Free like a Singaporean: 50% of city professionals work no more than 3 days in office per week

Michael Petraeus

23 mins ago

Disclaimer: Unless otherwise stated any opinions expressed below belong solely to the author.

While many companies in America are pushing for full

return to office of all of their employees for five days a week, including tech giants

like Amazon, with Elon Musk recently

extending his demands to all federal employees currently evaluated by his Department of Government Efficiency (DOGE), Singapore seems to be bucking the trend.

Not only did the official

Tripartite Guidelines for Flexible Work Arrangements (FWA) take effect in December—a product of consultation between the government, unions and employers—but the companies themselves have embraced the hybrid work model following the pandemic.

Thanks to a survey included in

Hays’ 2025 Asia Salary Guide we now know exactly how common the practice is in Singapore and several other Asian nations.

Free at work

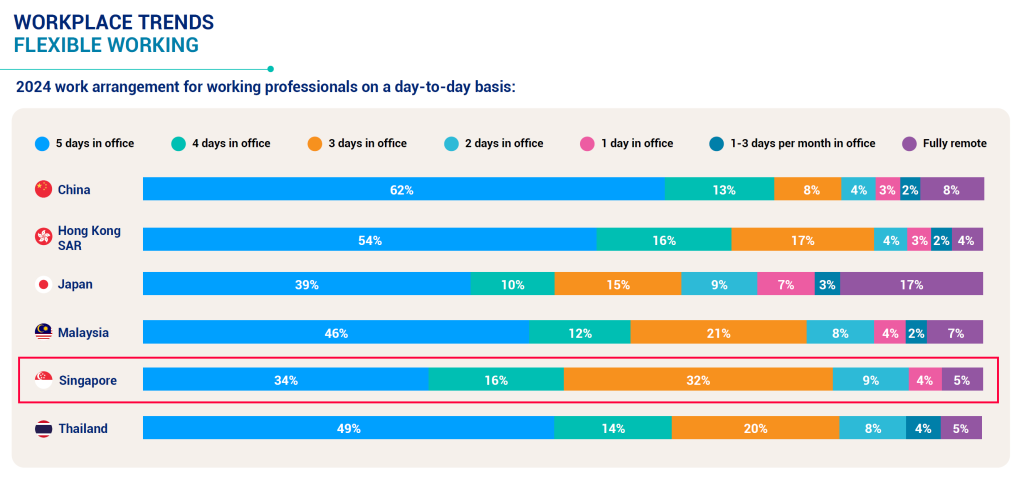

As it turns out Singaporeans enjoy by far the most freedom of all surveyed nations, followed—surprisingly perhaps—by Japan, where nearly a fifth of professionals are permitted fully remote work (although nearly 40% are still expected to show up at the office five days a week).

In Singapore the traditional full-time arrangement applies only to a third of white-collar workers:

Image Credit: Hays

Full 66%, or two thirds, of Singaporeans are already given at least one day to work from home and for 50% that is two or more.

By comparison, 62% of mainland Chinese are expected to work as usual and even in the more liberal Hong Kong it is still a requirement for over 50% of the workforce.

Even in neighbouring Malaysia, usually considered more relaxed and less disciplined than Singapore, close to half of the workers are expected to turn up daily.

Is hybrid work here to stay?

For the time being it certainly is but employers will look closely at how companies like Amazon, Tesla or JP Morgan—which have been most vocal about full-time return to office policies—function compared to their more flexible counterparts.

CEOs opposing remote work do have a point saying that it impedes collaboration and may lead to breakdowns in teamwork, as people who fundamentally have to cooperate as a group don’t see each other often enough, don’t build relationships, and don’t communicate effectively.

This is especially true for work on complex projects where many people are involved.

Image Credit: Hays

Image Credit: Hays