-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Global US-Dollar Shortage - Are We Already in a Recession?

- Thread starter Chase

- Start date

- Joined

- May 16, 2023

- Messages

- 35,711

- Points

- 113

Ang Mo Big Ear Hole Club

For Mains: India's Position on Bilateral Negotiation with Sri Lanka, India’s Neighborhood First Policy.

International Relations

Paris Club

- 06 Feb 2023

- 6 min read

For Mains: India's Position on Bilateral Negotiation with Sri Lanka, India’s Neighborhood First Policy.

Why in News?

The Paris Club, an informal group of creditor nations, will provide financial assurances to the International Monetary Fund (IMF) on Sri Lanka’s debt.- Sri Lanka needs assurance from the Paris Club and other creditors in order to receive a USD 2.9 billion bailout package from the IMF, following an economic crisis in 2022.

What is the Paris Club?

- About:

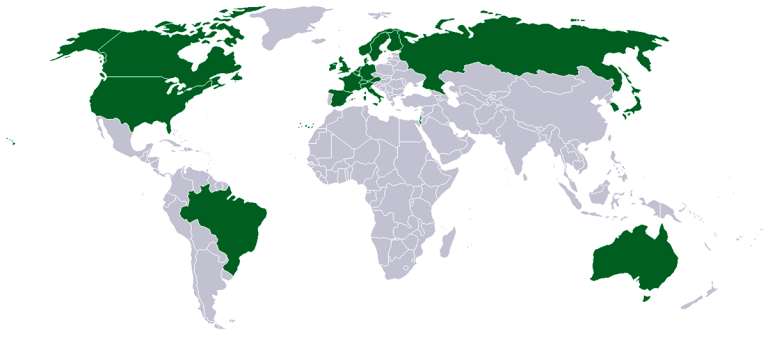

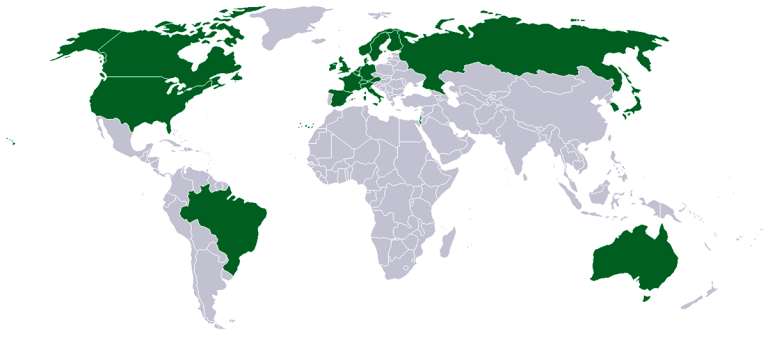

- The Paris Club is a group of mostly western creditor countries that grew from a 1956 meeting in which Argentina agreed to meet its public creditors in Paris.

- It describes itself as a forum where official creditors meet to solve payment difficulties faced by debtor countries.

- Their objective is to find sustainable debt-relief solutions for countries that are unable to repay their bilateral loans.

- The Paris Club is a group of mostly western creditor countries that grew from a 1956 meeting in which Argentina agreed to meet its public creditors in Paris.

- Members:

- The members are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Israel, Japan, Netherlands, Norway, Russia, South Korea, Spain, Sweden, Switzerland, the United Kingdom and the United States.

- All 22 are members of the group called Organisation for Economic Co-operation and Development (OECD).

- Involved in Debt Agreements:

- According to its official website, Paris Club has reached 478 agreements with 102 different debtor countries.

- Since 1956, the debt treated in the framework of Paris Club agreements amounts to USD 614 billion.

- Recent Developments:

- The Paris group countries dominated bilateral lending in the last century, but their importance has receded over the last two decades or so with the emergence of China as the world’s biggest bilateral lender.

- In Sri Lanka’s case, for instance, India, China, and Japanare the largest bilateral creditors.

- Sri Lanka’s debt to China is 52% of its bilateral debt, 19.5% to Japan, and 12% to India.

