Your cock says banks refrain from lending. They are actually scared when people dowan to borrow. UOB just issued a .01 euro bond. They are ready to splurge on lending big.

-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chitchat I feel the earth move.... property crash tumbling down coming soon...

- Thread starter tanwahtiu

- Start date

You are spot on. If really property were to crash, that ultimately means the whole SG economy is tanking. Be prepared for it can happen very quickly.Unfortunately, the PAP govt's political fortunes are closely intertwined with a property market that is climbing up. Expect it to use all methods fair and foul to prop it up.

That's why PAP-Sinkieland is a microcosm of CCP-Tiongland. Only the latter doesn't have elections and has a Great Firewall.

Liquidate all assets esp property, and move as much as those liquid assets to a more stable and resource rich country.

But for the majority who only have HDB which is their only roof, if you are nimble and swift, sell at high but buy when the prices drops. Stay with relatives if you can.

Will get suck in once the building construction industry get hit badly.... no mercy...

How can this covid goes away like magic... it's bleeding the world economy.

There is this best time of the century to boom the world economy from 2000 to 2016 for a good reason. Not for me to say... only experts can say..

But can say in yr 2000 was the opening up of unsecured bank loan instrument MTN 4 year financial game which leads to LOC to finance loans for residential investment properties for commoners.

Then after 2016 it is going to crash the world economy..... they haven't figure out how to crash the economy worldwide yet to stop residential building construction from booming. Now it is happening, Game over.

Now this LOC become unlucrative financial instrument and business for lenders and is time to crash it is now.

Those who sold the residential buildings now is safe from drowning.

When that HK tycoon sold his HK properties 2 years ago he must had known the 三宝殿, the 3 major movers and shakers, plans.

The Happy days are over...

This Covid was planned to halt world economy booming.

Furthermore, this Covid game is to stop negative interest rate from happening. Banks are bleeding now, and if negative interest rate shows up the world economy is finished.

So Pinky wasn't in mailing list? So irrelevant until somebody forgot him

USA and 5 eyes are printing toilet paper money without gold backup.... at 0.1% is suicide rate for you? Or the bank?

When shit hit the roof the new rate will climb up the suicide rate is for your balls to drop...

When shit hit the roof the new rate will climb up the suicide rate is for your balls to drop...

Your cock says banks refrain from lending. They are actually scared when people dowan to borrow. UOB just issued a .01 euro bond. They are ready to splurge on lending big.

so when rates go up, property will plunge, is this your logic. Rates went up from .3 in march 2020 to 1.75...but nothing happened so far.USA and 5 eyes are printing toilet paper money without gold backup.... at 0.1% is suicide rate for you? Or the bank?

When shit hit the roof the new rate will climb up the suicide rate is for your balls to drop...

so when rates go up, property will plunge, is this your logic. Rates went up from .3 in march 2020 to 1.75...but nothing happened so far.

1.75% still very low. If mortgage interest rates went up to 5% and above then yes it will affect the property market.

In the 1980s the Fed interest rate was 11-13%

Nah. It's not the number of the rate, it's the delta that will affect the market.1.75% still very low. If mortgage interest rates went up to 5% and above then yes it will affect the property market.

In the 1980s the Fed interest rate was 11-13%

Delta affects existing homeowners. They feel the pinch when the rate goes up. Supply might go up as more have to sell because they cannot afford the mortgage payments. Although this might not affect those who are on fixed rate. Hence delta has its limitations.Nah. It's not the number of the rate, it's the delta that will affect the market.

Actual rate affects whether people can afford to buy ie demand. It also affects when people need to renew their mortgage.

When we speak of mortgage interest rates at around <3% it is considered historically very low already.

What come down will shoot up in finance... u born only yesterday young man. Never faced 18% interest rate before...

Rates are made low in last 20 years for a reason which is not for me to say.

Now is the time to shoot up after this program ended in 2016.... and stop bank negative interest rate doesn't show up.

We live in a world like a game. We are the digits or seeds and the movers and shakers are the game players... war is a game played by war game gunboats makers. War is also a economy.... a game of chess..

Rothschild controls the banks and finance economy. Every economy is control by some movers and shakers....

Ask Harvard university they can tell u more what new game to play next...

Rates are made low in last 20 years for a reason which is not for me to say.

Now is the time to shoot up after this program ended in 2016.... and stop bank negative interest rate doesn't show up.

We live in a world like a game. We are the digits or seeds and the movers and shakers are the game players... war is a game played by war game gunboats makers. War is also a economy.... a game of chess..

