-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Investments gone bad

- Thread starter LITTLEREDDOT

- Start date

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

S’pore ride-hailing firm Ryde’s shares plunge over 80% on New York Stock Exchange

Ryde collapsed to US$2.08 at the close on Sept 12 from a previous closing price of US$13.11 on Sept 11. PHOTO: RYDE

Sue-Ann Tan

Business Correspondent

Sep 14, 2024

SINGAPORE – Singapore ride-hailing and carpooling company Ryde saw its share price plunge by more than 80 per cent in the past week, a development that market analysts described as concerning, though they added that it can happen to some small technology firms listed in the United States.

Ryde, which is listed on the New York Stock Exchange (NYSE), collapsed to US$2.08 at the close on Sept 12, from US$13.11 the day before and US$12.14 a week earlier.

On Sept 11, the stock had reached a high of US$22.49.

Associate Professor Ben Charoenwong from Insead Singapore noted that Ryde’s last announcement was a partnership with Singapore insurance provider Singlife in August, and Ryde’s share price had been flat until September.

“Then, seemingly out of nowhere, the stock surged over 40 per cent on Sept 6, only to dramatically reverse course shortly after,” said the finance expert.

He noted that Ryde usually sees about 20,000 to 200,000 shares traded daily. But in early September, this jumped to over a million shares.

“It appears some large traders might have started building positions around Sept 3, driving up both volume and prices. This likely caught the attention of other investors who jumped in,” said Prof Charoenwong.

On Sept 11, the stock then plummeted over 60 per cent on a volume of almost nine million shares.

Ryde debuted on the NYSE on March 6, opening at US$4, with around 2.7 million shares traded during regular hours. Its initial public offering raised US$12 million.

Prof Charoenwong noted that the sudden rise and plunge of the stock in September raised eyebrows as the company had not made any announcements during the period.

But he added that the movements could also have been driven by momentum-based investors trying to detect patterns of price movements.

“If any large trades were enough to push prices above some level, quantitative traders and algorithms may simply pile in. Then, once any news failed to materialise and the price impact is revealed to be transitory, then the algorithms may reverse their positions and cut losses.”

He added that as a micro-cap stock, Ryde is more vulnerable to these kinds of movements due to lower liquidity and often less regulatory scrutiny.

He noted that such price patterns are also “fairly rampant”. For example, Grab also saw volatility following its special purpose acquisition company (Spac) merger. It has fallen some 70 per cent since its Nasdaq listing and has failed to recover so far.

In May, Singapore-based telehealth provider Mobile-health Network Solutions plunged 85 per cent after the stock surged more than 580 per cent in its first weeks of trading in April. The stock has also not recovered.

Prof Charoenwong said: “These types of price trends are more common with newly listed companies, those undergoing major transitions like Spac mergers, micro-cap stocks, or stocks with low liquidity.”

Mr Nirgunan Tiruchelvam, head of consumer and internet at investment firm Aletheia Capital, agreed that it is not unusual for small technology companies on the Nasdaq to see such volatility, adding that it is unconnected to the fundamentals of the firm’s business model.

Professor Mak Yuen Teen from NUS Business School said the sharp drop might have been due to the market thinking bad news is coming, or a large investor selling shares.

“The business challenges of ride-hailing firms are well known, with increasing costs and regulation and a challenging path to profitability,” he added.

Moomoo Singapore chief executive Gavin Chia pointed to several factors that might have caused the crash, such as the firm reporting losses.

“Additionally, the stock has faced heavy sell-offs after the company’s recent secondary listing on the Frankfurt and Stuttgart stock exchanges in June, which may have caused a loss of investor confidence,” he said.

“These issues, combined with intense competition in the ride-hailing and quick commerce industries, have put further pressure on the company’s ability to maintain market value.”

Ultimately, investors have to do their due diligence and be wary when a stock experiences large price corrections, said the experts.

Prof Charoenwong cautioned: “It’s also wise to check regulatory filings... Do not blindly follow forums, social media or influencers without doing your own background work.”

Mr Chia of Moomoo also said investors should evaluate companies based on aspects such as financial health and profitability, as well as investor confidence levels, as stock sell-offs or high volatility can indicate market concerns.

Professor Lawrence Loh from NUS Business School said: “Investors should assess the underlying reasons when there are unexpected surges. They should not just go with the flow, especially if the price increases may reflect exuberant market sentiments.”

- Joined

- May 16, 2023

- Messages

- 35,414

- Points

- 113

China Stock Traders Ponder How Far Blockbuster Rally Can Go

- Hang Seng China gauge has gained about 35% since Sept. low

- Traders await release of holiday data, fiscal stimulus details

By Winnie Hsu

October 4, 2024 at 10:12 AM GMT+8

Updated on

October 4, 2024 at 3:22 PM GMT+8

Save

Translate

As Chinese stocks in Hong Kong head for their best two-week rally since 2007, questions are arising over just how far this rebound can go.

The Hang Seng China Enterprises Index has gained 35% since last month’s low, with a bulk of the gains coming after Beijing’s bumper stimulus announcement on Sept. 24. Some stocks have seen astronomical gains as share prices more than doubled in a matter of days.

Have a confidential tip for our reporters

- Joined

- May 16, 2023

- Messages

- 35,414

- Points

- 113

Global banks to use Swift for trialling live digital asset transactions from 2025

Technology and Innovation,3 October 2024 | 4 min read

- Banks across North America, Europe and Asia will use Swift connectivity to conduct live trials of digital asset and currency transactions as innovation accelerates from experimental phase to real-world application

- The trials follow groundbreaking collaborative work with dozens of financial institutions that have demonstrated Swift’s ability to connect multiple digital networks, technologies and asset classes

Brussels, 3 October 2024 — Central and commercial banks will be able to use the Swift network to carry out trial transactions of digital currencies and assets, in expansive pilots that seek to demonstrate the cooperative’s ability to facilitate the flow of all kinds of value between more than four billion accounts across 200 countries and territories.

Swift has already successfully demonstrated that it can transfer tokenised value across public and private blockchains, interlink central bank digital currencies (CBDCs) globally, and integrate multiple digital asset and cash networks. The new trials will explore how Swift can provide its community of financial institutions with a single window of access to multiple digital asset classes and currencies – paving the way for their seamless integration into the wider financial system. Initial use cases will focus on payments, FX, securities, and trade, to enable multi-ledger Delivery-versus-Payment (DvP) and Payment-versus-Payment (PvP) transactions.

Latest industry figures show that 134 countries are currently exploring CBDCs , and the tokenised asset market is projected to reach $16 trillion by 2030 . But the rapid growth of unconnected platforms and technologies has led to an increasingly fragmented landscape, creating a complex web of 'digital islands’ that presents a significant barrier to global adoption. Swift’s trials will leverage its unique position at the heart of the financial system to interlink these disparate networks with each other as well as with existing fiat currencies, enabling its global community to seamlessly transact using digital assets and currencies alongside traditional forms of value, using their existing infrastructure.

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Police called to office at Ubi Techpark after unhappy investors demand refund from gemstone scheme

The police were called to an office at Ubi Techpark on Aug 23, where a group of angry investors gathered to demand their money back from an investment scheme. ST PHOTO: GAVIN FOO

Christine Tan

Sep 23, 2024

SINGAPORE – Investors trying to get their money back from a gemstone scheme which bears the hallmarks of a multi-level marketing programme say they have been stonewalled for years.

The investors, who set up a chat group of about 100 participants, include a number of elderly retirees.

On Aug 23, about 10 of them turned up at the fourth floor of Ubi Techpark, in Ubi Crescent, and thumped tables and shouted at staff.

The police were called in to restore calm. The Straits Times understands that they are looking into the investors’ complaints.

The investment scheme involved amber gemstones. Investors were awarded points, which could be redeemed for cryptocurrency tokens that promised high returns.

Ms Shonna Seow, 42, a business owner, turned up at the Ubi Techpark office on Aug 23 with her parents, who are in their 80s.

She said her parents each invested $35,000 in 2017 with Global GC.

Her mother told ST in Mandarin: “We didn’t earn any profits, not even one cent. We only got a few hundred dollars from introducing new members. They said those were profits, but it was actually only commission.”

Ms Seow said that when they tried to get their money back, they were told they had to pay a sum of money.

She said the money her parents invested was part of the proceeds from selling their three-room flat.

“They wanted to keep the money for their retirement. But they were swayed by their friend’s words to invest.

“I asked the (firm’s representative), ‘These old people don’t even know how to use computers, how do you expect them to understand cryptocurrency?’” she said, adding that she has made a police report.

Ms Shonna Seow's parents, who are both in their 80s, said they were asked to pay a sum for a chance to get back their $70,000 investment. ST PHOTO: GAVIN FOO

Retiree Dennis Tan, 56, said he invested more than US$20,000 (S$25,800) in 2015 with USFIA Singapore.

He said the company offered a “commission” of 10 per cent of their investment sum for every new member investors recommended. He added that the promised profits from the investment scheme never materialised, and has filed a police report about the matter.

USFIA Singapore and Global GC are listed on the Monetary Authority of Singapore’s (MAS) investor alert list.

Checks by ST showed that USFIA Singapore, which was formed in 2014 and struck off in 2020, had listed one Mr Wong Yet Loong as director.

Mr Wong, who is also known as Lionel Wong, registered Global GC in 2015. The firm was struck off in 2023.

The business office at Ubi Techpark is currently registered to Amtop Holding and Universal Mall. Amtop Holding was created in 2018, and Universal Mall was registered in 2017.

Mr Wong Yet Loong (in blue shirt and mask), also known as Lionel Wong, speaking to investors at an office at Ubi Techpark on Aug 23. ST PHOTO: GAVIN FOO

Amtop Holding is a holding company, while Universal Mall is involved in software development and wholesale trade.

Mr Wong was at the Ubi Techpark office on Aug 23 and spoke to investors, who referred to him as “boss”.

Business records show he is not among the appointment holders of Amtop Holding and Universal Mall.

However, he shares the same residential address with Ms Lim Ai Lan, director of Universal Mall, and Ms Wong Ji Hui Joyvina, director of Amtop Holding.

Mr Wong and the staff at Ubi Techpark told investors that their investment was handled by Estonian-registered company, MaxiTrading Invest OU, where Ms Wong is the owner.

A check by ST on Aug 26 found MaxiTrading Invest OU was in liquidation. It was deleted from the Estonian business register on Sept 15.

MAS said MaxiTrading Invest OU, Amtop Holding and Universal Mall are not licensed or authorised by the regulator to provide financial services in Singapore.

US links

USFIA Singapore was linked to USFIA Inc in Los Angeles. US citizen Steve Chen, founder of USFIA Inc, was a director and shareholder of USFIA Singapore.The US Securities and Exchange Commission (SEC) described USFIA Inc as a pyramid scheme and took Chen to court in 2015.

They said he made false and misleading representations, including claims that the firm owned several large amber mines in the Dominican Republic and Argentina.

Chen pleaded guilty to federal criminal charges that he had falsely promised profits to more than 70,000 investors worldwide, and was sentenced to 10 years’ jail in January 2021.

Investigators in the US found a money trail from USFIA Singapore to Chen.

A report in June 2024 found that Chen had raised about US$197 million from investors. A large portion of the money was used to fund his lavish lifestyle.

Mr Wong has repeatedly distanced himself from USFIA Inc, and continued to do so on Aug 23.

He told ST that there were “a lot of problems” in the US, and there were things that “could not be done” in Singapore, without elaborating.

Mr Wong is no stranger to angry investors. In September 2015, a man used a chopper and a knife to threaten him.

The man wanted the $450,000 his wife had invested with USFIA Singapore returned. Court documents then described it as a multi-level marketing company.

The man’s wife got her money back but he was sentenced to three weeks’ jail for criminal intimidation in November 2016.

In an e-mail reply to ST’s queries about the company’s investment plans, its beneficial owners and history, MaxiTrading Invest OU said it has handed the matter over to its lawyers and the police.

It added: “We reserve all legal rights in this matter. Thank you for your understanding.”

Civil case

Commercial lawyer Daniel Soo said firms that do not intend to invest in what they promise could be committing fraud.“If (investors) were misled into believing that this transaction would likely result in them making a profit, and if these representations were found to be false, then they would have a remedy by way of a civil claim for fraud,” added Mr Soo, head of Selvam’s insolvency and restructuring practice.

Even if companies are struck off, investors could file suits against their directors for personal liability in some cases, he said.

He added that if the scheme offered members a commission from introducing new members but no other income, it would be a multi-level marketing or pyramid scheme, which is illegal in Singapore.

Silvester Legal managing director Walter Silvester said investors should ask company directors to put their claims about investment schemes in writing so they have documentary evidence of such promises.

He said there is a difference between fraud and a failed business venture.

“It could very well be that (the director) actually had this whole idea and genuinely wanted to get this amber and (cryptocurrency) thing going, and it just didn’t work out,” he added.

If this case was deemed to be a failed business venture, he said, it is unlikely that investors can get back their money.

MAS said investors should do their checks before dealing with any entity offering financial products and services. They can do this via its Financial Institutions Directory, its investor alert list, and its register of representatives.

Said a spokesperson: “They should ask for details about the entity, including its track record and background of the people running the operation before making any investment decision.”

He added that investors are strongly encouraged to deal only with people who are regulated by MAS, as those who deal with unregulated entities will not have the protection that come with the authority’s regulations.

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Temasek-owned GenZero to review carbon credit investment after fraud charges

GenZero said in a statement that they are assessing the implications on the integrity and impact of the current outcomes on the carbon credit programme. PHOTO: GENZERO.CO

David Fogarty

Climate Change Editor

Oct 04, 2024

SINGAPORE – Temasek-owned investment firm GenZero said it is reviewing its involvement in a South-east Asian carbon credit programme after US federal prosecutors filed fraud charges against a senior figure behind the company running the programme.

Former C-Quest Capital (CQC) chief executive officer Kenneth Newcombe, who stepped down from the role in February, was indicted on Oct 2 in New York on wire fraud and securities and commodities fraud charges.

Under Newcombe, the US-based CQC ramped up its programme from 2021 to roll out more efficient cookstoves to local communities, mainly in Africa and Asia. The stoves are said to burn less fuel and produce less pollution. Carbon credits can be claimed for each tonne of carbon dioxide (CO2) emission avoided.

Newcombe and some of his ex-colleagues were charged over fraudulently exaggerating the amount of emissions avoided and duping investors in a case that risks further damaging the already tarnished image of the global voluntary carbon market.

Among the others facing charges are Tridip Goswami, former head of CQC’s carbon and sustainability accounting team, and Jason Steele, the company’s former chief operating officer.

The 77-year-old Newcombe, a pioneer of the carbon credit market, denies any wrongdoing, Bloomberg reported, quoting a statement from him.

GenZero said in a statement to The Straits Times on Oct 3: “As a partner in C-Quest Capital’s South-east Asia Clean Cookstove Programme, we are assessing the implications on the integrity and impact of the current outcomes on the programme.

“We take allegations of wrongdoing by our programme partners seriously, particularly when those actions impact the credibility of carbon markets.”

In a deal announced in 2022, GenZero and Pavilion Energy – until recently a wholly owned subsidiary of Temasek – invested US$14 million (S$18.3 million) in the South-east Asia cookstove programme.

Pavilion Energy told ST on Oct 4 it has fully exited the CQC project and has no further comment.

In a statement, the US Attorney’s Office for the Southern District of New York accused Newcombe and his co-defendants at CQC of fraudulently obtaining carbon credits worth tens of millions of dollars, and fraudulently securing more than US$100 million in investment. The charges are related to misdeeds allegedly committed between 2021 and 2023.

The statement said the defendants “manipulated data to make it appear as if certain cookstove projects were far more successful in reducing carbon emissions than was actually the case”.

The statement cited internal e-mails showing that there was a coordinated attempt to inflate the emission reductions of several projects or claim reductions from cookstoves that did not exist.

As a result, investors were misled, along with the carbon credit standards body Verra. Verra is the main non-profit organisation that vets and verifies voluntary carbon credit projects and issues carbon credits for those projects.

Because of the allegedly false information from CQC, Verra was “tricked” into giving CQC carbon credits for emission reductions that, according to Verra’s methodology for calculating such reductions, had not in fact been achieved, the US Attorney’s Office statement said.

In a June 26 statement, CQC said it had uncovered the suspected fraud and voluntarily notified the US authorities. The company has not been charged.

On the same day as CQC’s statement, Verra said it had immediately suspended 27 CQC projects, most of them cookstove projects, and launched a review of the projects.

The regional cookstove programme involved projects in Cambodia, Laos, Thailand and Vietnam. In a blog posting announcing the funding agreement with GenZero and Pavilion Energy at the time, CQC said: “The investment will initially fund the deployment of clean cookstoves to 650,000 rural households... with the opportunity to further scale to one million households.”

All four projects were fully verified and registered under Verra.

CQC said in June that it was “voluntarily facilitating the cancellation of any over-issued credits from its inventory in Verra” and “adopting new measurement, reporting and verification processes, crediting methodologies, and policies to ensure its future activities meet the highest ethical standards”.

A Verra spokesman told ST the review into the 27 suspect CQC projects was ongoing.

The spokesman said that if they find there has been an excess issuance of credits, CQC is then responsible for compensating for that excess. And one way to resolve this is to cancel the excess credits, meaning they are removed from Verra’s registry.

The global voluntary carbon market has been hit by a series of investigations and media reports alleging some carbon credit projects, including investments such as tree plantations or to protect threatened areas of rainforest, have been issued with too many credits.

There have also been allegations that some projects were not truly “additional”.

Carbon credits are meant to compensate investors for projects that would not otherwise have happened without the revenue from credit sales.

For instance, a project could be protecting a patch of rainforest that was in danger of being cleared for mining or agriculture. But in some cases, the carbon projects would have gone ahead anyway, meaning they were not “additional”.

Yet, many carbon credit projects are good for the climate and local communities, experts say.

And for an industry that is already working on tougher standards, stronger rules and quick responses to any instances of alleged fraud are positive signs.

Ms Donna Lee, co-founder of carbon credit project ratings firm Calyx Global, told ST the case involving Newcombe and his associates was a rarity in the voluntary carbon market, which was worth about US$2 billion in 2023.

“We believe the vast majority (of cookstove projects) are not engaging in the fraudulent activity,” she said.

“Many cookstove projects are engaging in legitimate mitigation activities that benefit the atmosphere, as well as the health of women and children. The methodologies for measuring that impact need to be updated to avoid over-claiming, but we should not confuse this issue with falsifying information,” she said.

GenZero, which is focused on accelerating global decarbonisation, including carbon credit project investments, said: “Stronger governance, enhanced transparency and clearer guard rails will drive progress and greater confidence in the integrity of the voluntary carbon market.”

ST has contacted CQC for comment.

- Joined

- May 16, 2023

- Messages

- 35,414

- Points

- 113

THey believe $$$$ drop from sky if u are well connectedthese kumgongkias think money falls from the sky

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

TLS Beta is a wholly owned subsidiary of Temasek Life Sciences, which is linked to Singapore’s investment company, Temasek.

Temasek declined to respond to queries from ST.

The multi-storey fish farming facility has been conditionally sold to a local construction and engineering firm. ST PHOTO: KUA CHEE SIONG

Cheryl Tan

Correspondent

Oct 17, 2024

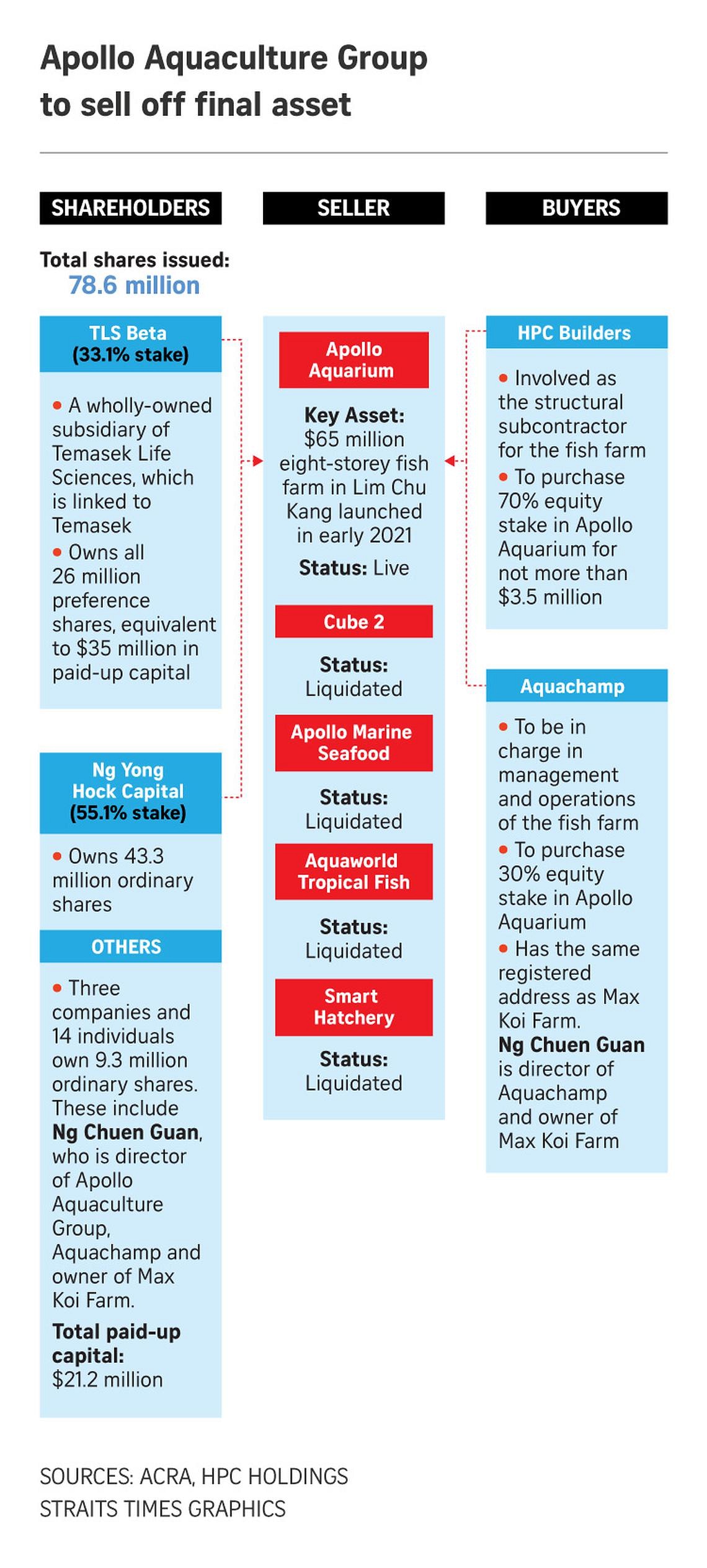

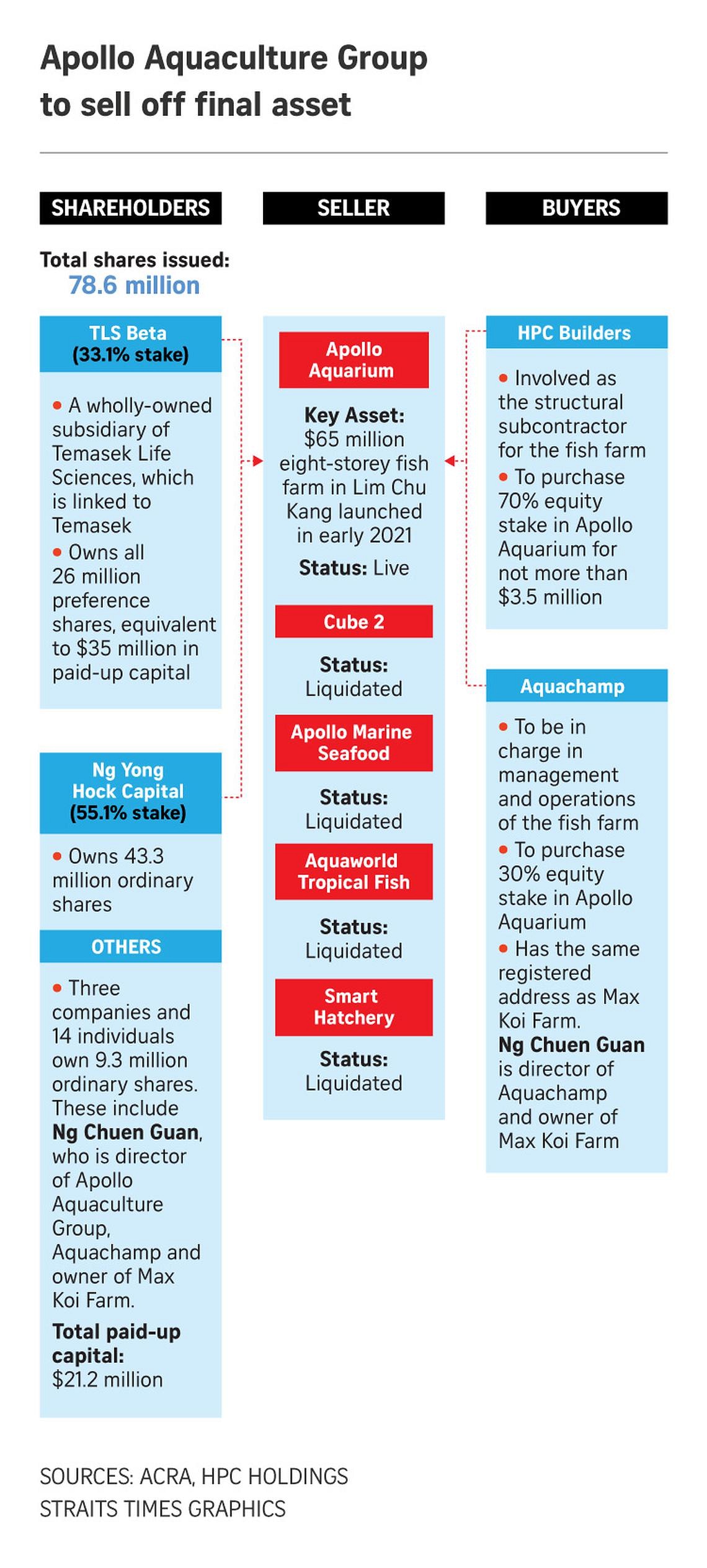

SINGAPORE - Two companies have conditionally agreed to purchase beleaguered Apollo Aquaculture Group’s (AAG) eight-storey fish farm in Lim Chu Kang, more than two years after the company ran into financial difficulties.

