yiming (left), daughter Tay Su-lyn and business partner Manoj Murjani in 2018. PHOTO: ST FILE

Tan Hsueh Yun

Senior Correspondent

Jul 18, 2024

SINGAPORE – Luxury and lifestyle company Group MMM and its director Manoj Murjani said they have reached an out-of-court settlement to end their business partnership with Peranakan cooking doyenne Violet Oon and her children.

Mr Murjani, 54, had bought a 50 per cent share in Ms Oon’s business, now with three restaurants, in 2014.

In a statement, he said the two parties had “reached an out-of-court settlement to end our partnership of the better part of a decade”. Ms Oon, 75, owns 50 per cent of the business with her children, Ms Tay Su-lyn and Mr Tay Yiming.

He added: “I wish Violet, Ming and Su all the best in their endeavours and trust that they will continue flying the flag for Singapore and Peranakan cuisine. I look forward to perhaps one day enjoying one of Violet’s meals again.”

Ms Oon and her children brought a shareholder oppression suit against Mr Murjani and Group MMM. They asked the court to grant an order for them to buy Mr Murjani’s 50 per cent stake in Violet Oon Inc, or for the company to be wound up.

They also asked for a shareholders’ agreement, signed in February 2019, to be invalidated, alleging it was signed under “duress and undue influence” from Mr Murjani.

The eight-day trial took place in July 2023.

In January 2024, the Oon family won the civil suit, with Singapore’s High Court ordering that the family buy out Mr Murjani’s 50 per cent stake in the company at fair value. The High Court’s view was that he and Group MMM’s conduct in the case made it “intolerable” for Ms Oon and her children to work with them.

Violet Oon Inc runs three restaurants, at National Gallery Singapore, Ion and this one at Jewel Changi Airport. PHOTO: VIOLET OON

On July 3, 2024, the High Court ordered Group MMM and Mr Murjani to pay $299,000 in legal costs to Ms Oon and her children.

When contacted, Ms Oon and her children declined to comment.

- Joined

- Aug 19, 2008

- Messages

- 38,563

- Points

- 113

You lao sai after eating their food.

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Short-seller’s claims of Adani conflict of interest denied by India’s market regulator chief

Hindenburg Research accused Ms Madhabi Puri Buch, the chair of India’s market regulator, of conflicts of interest. PHOTO: REUTERS

Aug 12, 2024

MUMBAI - Adani Group’s stocks fell on Aug 12 after Hindenburg Research accused the head of India’s market regulator of having conflicts of interest that allegedly prevented a thorough probe into its claims of manipulation and fraud at the conglomerate.

Shares of Adani Enterprises, the group’s flagship, slid as much as 5.3 per cent in early Mumbai trading, before paring some of their declines. Adani Energy Solutions plunged as much as 17 per cent as all of the conglomerate’s 10 stocks dropped.

In a report published on Aug 10, US short-seller Hindenburg said Ms Madhabi Puri Buch – the chairwoman of the Securities and Exchange Board of India (Sebi) – and her husband Dhaval Buch invested in offshore entities that were allegedly part of a fund structure in which Mr Vinod Adani, the brother of billionaire Gautam Adani, also had investments.

The Buchs denied the allegations.

The investments by the couple were made in 2015, two years before Ms Madhabi was appointed to Sebi, Hindenburg said, citing whistleblower information and other documents Bloomberg was not able to verify.

The fund structure is managed by India Infoline, a financial services and wealth management firm.

“We would like to state that we strongly deny the baseless allegations and insinuations made in the report,” the Buchs wrote in a statement shared by a Sebi representative. “All disclosures as required have already been furnished to Sebi over the years.”

The face-off between Hindenburg and Sebi is escalating, weeks after the short-seller was queried by the Indian regulator about its scathing report against Adani in early 2023.

The report wiped out more than US$150 billion (S$198 billion) in the Adani companies’ market value in February 2023, and led India’s top court to order a Sebi probe on possible Adani violations and any suspicious trading activity.

While Sebi has yet to make a case against the Adani Group, the regulator had sent Adani officials and Hindenburg notices seeking further information on suspected regulatory violations.

Hindenburg’s latest broadside at the Indian regulator for not acting tough on Adani comes at a time when the conglomerate has just returned to tapping equity investors and is back on its aggressive growth spree.

The securities regulator said on Aug 11 it had completed 23 of 24 investigations into the Adani Group, with one remaining probe “close to completion”.

It also added that proceedings in its investigation into whether Hindenburg violated securities laws are ongoing.

Disclosures made

Sebi “has adequate internal mechanisms for addressing issues relating to conflict of interest, which include disclosure framework and provision for recusal”, the regulator said in a statement.

“It is noted that relevant disclosures required in terms of holdings of securities and their transfers have been made by the chairperson from time to time. The chairperson has also recused herself in matters involving potential conflicts of interest.”

A spokesperson for the Adani Group said on Aug 11 that the latest Hindenburg allegations are “manipulative selections of publicly available information”.

The ports-to-power Adani conglomerate has repeatedly denied the short-seller’s accusations of share manipulation and accounting fraud.

“The Adani Group has absolutely no commercial relationship with the individuals or matters mentioned” in the latest report, the spokesperson said via a stock exchange filing on Aug 11.

“Our overseas holding structure is fully transparent” with regular disclosures, it added.

Hindenburg’s report on Aug 10 did not explicitly mention the precise nature of its current exposure to the Indian market.

While short-sellers in recent years have increasingly found themselves in regulatory crosshairs from the US to South Korea, it is unusual for such a company to call out the chief of an overseas market regulator on alleged ethical issues.

The fund that the Buchs invested in was the IPE-Plus Fund set up through India Infoline or IIFL, Hindenburg said.

The company in question now trades as 360 ONE WAM, and it said on Aug 11 the “IPE-Plus Fund 1 made zero investments in any shares of the Adani Group either directly or indirectly” throughout its tenure in the six years to October 2019.

“The fund was managed as a discretionary fund by the investment manager,” 360 ONE WAM said in an exchange filing.

“No investor had any involvement in the fund’s operations or investment decisions.”

Holdings by the Buchs in the fund were less than 1.5 per cent of its total inflow, it said.

The Buchs plan to issue a more detailed statement “in the interest of complete transparency”.