Rothschild controls the banks and finance economy. Every economy is control by some movers and shakers....

Ask Harvard university they can tell u more what new game to play next...

so when rates go up, property will plunge, is this your logic. Rates went up from .3 in march 2020 to 1.75...but nothing happened so far.

Last edited:

I remember I the 90s interest rates went to 9% and many many had to suicide.

It a good time LHL set up the euthanasia industry. Let them not disrupt mrt or hdb cleaners when they jump.

I hope it happens soon.

It a good time LHL set up the euthanasia industry. Let them not disrupt mrt or hdb cleaners when they jump.

I hope it happens soon.

when the interest rate number is high, it means economic activity is buzzing. What is low or high rates? High rates did not stop people from buying cars here. small merc min 250k. sold outDelta affects existing homeowners. They feel the pinch when the rate goes up. Supply might go up as more have to sell because they cannot afford the mortgage payments. Although this might not affect those who are on fixed rate. Hence delta has its limitations.

Actual rate affects whether people can afford to buy ie demand. It also affects when people need to renew their mortgage.

When we speak of mortgage interest rates at around <3% it is considered historically very low already.

You are using the BE narrative in your argument. You are a closet angmo cocksucker.What come down will shoot up in finance... u born only yesterday young man. Never faced 18% interest rate before...

Rates are made low in last 20 years for a reason which is not for me to say.

Now is the time to shoot up after this program ended in 2016.... and stop bank negative interest rate doesn't show up.

We live in a world like a game. We are the digits or seeds and the movers and shakers are the game players... war is a game played by war game gunboats makers. War is also a economy.... a game of chess..

Rothschild controls the banks and finance economy. Every economy is control by some movers and shakers....

Ask Harvard university they can tell u more what new game to play next...

He is a ahneh cheater know shits. No need to feed him info he is stealing ideas from u pretend to act blur...

Go fuck him deep deep shitskin ahneh..

Go fuck him deep deep shitskin ahneh..

Delta affects existing homeowners. They feel the pinch when the rate goes up. Supply might go up as more have to sell because they cannot afford the mortgage payments. Although this might not affect those who are on fixed rate. Hence delta has its limitations.

Actual rate affects whether people can afford to buy ie demand. It also affects when people need to renew their mortgage.

When we speak of mortgage interest rates at around <3% it is considered historically very low already.

when the interest rate number is high, it means economic activity is buzzing. What is low or high rates? High rates did not stop people from buying cars here. small merc min 250k. sold out

Hmm that is new to me. Interest rate high is good for economy?

Bro @tanwahtiu can advise?

Don't act dumb to steal info from me. Pass dumbtwit u...

You are using the BE narrative in your argument. You are a closet angmo cocksucker.

He is a chao ahneh stealer act blur want to cheat u for value info for free. Pass.

@SalahParking

https://www.economicshelp.org/macro...tes tend to,appreciation in the exchange rate.

. Higher interest rates tend to moderate economic growth. Higher interest rates increase the cost of borrowing, reduce disposable income and therefore limit the growth in consumer spending. Higher interest rates tend to reduce inflationary pressures and cause an appreciation in the exchange rate.

https://www.economicshelp.org/macro...tes tend to,appreciation in the exchange rate.

. Higher interest rates tend to moderate economic growth. Higher interest rates increase the cost of borrowing, reduce disposable income and therefore limit the growth in consumer spending. Higher interest rates tend to reduce inflationary pressures and cause an appreciation in the exchange rate.

Skip to content

Menu

The Central Bank usually increase interest rates when inflation is predicted to rise above their inflation target. Higher interest rates tend to moderate economic growth. Higher interest rates increase the cost of borrowing, reduce disposable income and therefore limit the growth in consumer spending. Higher interest rates tend to reduce inflationary pressures and cause an appreciation in the exchange rate.

Higher interest rates have various economic effects:

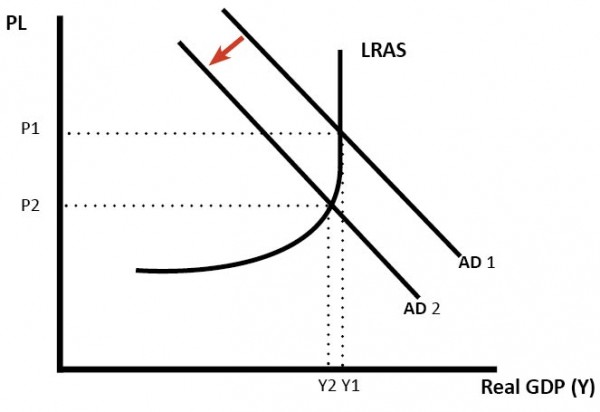

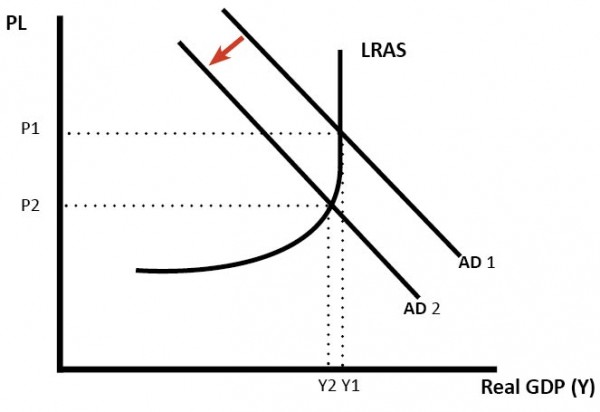

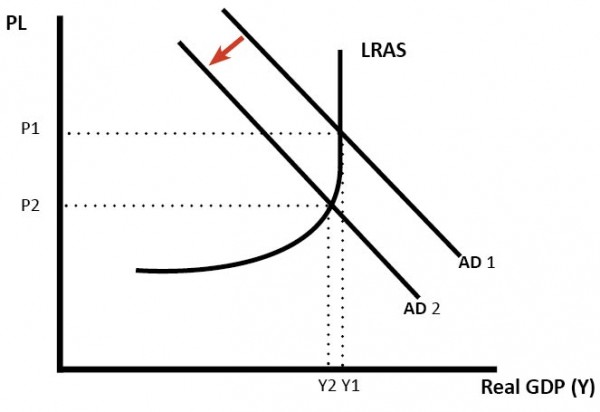

Therefore, higher interest rates will tend to reduce consumer spending and investment. This will lead to a fall in Aggregate Demand (AD).

If we get lower AD, then it will tend to cause:

Effect of higher interest rates – using AD/AS diagram.

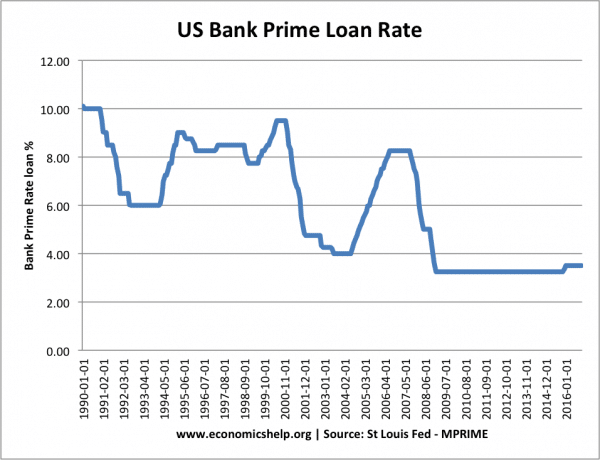

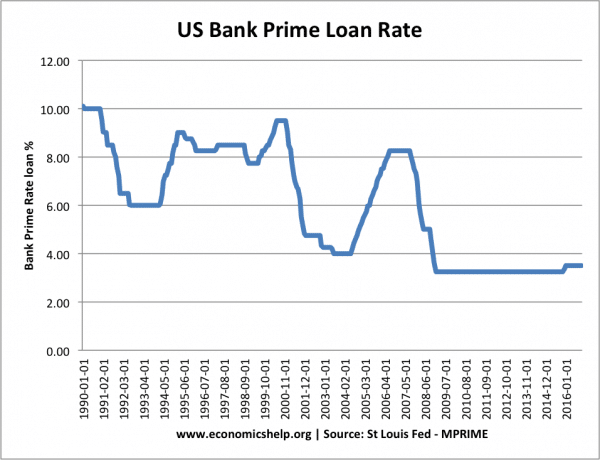

Increased interest rates 2004-06 had a significant impact on US housing market. Higher mortgage costs led to a rise in mortgage defaults – exacerbated by a high number of sub-prime mortgages in the housing bubble.

In this case, higher interest rates were a significant factor in bursting the housing bubble and causing the subsequent credit crunch.