What is India's Position on Bilateral Negotiation with Sri Lanka?

- India launched its own bilateral negotiations with Sri Lankain January 2023.

- The Indian External Affairs Minister announced that India had written to the IMF providing the necessary financial assurances, adding that it hoped others would follow suit.

- The decision of financing assurance was also a reassertion of India’s belief in the principle of “neighborhood first”, and not leaving a partner to fend for themselves.

- Joined

- May 16, 2023

- Messages

- 35,711

- Points

- 113

CHINESE Big Ear Hole Network

Issued on: 07/11/2023 - 06:17Modified: 07/11/2023 - 06:20

2 min

Issued on: 07/11/2023 - 06:17Modified: 07/11/2023 - 06:20

2 min

ADVERTISING

Beijing says upwards of 150 countries stretching from Uruguay to Sri Lanka have signed up to the BRI, a vast global infrastructure push unveiled by President Xi Jinping a decade ago.

The first decade of the initiative saw China distribute huge loans to fund the construction of bridges, ports and highways in low and middle-income countries.

But much more than half of those loans have now entered their principal repayment period, said a report released Monday by AidData, a research institute tracking development finance at Virginia's College of William and Mary.

That figure is set to hit 75 percent by the end of the decade, it added.

Crunching data compiled on Chinese financing of almost 21,000 projects across 165 countries, AidData said Beijing had now committed aid and credit "hovering around $80 billion a year" to low and middle-income nations.

China owed more than $1 trillion in Belt and Road debt: report

Beijing (AFP) – China is owed more than a trillion dollars through its Belt and Road project, making it the biggest debt collector in the world, a report said this week, with an estimated 80 percent of the loans supporting countries in financial distress.Issued on: 07/11/2023 - 06:17Modified: 07/11/2023 - 06:20

2 min

China owed more than $1 trillion in Belt and Road debt: report

Beijing (AFP) – China is owed more than a trillion dollars through its Belt and Road project, making it the biggest debt collector in the world, a report said this week, with an estimated 80 percent of the loans supporting countries in financial distress.Issued on: 07/11/2023 - 06:17Modified: 07/11/2023 - 06:20

2 min

ADVERTISING

Beijing says upwards of 150 countries stretching from Uruguay to Sri Lanka have signed up to the BRI, a vast global infrastructure push unveiled by President Xi Jinping a decade ago.

The first decade of the initiative saw China distribute huge loans to fund the construction of bridges, ports and highways in low and middle-income countries.

But much more than half of those loans have now entered their principal repayment period, said a report released Monday by AidData, a research institute tracking development finance at Virginia's College of William and Mary.

That figure is set to hit 75 percent by the end of the decade, it added.

Crunching data compiled on Chinese financing of almost 21,000 projects across 165 countries, AidData said Beijing had now committed aid and credit "hovering around $80 billion a year" to low and middle-income nations.

- Joined

- May 16, 2023

- Messages

- 35,711

- Points

- 113

China spent $240bn on belt and road bailouts from 2008 to 2021, study finds

Rise in emergency financing for other countries since 2016 correlates with drop in infrastructure lendingAmy Hawkins

Tue 28 Mar 2023 08.06 EDT

- Share on Facebook

- Share on Twitter

- Share via Email

China spent $240bn (£195bn) bailing out countries struggling under their belt and road initiative debts between 2008 and 2021, new data shows.

Research found that Chinese state-backed lenders released bailout funds to 22 countries, including Argentina, Pakistan, Sri Lanka and Ukraine. Almost 80% of the emergency rescue lending was issued after 2016, reaching more than $40bn in 2021.

The increase in emergency financing since 2016 correlates with a drop in Chinese lending for infrastructure projects that are part of the belt and road initiative.

Commitments from China’s two main institutional lenders, China Development Bank and the Export-Import Bank of China (China Exim), fell from a peak of $87bn in 2016 to $3.7bn in 2021, according to data analysed by Boston University.

Ai Weiwei on the new Silk Road: ‘This is China’s counterattack in a global game of chess’

The failure of several infrastructure projects and the debt problems experienced by several recipient countries, hurt by the rising costs of servicing their loans, has forced a recalibration of China’s overseas development programme.

