-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How GIC and Temasek are managing your money

- Thread starter LITTLEREDDOT

- Start date

- Joined

- Jul 25, 2008

- Messages

- 13,602

- Points

- 113

Temasek-backed Zilingo’s CEO suspended pending investigation, board confirms

CEO Ankiti Bose has disputed allegations of wrongdoing. PHOTO: ZILINGO

Choo Yun Ting

Business Correspondent

Apr 13, 2022

SINGAPORE - Temasek-backed e-commerce start-up Zilingo has suspended its chief executive Ankiti Bose pending an investigation.

In a media statement on Wednesday (April 13), the Zilingo board said the major investors of the company had authorised it to suspend Ms Bose while an investigation is conducted into matters that surfaced in March.

The statement did not mention what the matters of concern are.

“In March 2022, shareholders of Zilingo and members of the board received information which required investigation. The major investors of the company authorised the board to put the CEO, Ankiti Bose, on suspension pending an investigation of the matters raised,” the statement said.

Bloomberg had earlier reported that Ms Bose was suspended after new funding efforts led to questions about the company’s accounting.

The concerns centred on the way that Singapore-headquartered Zilingo had accounted for transactions and revenue across a platform spanning thousands of small merchants, according to Bloomberg’s sources.

Zilingo had been trying to raise US$150 million (S$205 million) to US$200 million with help from Goldman Sachs Group, and the funding round was expected to lift its valuation above US$1 billion.

Besides Singapore state investment firm Temasek, Zilingo also counts venture capital firms Sequoia Capital and Burda Principal, as well as Singapore's Economic Development Board’s investment arm EDBI, among its investors.

The Zilingo board said the company’s major investors have hired an independent firm to investigate the matter, and Zilingo is working closely with the investors and the independent firm for the probe.

“Proper due process has been and will be followed. The board is committed to protecting the interests of all stakeholders in a just manner while fulfilling its fiduciary obligations,” it added.

“Apart from the above, the specific details of these investigations – and the affairs of the company – are strictly confidential.”

Temasek declined to comment when contacted.

Bloomberg reported that Ms Bose has disputed allegations of wrongdoing and contends her suspension was due in part to her complaints about harassment.She has also called the investigation a “witch hunt”, the news agency reported.

The Straits Times has contacted Ms Bose’s lawyer for more information.

Regulatory checks show that Zilingo’s last financial statement was filed in March 2019.

The start-up, which provides technology solutions to support the fashion supply chain, was set up by Ms Bose and co-founder Dhruv Kapoor in 2015.

The suspension of Zilingo CEO Ankiti Bose, seen here in 2017, is scheduled to run until May 5. PHOTO: BT FILE

Commenting on the suspension, National University of Singapore Business School Professor Mak Yuen Teen noted that it is normal for investors to require due diligence when a start-up looks to raise more funds.

There have been situations, such as for co-working firm WeWork, where such due diligence has uncovered issues with accounting and other matters, such as conflict of interest, he added.

“As start-ups are often valued based on revenue or gross merchandise value (GMV), rather than profits, how revenues or GMV are computed is clearly an area of significant risk from an accounting and reporting standpoint,” Prof Mak explained.

He said the board does have the power to order an investigation and to put the CEO on leave or suspend the executive in such situations, but there has to be due process and natural justice, which includes fairness to the accused party.

“It is generally not appropriate for the CEO to still be running the business during the period of the investigation. It is not an easy situation to handle,” Prof Mak added.

The company made an aggressive pitch in its latest effort to raise fresh capital. Late last year, it forecast that core net revenue would rise from about US$40 million in fiscal 2021 to roughly US$60 million in fiscal 2022 and US$100 million the year after, according to presentation documents reviewed by Bloomberg News.

Zilingo said it anticipated breaking even on core Ebitda - or earnings before interest, taxes, depreciation and amortisation - in fiscal 2023 and then reaching almost US$200 million in fiscal 2026.

On March 31, Ms Bose was called to a meeting with three board members and told about "serious" complaints about discrepancies in accounts and mismanagement, according to the correspondence reviewed by Bloomberg.

She was later questioned by two people from Kroll, the investigations firm.

Her suspension is scheduled to run until May 5.

Ms Bose, through her lawyer, has argued that the directors did not follow proper procedures during the process and questioned their right to suspend her, according to the correspondence from her attorney to Zilingo.

"We are of the view that our client's suspension has been procured by invalid and defective means; that the investigation commenced into her is unfair and lacking in due process; and that she has been suspended without proper and reasonable cause," her attorney wrote.

About Zilingo’s Ankiti Bose

Zilingo’s suspended chief executive Ankiti Bose co-founded the Singapore-based e-commerce start-up with Mr Dhruv Kapoor in 2015, when she was just 23.The Indian national, who is a Singapore permanent resident, was inspired to set up the technology platform after visiting Thailand’s Chatuchak weekend market several years ago.

The visit seeded the idea for the start-up, which initially sought to provide an avenue for small business owners to market their products online.

It has since broadened its focus across the fashion supply chain, providing procurement, distribution and trade services as well.

Before setting up Zilingo, Ms Bose was an investment analyst at venture capital firm Sequoia Capital in India, where she was immersed in Asia’s fast-growing tech scene.

Her achievements as a young female entrepreneur have been widely celebrated, and she has spoken in media interviews about inspiring other young women to start their own businesses and chase their dreams.

Ms Bose and Mr Kapoor were named on Forbes 30 Under 30 Asia in 2018, and she was featured in the Singapore 100 Women in Tech List in 2020.

She has also been a speaker at several global and regional conferences, including the Bloomberg New Economy Forum in Singapore last year (2021).

- Joined

- Jul 25, 2008

- Messages

- 13,602

- Points

- 113

"Temasek doesn’t comment on direct investing activities but as of “today, Temasek does not own Bitcoin,” said Pradyumna Agrawal, the fund’s managing director for blockchain investment."

F**king dis-ingenious statement by a foreign talent: "as of today". This could mean that Temasek did own bitcoin (and TerraUSD and Luna) the days, weeks, and months before and could have made a lot, or lost 99% (TerraUSD and Luna).

How much of the citizens' hard-earned reserves have been lost in cryptocurrencies? A few billions?

Singapore’s Temasek Holdings, one of the world’s top 10 sovereign wealth funds, said it doesn’t currently own Bitcoin, but it is active in blockchain investments and looking at emerging opportunities in the industry.

Temasek doesn’t comment on direct investing activities but as of “today, Temasek does not own Bitcoin,” said Pradyumna Agrawal, the fund’s managing director for blockchain investment, in an interview with Forkast’s Editor-in-Chief Angie Lau.

“But that is not a statement on whether we like Bitcoin or whether we want to own Bitcoin or not,” Agrawal said in the May 13 interview in Singapore. “That is just a factual statement of fact.”

His comments follow media reports last year that said Temasek, which manages a portfolio worth about S$381 billion (US$274 billion) for the city-state, was buying Bitcoin.

The reports at the time were “misinformation which we have chosen not to comment on,” Agrawal said.

Play

However, elsewhere Temasek is letting its wallet do the talking in the industry, and is “very focused on backing the best projects,” Agrawal said.

In February, it led a US$200 million funding round in cryptocurrency firm Amber Group. Also, Australian non-fungible tokens (NFTs) startup Immutable in March raised $200 million in a Series C funding led by Temasek.

Temasek has a flexible mandate toward blockchain companies that prefer raising money through tokenization, Agrawal said.

“We can gain exposure or seek to gain exposure to areas which we think are of interest to us and will deliver appropriate risk-adjusted returns,” he said.

“It’s within our mandate to be able to own tokens,” Agrawal added. But if Temasek wants to be able to directly hold and act on tokens, “you need a completely different set of infrastructure.”

Agrawal (right) sat down with Forkast’s Editor-in-Chief Angie Lau for an upcoming episode of Word on the Block.

Agrawal (right) sat down with Forkast’s Editor-in-Chief Angie Lau for an upcoming episode of Word on the Block.

Another way of saying Temasek is getting ready to handle tokenized assets?

“I would say it will need some time to ensure that it meets our operating risk requirements and that we can do it at scale,” he said.

In Singapore, it’s not just Temasek that sees opportunities in blockchain technology.

GIC, another major Singaporean sovereign wealth fund, on Thursday led a $170 million Series F financing round in New York-based blockchain data analysis firm Chainalysis.

GIC has also invested in crypto exchange Coinbase and Hong Kong’s digital asset company BC Group.

F**king dis-ingenious statement by a foreign talent: "as of today". This could mean that Temasek did own bitcoin (and TerraUSD and Luna) the days, weeks, and months before and could have made a lot, or lost 99% (TerraUSD and Luna).

How much of the citizens' hard-earned reserves have been lost in cryptocurrencies? A few billions?

Singapore’s Temasek says doesn’t own Bitcoin, but prepping for tokenized assets

The Bitcoin community got a lift last year when it was reported Singapore’s sovereign wealth fund had bought Bitcoin. The company told Forkast in an interview that they do not own BTC, but they are keen on blockchain investments.

Singapore’s Temasek Holdings, one of the world’s top 10 sovereign wealth funds, said it doesn’t currently own Bitcoin, but it is active in blockchain investments and looking at emerging opportunities in the industry.

Temasek doesn’t comment on direct investing activities but as of “today, Temasek does not own Bitcoin,” said Pradyumna Agrawal, the fund’s managing director for blockchain investment, in an interview with Forkast’s Editor-in-Chief Angie Lau.

“But that is not a statement on whether we like Bitcoin or whether we want to own Bitcoin or not,” Agrawal said in the May 13 interview in Singapore. “That is just a factual statement of fact.”

His comments follow media reports last year that said Temasek, which manages a portfolio worth about S$381 billion (US$274 billion) for the city-state, was buying Bitcoin.

The reports at the time were “misinformation which we have chosen not to comment on,” Agrawal said.

Play

However, elsewhere Temasek is letting its wallet do the talking in the industry, and is “very focused on backing the best projects,” Agrawal said.

In February, it led a US$200 million funding round in cryptocurrency firm Amber Group. Also, Australian non-fungible tokens (NFTs) startup Immutable in March raised $200 million in a Series C funding led by Temasek.

Temasek has a flexible mandate toward blockchain companies that prefer raising money through tokenization, Agrawal said.

“We can gain exposure or seek to gain exposure to areas which we think are of interest to us and will deliver appropriate risk-adjusted returns,” he said.

“It’s within our mandate to be able to own tokens,” Agrawal added. But if Temasek wants to be able to directly hold and act on tokens, “you need a completely different set of infrastructure.”

Another way of saying Temasek is getting ready to handle tokenized assets?

“I would say it will need some time to ensure that it meets our operating risk requirements and that we can do it at scale,” he said.

In Singapore, it’s not just Temasek that sees opportunities in blockchain technology.

GIC, another major Singaporean sovereign wealth fund, on Thursday led a $170 million Series F financing round in New York-based blockchain data analysis firm Chainalysis.

GIC has also invested in crypto exchange Coinbase and Hong Kong’s digital asset company BC Group.

- Joined

- Jul 25, 2008

- Messages

- 13,602

- Points

- 113

S'pore start-up Zilingo fires CEO Ankiti Bose, reserves right to pursue legal action

Ms Ankiti Bose said her employment was terminated on grounds of "insubordination", while Zilingo said the ouster followed a probe into complaints of serious financial irregularities. PHOTO: ZILINGO

Choo Yun Ting

Business Correspondent

May 20, 2022

SINGAPORE - E-commerce platform Zilingo has terminated its chief executive Ankiti Bose, also the co-founder of the firm, following an investigation into complaints of serious financial irregularities.

In a statement on Friday (May 20), the Singapore-based firm said it decided to terminate Ms Bose’s employment “with cause” and that it reserves the right to pursue appropriate legal action.

The start-up, which counts Sequoia Capital India, Singapore state investor Temasek, and the Economic Development Board’s investment arm EDBI among its investors, had earlier suspended Ms Bose on March 31.

In its statement, Zilingo said that Ms Bose brought “certain harassment-related issues pertaining to past time periods” to the attention of the firm’s board on April 11.

These issues did not include any harassment complaints against investors or their nominees, it added, noting that a top consulting firm had been engaged to look into the claims brought forth.

“The investigation has concluded that the company took appropriate action and followed due process to address these complaints that were brought to their notice, contrary to media reports that have suggested that the suspension and investigation into Ankiti Bose were aimed at suppressing the said harassment claims,” Zilingo said.

Bloomberg News reported that Ms Bose said in a separate statement that her employment was terminated on grounds of insubordination, after being suspended on the basis of an “anonymous whistle-blower complaint”.

In its statement, Zilingo said: “The company is deeply pained and disappointed to see the manner in which the board, investors and employees have been constantly attacked through ostensibly leaked and fake information, along with what unfortunately appears to be paid and defamatory social media campaigns throughout the investigation period.”

This has cause irreparable damage to the start-up, board, staff and backers, it added.

The company noted that following the recall of loans by debt holders, an independent financial adviser was appointed and is in the midst of assessing options for the business.

More information will be provided in due course, it said.

Ms Bose had earlier been suspended from her duties while the start-up’s accounting practices were investigated. Regulatory checks show that Zilingo’s last financial statement was filed in 2019.

Ms Bose, who co-founded the company with Mr Dhruv Kapoor in 2015, has disputed claims of wrongdoing.

Commenting on corporate governance issues that start-ups face, NUS Business School’s Professor Mak Yuen Teen noted that such issues are not uncommon. Start-ups here and elsewhere have faced the likes of toxic culture, product fraud, financial irregularities and conflict of interest, he noted.

“Founders are by their nature entrepreneurial and risk takers, and may push the boundaries. They are also often charismatic and able to convince people to buy into their vision,” he said.

Prof Mak added that with problems emerging in start-ups, investors may be more careful about due diligence before investing and may demand better corporate governance, and start-ups that are not prepared for these may find it harder to attract investors.

Start-ups need to ensure that they have at least the basic corporate governance in place, he said.

This includes measures such as having accounts audited by a respectable audit firm on a timely basis, having proper internal controls for key business operations, having an internal audit of the key risk areas, and having a properly constituted board with some independent members.

Singapore Institute of Directors vice-chairman Adrian Chan said that while he does not believe confidence in the boards or founders of start-ups has necessarily been shaken by Zilingo’s situation, there are lessons to be learnt from this case and the issues that have surfaced.

Mr Chan, who also serves on the Enterprise Board of the SMU Institute of Innovation and Entrepreneurship, noted that start-up boards and founders should be trained and equipped with the necessary governance skills and knowledge to run their businesses effectively.

“Paying heed to corporate governance makes good business sense and should not be viewed as a burden. And if boards fail to recognise this early on, they may find themselves paying a higher price later on,” he said.

- Joined

- Nov 16, 2012

- Messages

- 129

- Points

- 28

Because all is YES men and women?Why lidat? No body ask to remove Looong for lack of succession planning.

- Joined

- Jul 25, 2008

- Messages

- 13,602

- Points

- 113

Unicorn becomes uni-con. From billion dollar valuation to zero value.

Zilingo's co-founder Dhruv Kapoor briefly made the pitch for a buyout, a surprise, last-minute development. PHOTO: ZILINGO

June 21, 2022

SINGAPORE (BLOOMBERG) - Zilingo's board of directors is weighing options for the embattled Singapore start-up after a financial adviser to the company said liquidation is the most viable solution and its co-founder presented an 11th-hour pitch for a management buyout.

The board members met on Monday (June 20) to hear the alternatives, including a presentation from adviser Deloitte to sell off the company's assets, according to sources familiar with the matter.

Co-founder Dhruv Kapoor briefly made the pitch for a buyout, a surprise, last-minute development, said the sources, asking not to be identified because the discussions are private.

The board meeting ended without a decision on Zilingo's fate, they said.

Directors will consider Deloitte's findings as well as the new management buyout proposal, and they are trying to set a date for a new gathering.

Zilingo and Deloitte representatives did not respond to requests for comment.

Mr Kapoor proposed the buyout to the Singapore-based company's board late on Sunday.

He has secured commitments from a small group of new investors including a United States private equity firm, Bloomberg News reported on Sunday.

The offer detailed plans for the investor group to inject US$8 million (S$11.1 million) in new equity in a newly incorporated entity in tranches, while the remaining assets and the old corporate entity would be liquidated in due course.