See: Housing boom

Also: Impact of increase in US interest rates 2016/17

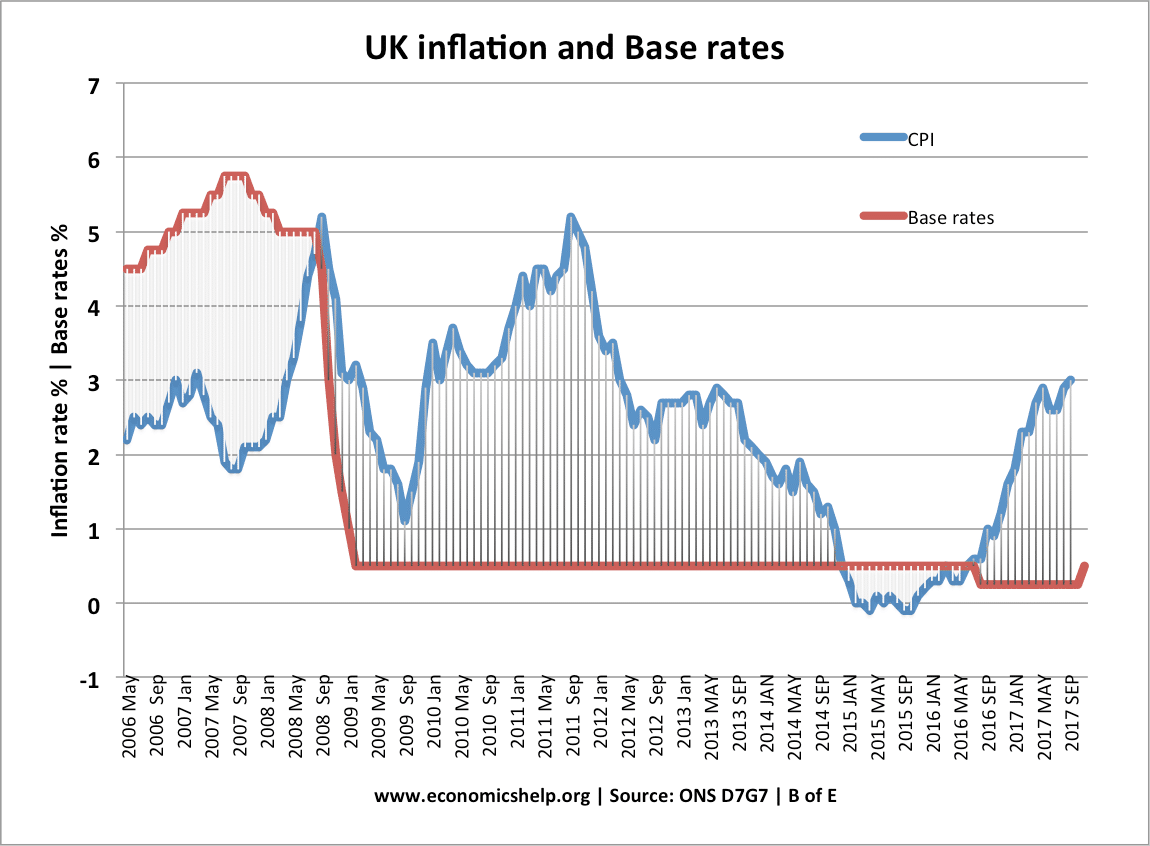

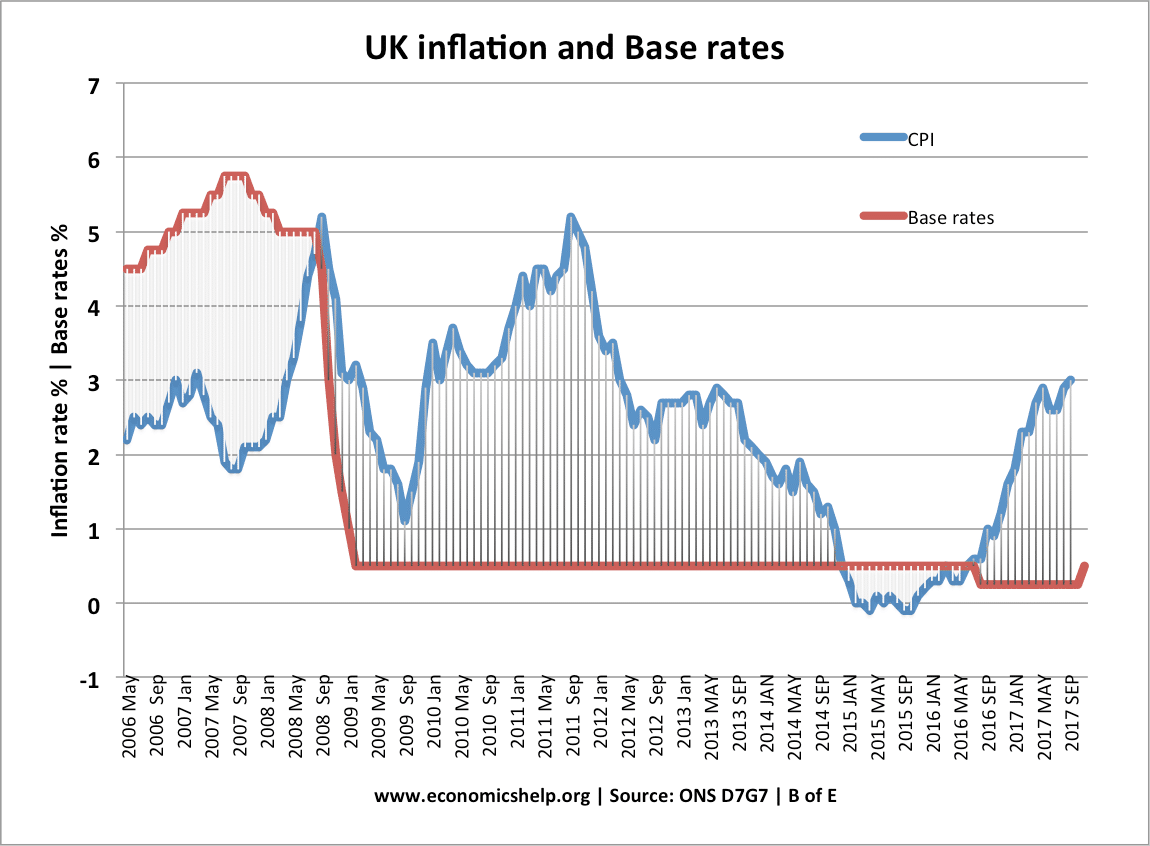

In 1979/80, interest rates were increased to 17% as the new Conservative government tried to control inflation (they pursued a form of monetarism). In 1980 and 81, the UK went into recession, due to the high-interest rates and appreciation in Sterling. (see Recession 1981) Interest rates also rose to 15% to tackle high inflation of the late 1980s (and also protect value of Pound in ERM.

Recent interest rates and UK inflation

Usually, if the Central Bank increase base rates, it will lead to higher commercial rates too. See: how are interest rates set.

Related pages

You are welcome to ask any questions on Economics.

Ask a question

Tejvan Pettinger studied PPE at LMH, Oxford University. Find out more

Tejvan Pettinger studied PPE at LMH, Oxford University. Find out more

Terms & Conditions | Privacy Policy | Contact | © - Economicshelp.org 2021

Item added to cart.

0 items - £0.00

Checkout

Our site uses cookies so that we can remember you, understand how you use our site and serve you relevant adverts and content. Click the OK button, to accept cookies on this website.OK and Continue to the sitePrivacy policy

Menu

Effect of raising interest rates

2 November 2019 by Tejvan PettingerThe Central Bank usually increase interest rates when inflation is predicted to rise above their inflation target. Higher interest rates tend to moderate economic growth. Higher interest rates increase the cost of borrowing, reduce disposable income and therefore limit the growth in consumer spending. Higher interest rates tend to reduce inflationary pressures and cause an appreciation in the exchange rate.

Higher interest rates have various economic effects:

Effect of higher interest rates

Effect of higher interest rates

- Increases the cost of borrowing. With higher interest rates, interest payments on credit cards and loans are more expensive. Therefore this discourages people from borrowing and spending. People who already have loans will have less disposable income because they spend more on interest payments. Therefore other areas of consumption will fall.

- Increase in mortgage interest payments. Related to the first point is the fact that interest payments on variable mortgages will increase. This will have a significant impact on consumer spending. This is because a 0. 5% increase in interest rates can increase the cost of a £100,000 mortgage by £60 per month. This is a significant impact on personal discretionary income.

- Increased incentive to save rather than spend. Higher interest rates make it more attractive to save in a deposit account because of the interest gained.

- Higher interest rates increase the value of a currency (Due to hot money flows, investors are more likely to save in British banks if UK rates are higher than other countries) A stronger Pound makes UK exports less competitive – reducing exports and increasing imports. This has the effect of reducing aggregate demand in the economy.

- Rising interest rates affect both consumers and firms. Therefore the economy is likely to experience falls in consumption and investment.

- Government debt interest payments increase. The UK currently pays over £30bn a year on its national debt. Higher interest rates increase the cost of government interest payments. This could lead to higher taxes in the future.

- Reduced confidence. Interest rates affect consumer and business confidence. A rise in interest rates discourages investment; it makes firms and consumers less willing to take out risky investments and purchases.

Therefore, higher interest rates will tend to reduce consumer spending and investment. This will lead to a fall in Aggregate Demand (AD).

If we get lower AD, then it will tend to cause:

- Lower economic growth (even negative growth – recession)

- Higher unemployment. If output falls, firms will produce fewer goods and therefore will demand fewer workers.

- Improvement in the current account. Higher rates will reduce spending on imports, and the lower inflation will help improve the competitiveness of exports.

AD/AS diagram showing impact of interest rates on AD

Effect of higher interest rates – using AD/AS diagram.

Evaluation of higher interest rates

- Higher interest rates affect people in different ways. The effect of higher interest rates does not affect each consumer equally. Those consumers with large mortgages (often first time buyers in the 20s and 30s) will be disproportionately affected by rising interest rates. For example, reducing inflation may require interest rates to rise to a level that causes real hardship to those with large mortgages. However, those with savings may actually be better off. This makes monetary policy less effective as a macro economic tool.

- Time-lags. The effect of rising interest rates can often take up to 18 months to have an effect. For example, if you have an investment project 50% completed, you are likely to finish it off. However, the higher interest rates may discourage starting a new project in the next year.

- It depends upon other variables in the economy. At times, a rise in interest rates may have less impact on reducing the growth of consumer spending. For example, if house prices continue to rise very quickly, people may feel that there is a real incentive to keep spending despite the increase in interest rates.

- Real interest rate. It is worth bearing in mind that the real interest rate is most important. The real interest rate is nominal interest rates minus inflation. Thus if interest rates rose from 5% to 6% but inflation increased from 2% to 5.5 %. This actually represents a cut in real interest rates from 3% (5-2) to 0.5% (6-5.5) Thus in this circumstance the rise in nominal interest rates actually represents expansionary monetary policy.

- It depends whether increases in the interest rate are passed on to consumers. Banks may decide to reduce their profit margins and keep commercial rates unchanged.

- Expectations. If people expect low-interest rates and they rise unexpectedly, it may cause people to find they can’t afford mortgages/loans. The concern is that after several years of zero interest rates – people have got used to low rates.

US interest rates

Increased interest rates 2004-06 had a significant impact on US housing market. Higher mortgage costs led to a rise in mortgage defaults – exacerbated by a high number of sub-prime mortgages in the housing bubble.

In this case, higher interest rates were a significant factor in bursting the housing bubble and causing the subsequent credit crunch.

See: Housing boom

Also: Impact of increase in US interest rates 2016/17

Interest rates and recession

Rising interest rates can cause a recession. The UK has experienced two major recessions, caused by a sharp rise in interest rates.

In 1979/80, interest rates were increased to 17% as the new Conservative government tried to control inflation (they pursued a form of monetarism). In 1980 and 81, the UK went into recession, due to the high-interest rates and appreciation in Sterling. (see Recession 1981) Interest rates also rose to 15% to tackle high inflation of the late 1980s (and also protect value of Pound in ERM.

Recent interest rates and UK inflation

Mechanics of raising interest rates

The primary interest rate (base rate) is set by the Bank of England / Federal Reserve. If the Central Bank is worried that inflation is likely to increase, then they may decide to increase interest rates to reduce demand and reduce the rate of economic growth.Usually, if the Central Bank increase base rates, it will lead to higher commercial rates too. See: how are interest rates set.

Related pages

A-Level revision guide £7.95 |

AS-Level Revision guide £4.00 |

A-Level Model Essays £8.00 |

GCSE Revision Guide £7.49 |

Recent Posts

- Collusion – meaning and examples

- Advantages and disadvantages of monopolies

- UK National Debt

- Who Benefits from a Recession?

- Prices and incomes policy

Selected Posts

- Causes of Wall Street Crash 1929

- Causes of Great Depression

- UK economy in 1920s

- Keynesian Economics

- The problem of printing money

- The importance of economics

- Understanding exchange rates

- 10 reasons for studying economics

- Impact of immigration on UK economy

Random Glossary term

UK economy statsSections

Ask an economics question

You are welcome to ask any questions on Economics.

Ask a question

About

Terms & Conditions | Privacy Policy | Contact | © - Economicshelp.org 2021

Item added to cart.