The $65 million multi-storey fish farming facility, owned by the group’s subsidiary Apollo Aquarium, has been conditionally sold to local construction and engineering firm HPC Builders and Aquachamp, an investment holding company which has subsidiaries in the fish farming industry.

One of the directors of Aquachamp is also a director of AAG.

The acquisition is subject to approval from the Singapore Food Agency (SFA), among other conditions. SFA declined to respond to ST’s request for comment.

The facility, one of Singapore’s tallest fish farms, began operations in 2021, when it was showcased as a high-tech farming solution that addressed the Republic’s land-scarcity constraints.

However, it has been lying dormant since its parent company, AAG, ran into financial difficulties and was placed under judicial management in May 2022.

In early 2023, Apollo Aquarium ceased operations.

Judicial management is a form of debt restructuring which aims to prevent viable companies in financial difficulties from being liquidated.

In judicial management, an independent judicial manager is appointed to manage the affairs, business and property of a company under financial distress.

The Apollo group has a total of five subsidiary companies.

They are Apollo Aquarium; water technology firm Cube 2; Aquaworld Tropical Fish, a company involved in the ornamental fish industry; Smart Hatchery, which operates fish hatcheries, and Apollo Marine Seafood, which is involved in the retail sale of meat, poultry, eggs and seafood.

Of the five, only Apollo Aquarium is still live, while the other four companies have already entered into liquidation.

AAG’s judicial manager, Deloitte Singapore’s strategy, risks and transactions partner Tan Wei Cheong, said that the company’s financial challenges resulted largely from delays in the completion of the fish farm.

The delays had resulted in escalating costs and, in turn, affected the group’s revenue and operations, he added.

The group is divesting its stake in Apollo Aquarium as part of its restructuring.

Mr Tan said he was unable to comment further on the sale and purchase agreement as it is still being finalised.

According to media reports in 2021, the company aimed to farm hybrid grouper and coral trout on the first three storeys of its Lim Chu Kang facility, with an expected output of up to 1,000 tonnes of fish a year from 2021, before scaling up to 2,700 tonnes by 2023.

However, the company’s operations ceased in early 2023. Had it hit its target output, it would have significantly added to the 4,100 tonnes of seafood Singapore produced in 2023.

According to media reports in 2021, Apollo Aquarium wanted to farm hybrid grouper and coral trout at the first three storeys of its Lim Chu Kang facility. PHOTO: ST FILE

According to a filing on the Hong Kong stock exchange on May 31, 2024, HPC Builders will purchase 70 per cent of Apollo Aquarium’s equity, for not more than $3.5 million, while the remaining 30 per cent will be sold to Aquachamp.

HPC Builders’ parent company, HPC Holdings, is listed in Hong Kong.

As at March 31, the book value of the farm – including its equipment and machinery – was worth $44 million.

The multi-storey fish farm is said to be Apollo Aquarium’s “only significant asset”, according to the filing.

The three entities had entered into an agreement for HPC and Aquachamp to acquire Apollo Aquarium on May 31.

The sale will essentially allow HPC Holdings to invest in Singapore’s aquaculture industry at a “low cost”, according to the filing.

Aquachamp, which is an “experienced fish farm operator”, according to the bourse filing, will be in charge of the management and operations of the fish farm. ST has contacted the company for comment.

HPC Holdings said that the investment was done at a “bargain price”, and the fish farm will be able to “run at full production capacity, yielding favourable returns in the long run, with a stable sales income and a broadened revenue base”.

Checks by ST found that Aquachamp’s registered address is in the same location as an ornamental fish farm known as Max Koi Farm, situated close to the Apollo facility in Lim Chu Kang.

Accounting and Corporate Regulatory Authority (Acra) records show that Max Koi Farm is owned by Mr Ng Chuen Guan, who is also a director of Aquachamp, and a director of AAG, in which he owns close to 2.9 million shares.

AAG’s two largest shareholders are Ng Yong Hock Capital, which holds around 55.1 per cent of the company’s shares, and TLS Beta, which holds about 33.1 per cent of the shares, equivalent to $35 million of paid-up capital.

TLS Beta is a wholly owned subsidiary of Temasek Life Sciences, which is linked to Singapore’s investment company, Temasek.

Temasek declined to respond to queries from ST.

The remaining equity is owned by three companies and 14 people, with each of their equity stake ranging from approximately 0.1 per cent to 3.6 per cent, according to the filing.

The group’s subsidiary, Apollo Aquarium, is primarily involved in fish farming activities and the import and export of freshwater ornamental fish.

According to the filing by HPC Holdings, as at March 31, Apollo Aquarium’s unaudited debt stood at about $35.4 million.

Cargill TSF Asia, the financial services arm of the agricultural commodity giant, was listed as one of AAG’s creditors, according to Acra. ST has approached Cargill for comment.

ST has reached out to AAG chief executive Eric Ng for comment.

The farm said it would grow hybrid grouper and coral trout on the first three storeys of the building, with an initial target of 1,000 tonnes of fish per year.

Apollo Aquarium, which owns the fish farm facility, is not under any form of administration but is said to have stopped operations at the beginning of 2023.

HPC Builders will purchase 70 per cent of equity for not more than $3.5 million, while Aquachamp will purchase the remaining 30 per cent.

SFA will need to approve the sale and purchase of the equity between the companies.

HPC Builders will also need to reinstate part of the unused plots owned by Apollo Aquaculture.

Temasek declined to respond to queries from ST.

$65m fish farm to be sold at fraction of cost amid owner’s financial woes

The multi-storey fish farming facility has been conditionally sold to a local construction and engineering firm. ST PHOTO: KUA CHEE SIONG

Cheryl Tan

Correspondent

Oct 17, 2024

SINGAPORE - Two companies have conditionally agreed to purchase beleaguered Apollo Aquaculture Group’s (AAG) eight-storey fish farm in Lim Chu Kang, more than two years after the company ran into financial difficulties.

The $65 million multi-storey fish farming facility, owned by the group’s subsidiary Apollo Aquarium, has been conditionally sold to local construction and engineering firm HPC Builders and Aquachamp, an investment holding company which has subsidiaries in the fish farming industry.

One of the directors of Aquachamp is also a director of AAG.

The acquisition is subject to approval from the Singapore Food Agency (SFA), among other conditions. SFA declined to respond to ST’s request for comment.

The facility, one of Singapore’s tallest fish farms, began operations in 2021, when it was showcased as a high-tech farming solution that addressed the Republic’s land-scarcity constraints.

However, it has been lying dormant since its parent company, AAG, ran into financial difficulties and was placed under judicial management in May 2022.

In early 2023, Apollo Aquarium ceased operations.

Judicial management is a form of debt restructuring which aims to prevent viable companies in financial difficulties from being liquidated.

In judicial management, an independent judicial manager is appointed to manage the affairs, business and property of a company under financial distress.

The Apollo group has a total of five subsidiary companies.

They are Apollo Aquarium; water technology firm Cube 2; Aquaworld Tropical Fish, a company involved in the ornamental fish industry; Smart Hatchery, which operates fish hatcheries, and Apollo Marine Seafood, which is involved in the retail sale of meat, poultry, eggs and seafood.

Of the five, only Apollo Aquarium is still live, while the other four companies have already entered into liquidation.

AAG’s judicial manager, Deloitte Singapore’s strategy, risks and transactions partner Tan Wei Cheong, said that the company’s financial challenges resulted largely from delays in the completion of the fish farm.

The delays had resulted in escalating costs and, in turn, affected the group’s revenue and operations, he added.

The group is divesting its stake in Apollo Aquarium as part of its restructuring.

Mr Tan said he was unable to comment further on the sale and purchase agreement as it is still being finalised.

According to media reports in 2021, the company aimed to farm hybrid grouper and coral trout on the first three storeys of its Lim Chu Kang facility, with an expected output of up to 1,000 tonnes of fish a year from 2021, before scaling up to 2,700 tonnes by 2023.

However, the company’s operations ceased in early 2023. Had it hit its target output, it would have significantly added to the 4,100 tonnes of seafood Singapore produced in 2023.

According to media reports in 2021, Apollo Aquarium wanted to farm hybrid grouper and coral trout at the first three storeys of its Lim Chu Kang facility. PHOTO: ST FILE

According to a filing on the Hong Kong stock exchange on May 31, 2024, HPC Builders will purchase 70 per cent of Apollo Aquarium’s equity, for not more than $3.5 million, while the remaining 30 per cent will be sold to Aquachamp.