Ms Ankiti Bose, the start-up's ousted chief executive, endorsed Mr Kapoor's preliminary proposal minutes after it was sent out to existing shareholders.

In her e-mail, as seen by Bloomberg News, Ms Bose urged investors to see beyond their "personal differences" and support the initiative.

Allegations of financial irregularities in March prompted an investigation into Zilingo, valued at US$970 million in 2019, and led to the dismissal of co-founder Ms Bose as CEO in May.

Her ouster plunged the once high-flying start-up into crisis and sent shock waves through South-east Asia and India's technology industry.

Zilingo's board to weigh options including liquidation or buyout

Zilingo's co-founder Dhruv Kapoor briefly made the pitch for a buyout, a surprise, last-minute development. PHOTO: ZILINGO

June 21, 2022

SINGAPORE (BLOOMBERG) - Zilingo's board of directors is weighing options for the embattled Singapore start-up after a financial adviser to the company said liquidation is the most viable solution and its co-founder presented an 11th-hour pitch for a management buyout.

The board members met on Monday (June 20) to hear the alternatives, including a presentation from adviser Deloitte to sell off the company's assets, according to sources familiar with the matter.

Co-founder Dhruv Kapoor briefly made the pitch for a buyout, a surprise, last-minute development, said the sources, asking not to be identified because the discussions are private.

The board meeting ended without a decision on Zilingo's fate, they said.

Directors will consider Deloitte's findings as well as the new management buyout proposal, and they are trying to set a date for a new gathering.

Zilingo and Deloitte representatives did not respond to requests for comment.

Mr Kapoor proposed the buyout to the Singapore-based company's board late on Sunday.

He has secured commitments from a small group of new investors including a United States private equity firm, Bloomberg News reported on Sunday.

The offer detailed plans for the investor group to inject US$8 million (S$11.1 million) in new equity in a newly incorporated entity in tranches, while the remaining assets and the old corporate entity would be liquidated in due course.

Ms Ankiti Bose, the start-up's ousted chief executive, endorsed Mr Kapoor's preliminary proposal minutes after it was sent out to existing shareholders.

In her e-mail, as seen by Bloomberg News, Ms Bose urged investors to see beyond their "personal differences" and support the initiative.

Allegations of financial irregularities in March prompted an investigation into Zilingo, valued at US$970 million in 2019, and led to the dismissal of co-founder Ms Bose as CEO in May.

Her ouster plunged the once high-flying start-up into crisis and sent shock waves through South-east Asia and India's technology industry.

- Joined

- Jul 25, 2008

- Messages

- 13,602

- Points

- 113

And Temasek sold NOL.....

Container capacity jumped 4.5 per cent last year, but it hasn't been enough to cool prices yet. ST PHOTO: CHONG JUN LIANG

JUN 21, 2022

SINGAPORE (REUTERS) - Shipping companies are transforming rust buckets into gold mines in a modern-day alchemy that could fuel already rampant inflation for years to come.

The disruption to world trade caused by pandemic lockdowns and a shortage of new cargo vessels has pushed freight rates for ageing container ships to record highs.

Cashing in on the boom, shipping firms are locking in long-term leases lasting three to four years, which means consumers could carry on paying the price for the surge in costs until hundreds of new ships on order come into service.

Take the Synergy Oakland, a mid-sized vessel flagged in Cyprus that can carry more than 4,200 20-foot steel containers. Greek firm Euroseas bought it in 2019 for US$10 million (S$13.8 million) when it was already a decade old.

As world trade spiralled into chaos last year, it raked in US$21 million in just over 100 days at the highest daily freight rate in history for a ship of its size. It squeezed in one more short-term charter earning around US$10 million in the space of two months before going out on a four-year lease for US$61 million in May, a sixfold return in itself on the purchase price three years ago.

"That was almost the perfect play in a rising market," Mr Symeon Pariaros, chief administrative officer of the shipping firm, told Reuters. "We've not seen something like that in the history of the container market."

The world's container ship fleet continued to grow in terms of capacity during the pandemic, rising 2.9 per cent in 2020 after increases of 4 per cent in 2019 and 5.6 per cent in 2018, according to shipping analytics firm Clarksons Research.

But the surge in demand for consumer goods during lockdowns, congestion at ports that tied up ships for longer than expected, and a slowdown in new shipbuilding, partly due to uncertainty about whether vessels would comply with new environmental rules, all contributed to the shipping crunch and record freight costs.

Container capacity jumped 4.5 per cent last year, mainly because ageing ships that might normally be headed for the graveyard kept on sailing, but it hasn't been enough to cool prices yet.

A Reuters review of more than 30 private transactions completed over the last six months showed that ship owners are leasing vessels on long-term charters at record rates to capitalise on the once-in-a-generation bull market. In May, the cost of locking in container shipments soared a staggering 30.1 per cent, a record monthly increase in long-term ocean freight rates, according to Xeneta's ocean freight index.

Record rates have already contributed to higher prices for everything from second-hand cars to dining tables to bicycles, and the pain for consumers is set to continue, experts say.

The International Monetary Fund estimates the container shipping boom in 2021 accounted for 1.5 percentage points of global price rises this year, or about a quarter of the US inflation rate.

While higher food and oil prices in the wake of Russia's occupation of Ukraine feed through to consumer prices within two months, it can take up to a year to feel the full effects of container shipping costs.

"The current still-high freight rates will continue to put pressure on consumer prices well into 2023," said Mr Jan Hoffmann, head of trade logistics at the United Nations Conference on Trade and Development. "I fear that freight rates will remain higher than pre-Covid for many more years."

"Container shipping markets in general remain in extraordinary territory," said Mr Stephen Gordon, managing director of Clarksons Research.

The container shipping industry as a whole made a mind-bending profit of US$59.3 billion in the first quarter this year, shipping expert John McCown said, up from US$19.1 billion in the same period a year ago.

US President Joe Biden said on June 9 that Congress should crack down on the outrageous prices being charged by shipping companies that control the market.

A record 503 second-hand container ships were sold last year, equivalent to 7 per cent of the global fleet, Clarksons said, with another 108 sold in the first five months of 2022.

With no container ships being scrapped this year, the average age of these vessels has risen to 13.9 years from 11 years back in 2017, Clarksons said. That means cargo ships that are 10 or 15 years old, an age at which they were being scrapped before the pandemic, are worth up to 10 times what they were two years ago, sales data shows.

Still, there are signs the boom could come to an end in the next year or two, when many of the giants of the sea ordered by the major companies enter service. In 2021, a record-breaking 555 container vessels worth US$42.5 billion were ordered and 208 vessels worth US$18.4 billion have been booked so far in 2022, according to the World Shipping Council, an industry group based in the United States.

Old is gold: Sky-high cost of ageing ships sounds inflation SOS

Container capacity jumped 4.5 per cent last year, but it hasn't been enough to cool prices yet. ST PHOTO: CHONG JUN LIANG

JUN 21, 2022

SINGAPORE (REUTERS) - Shipping companies are transforming rust buckets into gold mines in a modern-day alchemy that could fuel already rampant inflation for years to come.

The disruption to world trade caused by pandemic lockdowns and a shortage of new cargo vessels has pushed freight rates for ageing container ships to record highs.

Cashing in on the boom, shipping firms are locking in long-term leases lasting three to four years, which means consumers could carry on paying the price for the surge in costs until hundreds of new ships on order come into service.

Take the Synergy Oakland, a mid-sized vessel flagged in Cyprus that can carry more than 4,200 20-foot steel containers. Greek firm Euroseas bought it in 2019 for US$10 million (S$13.8 million) when it was already a decade old.

As world trade spiralled into chaos last year, it raked in US$21 million in just over 100 days at the highest daily freight rate in history for a ship of its size. It squeezed in one more short-term charter earning around US$10 million in the space of two months before going out on a four-year lease for US$61 million in May, a sixfold return in itself on the purchase price three years ago.

"That was almost the perfect play in a rising market," Mr Symeon Pariaros, chief administrative officer of the shipping firm, told Reuters. "We've not seen something like that in the history of the container market."

The world's container ship fleet continued to grow in terms of capacity during the pandemic, rising 2.9 per cent in 2020 after increases of 4 per cent in 2019 and 5.6 per cent in 2018, according to shipping analytics firm Clarksons Research.

But the surge in demand for consumer goods during lockdowns, congestion at ports that tied up ships for longer than expected, and a slowdown in new shipbuilding, partly due to uncertainty about whether vessels would comply with new environmental rules, all contributed to the shipping crunch and record freight costs.

Container capacity jumped 4.5 per cent last year, mainly because ageing ships that might normally be headed for the graveyard kept on sailing, but it hasn't been enough to cool prices yet.

A Reuters review of more than 30 private transactions completed over the last six months showed that ship owners are leasing vessels on long-term charters at record rates to capitalise on the once-in-a-generation bull market. In May, the cost of locking in container shipments soared a staggering 30.1 per cent, a record monthly increase in long-term ocean freight rates, according to Xeneta's ocean freight index.

Record rates have already contributed to higher prices for everything from second-hand cars to dining tables to bicycles, and the pain for consumers is set to continue, experts say.

The International Monetary Fund estimates the container shipping boom in 2021 accounted for 1.5 percentage points of global price rises this year, or about a quarter of the US inflation rate.

While higher food and oil prices in the wake of Russia's occupation of Ukraine feed through to consumer prices within two months, it can take up to a year to feel the full effects of container shipping costs.

"The current still-high freight rates will continue to put pressure on consumer prices well into 2023," said Mr Jan Hoffmann, head of trade logistics at the United Nations Conference on Trade and Development. "I fear that freight rates will remain higher than pre-Covid for many more years."

"Container shipping markets in general remain in extraordinary territory," said Mr Stephen Gordon, managing director of Clarksons Research.

The container shipping industry as a whole made a mind-bending profit of US$59.3 billion in the first quarter this year, shipping expert John McCown said, up from US$19.1 billion in the same period a year ago.

US President Joe Biden said on June 9 that Congress should crack down on the outrageous prices being charged by shipping companies that control the market.

A record 503 second-hand container ships were sold last year, equivalent to 7 per cent of the global fleet, Clarksons said, with another 108 sold in the first five months of 2022.

With no container ships being scrapped this year, the average age of these vessels has risen to 13.9 years from 11 years back in 2017, Clarksons said. That means cargo ships that are 10 or 15 years old, an age at which they were being scrapped before the pandemic, are worth up to 10 times what they were two years ago, sales data shows.

Still, there are signs the boom could come to an end in the next year or two, when many of the giants of the sea ordered by the major companies enter service. In 2021, a record-breaking 555 container vessels worth US$42.5 billion were ordered and 208 vessels worth US$18.4 billion have been booked so far in 2022, according to the World Shipping Council, an industry group based in the United States.

- Joined

- Jul 25, 2008

- Messages

- 13,602

- Points

- 113

Han Rasman

As an analyst I am always reminded that all of us have a data model of the world we live in, none of us can take into account all the systems in play because perfect information does not exist and even if it did, no one person can process all of it. In other words, though some in practice may deride academia, even practitioners have at best an academic understanding of the real world.

The great homecoming of Singapore wealth has begun. Temasek is a contradictory animal.

On the one hand, local media is inundating the market and the citizenry with news that Temasek's portfolio has crossed the SGD400 billion mark - suggesting it is successful. The not-so-free media's subtext reads the government is successful. Global media has no information to add and so parrots. The truth is nobody can know this. Temasek is a gazetted company and its corporate information is sealed as a matter of national security. Temasek may have made capital gains of $399 billion, but it may also have borrowed $399 billion from Martians and invested it. The market rightly recognizes that Singaporeans are generally an honest lot, but we are not incapable of a little mischief either.

On the other hand, Temasek is in retreat. Of note, Temasek's top destination is no longer China but home sweet home. It's been a few months since we knew Temasek has been bleeding money on Chinese tech stocks and that theme continues, but there are other strong reasons for returning capital to Singapore. Temasek is still ultimately a state tool even if it is not a statutory board. Repatriation of capital may herald weakness in the Singapore economy as Temasek quietly props up or nakedly bails out entire sectors such as air travel, tourism and real estate. Further, not many realize that Singapore and China are not exactly friends. The latter has threatened and subverted the former. Concentrating national assets in China could support Singapore state coffers, but it also means volunteering to be taken hostage by sovereign thugs. We are well aware what happened to Lotte et al.

There is a lot of noise to tempt us to lose sight of the forest for the trees. My takeaway is simple - globalization is in retreat. Even if China is no longer the best opportunity, to be very clear Singapore being the top destination does not mean Singapore is the new best opportunity. Everywhere I look there is a sprint to safety as risks accumulate.

As an analyst I am always reminded that all of us have a data model of the world we live in, none of us can take into account all the systems in play because perfect information does not exist and even if it did, no one person can process all of it. In other words, though some in practice may deride academia, even practitioners have at best an academic understanding of the real world.

The great homecoming of Singapore wealth has begun. Temasek is a contradictory animal.

On the one hand, local media is inundating the market and the citizenry with news that Temasek's portfolio has crossed the SGD400 billion mark - suggesting it is successful. The not-so-free media's subtext reads the government is successful. Global media has no information to add and so parrots. The truth is nobody can know this. Temasek is a gazetted company and its corporate information is sealed as a matter of national security. Temasek may have made capital gains of $399 billion, but it may also have borrowed $399 billion from Martians and invested it. The market rightly recognizes that Singaporeans are generally an honest lot, but we are not incapable of a little mischief either.

On the other hand, Temasek is in retreat. Of note, Temasek's top destination is no longer China but home sweet home. It's been a few months since we knew Temasek has been bleeding money on Chinese tech stocks and that theme continues, but there are other strong reasons for returning capital to Singapore. Temasek is still ultimately a state tool even if it is not a statutory board. Repatriation of capital may herald weakness in the Singapore economy as Temasek quietly props up or nakedly bails out entire sectors such as air travel, tourism and real estate. Further, not many realize that Singapore and China are not exactly friends. The latter has threatened and subverted the former. Concentrating national assets in China could support Singapore state coffers, but it also means volunteering to be taken hostage by sovereign thugs. We are well aware what happened to Lotte et al.

There is a lot of noise to tempt us to lose sight of the forest for the trees. My takeaway is simple - globalization is in retreat. Even if China is no longer the best opportunity, to be very clear Singapore being the top destination does not mean Singapore is the new best opportunity. Everywhere I look there is a sprint to safety as risks accumulate.

- Joined

- Aug 6, 2008

- Messages

- 15,933

- Points

- 113

No worries. Will just increase minimum sum by another 50% and delay your CPF to when you're 80 years old.

- Joined

- Oct 30, 2014

- Messages

- 36,768

- Points

- 113

Thanks to the PAP, Temasek has been managing our money very well. Majulah PAP!

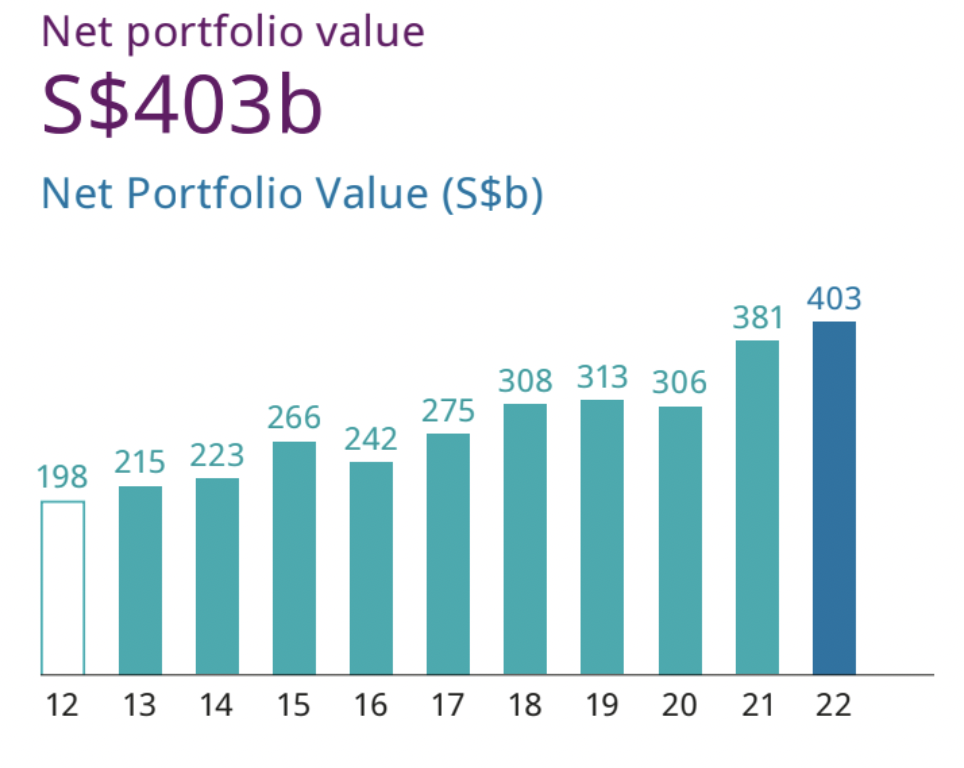

Temasek Holdings held its annual review on Jul. 12, revealing a net portfolio value of S$403 billion for its last financial year, which ended on Mar. 31, 2022.

This is the highest net portfolio value it has achieved, following its previous record high of S$381 billion in 2021.

The company’s one-year Total Shareholder Return (TSR) was 5.81 per cent, down from the record 24.53 per cent in 2021.

Its 10- and 20-year TSR returns were seven per cent and eight per cent respectively.

https://mothership.sg/2022/07/temasek-review-2022/

Temasek Holdings held its annual review on Jul. 12, revealing a net portfolio value of S$403 billion for its last financial year, which ended on Mar. 31, 2022.

This is the highest net portfolio value it has achieved, following its previous record high of S$381 billion in 2021.

The company’s one-year Total Shareholder Return (TSR) was 5.81 per cent, down from the record 24.53 per cent in 2021.

Its 10- and 20-year TSR returns were seven per cent and eight per cent respectively.

https://mothership.sg/2022/07/temasek-review-2022/

- Joined

- Jul 25, 2008

- Messages

- 13,602

- Points

- 113

How a celebrity CEO's rule of fear helped bring down hot Singapore start-up Zilingo

Zilingo suspended its 30-year-old chief executive officer Ankiti Bose over complaints about alleged financial irregularities in March. ST PHOTO: FELINE LIM

Aug 4, 2022

SINGAPORE (BLOOMBERG) - At first glance, the implosion of vaunted fashion start-up Zilingo looked jarringly sudden.

When the Singapore tech darling suspended its 30-year-old chief executive officer Ankiti Bose over complaints about alleged financial irregularities, it was March. Within weeks, creditors were recalling loans, more than 100 employees had left, and Ms Bose found herself fired, though she denies any wrongdoing. The company's survival is now in question.

The Zilingo meltdown has rattled the tech industry in South-east Asia and beyond. The start-up had raised more than US$300 million (S$414 million) from some of the region's most prominent investors, including Singapore investment company Temasek and Sequoia Capital India, the regional arm of the Silicon Valley firm that backed Apple and Google. Ms Bose was a celebrity who criss-crossed the globe to speak at tech gatherings from Hong Kong to California.

Interviews with more than 60 people, including current and former staff, merchants, investors, entrepreneurs and friends of the key players, suggest that Zilingo struggled for years under Ms Bose's leadership. Her management style alienated employees and undermined the business, according to staff who worked under her.

The start-up veered from one strategy to another in pursuit of sales, including a US$1 million promotional trip in Morocco, loans to customers and a short-lived push into the United States. At one point, she became fixated on "crazy growth" to catch the attention of Japanese tech titan Masayoshi Son, according to two former employees with direct knowledge of the matter.

At the heart of the company's breakdown lies the soured relationship between Ms Bose and her long-time supporter, Mr Shailendra Singh, head of Sequoia India. Allies for years, they fell out as financial pressures mounted. Mr Singh lost faith in the management skills of the young founder he had championed, while Ms Bose believed Mr Singh betrayed her by pushing her out of her own company, according to people familiar with their relationship, who requested anonymity as the talks were private.

The clash grew so acrimonious that Sequoia's lawyers demanded in a May legal notice that Ms Bose stop making allegations that could tarnish Sequoia's reputation, the people said.

Zilingo's turmoil highlights an apparent lax internal corporate governance culture that is not uncommon in the start-up industry. For two years, the company failed to file annual financial statements, a basic requirement for all businesses of its size in Singapore. Auditor KPMG has yet to sign off on Zilingo's financial year 2020 results. While it is not unusual for start-ups to miss these deadlines, which can result in a fine of up to $600, it is typically a warning sign that firmer action may be needed by the board.

Yet, investors, including Temasek and the Economic Development Board's investment arm EDBI, put more funds into Zilingo at the end of 2020. Shareholders that together own a majority stake of the company only formally acted against Ms Bose after whistle-blower complaints were filed earlier this year.

Tech warning

The saga has also become a warning for the region's tech community, which is assessing the fallout of global economic shocks from Covid-19, the war in Ukraine and global inflation."Whatever happened at Zilingo, there will be a lot more dramas in the next couple of years as the big worldwide recession impedes hot shots from raising money," said veteran investor Jim Rogers, chairman of Rogers Holdings in Singapore. "I have seen this rodeo before."

Bloomberg News reviewed dozens of internal documents, e-mails, texts and other media from Zilingo, and Ms Bose sat for two extensive interviews, one before and one after her dismissal from the company on May 20. The board's decision to fire her was not abrupt, but rather the culmination of years of tension, according to the documents and people with direct knowledge of the matter.

"Board members were concerned about the company's performance over the last few years and sought to share suggestions to address the company's performance including cash burn," Zilingo and its board said in a statement to Bloomberg News.

"In March 2022, investors received complaints about serious financial irregularities which appeared to require investigation. With the support of the majority investor shareholders, an independent forensic investigations consultancy was appointed to look into the said complaints. After a comprehensive process lasting almost two months, including numerous opportunities for Ms Bose to provide documents and information, the company subsequently terminated Ms Bose for cause based on the findings of that investigation."

SPH Brightcove Video

Ms Bose said the process to terminate her was an "unfair witch hunt" and denied that she was given numerous opportunities to respond to allegations. She said she has not seen the investigation report, which was not made public. On the board's suggestion to implement changes, she said the team cut the cash burn by 70 per cent between the end of 2019 and the end of 2021.

"It was not easy, we did not succeed at everything," she said in July. "It was chaotic and painful, but we did do it and we made the best effort we could."

Zilingo's origin story is part of South-east Asia's start-up lore. Ms Bose came up with the idea as she wandered through Bangkok's Chatuchak market, where 15,000 stalls offer goods from across Thailand. She and co-founder Dhruv Kapoor wanted to build a platform that would allow such small merchants to sell to consumers across South-east Asia.

Mr Singh was instrumental from the start. He and Ms Bose had worked together at Sequoia and he was happy to support one of the firm's own. Mr Singh had started his career in Sequoia's Silicon Valley office, learning at the side of veteran investors Michael Moritz and Doug Leone. Mr Singh had transformed Sequoia Capital India over 16 years into the region's biggest venture capital (VC) firm with some US$9 billion of assets under management and 36 unicorns on its score sheet across India and South-east Asia.

He invested in Zilingo's seed round in 2015, when Ms Bose was 23 years old, and in every fund raising since. "We think the world of her," he told a fellow venture capitalist in 2016, in an e-mail seen by Bloomberg News.

Mr Dhruv Kapoor, co-founder and chief technology officer of fashion e-commerce marketplace Zilingo. PHOTO: ZILINGO

But like many upstarts, Ms Bose and Mr Kapoor faced challenges almost from the beginning. Their consumer-focused fashion site struggled because of the thin margins and low average income in South-east Asia, a fragmented region with different languages and currencies. By late 2017, they decided to reposition Zilingo into a business-to-business platform, where small manufacturers and wholesalers could sell goods directly to small retailers in the region.

In 2018, Zilingo raised US$54 million from investors. The company decided to splurge US$1 million to whisk nine social media influencers to Morocco for a three-day extravaganza, complete with camel rides, a hot-air balloon trip, yoga lessons and gourmet dinners.

It was a massive flop, according to an early employee with direct knowledge of the event. The goal of #ZilingoEscape was to bring in one million new users, one for each US$1 spent. The final tally was about 10,000, the person said. Ms Bose declined to comment specifically on the campaign, but said it was part of the company's US$10 million annual marketing budget.