- Joined

- May 16, 2023

- Messages

- 35,711

- Points

- 113

Because Saudi Petrodollar Game is endingSay only. Until now to sound and shadow.

KING Trump ready to promote massive oil / gas drilling in 2025. US Oil trade in what currency hah?

It is time now...Drill Baby Drill...

- Joined

- Sep 13, 2023

- Messages

- 1,856

- Points

- 83

- Joined

- Oct 5, 2018

- Messages

- 17,570

- Points

- 113

Russian Central Bank raises key rate for the sixth time this year to 18%

Moscow’s federal budget has jumped almost 50 percent over the last three years — from 24.8 trillion rubles ($289 billion) in 2021, before the Ukraine offensive, to a planned 36.6 trillion rubles ($427 billion) this year. https://www.barrons.com/news/russian-central-bank-hikes-key-rate-to-fight-inflation-27337d73- Joined

- May 16, 2023

- Messages

- 35,711

- Points

- 113

Bangalesh is now at stage 4-5

- Joined

- May 16, 2023

- Messages

- 35,711

- Points

- 113

U.S. Energy Production Chalks Up Another Record - 肥水不流外人田

By Alex Kimani - Jun 30, 2024, 6:00 PM CDT- EIA: U.S. Energy production rose 4% to nearly 103 quadrillion British thermal units (quads) in 2023.

- Dry natural gas production increased 4% in 2023 and 58% since 2013 while crude oil production has grown 9% since 2022 and 69% since 2013.

- On the flip side, U.S. energy consumption fell 1% largely driven by a 17% decline in coal consumption.

For decades, the United States has been a net consumer of energy, using up more energy than it produces.

However, a sharp increase in oil and gas production following the shale boom as well as the ongoing renewable energy revolution has helped change the energy trajectory over the past 15 years. And now the U.S. Energy Information Administration (EIA) has reported that U.S. energy production exceeded consumption by record amounts in 2023.

According to the EIA, U.S. Energy production rose 4% to nearly 103 quadrillion British thermal units (quads) in 2023, a record for the country. On the other hand, energy consumption fell 1% to 94 quads during the same period, implying production exceeded consumption by 9 quads, the widest margin since 1949.

- Joined

- May 16, 2023

- Messages

- 35,711

- Points

- 113

Dry natural gas production increased 4% in 2023 and 58% since 2013 while crude oil production has grown 9% since 2022 and 69% since 2013. Meanwhile, renewable energy production rose 1% compared to the previous year and a 28% increase since 2013, hitting eight quads of energy. Solar energy production recorded an impressive 15% Y/Y growth in 2023 while wind production fell 2%.

On the flip side, U.S. energy consumption fell 1% largely driven by a 17% decline in coal consumption. Coal demand has been on a tailspin for years to its lowest level in more than a century thanks in large part to its shrinking role in electricity generation due to a high carbon footprint.

On the flip side, U.S. energy consumption fell 1% largely driven by a 17% decline in coal consumption. Coal demand has been on a tailspin for years to its lowest level in more than a century thanks in large part to its shrinking role in electricity generation due to a high carbon footprint.

- Joined

- May 16, 2023

- Messages

- 35,711

- Points

- 113

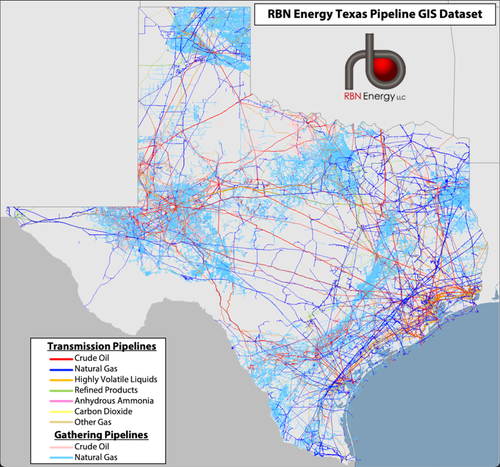

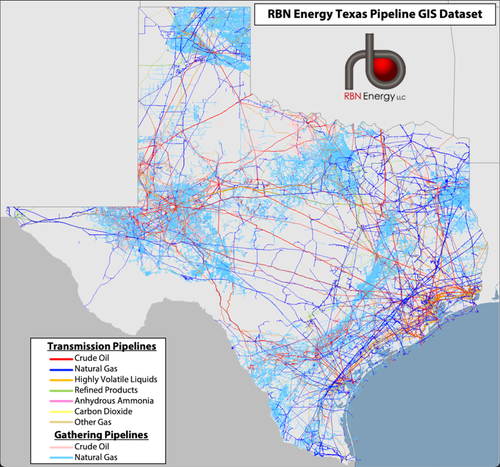

Bloomberg cites new data from energy researcher East Daley Analytics, which says major pipelines between the Permian Basin and the Port of Corpus Christi pipeline are currently more than 90% full. That number could easily rise to 94% or 95% by the second half of 2025.

Bloomberg pointed out, "While output is set to keep growing, it will be difficult for that incremental output to reach international buyers without ample pipeline space."

Bloomberg pointed out, "While output is set to keep growing, it will be difficult for that incremental output to reach international buyers without ample pipeline space."

- Joined

- May 16, 2023

- Messages

- 35,711

- Points

- 113

- Joined

- May 16, 2023

- Messages

- 35,711

- Points

- 113

Can We Get a Repeat of Record-Setting U.S. Energy Exports in 2024?

https://www.cmegroup.com/openmarket...Record-Setting-US-Energy-Exports-in-2024.html

At a Glance

Crude oil, liquefied petroleum gas and natural gas production and exports rose in 2023, positioning the U.S. as a global leader in energy exports

In February, U.S. Gulf Coast crude and condensate exports reached a record 4.56 million barrels per day

The United States secured a top spot on the list of the world’s largest energy exporters in 2023, helping to meet rising global energy demand amidst OPEC production restraint and Russian sanctions.

U.S. Energy Exports Surge with Production

The latest data from the Energy Information Administration (EIA) shows that U.S. energy exports rose 7% in 2023, underscoring the country’s growing role as an incremental energy supplier to the world.Crude oil and liquefied petroleum gas (LPG) saw the largest growth, both rising by 12% from 2022 to 2023. Natural gas followed, with growth up 9%. These gains were partially offset by a fall in the exports of petroleum products (gasoline and diesel) which were down about 6% in 2023.

Complementing this rise in exports, the U.S. also set records in production. Crude oil and natural gas liquids (NGLs) output rose 8% in 2023, while natural gas rose 4% year on year.

Industry experts are expecting production of these energy products to keep growing in the coming years. However, production growth is not the only factor determining exports. Infrastructure capacity, shifts in domestic consumption, global supply-and-demand dynamics and regulatory policies can all play important roles. Each of these factors can be headwinds or tailwinds to U.S. energy exports in 2024.

- Joined

- Sep 13, 2023

- Messages

- 1,856

- Points

- 83

https://www.forbes.com/sites/digita...rning-that-could-trigger-a-crypto-price-boom/

Senior Contributor

Elon Musk, the billionaire chief executive of Tesla, has mostly steered clear of bitcoin and crypto comments following the bitcoin price crash in 2022 (even as fellow billionaire Mark Cuban makes a "crazy" bitcoin price prediction).

The bitcoin price has however surged back, topping its late 2021 peak and climbing over $70,000 per bitcoin as Wall Street adoption and Donald Trump's crypto conversion powering the market higher.

Now, after Musk issued a shock warning over the future of the U.S. dollar, the fickle billionaire has broken his long silence on bitcoin, saying he sees "some merit" in it.

Elon Musk Suddenly Breaks His Silence On Bitcoin After Issuing A Shock U.S. Dollar ‘Destruction’ Warning That Could Trigger A Crypto Price Boom

Billy BambroughSenior Contributor

Elon Musk, the billionaire chief executive of Tesla, has mostly steered clear of bitcoin and crypto comments following the bitcoin price crash in 2022 (even as fellow billionaire Mark Cuban makes a "crazy" bitcoin price prediction).

