Minister K Shanmugam transfers Astrid Hill GCB to UBS Trustees for S$88 Million following Ridout Road controversy

In August 2023, Minister K Shanmugam transferred ownership of his Good Class Bungalow at 6 Astrid Hill for S$88 million. This transfer followed shortly after his parliamentary address, where he addressed questions about his rental of the state-owned Ridout Road property.

12 September 2024

By

The Online Citizen

In August 2023, records from the Singapore Land Authority (SLA) revealed that Minister for Home Affairs and Law, K Shanmugam, transferred ownership of his Good Class Bungalow (GCB) at 6 Astrid Hill to UBS Trustees (Singapore) Ltd, for a staggering S$88,000,000.

UBS Trustees, acting as a trustee for The Jasmine Villa Settlement, is a trust company licensed under the Trust Companies Act 2005.

The transaction was facilitated by Ms Ho Sheau Farn on behalf of UBS Trustees and Mr Ho Kin San representing Mr Shanmugam, both lawyers from Allen & Gledhill, the law firm where Mr Shanmugam previously practised.

The property, spanning 3,170.7 square meters, was originally purchased by Mr Shanmugam in December 2003 for S$7,950,000, reflecting a significant increase in value over two decades. Located in District 10, which is commonly associated with Singapore’s most affluent residential estates, the property’s value aligns with the area’s reputation for high-end luxury homes and prime real estate.

S$150 Million Total Cost for UBS Trustees Property Transfer

The transfer of the property valued at S$88,000,000 to UBS Trustees would involve significant stamp duties. Based on current buyer’s stamp duty (

BSD) rates, the BSD alone amounts to S$5,219,600.

Additionally, given the 65% additional buyer’s stamp duty (

ABSD) applicable for such transactions, UBS Trustees would have to pay an additional S$57,200,000. In total, the transfer would require UBS Trustees to pay a staggering S$150,419,600, including the property price, BSD, and ABSD.

However, UBS Trustees may also be eligible to seek a

remission of the 65% additional buyer’s stamp duty (ABSD) under certain conditions.

If the property is held in trust for identifiable individual beneficiaries, part or all of the ABSD (Trust) paid could be refunded. The amount refunded would depend on the difference between the 65% ABSD (Trust) paid and the ABSD applicable based on the highest profile of the individual beneficiaries.

To qualify for this remission, the application must be submitted within six months of the transfer’s execution, and the beneficiaries must meet strict criteria.

For instance, beneficiaries must be explicitly named in the declaration of trust and must have irrevocable beneficial ownership of the property. The remission process does not apply to individuals with contingent or discretionary interests, or those entitled only to income from the property.

It is unclear whether UBS Trustees applied for or was granted any remission of the 65% ABSD under the outlined conditions.

Despite the high-value transaction, the transfer between Mr Shanmugam and UBS Trustees did not appear in the Urban Redevelopment Authority’s (URA) Private Residential Property Transactions database and was not reported by property market monitors, possibly due to the nature of the transaction involving a transfer to a trust.

Such trust arrangements are commonly used for asset management and estate planning purposes, though they can raise questions about the tax implications of transferring high-value properties through these structures.

According to available records, the mortgage on the property was fully paid off by Mr Shanmugam by the end of 2008. Notably, no mortgage was taken by UBS Trustees following the transfer, which suggests that the payment for the property may have been made in cash.