This appears to have become a pattern for Ms Bose. With cash in Zilingo's coffers, she would dive into new initiatives to supercharge growth even if the immediate financial benefits were questionable. In one example, Ms Bose suggested that Zilingo subsidise a 2 per cent to 4 per cent discount for transactions, effectively paying merchants to trade with one another. She cheered on the team as gross merchandise value hit US$1 million for the first two months, even though Zilingo was getting no fees from the merchants, said a person directly involved.

In 2018, Ms Bose came up with the idea of giving out loans to suppliers and vendors who needed capital. It took off, so in the coming months Ms Bose cranked up the pressure. She told the team to give out more loans each month on a running basis, the person said. But no one could have predicted the pandemic, or the toll it would take on start-ups like Zilingo, and much of the debt had to be written off.

Yet Ms Bose's star was rising in the industry. In early 2019, Zilingo raised US$226 million, lifting its valuation to US$970 million. The charismatic CEO wooed tech gatherings with her vision of how start-ups like hers were a new model for the emerging world.

"We are about to shake things up quite a bit," Ms Bose said at a panel discussion in Singapore, flashing a wide smile and drawing applause from the audience.

Inside the company, she drove staff relentlessly. In one instance, Ms Bose messaged a senior lieutenant early on a Sunday morning and called about a dozen times. When the employee did not pick up immediately, she told the lieutenant: "You obviously don't care about the company enough."

Publicly, the company seemed to be going from strength to strength. In July 2019, Mr James Perry, former managing director and Asia-Pacific head of technology investment banking for Citigroup, joined Zilingo as its first chief financial officer.

It was a coup for Ms Bose, some 20 years Mr Perry's junior. Ms Bose said in an interview with Bloomberg News in 2019 that Mr Perry's experience and respect in the financial world would complement her "young and crazy" self and give confidence to investors. "He's James Perry, he's a god in finance," she said.

In the investment world, her big target remained Mr Son, whose SoftBank Group had upended venture capital by making huge bets on unproven start-ups. Ms Bose told her deputies that Zilingo needed to achieve rapid growth to catch Mr Son's attention, one of the deputies said.

Ms Bose met Mr Son twice that year, once in Jakarta and a second time in Tokyo, according to people familiar with the matter. She explained her vision for Zilingo, but Mr Son never backed her. Neither did KKR & Co, which was considering investing in the start-up at the time, the people said.

In October 2019, Zilingo announced it would spend US$100 million to expand into the US, establishing offices in New York and Los Angeles. Ms Bose's idea was to take advantage of then President Donald Trump's trade war by offering American retailers a way to avoid tariffs by finding producers outside China. Less than a year later, the company shut its US operations.

By the end of 2019, Mr Singh and other directors had told Ms Bose several times to slow the cash burn. But Mr Singh was not getting regular financial reports from Ms Bose, and it was not till a board meeting in November that the directors learnt that the company was actually going through some US$7 million to US$8 million a month, more than they had expected. Mr Singh picked up the phone and had a tough conversation with Ms Bose, according to people with knowledge of the conversations.

Guzzling money

It turns out that the company was guzzling money. The US$226 million Zilingo had raised from investors in early 2019 was gone in less than two years.In 2020, the pandemic battered the business and Ms Bose saw an opportunity to supply personal protective equipment, inking a deal in April to supply 10 million KN-95 masks, valued at US$22.5 million, to India. Six months later, Zilingo was embroiled in a legal battle with the Indian government, which claimed the company had failed to deliver 3.2 million of the masks on time. The company did not comment on the lawsuit, which is still ongoing.

In September, Mr Perry left Zilingo to rejoin Citigroup.

Inside the company, former employees paint a picture of a boss who ruled by fear. She allegedly told some staff they would have no second chance in the start-up industry because of her powerful connections. She would publicly shame employees and declare that she had to do everything herself to save the company, one person said. Another described her as a narcissist who would throw anyone under the bus if it meant saving her own reputation.

Asked in an interview in Singapore before she was fired about the culture under her leadership, Ms Bose uncharacteristically paused and stared out of the window as the sun set over the city.

"I was 23 when I started the company," she said eventually. "I liked having control at the beginning. Of course, I made mistakes and learnt from them. By the time we got to the stage where we had all these senior people, I don't think I was a control freak."

In her most recent interview with Bloomberg in July, Ms Bose reiterated that she has not done anything wrong. "I'm going to be a lot calmer, a lot more empathetic and understanding of how people work together. That has been a big learning for me. Managing people, managing relationships, managing communications - I think all of this is coming down to that," she said.

By November 2020, Zilingo had barely enough cash to last a month. A group of existing investors, including Sequoia, EDBI, Sofina, Temasek and SIG, stepped in to rescue the company by purchasing US$25 million of convertible notes.

In January 2021, Mr Singh and Ms Bose met at the Four Seasons Hotel's alfresco cafe as they did from time to time to talk shop. Mr Singh suggested that Ms Bose consider stepping aside. He said Mr Ananth Narayanan, founder of brand-building service Mensa Brands and former CEO of fashion platform Myntra, could be a potential successor. The two men had met recently and, when Mr Narayanan said he was looking for a new opportunity, Mr Singh had thought of Zilingo.

Ms Bose was shocked. "Not yet," she said.

She went home and, that night, sent a series of emotional texts to Mr Singh, saying his suggestion was a gender-related issue and pouring her heart out. She said her departure would make her look bad, as though the firm needed to be saved by someone else. Mr Singh said it was just a preliminary idea and there was no need to discuss it again. He urged her instead to focus on improving metrics, finding a new CFO and fund raising, according to people familiar with the meeting and texts seen by Bloomberg.

Ms Bose ended the chat by saying they should work together towards the best possible outcome, and Mr Singh replied with two thumbs-up emojis. It was 2.29am.

The mounting pressure was also testing the relationship between Ms Bose and co-founder Mr Kapoor, the chief technology officer. They had clashed over the future of the company the previous month when the company was scrambling to stay afloat.

"I am scared honestly that we will not hit our goals," she texted Mr Kapoor several hours after the chat with Mr Singh. "When something is wrong, the blame falls on me, but everyone's there to take credit for the good," she wrote.

"I don't like being hated for busting my ass at all," she added.

Ms Bose spent most of the year trying to pull in more funds. In July 2021, the company took mezzanine debt of US$40 million from Indies Capital Partners and Varde Partners, but subsequent efforts to raise money from private equity and venture capital firms failed. One issue was a concern from potential investors that users were making fake transactions in key markets to bilk Zilingo's subsidies. Executives from two firms told Bloomberg News that they decided not to back Zilingo after they found evidence of merchant fraud in Indonesia, the country that accounted for more than half of Zilingo's gross merchandise volume in financial year 2021.

There was no suggestion that Zilingo was involved in the suspected fake transactions. Some existing investors, including Burda Principal Investments, Temasek and Sofina, questioned Ms Bose about the company's unaudited financial reports, according to people familiar with the matter. But Ms Bose was providing monthly financial updates to the board, and they were lenient as Zilingo was busy with fund raising at the time, one of the people said.

In March this year, Ms Bose received an ominous text on her phone: "Storm is coming your way."

A few days later, she was asked to join a meeting with investors at Burda's shophouse office in Singapore's Boat Quay, according to people familiar with the details of the meeting. There, Mr Singh and the two other shareholders dealt her a stunner. They said Zilingo's board had received complaints about alleged mismanagement and financial misrepresentation and they were suspending her during an investigation. Mr Singh urged her to be cooperative.

"We just want to save the company," he said, according to one of the people.

Ms Bose promised to help. As she left, she started running through the pouring rain.

"I think the tale is about what sometimes happens when you go into hyper-growth mode," said Ms Aliza Knox, senior adviser at Boston Consulting Group, who has held senior management positions at tech companies including Google and Twitter in Asia Pacific.

In these situations, start-ups need to think about adding independent board members beyond "founders and funders", she said. "Could some of the problems have been mitigated if there were a different kind of board a little bit earlier? That's an important question to ask."

Zilingo is not the only Sequoia-backed start-up embroiled in controversy. BharatPe's co-founder Ashneer Grover resigned from the fast-growing Indian fintech start-up in March after senior leadership accused him of misappropriation of funds. Mr Grover has denied the accusations against him, including that he stole company money to fund an extravagant lifestyle, which he said stem from "personal hatred and low thinking", he said on LinkedIn.