The bitcoin price has however surged back, topping its late 2021 peak and climbing over $70,000 per bitcoin as Wall Street adoption and Donald Trump's crypto conversion powering the market higher.

Now, after Musk issued a shock warning over the future of the U.S. dollar, the fickle billionaire has broken his long silence on bitcoin, saying he sees "some merit" in it.

- Joined

- Oct 5, 2018

- Messages

- 17,570

- Points

- 113

TRADERS BET ON EMERGENCY FED MEETING

US T-bills went up (yields down) as traders bets on Biden to force Fed Rate Cut

https://www.nytimes.com/2024/08/05/business/stock-market-fed-rate-cut.html

Bloomberg: An Emergency Rate-Cut would be a mistake

https://www.bloomberg.com/opinion/a...y-federal-reserve-rate-cut-would-be-a-mistake

US T-bills went up (yields down) as traders bets on Biden to force Fed Rate Cut

https://www.nytimes.com/2024/08/05/business/stock-market-fed-rate-cut.html

Bloomberg: An Emergency Rate-Cut would be a mistake

https://www.bloomberg.com/opinion/a...y-federal-reserve-rate-cut-would-be-a-mistake

- Joined

- Sep 13, 2023

- Messages

- 1,856

- Points

- 83

https://asia.nikkei.com/Opinion/The-dollar-s-days-as-a-universal-reserve-currency-are-numbered

Satyajit DasAugust 5, 2024 17:05 JST

Satyajit DasAugust 5, 2024 17:05 JST

Current debates around the international monetary system focus on de-dollarization. Despite modest shifts to other currencies and gold, the U.S. dollar remains dominant due to its incumbency, large share of trade and reserves, liquid capital markets and the absence of obvious replacements. But that misses the central issue: a universal trading and reserve currency is needed because of underlying imbalances in trade and savings.

Where India imports more from than it exports to China, if denominated in rupees, then the Chinese have surplus Indian currency to be invested or used for purchases. If denominated in Chinese yuan, India has to finance the deficit. Unless there is unrestricted access to investments or funding in the relevant currencies, using an acceptable convertible third currency facilitates trade.

Imbalances also reflect mercantilist policies described by Thomas Mun, a director of the East India Company in the early 1600s. The objective is to export more than you import and amass surpluses to finance control of resources and assets. Consistent with this model, and often assisted by advantageous currency rates and protectionism, many East Asian countries and Germany have historically generated trade surpluses and accumulated large reserves. Outsourcing by advanced economies to lower costs and minimize emissions is an additional reason.

Another driver of imbalances is the significant savings in surplus countries, frequently because of modest domestic consumption, import restrictions, low credit availability and limited state social infrastructure for education, the elderly and health care. For petro-states, small populations contribute to trade surpluses and excess savings. Where these amounts cannot be invested locally, they are exported through purchases of foreign assets denominated in liquid, convertible currencies.

Several developments are now reducing trade and saving imbalances which will, in turn, diminish the need for reserve currencies.

Rising barriers to trade may decrease mismatches between exports and imports. In the 2020s, an average of just five free trade agreements were signed each year, half that in the 2000s. In 2023, nearly 3,000 trade restrictions were imposed globally, five times the number in 2015.

Unsustainable trade deficits, such as that of the U.S., at 3.4% of its gross domestic product, or more than $800 billion, is one factor. National sovereignty and security concerns are another. The pandemic, transport disruptions and wars in Ukraine and Gaza have highlighted the vulnerabilities of long, transnational supply chains for food, energy, medical supplies, raw materials, chips and armaments. This is exacerbated by anti-globalization pressures from voters marginalized by the deindustrialization of some advanced economies.

Tit-for-tat trade wars and industrial policies, which frequently mask subsidies, are accelerating. Both U.S. presidential candidates support beggar-thy-neighbor protectionist policies. The U.S. Inflation Reduction Act and proposed European Union import restrictions on EV imports are evidence of these trends. Re- or friend-shoring will persist. Sanctions and limits on technology transfer further limit activity.

