-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Global US-Dollar Shortage - Are We Already in a Recession?

- Thread starter Chase

- Start date

- Joined

- May 16, 2023

- Messages

- 35,180

- Points

- 113

Strap In’—Serious $40,000 Bitcoin Price Crash Warning Issued As The Fed Suddenly Braces For A U.S. Dollar ‘Crisis’ That’s Predicted To Spark ‘Total Collapse’

Billy BambroughSenior Contributor

I write about how bitcoin, crypto and blockchain can change the world.

Follow

9

Sep 3, 2024,06:17am EDT

Updated Sep 3, 2024, 06:18am EDT

09/03 update below. This post was originally published on September 02

BitcoinBitcoin +0.9% and crypto prices have surged this year as the U.S. dollar index falls to year-to-date lows (with the Coinbase chief executive last week revealing an AI game-changer).

The bitcoin price is trading around $60,000 per bitcoin, up from January lows of under $40,000, as traders bet a fresh injection of liquidity by the Federal Reserve will put the bitcoin and crypto market on the "cusp" of a major move.

Now, as China gears up to drop a bitcoin price bombshell, fears are swirling the U.S. dollar is on "the verge of a total collapse," setting up the bitcoin price for "a critical tipping point."

The U.S. Dollar Index just hit a new 2024 low [and it's] actually still relatively high, but it looks like it's on the verge of a total collapse," economist and gold bull Peter Schiff posted to X.

The index could easily sink below 90 before year-end, challenging the 2020 low," Schiff, the founder of money manager Euro Pacific Asset Management and a bitcoin and crypto skeptic, later added. "I think that low will be breached in 2025, triggering a U.S. dollar crisis, crashing the economy, and sending consumer prices and long-term interest rates soaring."

09/03 update: The bitcoin price has continued on its recent downward trend as September gets underway, which is historically a bad time to be holding bitcoin.

"September has traditionally been a volatile month for bitcoin, with an average return of 4.78% and a typical peak-to-trough decline of 24.6%," analysts with the Bitfinex crypto exchange said in emailed comments.

- Joined

- May 16, 2023

- Messages

- 35,180

- Points

- 113

T. Rowe Manager Who Predicted Yen Shock Sees Another One Coming

- ‘Scapegoating’ of yen carry trade ignores bigger, deeper trend

- BOJ hikes and impact on global capital far from simple: Husain

Advertisement

0:14

Unmute

Carry Trade Risk in Focus as Ueda Comments Boost Yen

By Ruth Carson

September 3, 2024 at 9:51 AM GMT+8

Updated on

September 3, 2024 at 4:45 PM GMT+8

Save

Translate

Arif Husain says he was early in sounding the alarm on Japan’s rising interest rates last year, which he described as the “San Andreas fault of finance.”

The head of fixed-income at T. Rowe Price is now warning that investors have “just seen the first shift in that fault, and there is more” market volatility ahead after the nation’s rate hike in July helped trigger a sharp reversal of the yen carry trade.

- Joined

- Sep 13, 2023

- Messages

- 1,841

- Points

- 83

- Joined

- Sep 13, 2023

- Messages

- 1,841

- Points

- 83

https://www.forexlive.com/centralba...-the-dollar-of-around-us100-billion-20240906/

Friday, 06/09/2024 | 10:06 GMT+8

Chinese banks used swaps to build short positions in the dollar of around US$100 billion

- Bloomberg report on China propping up the yuan, and the risks it poses to their state banks

Friday, 06/09/2024 | 10:06 GMT+8

- State run Chinese banks have used FX swaps to prop up the yuan

- Bloomberg cites estimates that the banks have built short positions in the USD of over USD100bn

- Which has created "virtually risk-free returns of about 6% as recently as July for traders who took the other side" ... since July, of course, those profits have moderated as the yuan strengthened

- It’s the latest side effect of China’s shifting approach to currency management, following a botched devaluation in 2015 that led authorities to burn through $650 billion of foreign-exchange reserves trying to stop the yuan from falling to levels they feared could prompt capital outflow or harm domestic companies who’d borrowed abroad. With banks now bearing the brunt of efforts to support the yuan, China has been able to stabilize the currency without a drop in reserves that might encourage a pile-on by bearish speculators keen to test how much firepower the People’s Bank of China is prepared to deploy.