HPC Builders’ parent company, HPC Holdings, is listed in Hong Kong.

As at March 31, the book value of the farm – including its equipment and machinery – was worth $44 million.

The multi-storey fish farm is said to be Apollo Aquarium’s “only significant asset”, according to the filing.

The three entities had entered into an agreement for HPC and Aquachamp to acquire Apollo Aquarium on May 31.

The sale will essentially allow HPC Holdings to invest in Singapore’s aquaculture industry at a “low cost”, according to the filing.

Aquachamp, which is an “experienced fish farm operator”, according to the bourse filing, will be in charge of the management and operations of the fish farm. ST has contacted the company for comment.

HPC Holdings said that the investment was done at a “bargain price”, and the fish farm will be able to “run at full production capacity, yielding favourable returns in the long run, with a stable sales income and a broadened revenue base”.

Checks by ST found that Aquachamp’s registered address is in the same location as an ornamental fish farm known as Max Koi Farm, situated close to the Apollo facility in Lim Chu Kang.

Accounting and Corporate Regulatory Authority (Acra) records show that Max Koi Farm is owned by Mr Ng Chuen Guan, who is also a director of Aquachamp, and a director of AAG, in which he owns close to 2.9 million shares.

AAG’s two largest shareholders are Ng Yong Hock Capital, which holds around 55.1 per cent of the company’s shares, and TLS Beta, which holds about 33.1 per cent of the shares, equivalent to $35 million of paid-up capital.

TLS Beta is a wholly owned subsidiary of Temasek Life Sciences, which is linked to Singapore’s investment company, Temasek.

Temasek declined to respond to queries from ST.

The remaining equity is owned by three companies and 14 people, with each of their equity stake ranging from approximately 0.1 per cent to 3.6 per cent, according to the filing.

The group’s subsidiary, Apollo Aquarium, is primarily involved in fish farming activities and the import and export of freshwater ornamental fish.

According to the filing by HPC Holdings, as at March 31, Apollo Aquarium’s unaudited debt stood at about $35.4 million.

Cargill TSF Asia, the financial services arm of the agricultural commodity giant, was listed as one of AAG’s creditors, according to Acra. ST has approached Cargill for comment.

ST has reached out to AAG chief executive Eric Ng for comment.

Timeline of events:

April 18, 2018:

Apollo Aquarium is awarded two plots of land in Lim Chu Kang by the Singapore Food Agency (SFA). It paid $378,000 for the 1.56ha plot, and $587,000 for the 2.4ha plot. Both plots have a tenure of 20 years each.First quarter of 2021:

The eight-storey fish farm, which cost $65 million to build, begins operations in Lim Chu Kang. Its gross floor area is 55,214 sq m.The farm said it would grow hybrid grouper and coral trout on the first three storeys of the building, with an initial target of 1,000 tonnes of fish per year.

March 17, 2022:

Apollo Aquaculture Group, the parent company of Apollo Aquarium, is placed under interim judicial management.May 4, 2022:

Apollo Aquaculture Group enters into judicial managementFeb 4, 2023:

Apollo Aquaculture Group’s judicial managers, Mr Tan Wei Cheong and Mr Lim Loo Khoon of professional services firm Deloitte and Touche, said that the company is in talks with investors to rehabilitate the group.Apollo Aquarium, which owns the fish farm facility, is not under any form of administration but is said to have stopped operations at the beginning of 2023.

May 31, 2024:

According to a filing on the Hong Kong Stock Exchange, local construction and engineering firm HPC Builders and investment holding company Aquachamp, which has subsidiaries in the fish farming business, have conditionally agreed to buy Apollo Aquarium.HPC Builders will purchase 70 per cent of equity for not more than $3.5 million, while Aquachamp will purchase the remaining 30 per cent.

SFA will need to approve the sale and purchase of the equity between the companies.

HPC Builders will also need to reinstate part of the unused plots owned by Apollo Aquaculture.

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Singapore

The signboard of No Signboard Holdings' restaurant in Geylang. (File photo: Facebook/No Signboard Seafood Geylang)

SINGAPORE: The former executive chairman and CEO of restaurant operator No Signboard Holdings was fined S$420,000 (US$317,000) on Friday (Nov 1) for price rigging offences.

Lim Yong Sim pleaded guilty to three charges of false trading, said the Singapore Police Force (SPF) in a news release on Friday.

In June 2018, Lim purchased 4,331,200 No Signboard shares using the trading account of Gugong Pte Ltd. This was to falsely push up No Signboard’s share price.

“Lim was then the director and majority shareholder of Gugong, which was in turn a majority shareholder of No Signboard Holdings,” said SPF.

The police added that at the material time, Lim was under pressure from shareholders due to No Signboard’s declining share price.

The false trades lifted No Signboard’s share price by 27 per cent, from S$0.154 to S$0.196, against the backdrop of a decline of 1.69 per cent in the Straits Times Index during the same period.

The restaurant operator’s share price fell again afterwards, following the announcement of its 2018 financial year results. No Signboard's share price fell to S$0.137 after the results announced on Nov 29 revealed that it had registered a loss.

A day after the announcement, Lim began trading in No Signboard shares again.

Between Nov 30, 2018, and Jan 11, 2019, he bought 3,535,100 shares using Gugong's trading account. These trades were aimed at cushioning the fall of the restaurant operator’s share price.

“Lim’s trades supported No Signboard share price at around S$0.140 between Nov 30 and Dec 21, 2018, and at around S$0.130 between Jan 3 and Jan 11, 2019,” said SPF.

He also used No Signboard’s corporate share buyback account for “similar manipulative trades” on Jan 31, 2019, added the police.

Lim purchased 1,068,700 No Signboard shares the day before the release of the restaurant operator’s financial results for the first quarter of the 2019 financial year. The restaurant operator had again recorded a loss.

Lim's trades were to “cushion the selling pressure that would likely follow from the imminent announcement”, said SPF.

The purchases were made above the price limit of No Signboard Holding’s share buyback mandate and raised its share price by 15.7 per cent over the previous day’s close.

“This far exceeded the movement in the STI, which rose only 0.50 per cent that day,” said the police.

Lim was arrested in April 2019 due to suspicions that he had breached sections under the Securities and Futures Act. He was charged in July last year for price rigging offences.

After his charging, No Signboard Holdings announced that Lim was suspended from all his executive duties.

Former No Signboard Holdings CEO fined S$420,000 for false trading

Under pressure from shareholders due to No Signboard Holdings' declining share price, Lim Yong Sim made false trades in 2018 and 2019.

The signboard of No Signboard Holdings' restaurant in Geylang. (File photo: Facebook/No Signboard Seafood Geylang)

Rachel Lim

01 Nov 2024 08:32PMSINGAPORE: The former executive chairman and CEO of restaurant operator No Signboard Holdings was fined S$420,000 (US$317,000) on Friday (Nov 1) for price rigging offences.

Lim Yong Sim pleaded guilty to three charges of false trading, said the Singapore Police Force (SPF) in a news release on Friday.

In June 2018, Lim purchased 4,331,200 No Signboard shares using the trading account of Gugong Pte Ltd. This was to falsely push up No Signboard’s share price.

“Lim was then the director and majority shareholder of Gugong, which was in turn a majority shareholder of No Signboard Holdings,” said SPF.

The police added that at the material time, Lim was under pressure from shareholders due to No Signboard’s declining share price.

The false trades lifted No Signboard’s share price by 27 per cent, from S$0.154 to S$0.196, against the backdrop of a decline of 1.69 per cent in the Straits Times Index during the same period.

The restaurant operator’s share price fell again afterwards, following the announcement of its 2018 financial year results. No Signboard's share price fell to S$0.137 after the results announced on Nov 29 revealed that it had registered a loss.

A day after the announcement, Lim began trading in No Signboard shares again.

Between Nov 30, 2018, and Jan 11, 2019, he bought 3,535,100 shares using Gugong's trading account. These trades were aimed at cushioning the fall of the restaurant operator’s share price.

“Lim’s trades supported No Signboard share price at around S$0.140 between Nov 30 and Dec 21, 2018, and at around S$0.130 between Jan 3 and Jan 11, 2019,” said SPF.

He also used No Signboard’s corporate share buyback account for “similar manipulative trades” on Jan 31, 2019, added the police.

Lim purchased 1,068,700 No Signboard shares the day before the release of the restaurant operator’s financial results for the first quarter of the 2019 financial year. The restaurant operator had again recorded a loss.

Lim's trades were to “cushion the selling pressure that would likely follow from the imminent announcement”, said SPF.

The purchases were made above the price limit of No Signboard Holding’s share buyback mandate and raised its share price by 15.7 per cent over the previous day’s close.

“This far exceeded the movement in the STI, which rose only 0.50 per cent that day,” said the police.

