- Joined

- May 16, 2023

- Messages

- 35,813

- Points

- 113

No cheekon jiak.... Jiak Neighbour XMM Cheese pie?You want to buy also no one is selling.

You may have to go without food for a few days.

There may be food rationing.

No cheekon jiak.... Jiak Neighbour XMM Cheese pie?You want to buy also no one is selling.

You may have to go without food for a few days.

There may be food rationing.

https://www.businesstimes.com.sg/co...ses-standards-purpose-bound-digital-money?amp

No worries, SG always smart wan, now have digital currency coming to solve all problems ler..

Swee swee Bo Run Water liao

Cannot say like that we are world most balai nation lai deSingapore even approved Ripple to aid money-laundering

https://www.kitco.com/news/2023-06-...igital-asset-payments-and-token-products.html

what is balai??Cannot say like that we are world most balai nation lai de

Thanks to China cheap yuan, Encik Putin is able to maintain his economic engine running while fight a Ukraine war and surviving Global sanctionRussians have been offloading yuan like crazy in the past 12 months

https://news.yahoo.com/russia-using-chinese-yuan-around-051945912.html

Malay word for Smartwhat is balai??

Bank for International Settlements (BIS), called on Sunday for more interest rate hikesWe were in recession during lockdowns.

Massive US handouts delayed it.

No way can anyone escape recession if economies were forced to shut.

How fed bank got its economic data is a mystery as as it indicate US economy is overheating when on the ground, everyone knows its not.

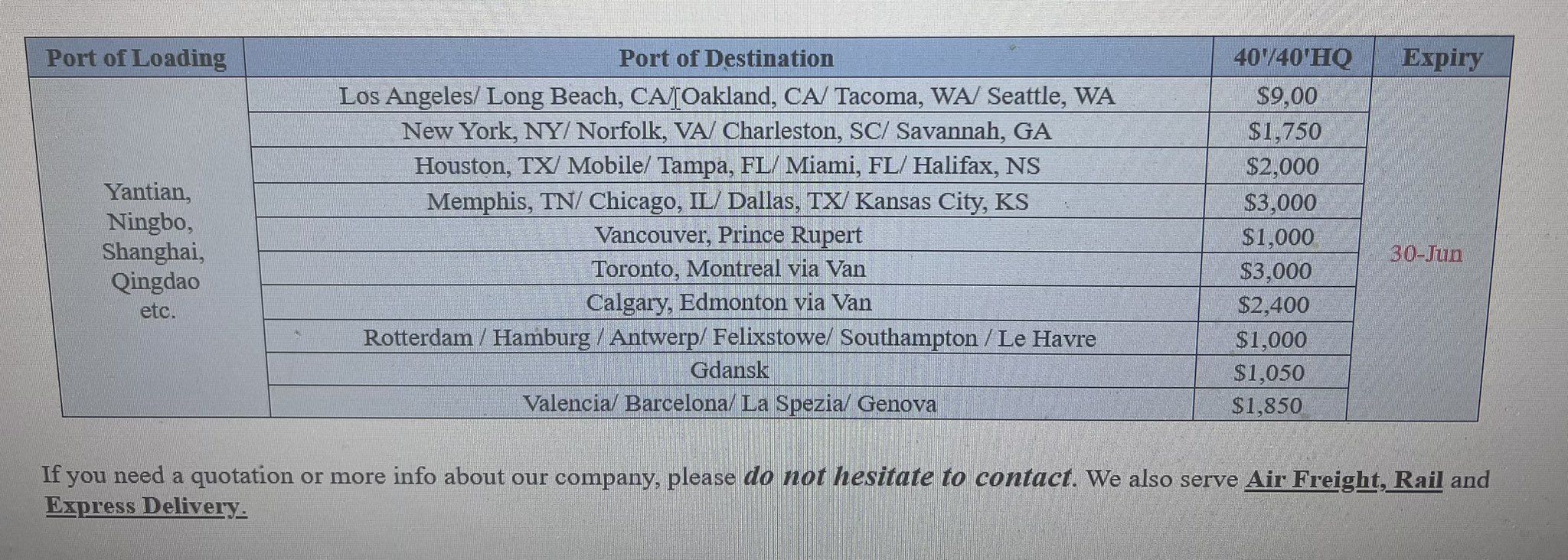

"De-risk" and "Friend Shoring" is happening nowContainer Shipping Cost From China To West Coast US Has Dropped 90% From US$18,000 To US$1800 average

We were in recession during lockdowns.

Massive US handouts delayed it.

No way can anyone escape recession if economies were forced to shut.

How fed bank got its economic data is a mystery as as it indicate US economy is overheating when on the ground, everyone knows its not.

Like that Balance Sheet Recession will go global De woh, countries with debt above 100% sure tioBank for International Settlements (BIS), called on Sunday for more interest rate hikes

https://finance.yahoo.com/news/bis-warns-world-economy-critical-090517941.html

we are thankful to Japan for resisting the rate-hikes.Like that Balance Sheet Recession will go global De woh, countries with debt above 100% sure tio

Because Nippon also try to cut down it's debt as well...we are thankful to Japan for resisting the rate-hikes.

their stock market benefiting from the weak yen, highest in decades.Because Nippon also try to cut down it's debt as well...

Last 20yrs, they have managed to reduce a lot debt in the Ultra Low Interest Rate era.

Nippon not only have high debt issue, it's population aged rapidly as well. So nippon may be running out of time to defuse their debt bomb