- Joined

- May 16, 2023

- Messages

- 35,180

- Points

- 113

After PBOC sell US Treasury, they need to convert the USD holding back to CNY...hence this large amount of USD sell off and buy in of CNY will trigger this "short effect" on USD / CNY currency pairhttps://www.forexlive.com/centralba...-the-dollar-of-around-us100-billion-20240906/

Chinese banks used swaps to build short positions in the dollar of around US$100 billion

Eamonn Sheridan

- Bloomberg report on China propping up the yuan, and the risks it poses to their state banks

Friday, 06/09/2024 | 10:06 GMT+8

Bloomberg add on the shifting of risks:

- State run Chinese banks have used FX swaps to prop up the yuan

- Bloomberg cites estimates that the banks have built short positions in the USD of over USD100bn

- Which has created "virtually risk-free returns of about 6% as recently as July for traders who took the other side" ... since July, of course, those profits have moderated as the yuan strengthened

Update USD/CNH (the offshore yuan - its strengthened since July):

- It’s the latest side effect of China’s shifting approach to currency management, following a botched devaluation in 2015 that led authorities to burn through $650 billion of foreign-exchange reserves trying to stop the yuan from falling to levels they feared could prompt capital outflow or harm domestic companies who’d borrowed abroad. With banks now bearing the brunt of efforts to support the yuan, China has been able to stabilize the currency without a drop in reserves that might encourage a pile-on by bearish speculators keen to test how much firepower the People’s Bank of China is prepared to deploy.

View attachment 205956

- Joined

- May 16, 2023

- Messages

- 35,180

- Points

- 113

US Bitcoin ETFs Bleed $1.2 Billion in Longest Run of Net Outflows

- Investors pulled cash from the funds for eight straight days

- Anxiety in global markets is spilling over into digital assets

By Sidhartha Shukla and Suvashree Ghosh

September 9, 2024 at 1:42 PM GMT+8

Save

US Bitcoin exchange-traded funds have posted their longest run of daily net outflows since listing at the start of the year, part of a wider retreat from riskier assets in a challenging period for global markets.

Investors pulled close to $1.2 billion in total from the group of 12 ETFs over the eight days through Sept. 6, data compiled by Bloomberg show. The drop comes amid a rocky period for shares and commodities on economic growth worries.

- Joined

- May 16, 2023

- Messages

- 35,180

- Points

- 113

China’s Deflationary Spiral Is Now Entering Dangerous New Stage

- Prices seen as falling through 2025 as wages, demand languish

- Long-term deflation could be major setback to China’s economy

“We are definitely in deflation and probably going through the second stage of deflation.”

Photographer: Qilai Shen/Bloomberg

By Bloomberg News

September 9, 2024 at 6:30 PM GMT+8

Save

Deflation stalking China since last year is now showing signs of spiraling, threatening to worsen the outlook for the world’s second-largest economy and raising calls for immediate policy action.

Data released Monday confirmed that apart from food costs, consumer price growth barely registered in large swathes of the economy at a time when incomes are sagging.

- Joined

- Sep 13, 2023

- Messages

- 1,841

- Points

- 83

https://www.scmp.com/economy/global...pen-petroyuan-closer-china-ties-minister-says