0 items - £0.00

Checkout

Our site uses cookies so that we can remember you, understand how you use our site and serve you relevant adverts and content. Click the OK button, to accept cookies on this website.OK and Continue to the sitePrivacy policy

Well done bro...

Skip to content

Menu

Effect of raising interest rates

2 November 2019 by Tejvan Pettinger

The Central Bank usually increase interest rates when inflation is predicted to rise above their inflation target. Higher interest rates tend to moderate economic growth. Higher interest rates increase the cost of borrowing, reduce disposable income and therefore limit the growth in consumer spending. Higher interest rates tend to reduce inflationary pressures and cause an appreciation in the exchange rate.

Higher interest rates have various economic effects:

Effect of higher interest rates

- Increases the cost of borrowing. With higher interest rates, interest payments on credit cards and loans are more expensive. Therefore this discourages people from borrowing and spending. People who already have loans will have less disposable income because they spend more on interest payments. Therefore other areas of consumption will fall.

- Increase in mortgage interest payments. Related to the first point is the fact that interest payments on variable mortgages will increase. This will have a significant impact on consumer spending. This is because a 0. 5% increase in interest rates can increase the cost of a £100,000 mortgage by £60 per month. This is a significant impact on personal discretionary income.

- Increased incentive to save rather than spend. Higher interest rates make it more attractive to save in a deposit account because of the interest gained.

- Higher interest rates increase the value of a currency (Due to hot money flows, investors are more likely to save in British banks if UK rates are higher than other countries) A stronger Pound makes UK exports less competitive – reducing exports and increasing imports. This has the effect of reducing aggregate demand in the economy.

- Rising interest rates affect both consumers and firms. Therefore the economy is likely to experience falls in consumption and investment.

- Government debt interest payments increase. The UK currently pays over £30bn a year on its national debt. Higher interest rates increase the cost of government interest payments. This could lead to higher taxes in the future.

- Reduced confidence. Interest rates affect consumer and business confidence. A rise in interest rates discourages investment; it makes firms and consumers less willing to take out risky investments and purchases.

Therefore, higher interest rates will tend to reduce consumer spending and investment. This will lead to a fall in Aggregate Demand (AD).

If we get lower AD, then it will tend to cause:

- Lower economic growth (even negative growth – recession)

- Higher unemployment. If output falls, firms will produce fewer goods and therefore will demand fewer workers.

- Improvement in the current account. Higher rates will reduce spending on imports, and the lower inflation will help improve the competitiveness of exports.

AD/AS diagram showing impact of interest rates on AD

Effect of higher interest rates – using AD/AS diagram.

Evaluation of higher interest rates

- Higher interest rates affect people in different ways. The effect of higher interest rates does not affect each consumer equally. Those consumers with large mortgages (often first time buyers in the 20s and 30s) will be disproportionately affected by rising interest rates. For example, reducing inflation may require interest rates to rise to a level that causes real hardship to those with large mortgages. However, those with savings may actually be better off. This makes monetary policy less effective as a macro economic tool.

- Time-lags. The effect of rising interest rates can often take up to 18 months to have an effect. For example, if you have an investment project 50% completed, you are likely to finish it off. However, the higher interest rates may discourage starting a new project in the next year.

- It depends upon other variables in the economy. At times, a rise in interest rates may have less impact on reducing the growth of consumer spending. For example, if house prices continue to rise very quickly, people may feel that there is a real incentive to keep spending despite the increase in interest rates.

- Real interest rate. It is worth bearing in mind that the real interest rate is most important. The real interest rate is nominal interest rates minus inflation. Thus if interest rates rose from 5% to 6% but inflation increased from 2% to 5.5 %. This actually represents a cut in real interest rates from 3% (5-2) to 0.5% (6-5.5) Thus in this circumstance the rise in nominal interest rates actually represents expansionary monetary policy.

- It depends whether increases in the interest rate are passed on to consumers. Banks may decide to reduce their profit margins and keep commercial rates unchanged.

- Expectations. If people expect low-interest rates and they rise unexpectedly, it may cause people to find they can’t afford mortgages/loans. The concern is that after several years of zero interest rates – people have got used to low rates.

US interest rates

Increased interest rates 2004-06 had a significant impact on US housing market. Higher mortgage costs led to a rise in mortgage defaults – exacerbated by a high number of sub-prime mortgages in the housing bubble.

In this case, higher interest rates were a significant factor in bursting the housing bubble and causing the subsequent credit crunch.