“We have no hesitation in disclosing any and all financial documents, including those that relate to the period when we were strictly private citizens, to any and every authority that may seek them,” they said.

A former investment banker and chief executive of ICICI Securities, Ms Madhabi moved to Singapore in 2011 where she joined Greater Pacific Capital, an Asia-focused fund.

She returned to India in 2017 to be appointed a full-time member of Sebi. In 2022, she was named chairwoman.

Hindenburg also raised questions about Ms Madhabi promoting real estate investment trusts (Reits) as a promising asset class without disclosing that Mr Dhaval is now an adviser to Blackstone, which has sponsored two of the four listed Reits in India.

Mr Dhaval has been a senior adviser to Blackstone Private Equity since 2019, before Ms Madhabi became Sebi’s chairwoman.

BLOOMBERG

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Police find no threatening items on Singapore-bound flight from India following bomb threat

Two of RSAF’s F-15SGs scrambled and escorted the plane away from populated areas. The plane landed safely at Changi Airport. PHOTO: NG ENG HEN/FACEBOOK

Chin Hui Shan and Lok Jian Wen

Oct 16, 2024

SINGAPORE – No threatening items were found aboard an Air India Express plane heading to Singapore from India, the police said on Oct 16 after completing security checks on the low-cost carrier’s aircraft at Changi Airport.

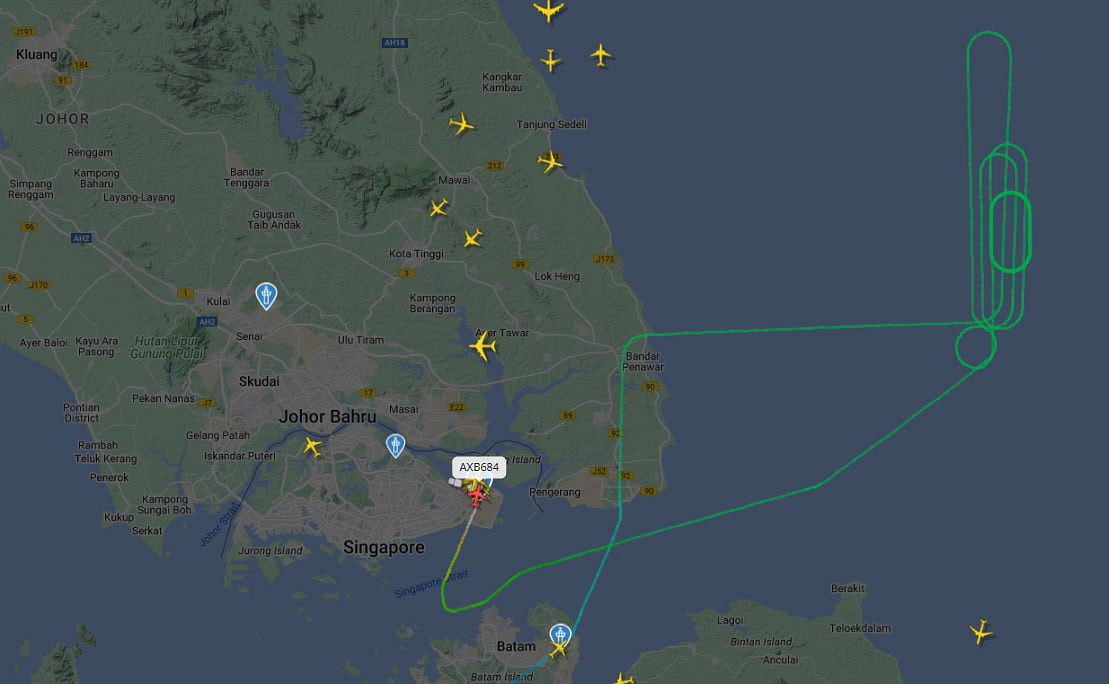

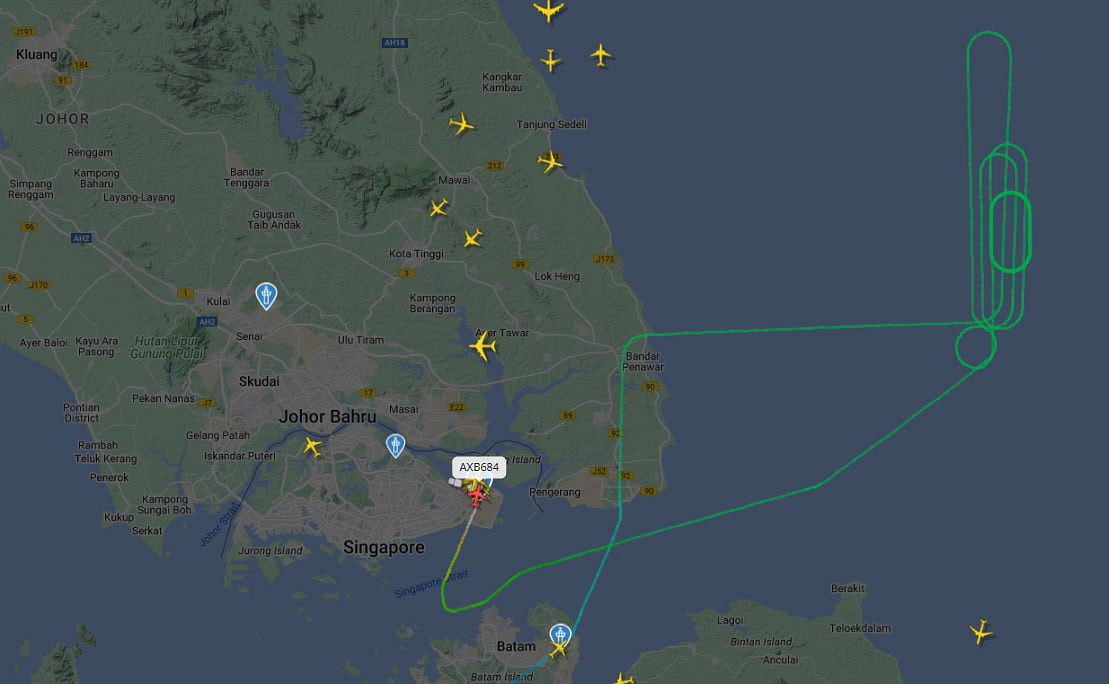

The airline had received an e-mail about an alleged bomb threat on flight AXB684 bound for Singapore from southern Indian city Madurai which landed in Changi Airport, escorted by fighter aircraft on Oct 15.