Global capital flows may decrease due to lower surpluses, as well as increased risk to cross-border investment from sanctions and asset seizures, as well as a mooted U.S. tax on inbound investments.

The retreat from free trade and capital flows, driven by a self-reinforcing combination of economic, political and social pressures, is pushing the world towards autarky -- closed economies with limited international trade or capital flows.

While only large countries or aggregations -- the U.S., the EU and China -- are self-sufficient enough to survive substantially alone, the broader trend may be toward trade blocs. Rather than geographical groupings, these may be between geopolitically like-minded and industrially complementary trading partners; for example, Russia (rich in natural resources) and China (a manufacturing powerhouse).

Trade and capital flows within these groupings would be more balanced under such arrangements. Individual surpluses or deficits would multilaterally offset with the bloc, much as they do within the EU, excluding energy imports. This reduces the need for a dominant reserve currency, splintering demand into multiple currencies needed to support specific trade and investment flows. The expansion of the BRICS, redenomination of some trade and establishment of non-dollar payment systems are tentative moves in this direction.

Such a shift in the global trading and monetary system would damage potential growth and living standards. The role of exports in driving economic activity will weaken. Moving away from the principle of comparative advantage reduces efficiency, encourages suboptimal scale production facilities and requires large buffer inventories. It increases the cost of and reduces access to many goods and services. For emerging economies, traditional development paths reliant on trade, technology transfer and foreign investment would be more difficult.

Capital markets could be destabilized in the transition to a new system. Debtor countries, such as the U.S., may find it more difficult to fund continuing budget and trade deficits. Dollar interest rates may rise, affecting borrowers globally. Foreign exchange markets will exhibit greater volatility. For creditor countries, existing investments may lose value. Investment options may be constrained.

Asian policymakers assume continuation of the dollarized status quo. Central banks and sovereign wealth funds continue business as usual favoring U.S. investments. But trading and investment relationships require careful reappraisal and reshaping. This might entail enhancing or creating new multilateral trading blocs with more balanced trade and capital flows. New trading and investment currencies require consideration. Foreign exchange swap arrangements between central banks to finance gaps in monetary flows may be required.

Rearranging investment portfolios would be judicious. Concerned about financial exposure, as well the domestic political consequences of potential losses, China has diversified away from U.S. government bonds. Firewalling transactions and assets from the effects of sanctions or seizures, to the extent possible, would be wise.

The postwar U.S.-dominated order is giving way to a more fluid and uncertain era. Adroit politics allied to flexible economic and financial policies are essential to navigate its risks and opportunities.

The dollar's days as a universal reserve currency are numbered

Retreat from free trade signals potential shift toward multipolar economic order

Current debates around the international monetary system focus on de-dollarization. Despite modest shifts to other currencies and gold, the U.S. dollar remains dominant due to its incumbency, large share of trade and reserves, liquid capital markets and the absence of obvious replacements. But that misses the central issue: a universal trading and reserve currency is needed because of underlying imbalances in trade and savings.

Where India imports more from than it exports to China, if denominated in rupees, then the Chinese have surplus Indian currency to be invested or used for purchases. If denominated in Chinese yuan, India has to finance the deficit. Unless there is unrestricted access to investments or funding in the relevant currencies, using an acceptable convertible third currency facilitates trade.

Imbalances also reflect mercantilist policies described by Thomas Mun, a director of the East India Company in the early 1600s. The objective is to export more than you import and amass surpluses to finance control of resources and assets. Consistent with this model, and often assisted by advantageous currency rates and protectionism, many East Asian countries and Germany have historically generated trade surpluses and accumulated large reserves. Outsourcing by advanced economies to lower costs and minimize emissions is an additional reason.

Another driver of imbalances is the significant savings in surplus countries, frequently because of modest domestic consumption, import restrictions, low credit availability and limited state social infrastructure for education, the elderly and health care. For petro-states, small populations contribute to trade surpluses and excess savings. Where these amounts cannot be invested locally, they are exported through purchases of foreign assets denominated in liquid, convertible currencies.

