- Joined

- Jan 5, 2010

- Messages

- 2,107

- Points

- 83

Until society gets its priorities right, poverty will be with us always.

Until society gets its priorities right, poverty will be with us always.

The following Pict illustrates how much $$$ SG gahmen has printed in last 20plus years:

.JPG) [pict source: https://secure.mas.gov.sg/msb-xml/Re...=I&tableID=I.1 ](Reference: Money printing (/borrowing) by Singapore government- how much is too much?)

[pict source: https://secure.mas.gov.sg/msb-xml/Re...=I&tableID=I.1 ](Reference: Money printing (/borrowing) by Singapore government- how much is too much?)

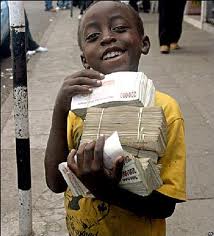

The following reveals a much more serious state where the Zimbabwe gahmen printed $$$ at an almost infinite rate:

(Caption: Zimbabwe currency to exchange for gold please- takers, anyone? [Image source])

(Caption: Zimbabwe currency to exchange for gold please- takers, anyone? [Image source])

U need to study, because as U grow up, your bills only increase ('inflate'???!!!): your parents retire and ask U for $$$, as do your wifey and kids (adults also eat more food than kids BTW). The pocket $$$ U currently receive will NEVER be enough to cover let alone your medical bills even if inflation were zero or below, needless to say, once U leave school, so ends the pocket $$$ that parents give.

Indeed you ARE right (on transferring costs), subsidies are transferring cost from subsidising one party to all the rest. Then again, isn't that what we have elected governments for??!!!. If we didn't value education, SAF, police service, healthcare, baby bonus, subsidised public transport, expensive politicians, civil defense, 'subsidised' public housing etc etc, then PAP wouldn't have garnered 60.1% valid vote in 2011GE (60.1% because PAP is far from perfect, it they were perfect, than the result would be a much higher % considering that blackmail/ gerrymandering 'earned' significant votes too).

So in an isolated/ basic sense, taxes are 'inflation' because it causes you be to afford less, however, in the sense of income taxes, this is payback to society since it is assumed in a modern society that the most successful amongst us are also those who benefited MOST from society in terms of healthcare, education, public peace/ good fortune etc...

Thus my abhorrence for 'economist' making sweeping statements like the 'inflation=good, deflation=bad' when the real question should be: after all the grandmothergoose story and complicated mathematical postulations, is the overall quality of life of the poor man on the streets BETTER OR WORSE???!!!

And if not, how do we better it. The terms "inflation/deflation" mean absolutely NOTHING if the ultimate benificiaries are not properly defined/ the poor remain unconvinced.

In short, 'inflation/deflation' is a man made phenomenon just like conscription, elections and the use of nuclear fission are man made phenomenons used mostly for good purposes (e.g. protecting country, achieving peaceful democracy, deriving 'clean' energy respectively), but also for EVIL (e.g. populating Hitler's army/ bogus DPRK elections/ Fukushima nuclear explosion (due to poor design/ negligence) respectively).

Ivory tower economist are paid what the rich(investment banks/ bankers) and their political representatives want them to say . The real economic/ social discussion should always be: how does this/ that help the plight of the poor and are U sure this/that plan will work without disadvantaging the poor?

Until society gets its priorities right, poverty will be with us always.

.

Until society gets its priorities right, poverty will be with us always.

Inflation in the academic sense ('economics') is the sustained increase in general PRICE LEVEL of goods. Guess it is even more controllable than AIR-POLLUTION, which today is almost 99.99% man made (0.01% due to volcano eruption etc). Inflation in price of goods however, is more than caused by excess printing of dollar bills and other related 'paper' of $ equivalent such as treasury bills by the gahmen.Thread source (SBY): Deflation and Inflation: Which is the lesser evil?

bro if u can control deflation and inflation then it would be a economic comedy wouldnt it?inflation is not something u can control....like that why dont the £ucking government just deflate all the price of wanton mee and gong bao chicken rice and prawn paste chicken in the hawker center to 10 cents?£uck education,if i can buy a plate of fu yong dan for 20 cents USD why the £uck do i still need to study?how the £uck can subsidies be deflation?u are just transferring the cost to another party.

The following Pict illustrates how much $$$ SG gahmen has printed in last 20plus years:

The following reveals a much more serious state where the Zimbabwe gahmen printed $$$ at an almost infinite rate:

The way U use "inflation/deflation" is confusing exactly BECAUSE DIFFERENT PEOPLE can use the term differently depending on what basket of goods they are referring to and why. I prefer to use the terms in a narrow sense, applying it to ONE GOOD AT A TIME: and explaining my points CLEARLY each time.... ...£uck education,if i can buy a plate of fu yong dan for 20 cents USD why the £uck do i still need to study?how the £uck can subsidies be deflation?u are just transferring the cost to another party.

U need to study, because as U grow up, your bills only increase ('inflate'???!!!): your parents retire and ask U for $$$, as do your wifey and kids (adults also eat more food than kids BTW). The pocket $$$ U currently receive will NEVER be enough to cover let alone your medical bills even if inflation were zero or below, needless to say, once U leave school, so ends the pocket $$$ that parents give.

Indeed you ARE right (on transferring costs), subsidies are transferring cost from subsidising one party to all the rest. Then again, isn't that what we have elected governments for??!!!. If we didn't value education, SAF, police service, healthcare, baby bonus, subsidised public transport, expensive politicians, civil defense, 'subsidised' public housing etc etc, then PAP wouldn't have garnered 60.1% valid vote in 2011GE (60.1% because PAP is far from perfect, it they were perfect, than the result would be a much higher % considering that blackmail/ gerrymandering 'earned' significant votes too).

So in an isolated/ basic sense, taxes are 'inflation' because it causes you be to afford less, however, in the sense of income taxes, this is payback to society since it is assumed in a modern society that the most successful amongst us are also those who benefited MOST from society in terms of healthcare, education, public peace/ good fortune etc...

Thus my abhorrence for 'economist' making sweeping statements like the 'inflation=good, deflation=bad' when the real question should be: after all the grandmothergoose story and complicated mathematical postulations, is the overall quality of life of the poor man on the streets BETTER OR WORSE???!!!

And if not, how do we better it. The terms "inflation/deflation" mean absolutely NOTHING if the ultimate benificiaries are not properly defined/ the poor remain unconvinced.

In short, 'inflation/deflation' is a man made phenomenon just like conscription, elections and the use of nuclear fission are man made phenomenons used mostly for good purposes (e.g. protecting country, achieving peaceful democracy, deriving 'clean' energy respectively), but also for EVIL (e.g. populating Hitler's army/ bogus DPRK elections/ Fukushima nuclear explosion (due to poor design/ negligence) respectively).

Ivory tower economist are paid what the rich(investment banks/ bankers) and their political representatives want them to say . The real economic/ social discussion should always be: how does this/ that help the plight of the poor and are U sure this/that plan will work without disadvantaging the poor?

Until society gets its priorities right, poverty will be with us always.

.

Last edited: