SPH to restructure media business into not-for-profit entity to support quality journalism

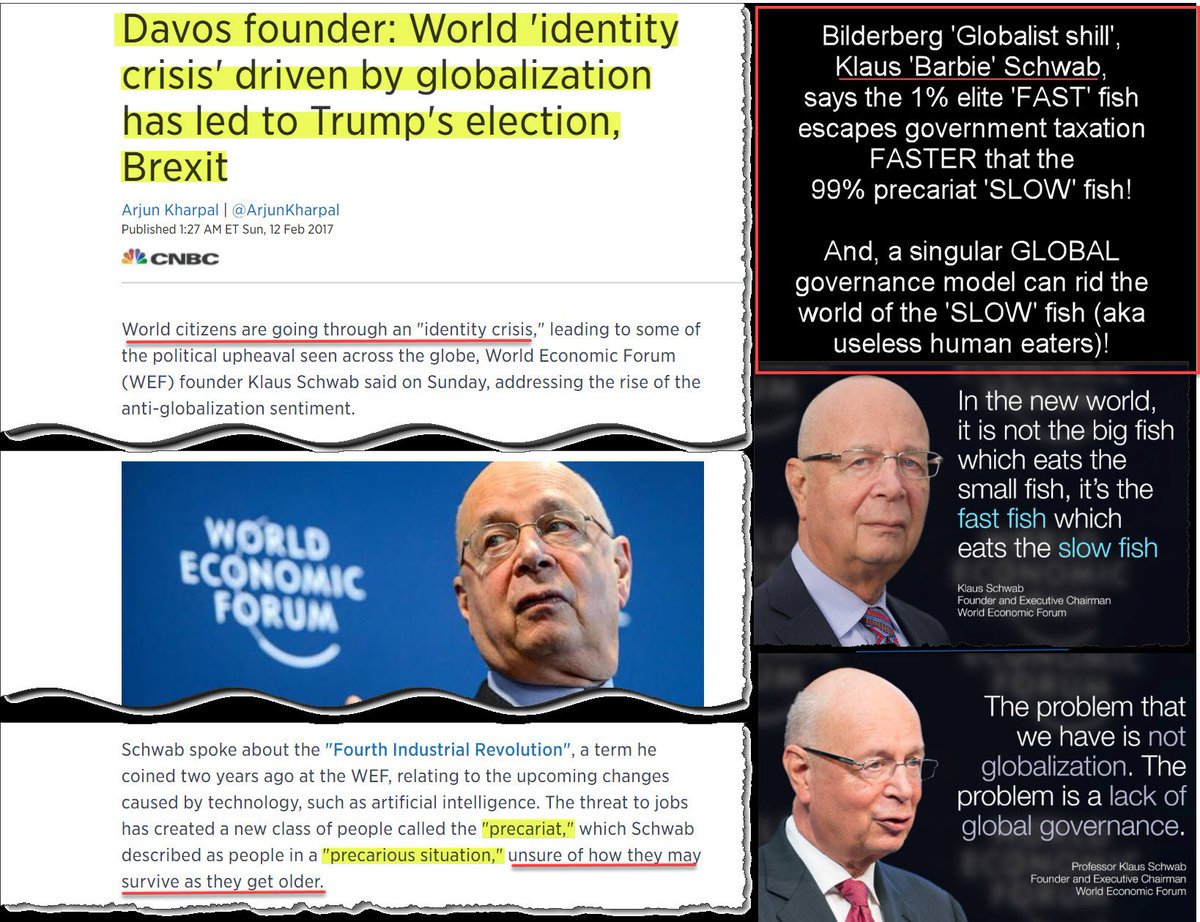

Under the restructuring proposal, SPH Media will eventually be transferred to a not-for-profit entity for a nominal sum. ST PHOTO: GAVIN FOO

Grace Ho

May 6, 2021

SINGAPORE - Singapore Press Holdings (SPH), which publishes The Straits Times and Lianhe Zaobao, intends to transfer its media business to a not-for-profit company as part of

a strategic review of its various businesses.