Two F-15 fighter jets from the Republic of Singapore Air Force (RSAF) had been scrambled to escort the plane, which landed at Changi Airport at 10.04pm, more than an hour after its 8.50pm scheduled arrival.

In response to queries, the police said they were informed of the bomb threat at 8.25pm and completed checks after the plane landed. Investigations are ongoing and action will be taken against those who intentionally cause public alarm, the police added.

Flight tracker Flightradar24 showed the plane was circling for about an hour in the east of Singapore before landing.

In a Facebook post, Defence Minister Ng Eng Hen said: “Two of our RSAF’s F-15SGs scrambled and escorted the plane away from populated areas, to finally land safely at Singapore Changi Airport at around 10.04pm tonight. Our Ground Based Air Defence systems and Explosive Ordnance Disposal team were also activated.”

When it landed, the plane was handed to the airport police, he added. Investigations are ongoing.

“Many thanks to the dedication and professionalism of our Singapore Armed Forces and Home Team that keep us safe in our homes, even when threats exist around us.”

According to Flightradar24, the flight was circling for about an hour in the east of Singapore. PHOTO: SCREENGRAB FROM FLIGHTRADAR24.COM

Local media reported at least five Indian flights received bomb threats on Oct 15, prompting emergency checks, with at least two flights making emergency landings.

An Ayodhya-bound Air India Express flight on Oct 15 received a bomb threat via a phone call, reported The Times of India, adding that the flight later made an emergency landing.

An Air India plane, flying from India’s capital, New Delhi, to Chicago, was forced to make an emergency landing in Canada. The airline said it was the subject of “a security threat posted online” and as a “precautionary measure” landed at Iqaluit Airport in Canada, AFP reported.

- Joined

- Aug 19, 2008

- Messages

- 38,563

- Points

- 113

They do smell.Police find no threatening items on Singapore-bound flight from India following bomb threat

Two of RSAF’s F-15SGs scrambled and escorted the plane away from populated areas. The plane landed safely at Changi Airport. PHOTO: NG ENG HEN/FACEBOOK

Chin Hui Shan and Lok Jian Wen

Oct 16, 2024

SINGAPORE – No threatening items were found aboard an Air India Express plane heading to Singapore from India, the police said on Oct 16 after completing security checks on the low-cost carrier’s aircraft at Changi Airport.

The airline had received an e-mail about an alleged bomb threat on flight AXB684 bound for Singapore from southern Indian city Madurai which landed in Changi Airport, escorted by fighter aircraft on Oct 15.

Two F-15 fighter jets from the Republic of Singapore Air Force (RSAF) had been scrambled to escort the plane, which landed at Changi Airport at 10.04pm, more than an hour after its 8.50pm scheduled arrival.

In response to queries, the police said they were informed of the bomb threat at 8.25pm and completed checks after the plane landed. Investigations are ongoing and action will be taken against those who intentionally cause public alarm, the police added.

Flight tracker Flightradar24 showed the plane was circling for about an hour in the east of Singapore before landing.

In a Facebook post, Defence Minister Ng Eng Hen said: “Two of our RSAF’s F-15SGs scrambled and escorted the plane away from populated areas, to finally land safely at Singapore Changi Airport at around 10.04pm tonight. Our Ground Based Air Defence systems and Explosive Ordnance Disposal team were also activated.”

When it landed, the plane was handed to the airport police, he added. Investigations are ongoing.

“Many thanks to the dedication and professionalism of our Singapore Armed Forces and Home Team that keep us safe in our homes, even when threats exist around us.”

According to Flightradar24, the flight was circling for about an hour in the east of Singapore. PHOTO: SCREENGRAB FROM FLIGHTRADAR24.COM

Local media reported at least five Indian flights received bomb threats on Oct 15, prompting emergency checks, with at least two flights making emergency landings.

An Ayodhya-bound Air India Express flight on Oct 15 received a bomb threat via a phone call, reported The Times of India, adding that the flight later made an emergency landing.

An Air India plane, flying from India’s capital, New Delhi, to Chicago, was forced to make an emergency landing in Canada. The airline said it was the subject of “a security threat posted online” and as a “precautionary measure” landed at Iqaluit Airport in Canada, AFP reported.

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

High Court dismisses claim of ex-flight steward who sued SIA for over $1m after fall on plane

Mr Durairaj Santiran had claimed that the fall caused injuries to his spine, leaving him medically unfit to continue working as a flight steward. PHOTO: ST FILE

Nadine Chua

Oct 18, 2024

SINGAPORE – A former flight steward who sued Singapore Airlines for over $1 million, after he claimed to have slipped on a grease patch on board a plane, has had his claim dismissed by the High Court.

Mr Durairaj Santiran, 35, claimed that the fall caused injuries to his spine, leaving him medically unfit to continue working as a flight steward.

The Malaysian also claimed his former employer was negligent for allowing the workplace to be unsafe.

But in a judgement on Oct 18, Justice Vinodh Coomaraswamy said he found that there was, in fact, no slippery area on the floor of the SIA aircraft.

The judge also said he did not accept Mr Durairaj’s claim that SIA had breached the duty of care that it owed to him.

Mr Durairaj claimed he had slipped and fell on a “patch of grease” on the floor of the economy-class galley during a flight from San Francisco to Singapore on Sept 6, 2019.

He said that he still suffers pain in his back and neck while sitting, standing, walking or running, and that he requires frequent breaks and painkillers to cope with the pain.

Mr Durairaj, who was employed by SIA from April 2016 to April 2021 on a salary of $6,058 a month, now works as a customer care analyst in Malaysia, where he earns RM4,200 (S$1,280) a month.

Over half of his total claim for damages was almost $700,000 for the loss of future earnings.

In dismissing the claim, the judge said he found that no foreign substance was present on the surface of the gallery floor that made it slippery.

A reason for this finding was that Mr Durairaj was not a credible witness.

Justice Vinodh said there were several material, self-serving and unexplained variances between what Mr Durairaj said in his statement of claim and the evidence that he gave at the trial.

In his statement of claim, Mr Durairaj said he immediately told the leading stewardess, Ms Christina Chia, about a “grease patch” on the floor of the gallery upon discovering it.