A forensic team from EY India has looked into Indian social commerce start-up Trell, another Sequoia-backed company, amid allegations of financial irregularities. Trell's three co-founders did not respond to requests for comment. Co-founder and CEO Pulkit Agrawal in March sent a note to investors, questioning the nature of the forensic audit, the Economic Times reported, citing its own review of the note.

Sequoia India and South-east Asia published a blog post in April, saying it would take "proactive steps" to drive corporate governance at start-ups it invests in.

Mr Singh is feeling the heat as he evolves from start-up cheerleader to champion of corporate governance. Increased scrutiny prompted some Sequoia-backed Indian founders to compare him to a forceful ruler from Indian history.

"There is art to setting up governance - the board, process and advisers - in such a way that brakes kick in automatically when something bad happens," said Mr Dmitry Levit, founder of Singapore-based VC firm Cento Ventures. He said many of Sequoia India's companies are like racing cars. "If somebody tries to run a Formula One car on off-road terrain in stormy weather, it cannot absorb the shocks."

Sequoia India said it has always cared about corporate governance.

"Building world-class companies requires first-rate governance," a Sequoia India spokesman said in a statement to Bloomberg. "There is always more we can do to work with founders so that their companies benefit from better, more robust standards of governance, such as stronger audit oversight, clear whistle-blower processes and the need to bring independent directors on board earlier."

Ankiti Bose was a celebrity who crisscrossed the globe to speak at tech gatherings from Hong Kong to California. PHOTO: ZILINGO

Salary questions

The zeal for governance may have come too late for Zilingo. About a week after Ms Bose was suspended, a board director and an adviser to another shareholder questioned her about why she was drawing a monthly salary of $50,000. Her employment contract five years ago stated it as $8,500 and the adviser had just discovered she had been making considerably more since 2019, according to people with knowledge of the matter. Ms Bose said the numbers are inaccurate but did not provide her salary information.Investigators hired by the board also questioned her about three sets of revenue numbers for financial year 2021 that Zilingo had shared with external parties: US$190 million, US$164 million and US$140 million. Ms Bose explained to them that the US$190 million had been circulated before the year closed and before the cancellation of masks and other orders. The US$140 million was used in a due diligence report for fund raising, while the US$164 million included uninvoiced revenue, according to a document seen by Bloomberg.

But another document the company shared with a potential investor, seen by Bloomberg News, showed that Zilingo's net revenue for the year was about US$40 million. A representative for Kroll, the firm that conducted the probe, declined to comment.

Ms Bose said in an interview with Bloomberg News in May that Zilingo has used aggressive methods for recognising revenue, but that the calculations are standard practice for the industry and that all of its investors were fully aware of them. "These matters are well understood by all investors," Ms Bose said in the interview.

Zilingo "went through a tough time during Covid-19", said Mr Rohit Sipahimalani, Temasek's chief investment officer. "There were clearly some things the board was unaware of, and when there were complaints made, they investigated into it and actions have been taken subsequently."

Now, the company is in turmoil and some employees say they are worried about their future. The board in June was considering liquidating the company. After her suspension in March, Ms Bose herself filed a formal complaint to the board, asking it to also suspend Mr Kapoor and then chief operating officer Aadi Vaidya, a friend from college, for their poor work performance and lack of leadership. A representative of the company, Mr Kapoor and Mr Vaidya declined to comment. Mr Vaidya resigned last week after seven years with Zilingo, explaining "now is the time to move on, clear my head and reset priorities".

It is a steep fall for Zilingo from just five months ago, when Ms Bose's fund-raising efforts valued the company at US$1.2 billion.

- Joined

- Feb 13, 2017

- Messages

- 3,708

- Points

- 113

THREE BIG LIES ABOUT THE NATIONAL RESERVES THAT YOU SHOULD KNOW ABOUT

"The national reserves must not be disclosed. If this is made public, the SGD can be subject to attacks by currency speculators" is the mantra of the Singapore government. Enough of this nonsense.

Speculative attacks happen during a currency crisis. A currency crisis is a consequence of chronic balance of payments deficits (it's also called a balance of payments crisis). This is how it goes. Due to trade imbalances ie a chronic deficit, the domestic currency of the country is weakened. Its central bank either refuses or is unable to allow the exchange rate to fall. To maintain the rate, the central bank has to keep buying its domestic currency. It continues the buying policy till it runs out of foreign reserves. This leads to a financial crisis as the value of foreign debt rises in relation to the weakened domestic currency. Foreign currency liquidity freezes because no one's going to sell the foreign currency to you if the exchange rate is forcibly maintained at unrealistic levels. Eventually the central bank capitulates because no one can go against the market in the long run. It is forced to devalue the domestic currency to bring it back to equilibrium. This type of scenario happens when the market anticipates that domestic policies will not be adjusted sufficiently to devalue the domestic currency. So they attack the currency by selling (shorting it) at the unrealistic high rate controlled by the central bank. Sooner or later when the government is forced to devalue, speculators buy back the currency at lower rates and make a killing.

First BIG LIE: Currency crisis happens when the exchange rate does not respond to market conditions. There is sufficient empirical evidence that such scenarios happen in cases of a pegged currency, ie the rate is fixed to some other currencies. In the case of Singapore, MAS manages on the basis of a floating rate, using an official band to control daily volatility only. Should chronic trade deficits force the rate down, MAS will loosen the band to allow the SGD to devalue. So the above illustrated currency crisis scenario won't happen in Singapore.

Second BIG LIE: If the SGD is weakened and the MAS wants to cushion the devaluation, it is forced to intervene in the market to buy up as much of the domestic currency as possible. To do this, MAS makes use of its foreign reserves. Thus, the more forex reserves it holds, the stronger the MAS is to support the SGD. So here's the rub. Like all central banks in the world, the holdings of forex reserves of the MAS are all in the open for the world to see. It is currently about SGD427 billion. There is nothing secretive about it, and it has nothing to do with national reserves.

Currency speculators aren't watching your reserves. There are watching the market. If the market sees the currency as over-valued, they know sooner or later the central bank has to devalue. Just like a poker player, if he sees he has a winning hand, he continues raising the stakes.

More at https://shrtcô.de/DGdfMr

"The national reserves must not be disclosed. If this is made public, the SGD can be subject to attacks by currency speculators" is the mantra of the Singapore government. Enough of this nonsense.

Speculative attacks happen during a currency crisis. A currency crisis is a consequence of chronic balance of payments deficits (it's also called a balance of payments crisis). This is how it goes. Due to trade imbalances ie a chronic deficit, the domestic currency of the country is weakened. Its central bank either refuses or is unable to allow the exchange rate to fall. To maintain the rate, the central bank has to keep buying its domestic currency. It continues the buying policy till it runs out of foreign reserves. This leads to a financial crisis as the value of foreign debt rises in relation to the weakened domestic currency. Foreign currency liquidity freezes because no one's going to sell the foreign currency to you if the exchange rate is forcibly maintained at unrealistic levels. Eventually the central bank capitulates because no one can go against the market in the long run. It is forced to devalue the domestic currency to bring it back to equilibrium. This type of scenario happens when the market anticipates that domestic policies will not be adjusted sufficiently to devalue the domestic currency. So they attack the currency by selling (shorting it) at the unrealistic high rate controlled by the central bank. Sooner or later when the government is forced to devalue, speculators buy back the currency at lower rates and make a killing.

First BIG LIE: Currency crisis happens when the exchange rate does not respond to market conditions. There is sufficient empirical evidence that such scenarios happen in cases of a pegged currency, ie the rate is fixed to some other currencies. In the case of Singapore, MAS manages on the basis of a floating rate, using an official band to control daily volatility only. Should chronic trade deficits force the rate down, MAS will loosen the band to allow the SGD to devalue. So the above illustrated currency crisis scenario won't happen in Singapore.

Second BIG LIE: If the SGD is weakened and the MAS wants to cushion the devaluation, it is forced to intervene in the market to buy up as much of the domestic currency as possible. To do this, MAS makes use of its foreign reserves. Thus, the more forex reserves it holds, the stronger the MAS is to support the SGD. So here's the rub. Like all central banks in the world, the holdings of forex reserves of the MAS are all in the open for the world to see. It is currently about SGD427 billion. There is nothing secretive about it, and it has nothing to do with national reserves.