Announcing the move on Thursday (May 6), SPH chairman Lee Boon Yang said the transfer will enable the media business to focus on quality journalism and invest in talent and new technology to strengthen its digital capabilities.

The restructuring entails transferring all the media-related businesses, including relevant subsidiaries, employees, News Centre and Print Centre along with their respective leaseholds, and all related intellectual property and information technology assets, to a newly incorporated wholly-owned subsidiary, SPH Media Holdings Pte Ltd (SPH Media).

SPH will provide the initial resources and funding by capitalising SPH Media with a cash injection of $80 million, $30 million worth of SPH shares and SPH Reit units, and SPH's stakes in four of its digital media investments.

Under the restructuring proposal, SPH Media will eventually be transferred to a not-for-profit entity for a nominal sum. This will be a newly formed public company limited by guarantee, or CLG. A CLG is an entity that does not have share capital or shareholders but, instead, has members who act as guarantors of the company's liabilities.

More information on the CLG will be announced in due course, said SPH in a press statement on Thursday.

SPH said a not-for-profit structure will allow SPH Media to seek funding from public and private sources with a shared interest in supporting quality journalism.

After the transfer of SPH Media to the CLG, SPH will no longer be subject to shareholder and other relevant restrictions under the Newspaper and Printing Presses Act (NPPA).

The transfer of the media assets to the CLG is subject to SPH shareholders' approval at an extraordinary general meeting (EGM). At a press conference on Thursday, Dr Lee said the EGM would be called in early July and, upon shareholders' approval, the restructuring is expected to be completed by October or a bit earlier.

Credit Suisse (Singapore) is the appointed financial adviser for the review.

Tackling unprecedented industry disruption

The move is the most major restructuring in the industry since 1984, when SPH was formed through a merger of three organisations - the Straits Times Press group, Singapore News and Publications Limited, and Times Publishing Berhad.

That merger consolidated the flagship newspapers in different languages under one roof.

Explaining the rationale for the move, SPH said the media industry has faced "unprecedented disruption" in recent years, with SPH's operating revenue halving in the past five years largely due to a decline in print advertising and print subscription revenue.

SPH's media business recorded its first-ever loss of $11.4 million for the financial year that ended Aug 31, 2020.

"If not for the Jobs Support Scheme, the loss would have been a deeper $39.5 million," said Dr Lee.

"In recent years, we have right-sized the media operations in the sales and back-end support functions and cut costs without affecting our media capabilities. There remains little scope for further cost cuts without impairing the ability to maintain quality journalism."

Even with the resumption of activities after the circuit breaker last year, the decline in advertising revenue is expected to continue at a similar pace to that of the last five years.

Due to digital transformation efforts, SPH's average monthly unique audience across all its titles over the past two years has nearly doubled to a record 28 million, and digital circulation has surpassed print circulation.

But digital subscriptions and digital advertising have been unable to offset the decline in print advertising and print circulation revenues. The losses of the media business are likely to continue and widen.

SPH said that with the critical function the media business plays in providing quality news and information to the public, particularly in the vernacular languages, winding up the media business or selling it off is not a feasible option.

"However, remaining part of a publicly listed company where it is subject to expectations from shareholders of profitability and regular dividends is no longer a sustainable business model.

"Hence, a not-for-profit structure that allows SPH Media to seek funding from a range of public and private sources with a shared interest in supporting quality journalism and credible information is the optimal solution."

SPH chairman Lee Boon Yang's opening remarks on restructuring of media business

SPH had approached the Ministry of Communications and Information with a restructuring proposal to put the media business on a long-term sustainable financial footing. The ministry, which regulates SPH under the NPPA,

has indicated its support for the restructuring. It has also given its in-principle approval for the shareholding and other relevant restrictions under the NPPA to be lifted from SPH upon the closing of the proposed restructuring.