Sale of GCB following explanation by Minister of his Ridout Road rental

This transfer came just weeks after Mr Shanmugam’s

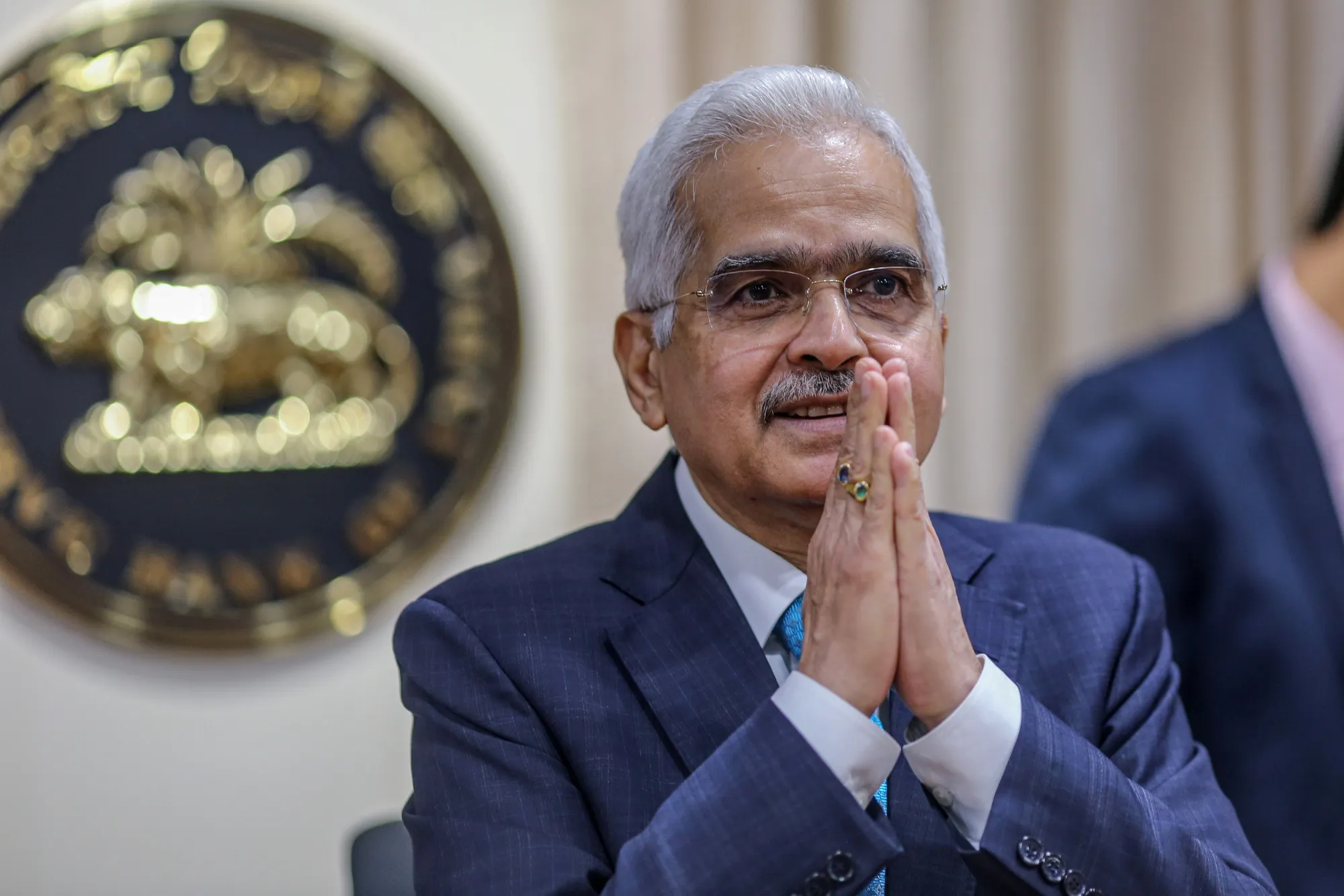

ministerial statement in July 2023, where he addressed concerns raised by Members of Parliament (MPs) regarding his rental of the state-owned property at 26 Ridout Road, a black-and-white colonial bungalow leased from the SLA.

MPs questioned his decision to rent the property, seeking details about the rental price, the size of the land, and any potential conflicts of interest, particularly as Mr Shanmugam, in his capacity as Minister for Law, oversees the SLA, which manages these properties.

In his statement, Mr Shanmugam explained that as he approached his 60s in 2016, he reviewed his finances and realized that too much of his savings were tied up in his family home. As a result, he put the property on the market and moved into a rental home.

“I did not consider selling my own home because of financial need,” he emphasized, explaining that his decision was based on prudent financial planning. He also clarified that while he rented 26 Ridout Road, he was renting out his family home but was not profiting after factoring in property taxes and other expenses.

The fact that Mr Shanmugam transferred his home for S$88 million after expressing concerns about his financial situation raises questions about how much of his savings were truly tied up in the property, considering the substantial value of the transfer. However, it is important to note that the transfer occurred in August 2023, after his ministerial statement in July, meaning his remarks were accurate at the time.

Regarding the Ridout Road property, which Mr Shanmugam rented for S$26,500 per month, the land size increased from 9,350 square meters to 23,164 square meters—significantly larger than the 3,170.7 square meters of the Astrid Hill GCB that he transferred to UBS Trustees.

This expansion was a result of negotiations between Mr Shanmugam and SLA.

According to the Corrupt Practices Investigation Bureau’s

independent investigation, Mr Shanmugam initially offered to maintain the adjacent land at his own cost if SLA cleared the vegetation. However, he preferred to exclude the land from his tenancy, as including it would impose legal obligations on him, such as responsibility for mosquito breeding or other maintenance issues.

SLA, on the other hand, preferred to include the adjacent land within the property boundary to ensure that the tenant bore responsibility for its maintenance and legal obligations. SLA negotiated an agreement with Mr Shanmugam in which the adjacent land was included within the property boundary, and the tenant was made responsible for maintaining it. This arrangement was said to ensure that the legal responsibilities were clear, with the tenant assuming both the cost and the liability.

Given Mr Shanmugam’s role overseeing the SLA, concerns about a potential conflict of interest were raised. However, in a parliamentary statement delivered by Senior Minister Teo Chee Hean in July 2023, it was clarified that Mr Shanmugam had recused himself from the decision-making process.

SM Teo

stated:

“Minister Shanmugam had removed himself from the chain of command and decision-making process entirely… CPIB established that there was no matter raised by SLA to MinLaw [Ministry of Law] and hence, to any of the Ministers during the entire rental process.”

SM Teo also noted that the Chief Executive of SLA had declared in March 2018 to the then Permanent Secretary of MinLaw that the rental process for 26 Ridout Road was carried out properly and that the rental price was in line with market rates, as assessed by SLA valuers.

Mr Shamugam’s wife, Mrs Shanmugam, signed the Tenancy Agreement for 26 Ridout Road in June 2018, with a lease term of 3+3+3 years. After the first three-year term, the tenancy was renewed in 2021, with the rent maintained at S$26,500 per month, in line with market conditions as determined by SLA.

The Online Citizen has reached out to Mr Shanmugam for comments on the transfer of his property. As of the time of publication, no response has been received. Should further remarks be provided, this article will be updated accordingly.