He said he attempted to clean it only after Ms Chia instructed him to do so.

But at the trial, he gave a different account. He said he had tried to clean the grease patch using paper hand towels and disinfectant on his own initiative while the plane was still taxiing for takeoff – before reporting the issue to Ms Chia.

Injured worker’s suit against employer: Judge throws out defence’s claim of ‘waiver’ signed

Maximum compensation for workplace-related injuries to increase by about 19 per cent in 2025

In his statement of claim, Mr Durairaj also said that despite his best efforts, he could not remove the grease using disinfectant cleaning spray and a paper hand towel.

However, during cross-examination at the trial, Mr Durairaj said he removed the greasy patch, although the surface of the floor was still slippery.

He then told the court a new version of events, saying the slippery area appeared shiny to him but was invisible to everyone else.

However, the judge noted that the other crew members gave evidence that they did not see any grease or other foreign substance on the galley floor at any time during the flight.

He also found that SIA did not breach its duty of care to Mr Durairaj, as there were measures taken to minimise the risk of anyone slipping and falling on board its aircraft.

This included an intensive training programme to teach all new cabin crew members how to identify potential risks of inflight work accidents and how to prevent them.

In his judgment, Justice Vinodh noted that this was not the first time Mr Durairaj suffered a workplace injury during his employment as a flight steward with SIA.

Besides the injury related to the current claim, Mr Durairaj suffered six other workplace injuries between April 2017 and April 2019.

In April 2017, he injured his back while helping a passenger close an overhead luggage compartment. He filed a claim for compensation and was awarded over $26,000.

In January 2018, he slipped and fell from a staircase while exiting the crew bunk and required surgery. SIA paid for his surgery and he was awarded over $91,000 after filing a compensation claim.

He also bruised the tip of his finger while opening a compartment door and broke his left fingernail while handling a meal cart, which were minor injuries that were resolved without treatment or claim.

- Joined

- Dec 23, 2020

- Messages

- 63

- Points

- 8

The journalist Nadine Chua face looked like she had enjoyed an Indian cock in her the night beforeHigh Court dismisses claim of ex-flight steward who sued SIA for over $1m after fall on plane

Mr Durairaj Santiran had claimed that the fall caused injuries to his spine, leaving him medically unfit to continue working as a flight steward. PHOTO: ST FILE

Nadine Chua

Oct 18, 2024

SINGAPORE – A former flight steward who sued Singapore Airlines for over $1 million, after he claimed to have slipped on a grease patch on board a plane, has had his claim dismissed by the High Court.

Mr Durairaj Santiran, 35, claimed that the fall caused injuries to his spine, leaving him medically unfit to continue working as a flight steward.

The Malaysian also claimed his former employer was negligent for allowing the workplace to be unsafe.

But in a judgement on Oct 18, Justice Vinodh Coomaraswamy said he found that there was, in fact, no slippery area on the floor of the SIA aircraft.

The judge also said he did not accept Mr Durairaj’s claim that SIA had breached the duty of care that it owed to him.

Mr Durairaj claimed he had slipped and fell on a “patch of grease” on the floor of the economy-class galley during a flight from San Francisco to Singapore on Sept 6, 2019.

He said that he still suffers pain in his back and neck while sitting, standing, walking or running, and that he requires frequent breaks and painkillers to cope with the pain.

Mr Durairaj, who was employed by SIA from April 2016 to April 2021 on a salary of $6,058 a month, now works as a customer care analyst in Malaysia, where he earns RM4,200 (S$1,280) a month.

Over half of his total claim for damages was almost $700,000 for the loss of future earnings.

In dismissing the claim, the judge said he found that no foreign substance was present on the surface of the gallery floor that made it slippery.

A reason for this finding was that Mr Durairaj was not a credible witness.

Justice Vinodh said there were several material, self-serving and unexplained variances between what Mr Durairaj said in his statement of claim and the evidence that he gave at the trial.

In his statement of claim, Mr Durairaj said he immediately told the leading stewardess, Ms Christina Chia, about a “grease patch” on the floor of the gallery upon discovering it.

He said he attempted to clean it only after Ms Chia instructed him to do so.

But at the trial, he gave a different account. He said he had tried to clean the grease patch using paper hand towels and disinfectant on his own initiative while the plane was still taxiing for takeoff – before reporting the issue to Ms Chia.

Injured worker’s suit against employer: Judge throws out defence’s claim of ‘waiver’ signed

Maximum compensation for workplace-related injuries to increase by about 19 per cent in 2025

In his statement of claim, Mr Durairaj also said that despite his best efforts, he could not remove the grease using disinfectant cleaning spray and a paper hand towel.

However, during cross-examination at the trial, Mr Durairaj said he removed the greasy patch, although the surface of the floor was still slippery.

He then told the court a new version of events, saying the slippery area appeared shiny to him but was invisible to everyone else.

However, the judge noted that the other crew members gave evidence that they did not see any grease or other foreign substance on the galley floor at any time during the flight.

He also found that SIA did not breach its duty of care to Mr Durairaj, as there were measures taken to minimise the risk of anyone slipping and falling on board its aircraft.

This included an intensive training programme to teach all new cabin crew members how to identify potential risks of inflight work accidents and how to prevent them.

In his judgment, Justice Vinodh noted that this was not the first time Mr Durairaj suffered a workplace injury during his employment as a flight steward with SIA.

Besides the injury related to the current claim, Mr Durairaj suffered six other workplace injuries between April 2017 and April 2019.

In April 2017, he injured his back while helping a passenger close an overhead luggage compartment. He filed a claim for compensation and was awarded over $26,000.

In January 2018, he slipped and fell from a staircase while exiting the crew bunk and required surgery. SIA paid for his surgery and he was awarded over $91,000 after filing a compensation claim.

He also bruised the tip of his finger while opening a compartment door and broke his left fingernail while handling a meal cart, which were minor injuries that were resolved without treatment or claim.

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Singapore judge chides lawyer for convoluted mitigation filled with grammatical errors

District Judge Lim said he had checked and confirmed with Mr Shanker that he himself had drafted the mitigation. PHOTO: PIXABAY

Samuel Devaraj

Nov 19, 2024

SINGAPORE - A judge chided a criminal lawyer for the poor quality of a written mitigation plea the latter submitted to the court on behalf of a client who admitted to a cheating charge.