Lim was arrested in April 2019 due to suspicions that he had breached sections under the Securities and Futures Act. He was charged in July last year for price rigging offences.

After his charging, No Signboard Holdings announced that Lim was suspended from all his executive duties.

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

CapitaLand warns of China losses as Singapore property investor cuts exposure

CapitaLand's current exposure to China is 27 per cent of its $113 billion in funds. PHOTO: LIANHE ZAOBAO

Nov 22, 2024

SINGAPORE – CapitaLand Investment, one of Asia’s largest property investment managers, warned of potential losses as it seeks to extricate itself from China’s real estate crisis.

The Singapore-listed firm wants to reduce its exposure in the world’s second-largest economy to 10-20 per cent of its expected $200 billion in funds under management by 2028, it said in an investor day presentation on Nov 22.

In doing so, the company may incur “potential fair value or divestment losses” that impact near-medium term non-operating earnings, it added.

Its current exposure to China is 27 per cent of its $113 billion in funds.

The listed investment arm of CapitaLand Group, which is owned by Singapore state investor Temasek, has long been a major investor in China, but a years-long property downturn there has made these bets, spanning from office space to malls, turn sour.

These struggles have hit the company’s stock, which is down almost 12 per cent in 2024 compared with a 16 per cent gain in the Straits Times Index.

Selling its property in China has been difficult, with the bulk of the $4.6 billion divestments in 2024 up to early November coming from Singapore and other countries like Japan.

CapitaLand Investment is seeking to more than double its operating earnings to more than $1 billion by 2028-2030, and could do new real estate investment trust listings in Australia, China and India, it said in the presentation.

So far, it has sought to increase its exposure elsewhere, including most recently announcing it will buy out SC Capital Partners Group, a Japan-focused property investor.

CapitaLand Investment’s management said in an analyst call earlier in November that it hopes to divest about $1 billion in China in 2024, according to a Citigroup Nov 6 note, which added that it estimates the company has just sold about $300 million so far.

Citigroup also said that the Singapore firm is aiming to divest about $3.5 billion Chinese assets on its balance sheet over three years, although it will stop giving divestment targets in 2025. BLOOMBERG

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

65 Equity Partners buys stake in Tuya for $134m, aims to list IOT specialist on SGX

65 Equity Partners CEO Tan Chong Lee said the investment aligns strategically with the fund’s mandate of supporting high quality businesses seeking a listing on SGX. PHOTO: 65 EQUITY PARTNERS

Ven Sreenivasan

Senior Columnist

Nov 19, 2024

SINGAPORE - In a move which could attract another listing to the Singapore bourse, Temasek-backed global investment firm 65 Equity Partners is buying into Hong Kong- and New York-listed internet of things (IOT) specialist Tuya Inc.

The deal will see the Singapore fund becoming a 13 per cent owner in Tuya via an investment of US$100 million (S$134 million).

It is buying the stake from venture capital firm New Enterprise Associates.

Tuya is a specialist in producing software which enables household devices to connect or “speak” with each other in a “smart” way.

It had revenue of US$135 million for the first half of 2024 (full-year 2023 revenue was US$230 million) and a market capitalisation of over US$1 billion.

Speaking to The Straits Times, 65 Equity Partners chief executive Tan Chong Lee said the investment aligns strategically with the fund’s mandate of supporting high-quality businesses seeking a listing on the Singapore Exchange (SGX).

“We are investing in high growth, mid-cap companies which are suited for listing on the Singapore market. These would ideally be those in the US$1 billion to US$3 billion range,” he said.

Mr Tan said 65 Equity Partners can help create liquidity for Tuya on the SGX, including by selling some of its shares back into the market if necessary. This would generate institutional and retail interest in a potential listing.

“Very often, secondary listings remain illiquid and unnoticed,” Mr Tan said. “Our mission is to come up with solutions to boost liquidity so that these companies gain a following and attract coverage.”

Established in October 2021, with some $4.5 billion of funds under management, and offices in Singapore, London and San Francisco, 65 Equity Partners invests in established family-owned and founder-led businesses in South-east Asia, Europe and the US across the consumer, industrials, business services, healthcare and technology sectors.

In Singapore, it holds stakes in listed corporate secretarial services company BoardRoom, while in Malaysia it has a stake in car e-commerce platform Carsome.

It is also an investor in Singapore-based immersive exhibition services specialist Neon, and shopping and rewards platform ShopBack. In the US, it has bought into lifestyle group Kendra Scott and custom-engineered appliance designer Felix Storch Inc.

Tuya is the second company, after Nasdaq-listed AvePoint, which the Singapore fund has invested in with the objective of a secondary listing on the SGX.

Having purchased a 10 per cent stake in AvePoint in 2023, 65 Equity Partners is also planning to lead the company to a secondary listing on the local bourse within the next two years.

Mr Tan said the existing geopolitical circumstances have made Singapore an increasingly attractive primary and secondary listing location for global companies.

“For global businesses, Singapore Exchange is a neutral venue. They can become a true multinational with their global headquarters in Singapore. One of the key things we seek to do is value add to these Singapore secondary listings.”

Temasek-backed 65 Equity Partners invests $100m in local contract manufacturer Hi-P

Temasek sets up 65 Equity Partners with $4.5b to invest in enterprises with regional, global ambitions

Tuya’s founder and CEO Jerry Wang said this investment reflects 65 Equity Partners’ confidence in his company’s vision to capture growing international markets as the key enabler of global IOT, intelligent devices, commercial and industry applications.

“The Asia-Pacific region, particularly South-east Asia, represents an enormous opportunity for us as it is a fast-growing emerging market,” he said.

“We believe the investment from 65 Equity Partners aligns seamlessly with our international expansion strategy and offers possibilities for a future additional listing on the Singapore Exchange, which will further enhance Tuya’s presence in the global capital markets.”

Of Tuya’s current shareholders, 15 per cent are China-based investors, 15 per cent are US investors and 35 per cent are Europeans. The rest of the shareholding is spread through Asia and Latin America.

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

ST Explains: What are the Adani indictments, and how do they affect S’pore’s financial sector?

The indictment wiped out US$27 billion in market value in the listed companies under the Adani Group umbrella when it was first announced.PHOTO: REUTERS

Sue-Ann Tan

Nov 26, 2024

SINGAPORE - Indian billionaire Gautam Adani is one of the world’s richest people, heading the country’s largest conglomerate Adani Group, which in 2020 won a bid to supply eight gigawatts of electricity to a state-owned firm through its renewable energy arm, Adani Green Energy.

That deal was what Adani called the single largest solar development bid ever awarded.

But all this was called into question when US prosecutors alleged a bribery scheme in criminal and civil charges related to the bid, unsealed on Nov 20.

US prosecutors alleged that Mr Adani and seven others, including his nephew, promised to pay bribes to Indian government officials to win solar energy contracts.

The bribes are said to be over US$250 million (S$336.5 million) for solar contracts worth an estimated US$2 billion over 20 years. The prosecutors alleged that this plan was concealed as the group tried to raise money from US investors.

The Adani Group denied the charge, saying the allegations were “baseless”. It said it will seek all possible legal recourse to defend itself.

The indictment wiped out US$27 billion in market value in the listed companies under the Adani Group umbrella when it was first announced. The group has businesses spanning ports, airports, manufacturing and energy.

The saga has hit the global financial sector, affecting businesses like French oil firm TotalEnergies, which holds a stake in Adani Green Energy, as well as some 770 environmental, social and governance (ESG) funds that hold its shares.

Could lenders and investors have been forewarned of the crisis? What implications does it have on the financial sector here?

Investors exposed to Adani’s listed companies could feel a financial pinch if the shares lose market value as a result of reputational damage, said corporate governance expert Lawrence Loh. Professor Loh is the director for the centre of governance and sustainability at the National University of Singapore (NUS).

Adani Group saw some of its bonds being put on watch for a possible downgrade by ratings agency Fitch, Reuters reported on Nov 26.

Fitch said Adani Energy Solutions, Adani Electricity Mumbai and some of Adani Ports and Special Economic Zone rupee and dollar bonds are now on “watch negative”. Ratings on four Adani subsidiary senior unsecured US dollar bonds were downgraded from stable to negative, the agency added.

Governance advocate Professor Mak Yuen Teen of the NUS said banks that might have lent money to Adani companies run the risk of these firms being unable to service their loans due to loss of business or loss of access to capital.

It is unlikely the credit ratings of banks would be affected unless they have big exposures, he added.

But 770 ESG funds that hold Adani Green shares could see their holdings affected. According to Bloomberg, these funds oversee about US$400 billion and some of them are managed by the world’s largest asset managers.

ESG funds are investment funds that focus on companies that meet specific ESG criteria. ESG fund managers are expected to take extra measures to protect clients from risks. Such funds are also available to investors in Singapore.

