- Joined

- Apr 29, 2013

- Messages

- 197

- Points

- 0

FROM LIM SWEE SAY, SECRETARY-GENERAL, NATIONAL TRADES UNION CONGRESS

PUBLISHED: JUNE 23, 9:47 PM

I refer to the article “Prepare for retirement ‘by using less CPF money when young’” (June 23).

The article paraphrased my comments and wrote: “The best way for Singaporeans to prepare for retirement is to use less of their Central Provident Fund (CPF) money when they are young.”

It gave the impression that I urged Singaporeans not to use their CPF monies before retirement for any purpose, including housing, healthcare and education for our children.

This is incorrect.

For the record, I made three points about the CPF:

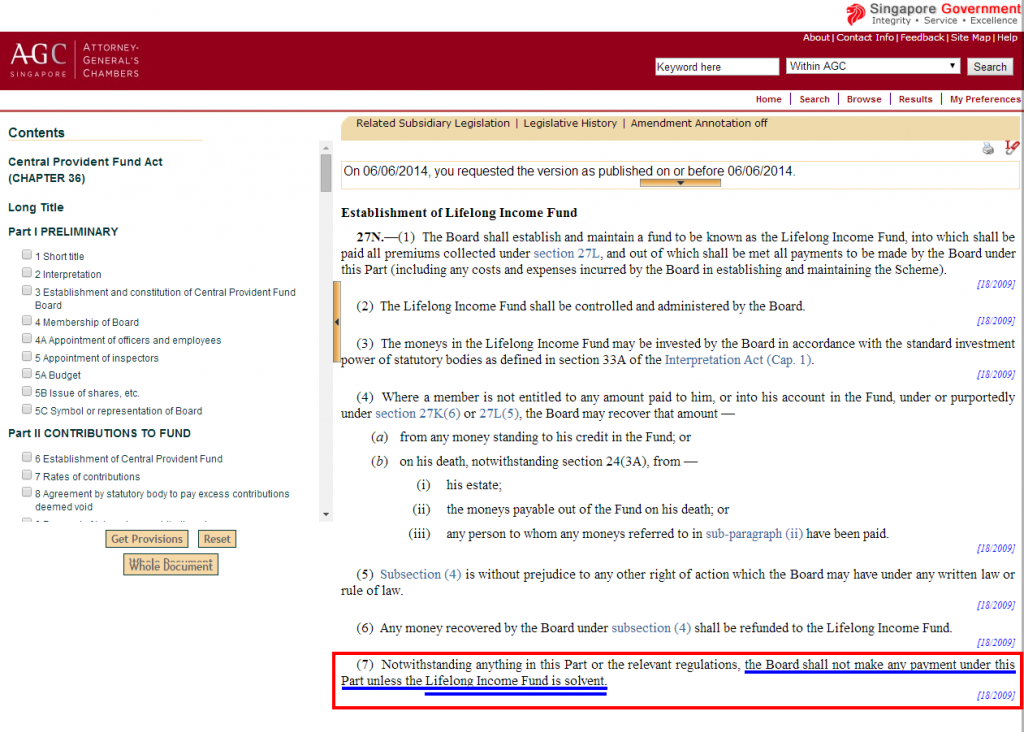

Firstly, the CPF is your money. Nobody can take away that money from you. Secondly, your money with CPF is 100 per cent safe and continues to earn risk-free interest, even during challenging times such as the global financial crisis in 2009.

As the third point was reported out of context, I reproduce the relevant text of my interview here:

“Thirdly, the money is mainly for your retirement purpose. Besides housing, healthcare and education for your children, a very important part of CPF is to cater for retirement. So, for every dollar, if you can defer the use of the dollar, it is better to defer the use of the dollar when you are still young.

“For example, instead of thinking of whether you can spend your CPF savings at the age of 55, I think we should think about how we should help our Singaporeans remain employed, to continue to earn a good living, a good job and, at the same time, to continue to contribute to the CPF.

“Because the more money you have in your CPF and the longer you defer the use of the CPF, the more you will have for retirement, as all of us are living longer and longer.

“So, these are the three basic points: Firstly, the CPF is your money, no one can take away from you. Secondly, your money is 100 per cent safe. Thirdly, the less you make use of your money when you are young, the more money you will have for retirement.”

It is clear in this context that “young” refers to those who are aged 55 and “less use” of the CPF money refers to the CPF cash withdrawal for purposes other than housing, healthcare and education for the children.

Labour chief Lim Swee Say clarifies CPF comments | TODAYonline

PUBLISHED: JUNE 23, 9:47 PM

I refer to the article “Prepare for retirement ‘by using less CPF money when young’” (June 23).

The article paraphrased my comments and wrote: “The best way for Singaporeans to prepare for retirement is to use less of their Central Provident Fund (CPF) money when they are young.”

It gave the impression that I urged Singaporeans not to use their CPF monies before retirement for any purpose, including housing, healthcare and education for our children.

This is incorrect.

For the record, I made three points about the CPF:

Firstly, the CPF is your money. Nobody can take away that money from you. Secondly, your money with CPF is 100 per cent safe and continues to earn risk-free interest, even during challenging times such as the global financial crisis in 2009.

As the third point was reported out of context, I reproduce the relevant text of my interview here:

“Thirdly, the money is mainly for your retirement purpose. Besides housing, healthcare and education for your children, a very important part of CPF is to cater for retirement. So, for every dollar, if you can defer the use of the dollar, it is better to defer the use of the dollar when you are still young.

“For example, instead of thinking of whether you can spend your CPF savings at the age of 55, I think we should think about how we should help our Singaporeans remain employed, to continue to earn a good living, a good job and, at the same time, to continue to contribute to the CPF.

“Because the more money you have in your CPF and the longer you defer the use of the CPF, the more you will have for retirement, as all of us are living longer and longer.

“So, these are the three basic points: Firstly, the CPF is your money, no one can take away from you. Secondly, your money is 100 per cent safe. Thirdly, the less you make use of your money when you are young, the more money you will have for retirement.”

It is clear in this context that “young” refers to those who are aged 55 and “less use” of the CPF money refers to the CPF cash withdrawal for purposes other than housing, healthcare and education for the children.

Labour chief Lim Swee Say clarifies CPF comments | TODAYonline