Several developments are now reducing trade and saving imbalances which will, in turn, diminish the need for reserve currencies.

Rising barriers to trade may decrease mismatches between exports and imports. In the 2020s, an average of just five free trade agreements were signed each year, half that in the 2000s. In 2023, nearly 3,000 trade restrictions were imposed globally, five times the number in 2015.

Unsustainable trade deficits, such as that of the U.S., at 3.4% of its gross domestic product, or more than $800 billion, is one factor. National sovereignty and security concerns are another. The pandemic, transport disruptions and wars in Ukraine and Gaza have highlighted the vulnerabilities of long, transnational supply chains for food, energy, medical supplies, raw materials, chips and armaments. This is exacerbated by anti-globalization pressures from voters marginalized by the deindustrialization of some advanced economies.

Tit-for-tat trade wars and industrial policies, which frequently mask subsidies, are accelerating. Both U.S. presidential candidates support beggar-thy-neighbor protectionist policies. The U.S. Inflation Reduction Act and proposed European Union import restrictions on EV imports are evidence of these trends. Re- or friend-shoring will persist. Sanctions and limits on technology transfer further limit activity.

Global capital flows may decrease due to lower surpluses, as well as increased risk to cross-border investment from sanctions and asset seizures, as well as a mooted U.S. tax on inbound investments.

The retreat from free trade and capital flows, driven by a self-reinforcing combination of economic, political and social pressures, is pushing the world towards autarky -- closed economies with limited international trade or capital flows.

While only large countries or aggregations -- the U.S., the EU and China -- are self-sufficient enough to survive substantially alone, the broader trend may be toward trade blocs. Rather than geographical groupings, these may be between geopolitically like-minded and industrially complementary trading partners; for example, Russia (rich in natural resources) and China (a manufacturing powerhouse).

Trade and capital flows within these groupings would be more balanced under such arrangements. Individual surpluses or deficits would multilaterally offset with the bloc, much as they do within the EU, excluding energy imports. This reduces the need for a dominant reserve currency, splintering demand into multiple currencies needed to support specific trade and investment flows. The expansion of the BRICS, redenomination of some trade and establishment of non-dollar payment systems are tentative moves in this direction.

Such a shift in the global trading and monetary system would damage potential growth and living standards. The role of exports in driving economic activity will weaken. Moving away from the principle of comparative advantage reduces efficiency, encourages suboptimal scale production facilities and requires large buffer inventories. It increases the cost of and reduces access to many goods and services. For emerging economies, traditional development paths reliant on trade, technology transfer and foreign investment would be more difficult.

Capital markets could be destabilized in the transition to a new system. Debtor countries, such as the U.S., may find it more difficult to fund continuing budget and trade deficits. Dollar interest rates may rise, affecting borrowers globally. Foreign exchange markets will exhibit greater volatility. For creditor countries, existing investments may lose value. Investment options may be constrained.

Asian policymakers assume continuation of the dollarized status quo. Central banks and sovereign wealth funds continue business as usual favoring U.S. investments. But trading and investment relationships require careful reappraisal and reshaping. This might entail enhancing or creating new multilateral trading blocs with more balanced trade and capital flows. New trading and investment currencies require consideration. Foreign exchange swap arrangements between central banks to finance gaps in monetary flows may be required.

Rearranging investment portfolios would be judicious. Concerned about financial exposure, as well the domestic political consequences of potential losses, China has diversified away from U.S. government bonds. Firewalling transactions and assets from the effects of sanctions or seizures, to the extent possible, would be wise.

The postwar U.S.-dominated order is giving way to a more fluid and uncertain era. Adroit politics allied to flexible economic and financial policies are essential to navigate its risks and opportunities.

Similar threads

- Replies

- 1

- Views

- 802

- Replies

- 13

- Views

- 2K

- Replies

- 2

- Views

- 1K

- Replies

- 14

- Views

- 2K

English

English Español

Español عربي

عربي Français

Français 中文

中文 日本語

日本語