Prof Mak said: “It is unfortunate that this case may be cited by opponents of ESG-investing to further push back against such investing.” He noted that Adani Green was doing rather well in most ESG ratings and that was why it was included as a component in many of such funds.

“The problem with ESG ratings is that by combining the E, S and G in one rating, poor corporate governance may be overshadowed by a company’s scores for other aspects – in Adani Green’s case, the ‘environment’ aspect,” he added.

“This is yet another example of why an assessment of a company’s sustainability must start with governance first... poor governance may ultimately still cause a company’s value to be destroyed.”

Prof Loh said: “The Adani case serves as yet another key lesson in the authenticity of ESG funds and the need for better global investment regulatory enforcement and coordination.”

So far, the local banking sector’s overall exposure to Adani Group is small, according to a Nov 25 statement by the Monetary Authority of Singapore.

Adani Group runs an edible oil and food business in India through a joint venture with Singapore-listed Wilmar International. Shares of Adani Wilmar, which is listed in India, have fallen since the indictment on Nov 20.

When contacted, Wilmar International declined to comment.

Aletheia Capital analyst Nirgunan Tiruchelvam is already reinforcing his sell recommendation on Wilmar International.

Wilmar International holds a 50 per cent stake in the Adani Wilmar joint venture, with Adani Enterprises holding the other 50 per cent. Mr Tiruchelvam noted that the two companies were planning to sell a minority stake in Adani Wilmar to comply with Indian securities laws.

“The sale would have involved selling a roughly 13 per cent interest in the company, which would have been valued at about US$736 million. The recent controversy may complicate and delay these plans,” he noted in a Nov 26 report.

It was reported in October 2022 that Adani was in early discussions with investors that included Temasek and Singapore sovereign wealth fund GIC to raise at least US$10 billion to fund Adani Group’s expansion into clean energy, ports and cement businesses.

Temasek has since let go of its positions in Adani. GIC declined to comment when contacted by ST.

Experts said the Adani case serves as a wake-up call to the finance sector and should prompt financial institutions to reassess their risk evaluation frameworks.

This is especially relevant to Singapore as a major Asian financial hub with significant exposure to emerging market investments, said Associate Professor Ben Charoenwong from Insead Singapore.

He said the finance sector can strengthen due diligence processes by integrating research with macro views, to understand underlying governance structures.

It can also develop an ESG evaluation framework that gives enough weight to governance factors, as well-governed firms usually deliver good performance for investors, as well as less negative social and environmental outcomes.

“Third, enhance cross-border cooperation in regulatory oversight. Given Singapore’s position as a global financial hub, taking the lead in developing stronger international governance standards could be beneficial for the entire sector,” he said.

Companies should be aware of the “herding mentality” whereby firms might feel that a very large company like Adani cannot possibly get into trouble. This mentality can be strengthened by the pressure on companies to engage in the green economy, he said.

“Moreover, as investors herd into the company, other foreign investors who may have less information are also less likely to go through their own costly due diligence process and instead follow the herd,” he said.

He noted that there were already negative reports about Adani group business practices.

“It’s akin to finding a hair in your soup. While one instance might not be immediately harmful or ruin that dish’s taste, it raises questions about the entire kitchen’s operations overall,” he said.

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Indonesian unicorn eFishery allegedly faked most of its sales

Indonesian start-up eFishery has raised hundreds of millions of dollars in an attempt to modernise the country’s fish industry.PHOTO: BLOOMBERG

Jan 22, 2025

Singapore – One of Indonesia’s most prominent start-ups, eFishery, may have inflated its revenue and profit over several years, according to an internal investigation triggered by a whistle-blower’s claim about the company’s accounting.

A preliminary, ongoing probe into the agritech start-up – backed by investors, including Japan’s SoftBank Group and Singapore’s Temasek – estimates that management inflated revenue by almost US$600 million (S$811 million) in the nine months through September in 2024, according to a 52-page draft report circulated among investors and reviewed by Bloomberg News. That would mean more than 75 per cent of the reported figures were fake, the report said.

The company, which deploys feeders to fish and shrimp farmers in Indonesia, was a darling of the nation’s start-up scene and turned unicorn with a valuation of US$1.4 billion when G42, an artificial intelligence firm controlled by the United Arab Emirates royal, Sheikh Tahnoun bin Zayed Al Nahyan, backed its latest funding round. Unicorns are start-ups that reach a valuation of US$1 billion and are not listed on the stock market.

The start-up has raised hundreds of millions of dollars in an attempt to modernise the country’s fish industry, providing farmers with smart feeding devices as well as feed and then buying their produce to sell into the broader market.

Investors were initially enticed by its profitability at a time when layoffs, chief executive officer resignations and plummeting valuations in the tech sector dominated headlines. It presented a US$16 million profit for the first nine months of 2024 to investors, but the investigation commissioned by the board alleges the firm actually generated a US$35.4 million loss.

Revenue for the period was estimated at US$157 million, rather than the US$752 million investors were told, according to the report. Management also inflated revenue and profit numbers for several previous years, the report said.

The report was initiated after a whistle-blower approached a board member with allegations that the accounts were not accurate, according to people familiar with the matter.

The board then commissioned a formal investigation in December, and dismissed co-founder and CEO Gibran Huzaifah after the accounting inconsistencies were discovered, the people said.

“We are fully aware of the gravity of the market speculation, and we take this matter with the utmost seriousness,” eFishery said in an e-mailed statement.

“We remain dedicated to upholding the highest standards of corporate governance and ethics in all of eFishery’s operations.”

The report, authored by FTI Consulting, is marked as a draft and subject to further changes as the investigation continues. It is based on more than 20 interviews with company staff and reviews of accounts and messages on WhatsApp, Slack and other channels, according to the report.

The draft report notes that investigators have yet to speak to the auditors or review any audit work papers or other documentation. The numbers are likely to change further, with bank statements, interviews and other accounts still yet to be found or completed.

Mr Huzaifah did not respond to messages seeking comment. Temasek and SoftBank declined to comment, while representatives of FTI and G42 did not immediately respond to queries.

Shareholders and directors have been surprised at the scale of the alleged fraud given the protective measures that were put in place, including channel checks and exit interviews of staff, one of the people said.

The company had previously hired PricewaterhouseCoopers and Grant Thornton to audit financial results. The two accounting firms declined to comment via email.

Investor calls have been taking place since the investigation began, and the key question will be what to do with the company’s assets and remaining cash, one of the people said.

While eFishery said it had more than 400,000 fish feeders in operation, initial investigations estimate it only had about 24,000.

In total, internal books show retained losses at roughly US$152 million from its inception until November 2024. While the total assets of the firm stand at US$220 million, this includes US$63 million in accounts receivable and US$98 million in investments, according to the report.

The allegations of fraud may be damaging for Indonesia’s start-up scene and come at a critical time as young companies and investors in the country struggle to raise new funding. The company was the nation’s latest so-called unicorn, or a start-up valued at more than US$1 billion. BLOOMBERG

- Joined

- Oct 5, 2018

- Messages

- 17,545

- Points

- 113

Singapore has a similar con job called "Barramundi Group". The business survived on government grants arranged by insiders who were former employees of BG's directors.Indonesian unicorn eFishery allegedly faked most of its sales

Indonesian start-up eFishery has raised hundreds of millions of dollars in an attempt to modernise the country’s fish industry.PHOTO: BLOOMBERG

Jan 22, 2025

Singapore – One of Indonesia’s most prominent start-ups, eFishery, may have inflated its revenue and profit over several years, according to an internal investigation triggered by a whistle-blower’s claim about the company’s accounting.

A preliminary, ongoing probe into the agritech start-up – backed by investors, including Japan’s SoftBank Group and Singapore’s Temasek – estimates that management inflated revenue by almost US$600 million (S$811 million) in the nine months through September in 2024, according to a 52-page draft report circulated among investors and reviewed by Bloomberg News. That would mean more than 75 per cent of the reported figures were fake, the report said.

The company, which deploys feeders to fish and shrimp farmers in Indonesia, was a darling of the nation’s start-up scene and turned unicorn with a valuation of US$1.4 billion when G42, an artificial intelligence firm controlled by the United Arab Emirates royal, Sheikh Tahnoun bin Zayed Al Nahyan, backed its latest funding round. Unicorns are start-ups that reach a valuation of US$1 billion and are not listed on the stock market.

The start-up has raised hundreds of millions of dollars in an attempt to modernise the country’s fish industry, providing farmers with smart feeding devices as well as feed and then buying their produce to sell into the broader market.

Investors were initially enticed by its profitability at a time when layoffs, chief executive officer resignations and plummeting valuations in the tech sector dominated headlines. It presented a US$16 million profit for the first nine months of 2024 to investors, but the investigation commissioned by the board alleges the firm actually generated a US$35.4 million loss.

Revenue for the period was estimated at US$157 million, rather than the US$752 million investors were told, according to the report. Management also inflated revenue and profit numbers for several previous years, the report said.