Kandy Wong

Published: 6:00pm, 9 Sep 2024Updated: 1:54pm, 11 Sep 2024

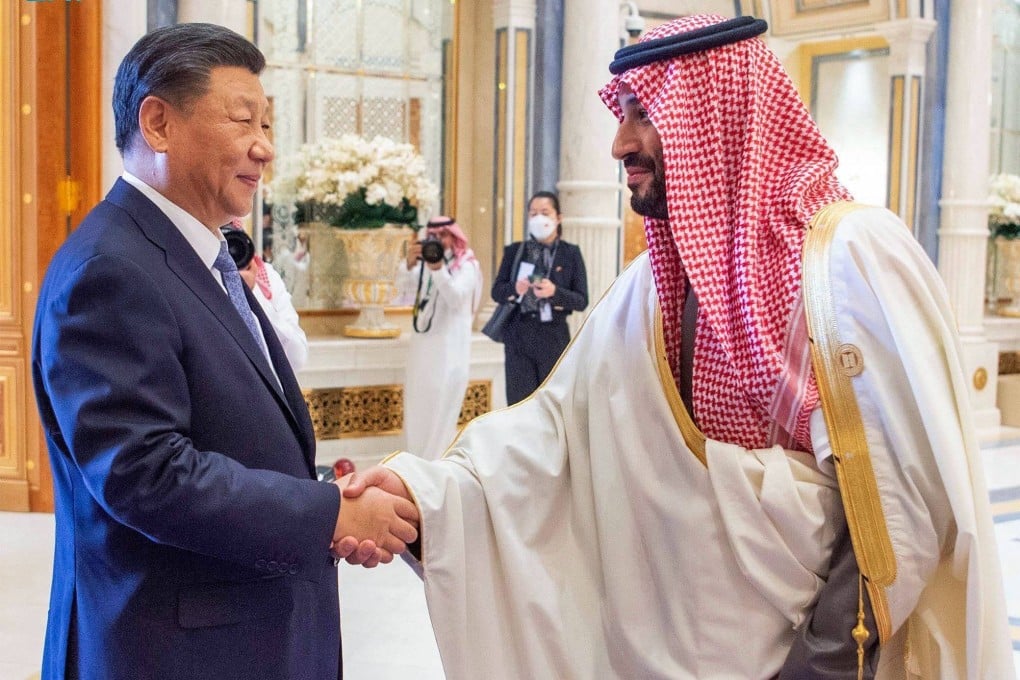

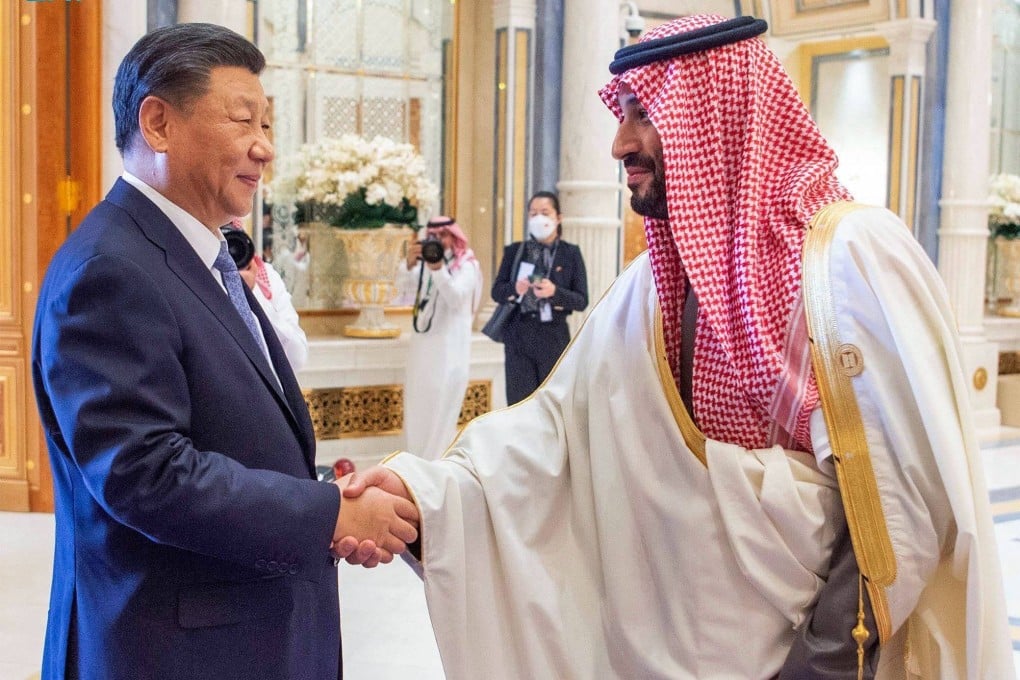

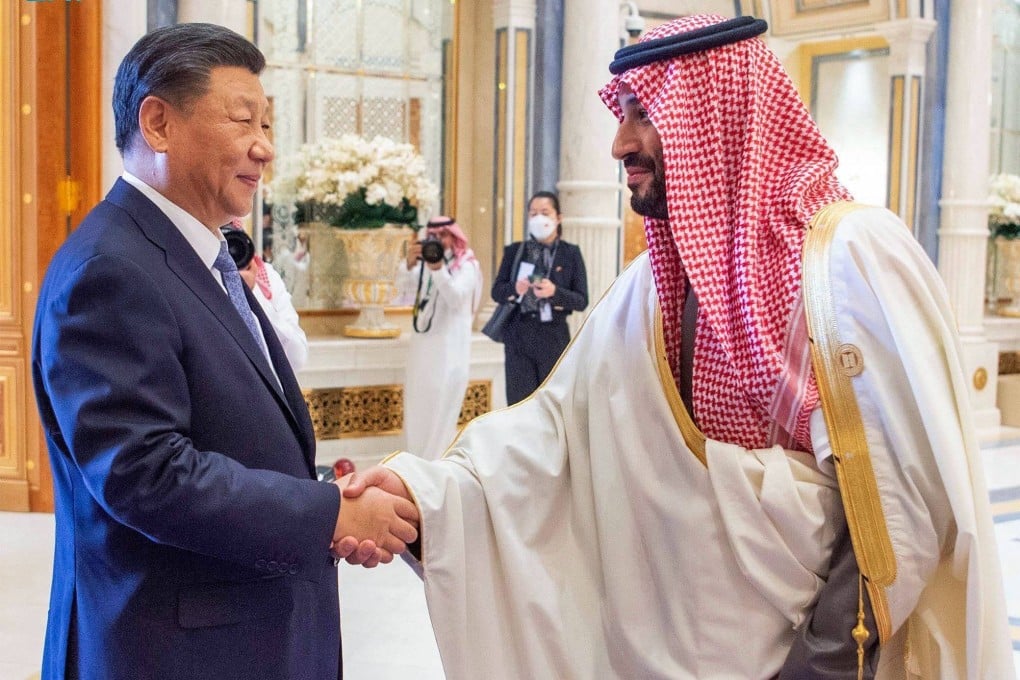

A top official from Saudi Arabia said the country is “open to new ideas” – including use of the yuan in crude settlements – as the oil-rich Middle Eastern nation looks to incorporate Chinese products like electric vehicles (EVs), the C919 passenger jet and renewable energy infrastructure while it attempts to diversify its economy.

Bandar Al-khorayef, Saudi minister of industry and mineral resources, made the comments as the two countries have moved closer despite an escalating rivalry between China and the US, Saudi Arabia’s traditional ally.

Exclusive | Saudi Arabia ‘open’ to petroyuan, closer China ties, minister says

Saudi Arabia’s minister of industry says country willing to ‘try new things’ in relationship with China, Chinese companies ‘welcome’

Reading Time:3 minutes

Kandy Wong

Published: 6:00pm, 9 Sep 2024Updated: 1:54pm, 11 Sep 2024

A top official from Saudi Arabia said the country is “open to new ideas” – including use of the yuan in crude settlements – as the oil-rich Middle Eastern nation looks to incorporate Chinese products like electric vehicles (EVs), the C919 passenger jet and renewable energy infrastructure while it attempts to diversify its economy.

Bandar Al-khorayef, Saudi minister of industry and mineral resources, made the comments as the two countries have moved closer despite an escalating rivalry between China and the US, Saudi Arabia’s traditional ally.

- Joined

- May 16, 2023

- Messages

- 35,180

- Points

- 113

ENd of Petro Dollar era...no renewal.https://www.scmp.com/economy/global...pen-petroyuan-closer-china-ties-minister-says