In a judgment dated Nov 11, District Judge Lim Tse Haw said he told Mr A. Revi Shanker that his mitigation was “so convoluted and verbose” and filled with grammatical errors, that he had difficulty understanding what the lawyer was trying to submit.

The judge said: “Lawyers and prosecutors would do well to prepare their written submissions in plain English and (an) easy-to-read manner. This would save much valuable judicial time in reading and understanding the submissions.”

In order to understand the mitigation, he asked Mr Shanker to make an oral presentation in court.

Mr Shanker’s client Jeremy Francis Cruez was sentenced to six months’ jail in October. The 60-year-old Sri Lankan national had admitted to cheating his former company, Major’s Pest Management Services.

The prosecution had asked for a jail term of between 14 and 16 months, while Mr Shanker asked for a fine.

While both sides appealed the sentence, court records show that Cruez has since discontinued his appeal.

As a fumigation manager, Cruez was responsible for ensuring that the supplies required for fumigation works were obtained.

Between April 13, 2017 and Oct 22, 2019, he submitted fake or forged invoices to his company for fumigation-related supplies from six suppliers, seeking a total of $190,455.60. The amount was to be paid in cash.

In fact, Cruez had bought the supplies from other sources and marked up the prices in the fake or forged invoices by 5 per cent. He had intended to pocket the difference.

When he was questioned by the company’s managing director why the suppliers required cash payment, he explained that they had been paid in cash under Major’s previous managing director.

He provided e-mails from the suppliers who purportedly requested for payment in cash or for the cheque to be made out to a person called Myrna, who was stated to be an “executive in charge of accounts” in the e-mails. However, Myrna was his close friend who was working as a domestic helper.

Believing the ruse, the company disbursed $190,455.60 as payment for the supplies to either Cruez or Myrna.

In the judgment, District Judge Lim highlighted the first paragraph of Mr Shanker’s mitigation, which comprised a single sentence of 176 words.

In the paragraph, among many other points, Mr Shanker said his client had to “live at the mercy of friends and relatives whose assistance is only, not unexpectedly, thinning away such that his queues for food (breakfast, lunch and dinner) on a daily basis at religious place of worship and other organisations have become more frequent”.

District Judge Lim said he had checked and confirmed with Mr Shanker that he himself had drafted the mitigation.

To avoid any misunderstanding of the mitigation, the judge asked the lawyer to summarise orally at a hearing on Oct 22, 2024, what he was trying to submit.

Mr Shanker said during the hearing that Cruez was not qualifying his plea of guilt.

He added that his client had offered to make full restitution to Major’s Pest Management Services of the sum of $12,953.73, which was Cruez’s personal gains from the offence. But the offer was declined by the pest control company.

While rejecting the defence’s submission for a fine, District Judge Lim said the prosecution’s submission for 14 to 16 month’s jail was manifestly excessive.

“Had the accused pocketed the entire sum of $190,455.60 and left the company in a lurch by not carrying out any of the fumigation works, then perhaps a sentence of 14 to 16 months’ imprisonment as sought for by the prosecution would be appropriate,” he said.

The first paragraph of the mitigation plea that District Judge Lim Tse Haw deemed convoluted and verbose. PHOTO: COURT DOCUMENTS

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Indian billionaire Gautam Adani charged by US over alleged $336m bribe plot

US prosecutors charged Gautam Adani (centre) with participating in a scheme that involved bribing Indian government officials to secure solar energy contracts. PHOTO: AFP

UPDATED Nov 21, 2024, 04:31 PM

WASHINGTON – US prosecutors charged Gautam Adani with helping drive a US$250 million (S$336 million) bribery scheme, threatening to throw the Indian tycoon’s conglomerate back into turmoil just as it rebounded from a short-seller’s fraud allegations.

Federal prosecutors alleged on Nov 20 that Adani, one of the world’s richest people, and other defendants promised to pay more than US$250 million in bribes to Indian government officials to win solar energy contracts, and concealed the plan as they sought to raise money from US investors.

The five count indictment also accuses Gautam Adani’s nephew Sagar R. Adani and Vneet S. Jaain, both executives at an Indian renewable-energy company, of breaking federal laws.

“The defendants orchestrated an elaborate scheme to bribe Indian government officials to secure contracts worth billions of dollars,” Mr Breon Peace, US Attorney for the Eastern District of New York which brought the case, said in a statement.

US law allows federal prosecutors to pursue foreign corruption allegations if they involve certain links to American investors or markets.

The Adani Group denied US prosecutors’ charge on Nov 21, saying that the allegations are baseless. It said it will seek all possible legal recourse to defend itself.

Lawyers for Sagar Adani and Jaain didn’t immediately respond to requests for comment.

ST Asian Insider: Malaysia Edition

Get exclusive insights into Malaysia in weekly round-upSign up

By signing up, I accept SPH Media's Terms & Conditions and Privacy Policy as amended from time to time.

Yes, I would also like to receive SPH Media Group's

SPH Media Limited, its related corporations and affiliates as well as their agents and authorised service providers.

marketing and promotions.

None of the defendants have been taken into custody.

Adani Group stocks tumbled in India on Nov 21, with flagship Adani Enterprises Ltd falling by as much as 23 per cent to the lowest level in a year, while Adani Green plunged over 19 per cent.

In addition to being a monolithic presence in India, with ports, airports, power lines and highway developments, Adani Group attracts capital from around the world.

Prosecuting the case would take months, if not years, meaning that it will fall to the incoming Trump administration’s Justice Department to determine how to proceed.

Mr Peace, the Brooklyn US attorney who was appointed during the Biden administration, is expected to step down and be replaced by whomever Donald Trump picks to lead the office, which is known as EDNY.

Neither a White House press official nor a representative for the Trump transition team immediately responded to emailed requests seeking comment.

Although the US and India have an extradition treaty, it’s likely that India would fight to protect its citizens from being forced to stand trial in the US.

If convicted, the defendants could face years behind bars, prosecutors said on Nov 20.

Beyond the Justice Department investigation, Adani has been dealing with claims from short-seller Hindenburg Research that the conglomerate manipulated its stock price and committed accounting fraud.

The group has vigorously denied those allegations, and its shares climbed back from their initial plunge caused by the report.

After also initially cratering on the short-seller’s claims, Gautam Adani’s fortune has rebounded as well. He’s the world’s 18th richest person with more than US$85.5 billion, according to Bloomberg Billionaires Index.