The report was initiated after a whistle-blower approached a board member with allegations that the accounts were not accurate, according to people familiar with the matter.

The board then commissioned a formal investigation in December, and dismissed co-founder and CEO Gibran Huzaifah after the accounting inconsistencies were discovered, the people said.

“We are fully aware of the gravity of the market speculation, and we take this matter with the utmost seriousness,” eFishery said in an e-mailed statement.

“We remain dedicated to upholding the highest standards of corporate governance and ethics in all of eFishery’s operations.”

The report, authored by FTI Consulting, is marked as a draft and subject to further changes as the investigation continues. It is based on more than 20 interviews with company staff and reviews of accounts and messages on WhatsApp, Slack and other channels, according to the report.

The draft report notes that investigators have yet to speak to the auditors or review any audit work papers or other documentation. The numbers are likely to change further, with bank statements, interviews and other accounts still yet to be found or completed.

Mr Huzaifah did not respond to messages seeking comment. Temasek and SoftBank declined to comment, while representatives of FTI and G42 did not immediately respond to queries.

Shareholders and directors have been surprised at the scale of the alleged fraud given the protective measures that were put in place, including channel checks and exit interviews of staff, one of the people said.

The company had previously hired PricewaterhouseCoopers and Grant Thornton to audit financial results. The two accounting firms declined to comment via email.

Investor calls have been taking place since the investigation began, and the key question will be what to do with the company’s assets and remaining cash, one of the people said.

While eFishery said it had more than 400,000 fish feeders in operation, initial investigations estimate it only had about 24,000.

In total, internal books show retained losses at roughly US$152 million from its inception until November 2024. While the total assets of the firm stand at US$220 million, this includes US$63 million in accounts receivable and US$98 million in investments, according to the report.

The allegations of fraud may be damaging for Indonesia’s start-up scene and come at a critical time as young companies and investors in the country struggle to raise new funding. The company was the nation’s latest so-called unicorn, or a start-up valued at more than US$1 billion. BLOOMBERG

https://www.straitstimes.com/singap...a-bass-in-s-pore-due-to-deadly-virus-outbreak

- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

SoftBank, Temasek among eFishery investors facing near wipeout

The labour union of eFishery staged a protest attended by more than 100 employees in January at its headquarters in Bandung, Indonesia.PHOTO: EFISHERY WORKERS' UNION

Feb 24, 2025

Investigators hired by the board of eFishery have determined the Indonesian start-up is in far worse shape than they previously thought, and that investors are likely to get back less than 10 US cents (13 Singapore cents) for every dollar they invested, according to documents seen by Bloomberg News.

The company, which deploys feeders to fish and shrimp farmers in Indonesia, incurred several hundred million dollars in losses between 2018 and 2024 and misrepresented its financial figures for years, according to the documents and a person familiar with the matter who asked not to be identified because the information isn’t public.

“eFishery is not commercially viable in its current form,” said a presentation prepared for the firm’s investors by FTI Consulting Singapore, the adviser hired to review the business and take over management of the company.

The fallen start-up, whose financial backers include SoftBank Group and Singapore’s Temasek Holdings, had been a star of Indonesia’s start-up scene. eFishery was valued at US$1.4 billion in 2023 after it raised US$200 million from Abu Dhabi’s 42XFund and some of its earlier investors.

In all, global investors plowed around US$315 million into eFishery’s preferred shares over five funding rounds, according to the presentation. In late 2024, the company was rocked by allegations of misconduct and inflated sales and profits, which led to the dismissal of its co-founders Gibran Huzaifah and Chrisna Aditya.

The FTI presentation estimated that eFishery had around US$50 million in cash as of around mid-February, and recommended that much of the business be wound down. “The cash balance continues to deplete without a restructuring plan in place,” it said.

That’s bad news for preference shareholders, all of whom would be paid back on an equal, or pari passu basis in the event of a liquidation. The investors could get back 9.5 US cents on the dollar under an “optimistic scenario”, and just 8.3 US cents on the dollar under a “conservative scenario, according to the presentation. That would mean Abu Dhabi’s G42, which invested US$100 million in the April 2023 round, may get just US$8.3 million back less than two years later.

A spokesperson for FTI Consulting declined to comment. SoftBank didn’t immediately respond to a request for comment outside regular business hours, while a Temasek spokesperson declined to comment. G42 didn’t immediately respond to an e-mailed request for comment.

Before its downfall, eFishery said its business revolved around installing AI-driven smart fish feeders, sensors and automated supply chains that connected farmers to buyers via smartphone apps. It also helped farmers obtain financing from peer-to-peer lenders and financial institutions to pay for their feed and operational costs.

The company had claimed to have more than 400,000 fish feeders deployed, and investigators initially estimated the number was closer to 24,000. The current estimate is just 6,300, of which only 600 are sending back data, according to the presentation.

The investigators also found that there was a high default rate on the financing arrangements, and that eFishery bears all losses when farmers fail to repay their loans. “In theory, the proceeds from the harvest or cash collected from farmers should be repaid back to the lenders,” the presentation said. “In practice, however, eFishery faced significant challenges when it comes to collection from borrowers.”

Hampering the debt collection process were the huge distances and fragmented nature of Indonesia’s developing economy, where almost 10 per cent of the population lives below the poverty line. About 76 per cent of eFishery’s US$68 million in accounts receivable were deemed as bad debt more than 60 days overdue, with the company ultimately liable for the bulk of loans it facilitated with banks, according to the presentation.

“Substantial costs would need to be incurred to realise or recover these outstanding amounts from borrowers who are scattered all across the country,” it said.

The company’s fish and shrimp businesses were operating on thin margins and “severely loss making”, the presentation said. Key apps were not connected to eFishery’s accounting systems, and many farmers were manually matched with buyers, the investigators found.

Much of the advanced technology that the firm touted did not work as claimed, according to the presentation. None of eFishery’s PondTag sensors that were supposed to help remotely judge water quality and automate fish and shrimp feeders had been deployed. The limited data collection meant fish feed predictions were wrong almost half the time, the document said.

In essence, eFishery was “operating like a traditional trading business without technology”, the presentation said, noting that this helped explain the company’s large workforce of almost 2,600 employees at its peak in early 2024. Following mass job cuts since the start of this year, the company has roughly 200 staff. BLOOMBERG

- Joined

- May 16, 2023

- Messages

- 35,414

- Points

- 113

Temasek, SoftBank among eFishery investors facing near wipeout

BloombergTue, 25 February 2025 at 10:29 AM SGT5-min read

Indonesian startup eFishery incurred several hundred million dollars in losses between 2018 and 2024 and misrepresented its financial figures for years, according to the documents and a person familiar with the matter who asked not to be identified because the information isn’t public. (Photo: Dimas Ardian/Bloomberg) (Bloomberg)More

By David Ramli and Olivia Poh

(Bloomberg) — Investigators hired by the board of eFishery Pte. have determined the Indonesian startup is in far worse shape than they previously thought, and that investors are likely to get back less than 10 cents for every dollar they invested, according to documents seen by Bloomberg News.

The company, which deploys feeders to fish and shrimp farmers in Indonesia, incurred several hundred million dollars in losses between 2018 and 2024 and misrepresented its financial figures for years, according to the documents and a person familiar with the matter who asked not to be identified because the information isn’t public.

How come during due diligence can't detect all these? (Genuine question.... asking auditor and M&A type samsters)SoftBank, Temasek among eFishery investors facing near wipeout

The labour union of eFishery staged a protest attended by more than 100 employees in January at its headquarters in Bandung, Indonesia.PHOTO: EFISHERY WORKERS' UNION

Feb 24, 2025

Investigators hired by the board of eFishery have determined the Indonesian start-up is in far worse shape than they previously thought, and that investors are likely to get back less than 10 US cents (13 Singapore cents) for every dollar they invested, according to documents seen by Bloomberg News.

The company, which deploys feeders to fish and shrimp farmers in Indonesia, incurred several hundred million dollars in losses between 2018 and 2024 and misrepresented its financial figures for years, according to the documents and a person familiar with the matter who asked not to be identified because the information isn’t public.

“eFishery is not commercially viable in its current form,” said a presentation prepared for the firm’s investors by FTI Consulting Singapore, the adviser hired to review the business and take over management of the company.

The fallen start-up, whose financial backers include SoftBank Group and Singapore’s Temasek Holdings, had been a star of Indonesia’s start-up scene. eFishery was valued at US$1.4 billion in 2023 after it raised US$200 million from Abu Dhabi’s 42XFund and some of its earlier investors.

In all, global investors plowed around US$315 million into eFishery’s preferred shares over five funding rounds, according to the presentation. In late 2024, the company was rocked by allegations of misconduct and inflated sales and profits, which led to the dismissal of its co-founders Gibran Huzaifah and Chrisna Aditya.