Exclusive | Saudi Arabia ‘open’ to petroyuan, closer China ties, minister says

Saudi Arabia’s minister of industry says country willing to ‘try new things’ in relationship with China, Chinese companies ‘welcome’

Reading Time:3 minutes

Kandy Wong

Published: 6:00pm, 9 Sep 2024Updated: 1:54pm, 11 Sep 2024

A top official from Saudi Arabia said the country is “open to new ideas” – including use of the yuan in crude settlements – as the oil-rich Middle Eastern nation looks to incorporate Chinese products like electric vehicles (EVs), the C919 passenger jet and renewable energy infrastructure while it attempts to diversify its economy.

Bandar Al-khorayef, Saudi minister of industry and mineral resources, made the comments as the two countries have moved closer despite an escalating rivalry between China and the US, Saudi Arabia’s traditional ally.

- Joined

- May 16, 2023

- Messages

- 35,180

- Points

- 113

Homepage

Subscribe

Economy

Sep 20, 2024, 8:16 AM GMT+8

Share

Save

Read in app

Left: AP Photo/Luca Bruno Right: AP Photo/Matt Rourke

Subscribe

Economy

The US economy could get hit by a double whammy on September 30, if 2 major negotiations are not hammered out

Erin SnodgrassSep 20, 2024, 8:16 AM GMT+8

Share

Save

Read in app

Left: AP Photo/Luca Bruno Right: AP Photo/Matt Rourke

- If Congress doesn't pass a stopgap bill by September 30, there will be a partial government shutdown.

- East Coast and Gulf Coast ports will also shut down if a union contract isn't renegotiated by the same date.

- If either — or both — were to happen, the US economy would take a hit ahead of the 2024 election.

Similar threads

- Replies

- 1

- Views

- 801

- Replies

- 13

- Views

- 2K

- Replies

- 2

- Views

- 1K

- Replies

- 14

- Views

- 2K