Separately, units of the conglomerate’s clean-energy arm sold a 20-year green dollar bond earlier on Nov 20 in an offering that was oversubscribed.

SEC lawsuit

Prosecutors on Nov 20 charged four of the eight defendants with conspiring to obstruct justice by deleting electronic evidence and lying to representatives of the Justice Department, Securities and Exchange Commission and the Federal Bureau of Investigation.The SEC, which is a civil law enforcement agency, provided detailed allegations against both Adanis and another one of the co-defendants, Cyril Sebastien Dominique Cabanes, in a parallel lawsuit.

The regulator identified the firm involved in the alleged bribery scheme, which wasn’t named in the indictment, as Adani Green Energy Ltd.

According to the regulator, Gautam Adani spearheaded an effort to pay or promise hundreds of millions of dollars in bribes to Indian state government officials to induce them to enter contracts that Adani Green needed to develop India’s largest solar power plant project.

Another company involved in the power plant project, Azure Power Global Ltd, agreed to pay some of the bribes, the SEC alleged.

In its lawsuit, the SEC said Cabanes served as a director on the board at Azure Power Global and as a representative of the company’s largest stockholder, pension fund company Caisse de Depot et Placement du Quebec, which is known as CDPQ.

While serving as a director, Cabanes, and others, “schemed” to make payments to bribe state government officials in India, the SEC said in its lawsuit.

A lawyer listed by the SEC as representing Cabanes didn’t immediately respond to a request for comment.

A representative for Azure Power Global didn’t immediately respond to a request for comment outside of normal business hours.

“CDPQ is aware of charges filed in the US against certain former employees,” a spokesperson for the pension manager said by email. “Those employees were all terminated in 2023 and CDPQ is cooperating with US authorities.”

US authorities ramped up an existing probe into Adani Group by looking into the conduct of the company’s billionaire founder, Bloomberg reported in March.

Officials were focused on whether there were improper payments made to officials in India for favourable treatment on an energy project. Bloomberg

Indian billionaire Gautam Adani charged by US over alleged $336m bribe plot

[IMG width="860px" alt="(FILES) Gautam Adani (4L), Chairperson of Indian conglomerate Adani Group and his wife Priti Adani (2L) show their inked finger after casting their ballot to vote in Ahmedabad on May 7, 2024, during the third phase of voting of India's general election. Billionaire Indian industrialist Gautam Adani has been charged with paying hundreds of millions of dollars of bribes and hiding the payments from investors, US prosecutors said on Wednesday.With a business empire spanning coal, airports, cement and media, the chairman of Adani Group has been rocked in recent years by corporate fraud allegations and a stock crash.

The close acolyte of Hindu nationalist Prime Minister Narendra Modi, a fellow Gujarat native, is alleged to have agreed to pay more than $250 million in bribes to Indian officials for lucrative solar energy supply contracts. (Photo by Sam PANTHAKY / AFP)"]https://cassette.sphdigital.com.sg/...69ead788fc125e5e3a1328fd062e5afbd?w=860[/IMG]

US prosecutors charged Gautam Adani (centre) with participating in a scheme that involved bribing Indian government officials to secure solar energy contracts. PHOTO: AFP

UPDATED Nov 21, 2024, 04:31 PM

WASHINGTON – US prosecutors charged Gautam Adani with helping drive a US$250 million (S$336 million) bribery scheme, threatening to throw the Indian tycoon’s conglomerate back into turmoil just as it rebounded from a short-seller’s fraud allegations.

Federal prosecutors alleged on Nov 20 that Adani, one of the world’s richest people, and other defendants promised to pay more than US$250 million in bribes to Indian government officials to win solar energy contracts, and concealed the plan as they sought to raise money from US investors.

The five count indictment also accuses Gautam Adani’s nephew Sagar R. Adani and Vneet S. Jaain, both executives at an Indian renewable-energy company, of breaking federal laws.

“The defendants orchestrated an elaborate scheme to bribe Indian government officials to secure contracts worth billions of dollars,” Mr Breon Peace, US Attorney for the Eastern District of New York which brought the case, said in a statement.

US law allows federal prosecutors to pursue foreign corruption allegations if they involve certain links to American investors or markets.

The Adani Group denied US prosecutors’ charge on Nov 21, saying that the allegations are baseless. It said it will seek all possible legal recourse to defend itself.

Lawyers for Sagar Adani and Jaain didn’t immediately respond to requests for comment.

ST Asian Insider: Malaysia Edition

Get exclusive insights into Malaysia in weekly round-upSign up

By signing up, I accept SPH Media's Terms & Conditions and Privacy Policy as amended from time to time.

Yes, I would also like to receive SPH Media Group's

SPH Media Limited, its related corporations and affiliates as well as their agents and authorised service providers.

marketing and promotions.

None of the defendants have been taken into custody.SPH Media Limited, its related corporations and affiliates as well as their agents and authorised service providers.

marketing and promotions.

Adani Group stocks tumbled in India on Nov 21, with flagship Adani Enterprises Ltd falling by as much as 23 per cent to the lowest level in a year, while Adani Green plunged over 19 per cent.

In addition to being a monolithic presence in India, with ports, airports, power lines and highway developments, Adani Group attracts capital from around the world.

Prosecuting the case would take months, if not years, meaning that it will fall to the incoming Trump administration’s Justice Department to determine how to proceed.

Mr Peace, the Brooklyn US attorney who was appointed during the Biden administration, is expected to step down and be replaced by whomever Donald Trump picks to lead the office, which is known as EDNY.

Neither a White House press official nor a representative for the Trump transition team immediately responded to emailed requests seeking comment.

Although the US and India have an extradition treaty, it’s likely that India would fight to protect its citizens from being forced to stand trial in the US.

If convicted, the defendants could face years behind bars, prosecutors said on Nov 20.

Beyond the Justice Department investigation, Adani has been dealing with claims from short-seller Hindenburg Research that the conglomerate manipulated its stock price and committed accounting fraud.

The group has vigorously denied those allegations, and its shares climbed back from their initial plunge caused by the report.

After also initially cratering on the short-seller’s claims, Gautam Adani’s fortune has rebounded as well. He’s the world’s 18th richest person with more than US$85.5 billion, according to Bloomberg Billionaires Index.