The NPPA states that no person shall, without the approval of the Minister, become a substantial shareholder of SPH; or enter into any agreement or arrangement "to act together with any other person with respect to the acquisition, holding or the exercise of rights in relation to, in aggregate more than 5 per cent of the shares".

Dr Lee said: "Without the encumbrances of the NPPA, SPH will have greater financial flexibility to tailor its capital and shareholding structure to pursue strategic growth opportunities across its other businesses and maximise returns for shareholders."

While a not-for-profit model may be "unfamiliar" in Singapore, SPH said that many news organisations overseas operate under similar funding structures, including the Guardian, which is controlled by the Scott Trust, in Britain, and the Tampa Bay Times, which is owned by the non-profit Poynter Institute, in the United States.

Dr Lee said the fundamental issue that needs to be addressed is the long-term viability of SPH Media in its present structure, that is subject to market pressures.

"SPH shareholders are not likely to tolerate the continued negative impact that the media business has on the company's financial prospects. On the other hand, we cannot allow a functioning, trusted and respected media organisation to be whittled down over time by market pressure and commercial constraints.

"In the context of Singapore's multiracial society, SPH serves a crucial function by providing news and information in vernacular languages to serve Singapore's diverse ethnic communities."

Considering these important roles, he said, winding up or selling off the media business is not an option for the group, as it will affect access to quality news and undermine media diversity and competition in Singapore. Either option would also require regulatory approval.

Responding to questions about whether employees face wage and bonus cuts now that SPH Media will be a non-profit-making entity, SPH chief executive officer Ng Yat Chung said there is no further scope for costs cuts without impairing the quality of journalism that SPH Media provides.

"The exercise is to make sure that we can preserve the fine bowl of china. The intention is not to do anything that will impair the ability of SPH Media to continue to provide quality journalism."

He was referring to what founding prime minister Lee Kuan Yew said to late president S R Nathan when the latter was appointed executive chairman of the Straits Times Press, a few years before the formation of SPH.

Mr Lee had told Mr Nathan: "Nathan, I am giving you The Straits Times. It has 150 years of history. It has been a good paper. It is like a bowl of china. If you break it, I can piece it together. But it will never be the same. Try not to destroy it."

Dr Lee said that he could not speak for the CLG, as the intent of the restructuring is for it to operate independently. But the restructuring exercise is to ensure that the media capability in SPH Media is in no way disadvantaged or undermined by the transfer.

"The CLG is fully aware of this intention and fully cognisant of the fact that it has now taken on the responsibility of caring for this china bowl. It will then continue to nurture and strengthen this previous legacy, rather than undermine it - whether by further right-sizing or wage adjustments. It would have to be very careful in ensuring that media capabilities are in no way adversely affected as a result of this transfer."

SPH called for a halt in the trading of its shares at 7.37am on Thursday morning before the stock market opened.

Shares of SPH closed two cents or 1.1 per cent lower at $1.79 on Wednesday.

SPH posted a net profit of $97.9 million for the first half of the financial year that ended on Feb 28 - a 26.1 per cent rise. The company remains operationally profitable at $119.8 million.

The media segment posted a profit of $3.1 million, down 70.9 per cent year on year. Excluding grants from the Jobs Support Scheme, it recognised a pre-tax loss of $9.7 million.

SPH's core business is in the publishing of newspapers, magazines and books, in both print and digital editions. The company also owns about 66 per cent of SPH Reit.

SPH owns and operates The Seletar Mall, and is developing an integrated development consisting of The Woodleigh Residences and The Woodleigh Mall. In addition, it owns purpose-built student accommodation in Britain and Germany.

The company also owns Orange Valley, one of Singapore's largest nursing homes, and has investments in motoring portal sgCarMart, job platform FastJobs, telco M1 and South Korean e-commerce giant Coupang.

It had 3,875 employees in financial year 2020.