See: Housing boom

Also: Impact of increase in US interest rates 2016/17

Interest rates and recession

Rising interest rates can cause a recession. The UK has experienced two major recessions, caused by a sharp rise in interest rates.

In 1979/80, interest rates were increased to 17% as the new Conservative government tried to control inflation (they pursued a form of monetarism). In 1980 and 81, the UK went into recession, due to the high-interest rates and appreciation in Sterling. (see Recession 1981) Interest rates also rose to 15% to tackle high inflation of the late 1980s (and also protect value of Pound in ERM.

Recent interest rates and UK inflation

Mechanics of raising interest rates

The primary interest rate (base rate) is set by the Bank of England / Federal Reserve. If the Central Bank is worried that inflation is likely to increase, then they may decide to increase interest rates to reduce demand and reduce the rate of economic growth.

Usually, if the Central Bank increase base rates, it will lead to higher commercial rates too. See: how are interest rates set.

Related pages

A-Level revision guide £7.95

AS-Level Revision guide £4.00

A-Level Model Essays £8.00

GCSE Revision Guide £7.49

Recent Posts

- Collusion – meaning and examples

- Advantages and disadvantages of monopolies

- UK National Debt

- Who Benefits from a Recession?

- Prices and incomes policy

Selected Posts

- Causes of Wall Street Crash 1929

- Causes of Great Depression

- UK economy in 1920s

- Keynesian Economics

- The problem of printing money

- The importance of economics

- Understanding exchange rates

- 10 reasons for studying economics

- Impact of immigration on UK economy

Random Glossary term

UK economy stats

Sections

Ask an economics question

You are welcome to ask any questions on Economics.

Ask a question

About

Tejvan Pettinger studied PPE at LMH, Oxford University. Find out more

Terms & Conditions | Privacy Policy | Contact | © - Economicshelp.org 2021

Item added to cart.

0 items - £0.00

Checkout

Our site uses cookies so that we can remember you, understand how you use our site and serve you relevant adverts and content. Click the OK button, to accept cookies on this website.OK and Continue to the sitePrivacy policy

This interest rate thing is quite a delicate balance.

If you follow stock markets and economic news generally when interest rates are cut ie brought lower by central banks the stock market responds positively.

Property markets also like it as the cost of mortgages is lower meaning easier to qualify to borrow to buy houses.

Business activity goes up. Again cost to borrow is lower to expand business.

When would central banks raise rates? To combat inflation. Nobody wants inflation to be too high.

In some situations the stock market may respond to a rate hike positively. Because they read that the central bankers are confident in the growth of the economy and are strong enough to raise rates to ward off inflation.

What you dont want is inflation out of control and central banks playing catch up to fight inflation.

In some cases a rate hike is alao good for banks as they earn more from mortgages and other loans. But again it has to be done carefully so as not to derail economic growth either.

These days we will almost never see a big delta when it comes to rate hikes. It is practically suicide. We may see small hikes regularly over the course of time and the final number will be what matters. I also think central bankers are careful nowadays and will balance things better.

With internet and connectivity flow of information is almost instantaneous.

But then again who knows? The markets are controlled indeed. But I dont see why they would manipulate by overnight increasing rates to 5%-10% and cause the global economy to collapse. Who does it benefit?

If you follow stock markets and economic news generally when interest rates are cut ie brought lower by central banks the stock market responds positively.

Property markets also like it as the cost of mortgages is lower meaning easier to qualify to borrow to buy houses.

Business activity goes up. Again cost to borrow is lower to expand business.

When would central banks raise rates? To combat inflation. Nobody wants inflation to be too high.

In some situations the stock market may respond to a rate hike positively. Because they read that the central bankers are confident in the growth of the economy and are strong enough to raise rates to ward off inflation.

What you dont want is inflation out of control and central banks playing catch up to fight inflation.

In some cases a rate hike is alao good for banks as they earn more from mortgages and other loans. But again it has to be done carefully so as not to derail economic growth either.

These days we will almost never see a big delta when it comes to rate hikes. It is practically suicide. We may see small hikes regularly over the course of time and the final number will be what matters. I also think central bankers are careful nowadays and will balance things better.

With internet and connectivity flow of information is almost instantaneous.

But then again who knows? The markets are controlled indeed. But I dont see why they would manipulate by overnight increasing rates to 5%-10% and cause the global economy to collapse. Who does it benefit?

Similar threads

- Replies

- 16

- Views

- 645

- Replies

- 3

- Views

- 481

- Replies

- 4

- Views

- 489

- Replies

- 10

- Views

- 839

- Replies

- 0

- Views

- 800