Currency speculators aren't watching your reserves. There are watching the market. If the market sees the currency as over-valued, they know sooner or later the central bank has to devalue. Just like a poker player, if he sees he has a winning hand, he continues raising the stakes.

More at https://shrtcô.de/DGdfMr

- Joined

- Apr 17, 2019

- Messages

- 6,840

- Points

- 113

i think plenty of ang moh kias already know stinkypura real reserves i.e. gic (eunuch loong + temasick (whore jinx) + mas total assets

nothing secretive coz plenty of ang moh kia are employed there, and these cheebye invest mostly in ang moh countries, somewhat in tiongkok or japs.

nothing secretive coz plenty of ang moh kia are employed there, and these cheebye invest mostly in ang moh countries, somewhat in tiongkok or japs.

- Joined

- Jul 25, 2008

- Messages

- 13,602

- Points

- 113

Lim How Teck exits as chairman of Temasek-backed Heliconia Capital, months after police arrest

Mr Lim's departure comes after he took a leave of absence from his role as chairman following his arrest in February. PHOTO: ST FILE

Janice Lim

Aug 25, 2022

SINGAPORE (THE BUSINESS TIMES) - Lim How Teck has stepped down as chairman of Temasek-backed Heliconia Capital, months after he was arrested in his capacity as the lead independent director of Raffles Education Corp.

Lim's departure comes after he took a leave of absence from his role as chairman of the investment firm following his arrest in February this year.

His resignation was announced via a bourse filing from CSE Global - one of Heliconia's portfolio companies - on Wednesday (Aug 24).

The international technology group announced in the filing that Lim would resign from his role as non-executive non-independent director of CSE Global with immediate effect since he was stepping down as Heliconia's chairman.

The investment firm had nominated Lim to be on CSE Global's board in the first place.

This also means Lim would be vacating his position as a member of the group's audit and risk committee, as well as nominating committee.

In February this year, five directors from Raffles Education were arrested, with their bail set at $30,000 each, following investigations from the Monetary Authority of Singapore and the Commercial Affairs Department.

The investigations are related to disclosures made by the company about a claim by Affin Bank against certain subsidiaries of the company, including Raffles K12 and Raffles Iskandar, which manage schools in Malaysia.

- Joined

- Mar 5, 2019

- Messages

- 11,031

- Points

- 113

dot. just wanted to say : many thanks for all your scam related posts you generate. I believe it's a public service and I hope people benefit from it. Whoever you are, and whether I agree on other matters or not, good on you for informing us.Lim How Teck exits as chairman of Temasek-backed Heliconia Capital, months after police arrest

Mr Lim's departure comes after he took a leave of absence from his role as chairman following his arrest in February. PHOTO: ST FILE

Janice Lim

Aug 25, 2022

SINGAPORE (THE BUSINESS TIMES) - Lim How Teck has stepped down as chairman of Temasek-backed Heliconia Capital, months after he was arrested in his capacity as the lead independent director of Raffles Education Corp.

Lim's departure comes after he took a leave of absence from his role as chairman of the investment firm following his arrest in February this year.

His resignation was announced via a bourse filing from CSE Global - one of Heliconia's portfolio companies - on Wednesday (Aug 24).

The international technology group announced in the filing that Lim would resign from his role as non-executive non-independent director of CSE Global with immediate effect since he was stepping down as Heliconia's chairman.

The investment firm had nominated Lim to be on CSE Global's board in the first place.

This also means Lim would be vacating his position as a member of the group's audit and risk committee, as well as nominating committee.

In February this year, five directors from Raffles Education were arrested, with their bail set at $30,000 each, following investigations from the Monetary Authority of Singapore and the Commercial Affairs Department.

The investigations are related to disclosures made by the company about a claim by Affin Bank against certain subsidiaries of the company, including Raffles K12 and Raffles Iskandar, which manage schools in Malaysia.

- Joined

- Jul 25, 2008

- Messages

- 13,602

- Points

- 113

Temasek speak up only when the merger is receiving flak from shareholders, and defends the merger.

Is Temasek's interest aligned with SembMarine's and Keppel's management instead of the shareholders?

MON, AUG 29, 2022 - 5:50 AM

Since becoming a direct shareholder of SembMarine, Temasek has made a significant investment of S$1.1 billion.

PHOTO: SEMBCORP MARINE

WE have noted increased commentary on the proposed combination of Keppel Offshore & Marine and Sembcorp Marine : S51 -2.56%(Sembmarine), and the letter by Sembcorp Industries : U96 0% (Sembcorp) to The Business Times on Aug 25, 2022 explaining the context behind the demerger of Sembcorp and SembMarine in 2020.

These highlight important issues for all shareholders to consider as they prepare to vote on the proposed combination at the respective extraordinary general meetings (EGMs) of Keppel Corporation : BN4 -0.69% and SembMarine, expected to take place in the fourth quarter of 2022. As a major shareholder in both Keppel and SembMarine, we think it would also be useful to share our perspectives with fellow shareholders.

Temasek became a direct shareholder of SembMarine in 2020 following the demerger of SembMarine from its then-parent, Sembcorp. Along with the demerger, SembMarine carried out a S$2.1 billion rights issue to repay a loan of S$1.5 billion advanced by Sembcorp to SembMarine, and to strengthen its cash position and balance sheet. Temasek took up the rights shares not subscribed by other SembMarine shareholders and received its pro-rata entitlement during Sembcorp’s distribution of SembMarine shares to its shareholders thereafter (based on our 49.3 per cent shareholding in Sembcorp). The demerger and the 2020 rights issue resulted in Temasek acquiring a 42.6 per cent shareholding in SembMarine. The financial outlay by Temasek in the 2020 rights issue was S$206 million.

In 2021, amid the Covid-19 pandemic, SembMarine urgently needed to recapitalise to address business requirements and complete existing projects. The board of SembMarine called for a S$1.5 billion rights issue to strengthen the company’s balance sheet, and continue its progress on its transformation journey, which included a memorandum of understanding for the proposed combination. Temasek participated in the rights issue based on commercial considerations. We voted in favour of the rights issue and agreed to subscribe for not only our pro-rata entitlements based on our 42.6 per cent shareholding in SembMarine, but also any excess rights not taken up by other shareholders, up to 67 per cent of the 2021 rights issue. The commitment, provided without the benefit of a whitewash waiver resolution, gave SembMarine certainty that it could raise the full S$1.5 billion that it needed. This resulted in Temasek having to make a mandatory general offer, at the rights issue price. Shareholders tendered an additional 8 per cent of SembMarine shares. The financial outlay by Temasek in the 2021 rights issue and mandatory general offer was S$942 million.

Since becoming a direct shareholder of SembMarine in 2020 through the demerger of Sembcorp and SembMarine, Temasek has made a significant investment of approximately S$1.1 billion in SembMarine through the 2020 rights issue, 2021 rights issue and mandatory general offer, resulting in an ownership of 54.6 per cent in the company.

This year, Keppel and SembMarine announced the proposed combination. Both companies have clearly articulated the benefits of the merger. As a major shareholder in both companies, we fully support the rationale for the transaction and share the belief that all shareholders will benefit from being part of the combined entity.

We expect the combined entity to be well-positioned to achieve the necessary scale and synergies to become more competitive and to build a sustainable orderbook amid the changing global energy environment. This is also well aligned with our objective to catalyse the transition of our portfolio companies towards a net zero world.

With substantial value at stake through our shareholding in SembMarine, Temasek is fully aligned with fellow shareholders in seeking the best outcome for the company. We support the SembMarine board’s expressed view that the proposed combination offers the best and most compelling way forward for SembMarine to unlock long term value for all of its stakeholders.

As a major shareholder of both Keppel and SembMarine, Temasek will abstain from voting on all resolutions relating to the proposed combination in the upcoming EGMs. The decision will therefore rest solely in the hands of the independent shareholders of both companies, who have to carefully consider the facts around the transaction. We hope our perspectives shared will be beneficial to fellow shareholders as they prepare to vote on the proposed combination.

Nagi Hamiyeh, head, portfolio development group, Temasek

Is Temasek's interest aligned with SembMarine's and Keppel's management instead of the shareholders?

Temasek’s interests aligned with those of SembMarine shareholders

MON, AUG 29, 2022 - 5:50 AM