Here is MCI's statement in full:

HELPING OUR NEWS MEDIA INDUSTRY BUILD CAPABILITIES TO THRIVE IN A DIGITAL WORLD

The Ministry of Communications and Information (MCI) has considered and supports the proposal by Singapore Press Holdings Limited (SPH Limited) to restructure itself and transfer its media business (SPH Media) to a company limited by guarantee (CLG), pending shareholder approval. To help SPH Media accelerate its digital transformation and build capabilities for the future, the Government is prepared to provide funding support to the CLG.

Financial realities of the global print news media business

2. SPH's newsroom and its publications in the four official languages have been trusted sources of news for much of Singapore's history. Amidst growing fragmentation of the information landscape, their role in providing Singaporeans with timely, accurate and credible information is even more critical. The importance of a reliable and credible local media has been especially evident in Singapore's fight against Covid-19. According to a YouGov study, seven in 10 Singaporeans said they trusted the local media's reporting on Covid-19. The continued growth of SPH Media's reach and readership confirms that its platforms remain valued news sources for Singapore residents.

3. However, the global print media industry has been severely disrupted. With the advent of the Internet and social media, it has come under immense stress. Competition for consumers' attention has also increased significantly.

4. Print advertising revenue has therefore been steadily declining as advertisers shift towards digital advertising. The challenge is most acute in small markets with high Internet penetration. Our local print media has moved decisively online, and succeeded in garnering high and growing page views. But it is a challenge to convert that into a viable revenue-generating model because on the Internet, information is largely free, and Internet platforms like Google and Facebook take the lion's share of online advertising revenue.

5. This is a structural issue faced by media companies worldwide. The financial viability and profitability of print media have been severely affected, a trend exacerbated by Covid-19. This has immediate and severe impact on the ability to sustain the quality of journalism.

6. SPH Media's financial performance and outlook reflect these secular trends. Despite total circulation holding steady, with digital circulation growing to offset the fall in print circulation, its profit margins have narrowed considerably over the years.

7. Under SPH Limited, SPH Media has over the years made substantial progress transforming itself for the digital era. However, SPH Limited's obligations as a listed company will constrain its ability to continue investing in the media business, given the adverse financial outlook for the industry. To ensure SPH Media's long-term viability, SPH Limited has proposed to transfer it to a CLG, which will no longer be managed by nor part of SPH Limited, the listed company.

Government's support for our local print media business

8. MCI supports SPH Limited's proposal. It is in the interest of Singapore and Singaporeans that our local media continues to thrive and deliver quality journalism. We note that the transfer is subject to shareholder approval. MCI will be consulting SPH Limited's management shareholders, who have long served as the custodians of SPH Media on behalf of Singapore and Singaporeans, on the next steps, including the formation of the CLG. After SPH Media is transferred to a CLG, MCI is prepared to provide it with funding support to help it build capabilities for the future.

9. Mr S. Iswaran, Minister for Communications and Information, said: "A professional, capable and respected local news media is critical to our national interest. They must continue to be trusted by Singaporeans as a reliable and objective source of news, reporting on domestic and overseas events, as well as on the diversity of views that Singaporeans hold. They report through a Singaporean lens, so that our citizens have a good understanding of the opportunities and challenges facing our country, the choices we need to make, and our place in the world. The Government therefore supports high-quality, credible journalism in our local news media.

SPH Board and management have concluded that the current media business model within a listed company structure is not viable, given global technology and industry trends, and the need for significant investments in digitalisation and capability development.

The Government agrees with this assessment. We are supportive of SPH's proposal to restructure and transfer SPH Media to the CLG. Our goal is to help the local news media and our journalists adapt and thrive in the digital era while maintaining the high professional standards we expect and value. The Government is also prepared to provide SPH Media with funding support, with fiscal discipline and accountability for outcomes in areas like digital innovation and capability development, as part of a long-term sustainable business plan.

This restructuring of SPH Media, and future government support for it, will help to strengthen SPH Media in continuing its important role in Singapore's media scene."

10. The Minister for Communications and Information will deliver a ministerial statement on this subject at the next Parliament sitting on May 10.