Separately, units of the conglomerate’s clean-energy arm sold a 20-year green dollar bond earlier on Nov 20 in an offering that was oversubscribed.

SEC lawsuit

Prosecutors on Nov 20 charged four of the eight defendants with conspiring to obstruct justice by deleting electronic evidence and lying to representatives of the Justice Department, Securities and Exchange Commission and the Federal Bureau of Investigation.The SEC, which is a civil law enforcement agency, provided detailed allegations against both Adanis and another one of the co-defendants, Cyril Sebastien Dominique Cabanes, in a parallel lawsuit.

The regulator identified the firm involved in the alleged bribery scheme, which wasn’t named in the indictment, as Adani Green Energy Ltd.

According to the regulator, Gautam Adani spearheaded an effort to pay or promise hundreds of millions of dollars in bribes to Indian state government officials to induce them to enter contracts that Adani Green needed to develop India’s largest solar power plant project.

Another company involved in the power plant project, Azure Power Global Ltd, agreed to pay some of the bribes, the SEC alleged.

In its lawsuit, the SEC said Cabanes served as a director on the board at Azure Power Global and as a representative of the company’s largest stockholder, pension fund company Caisse de Depot et Placement du Quebec, which is known as CDPQ.

While serving as a director, Cabanes, and others, “schemed” to make payments to bribe state government officials in India, the SEC said in its lawsuit.

A lawyer listed by the SEC as representing Cabanes didn’t immediately respond to a request for comment.

A representative for Azure Power Global didn’t immediately respond to a request for comment outside of normal business hours.

“CDPQ is aware of charges filed in the US against certain former employees,” a spokesperson for the pension manager said by email. “Those employees were all terminated in 2023 and CDPQ is cooperating with US authorities.”

US authorities ramped up an existing probe into Adani Group by looking into the conduct of the company’s billionaire founder, Bloomberg reported in March.

Officials were focused on whether there were improper payments made to officials in India for favourable treatment on an energy project. Bloomberg

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Indian billionaire Gautam Adani charged by US over alleged $336m bribe plot

US prosecutors charged Gautam Adani (centre) with participating in a scheme that involved bribing Indian government officials to secure solar energy contracts. PHOTO: AFP

Nov 21, 2024

WASHINGTON – US prosecutors charged Gautam Adani with helping drive a US$250 million (S$336 million) bribery scheme, threatening to throw the Indian tycoon’s conglomerate back into turmoil just as it rebounded from a short-seller’s fraud allegations.

Federal prosecutors alleged on Nov 20 that Adani, one of the world’s richest people, and other defendants promised to pay more than US$250 million in bribes to Indian government officials to win solar energy contracts, and concealed the plan as they sought to raise money from US investors.

The five count indictment also accuses Gautam Adani’s nephew Sagar R. Adani and Vneet S. Jaain, both executives at an Indian renewable-energy company, of breaking federal laws.

“The defendants orchestrated an elaborate scheme to bribe Indian government officials to secure contracts worth billions of dollars,” Mr Breon Peace, US Attorney for the Eastern District of New York which brought the case, said in a statement.

US law allows federal prosecutors to pursue foreign corruption allegations if they involve certain links to American investors or markets.

The Adani Group denied US prosecutors’ charge on Nov 21, saying that the allegations are baseless. It said it will seek all possible legal recourse to defend itself.

Lawyers for Sagar Adani and Jaain didn’t immediately respond to requests for comment.

None of the defendants have been taken into custody.

Adani Group stocks tumbled in India on Nov 21, with flagship Adani Enterprises Ltd falling by as much as 23 per cent to the lowest level in a year, while Adani Green plunged over 19 per cent.

In addition to being a monolithic presence in India, with ports, airports, power lines and highway developments, Adani Group attracts capital from around the world.

Prosecuting the case would take months, if not years, meaning that it will fall to the incoming Trump administration’s Justice Department to determine how to proceed.

Mr Peace, the Brooklyn US attorney who was appointed during the Biden administration, is expected to step down and be replaced by whomever Donald Trump picks to lead the office, which is known as EDNY.

Neither a White House press official nor a representative for the Trump transition team immediately responded to emailed requests seeking comment.

Although the US and India have an extradition treaty, it’s likely that India would fight to protect its citizens from being forced to stand trial in the US.

If convicted, the defendants could face years behind bars, prosecutors said on Nov 20.

Beyond the Justice Department investigation, Adani has been dealing with claims from short-seller Hindenburg Research that the conglomerate manipulated its stock price and committed accounting fraud.

The group has vigorously denied those allegations, and its shares climbed back from their initial plunge caused by the report.

After also initially cratering on the short-seller’s claims, Gautam Adani’s fortune has rebounded as well. He’s the world’s 18th richest person with more than US$85.5 billion, according to Bloomberg Billionaires Index.

Separately, units of the conglomerate’s clean-energy arm sold a 20-year green dollar bond earlier on Nov 20 in an offering that was oversubscribed.

SEC lawsuit

Prosecutors on Nov 20 charged four of the eight defendants with conspiring to obstruct justice by deleting electronic evidence and lying to representatives of the Justice Department, Securities and Exchange Commission and the Federal Bureau of Investigation.The SEC, which is a civil law enforcement agency, provided detailed allegations against both Adanis and another one of the co-defendants, Cyril Sebastien Dominique Cabanes, in a parallel lawsuit.

The regulator identified the firm involved in the alleged bribery scheme, which wasn’t named in the indictment, as Adani Green Energy Ltd.

According to the regulator, Gautam Adani spearheaded an effort to pay or promise hundreds of millions of dollars in bribes to Indian state government officials to induce them to enter contracts that Adani Green needed to develop India’s largest solar power plant project.

Another company involved in the power plant project, Azure Power Global Ltd, agreed to pay some of the bribes, the SEC alleged.

In its lawsuit, the SEC said Cabanes served as a director on the board at Azure Power Global and as a representative of the company’s largest stockholder, pension fund company Caisse de Depot et Placement du Quebec, which is known as CDPQ.

While serving as a director, Cabanes, and others, “schemed” to make payments to bribe state government officials in India, the SEC said in its lawsuit.

A lawyer listed by the SEC as representing Cabanes didn’t immediately respond to a request for comment.

A representative for Azure Power Global didn’t immediately respond to a request for comment outside of normal business hours.

“CDPQ is aware of charges filed in the US against certain former employees,” a spokesperson for the pension manager said by email. “Those employees were all terminated in 2023 and CDPQ is cooperating with US authorities.”

US authorities ramped up an existing probe into Adani Group by looking into the conduct of the company’s billionaire founder, Bloomberg reported in March.

Officials were focused on whether there were improper payments made to officials in India for favourable treatment on an energy project. Bloomberg

Last edited:

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

How Gautam Adani’s alleged bribery scheme took off and unravelled

Mr Gautam Adani said on Dec 14, 2021 Azure company was on track to become the world’s largest renewables player by 2030.

PHOTO: NYTIMES

Nov 22, 2024

NEW YORK – In June 2020, a renewable energy company owned by Indian billionaire Gautam Adani won what it called the single largest solar development bid ever awarded: an agreement to supply eight gigawatts of electricity to a state-owned power company.

But there was a problem. Local power players did not want to pay the prices the state company was offering, jeopardising the deal, according to US authorities. To save the deal, Mr Adani allegedly decided to bribe local officials to persuade them to buy the electricity.

That allegation is at the heart of US criminal and civil charges unsealed on Nov 20 against Mr Adani, who is not in US custody and is believed to be in India. His company, Adani Group, said the charges are “baseless” and that it will seek “all possible legal recourse”.

The alleged hundreds of millions of dollars in bribes promised to local Indian officials caught the attention of the US Justice Department and Securities and Exchange Commission (SEC) as Mr Adani’s companies were raising funds from US-based investors in several transactions starting in 2021.

This account of how the alleged scheme unfolded is drawn from federal prosecutors’ 54-page criminal indictment of Mr Adani and seven of his associates and two parallel civil SEC complaints, which extensively cite electronic messages among the scheme’s alleged participants.

In early 2020, the Solar Energy Corporation of India awarded Adani Green Energy and another company, Azure Power Global, contracts for a 12-gigawatt solar energy project, expected to yield billions of dollars in revenue for both companies, according to the indictment.

It was a major step forward for Adani Green Energy, run by Mr Adani’s nephew Sagar Adani. Up until that point, the company had earned only roughly US$50 million (S$67 million) in its history and had yet to turn a profit, according to the SEC complaint.

But the initiative soon hit roadblocks. Local state electricity distributors were reluctant to commit to buying the new solar power, expecting prices to fall in the future, according to an April 7, 2021, report by the Institute for Energy Economics and Financial Analysis, a think-tank.

Mr Sagar Adani and the Azure chief executive at the time discussed the delays and hinted at bribes on encrypted messaging application WhatsApp, according to the SEC.

When the Azure CEO wrote on Nov 24, 2020, that the local power companies “are being motivated”, Mr Sagar Adani allegedly replied: “Yup... but the optics are very difficult to cover.”

In February 2021, Mr Sagar Adani allegedly wrote to the CEO: “Just so you know, we have doubled the incentives to push for these acceptances.”

The SEC did not name the Azure CEO as a defendant, but Azure’s securities filings show the CEO at the time was Mr Ranjit Gupta.

He was charged by the Justice Department with conspiracy to violate an anti-bribery law.

Azure said on Nov 21 it was cooperating with the US investigations, and that the individuals involved with the accusations left the company before 2023.

Political wrangling in India as US accuses Gautam Adani of briberyIndian billionaire Gautam Adani charged by US over alleged $336m bribe plot

In August 2021, Mr Gautam Adani had the first of several meetings with an official in southern state Andhra Pradesh, to whom he allegedly ultimately promised US$228 million in bribes in exchange for agreeing to have the state buy the power, according to the Justice Department’s indictment.

By December 2021, Andhra Pradesh had agreed to buy the power, and other states with smaller contracts soon followed. Other states’ officials were promised bribes as well, US authorities said.

During a Dec 6, 2021, meeting at a coffee shop, Azure executives allegedly discussed “rumours that the Adanis had somehow facilitated signing” of the deals, according to the SEC.

Mr Gautam Adani said on Dec 14, 2021, the company was on track “to become the world’s largest renewables player by 2030”.

The SEC wrote in its complaint: “The sudden good fortune for Azure and Adani Green prompted speculation in the marketplace about the contract awards.”

Before long, the SEC began to probe. The agency sent a “general inquiry” letter to Azure – which at the time traded on the New York Stock Exchange – on March 17, 2022, asking about its recent contracts and if foreign officials had sought anything of value, according to the Justice Department indictment.

According to the Department of Justice, Mr Gautam Adani told representatives of Azure during a meeting in his Ahmedabad, India, office the next month that he expected to be reimbursed more than US$80 million for the bribes he had paid officials that ultimately benefited Azure’s contracts.

Some Azure representatives and a leading investor in the company decided to pay him back by allowing his company to take over a potentially profitable project. The representatives and investor allegedly agreed to tell Azure’s board of directors that Mr Adani requested bribe money, but hid their role in the scheme, prosecutors said.

All the while, Adani’s companies were raising billions of dollars in loans and bonds through international banks, including from US investors. In four separate fund-raising transactions between 2021 and 2024, the companies sent investors documents indicating that they had not paid bribes – statements prosecutors said are false and constitute fraud.

During a visit to the US on March 17, 2023, Federal Bureau of Investigation agents seized Mr Sagar Adani’s electronic devices. The agents handed him a search warrant from a judge indicating that the US government was investigating potential violations of fraud statutes and the Foreign Corrupt Practices Act.

According to prosecutors, Mr Gautam Adani e-mailed himself photographs of each page of the search warrant on March 18, 2023.

His companies nonetheless went through with a US$1.36 billion syndicated loan agreement on Dec 5, 2023, and another sale of secured notes in March 2024, and once again furnished investors with misleading information about their anti-bribery practices, according to prosecutors.

On Oct 24, federal prosecutors in Brooklyn secured a secret grand jury indictment against Mr Gautam Adani, Mr Sagar Adani, Mr Gupta and five others allegedly involved in the scheme.

The indictment was unsealed on Nov 20, prompting a US$27 billion plunge in Adani Group companies’ market value. Adani Green Energy promptly cancelled a scheduled US$600 million bond sale. REUTERS

Similar threads

- Replies

- 27

- Views

- 1K

- Replies

- 0

- Views

- 145

- Replies

- 1

- Views

- 130