How bitcoins became worth $10,000

A few years ago, people thought Bitcoin was a joke. Now it’s worth billions.

TIMOTHY B. LEE - 11/29/2017, 7:40 AM

Enlarge

Aurich / Getty

200

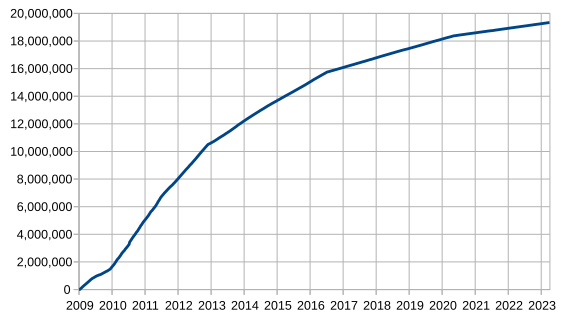

On Tuesday evening, the value of one bitcoin shot above $10,000. It has been a remarkable run for a currency that was only worth about $12 five years ago.

The run has been particularly remarkable because it's still not clear what Bitcoin is useful for. During its early years, the cryptocurrency garnered a lot of

optimistic talk about how it would disrupt conventional payment networks like MasterCard or Western Union. But almost nine years after Bitcoin was created, there's little sign of it becoming a mainstream technology. Few people own any bitcoins at all. Even fewer use it as a daily payment technology.

Yet that hasn't prevented the cryptocurrency's value from zooming upward. One factor driving Bitcoin's growth has been the emergence of a broader cryptocurrency ecosystem. Bitcoin serves as the reserve currency for the cryptocurrency economy in much the same way that the dollar serves as the main anchor currency for international trade.

In this piece, we'll explain the key innovation that set Bitcoin apart from all previous electronic payment schemes. We'll look at how Bitcoin won over regulators and venture capitalists to become a significant part of the global financial system. And we'll examine the cryptocurrency boom of the last year that has helped drive Bitcoin's value into the stratosphere.

While we can tell the story of Bitcoin's rise and point to some of the factors that have pushed its value upward, we can't really explain why the currency's value goes up or down during a particular day, week, or month. In particular, bitcoins have more than doubled in value since the start of October, which is hard to explain with anything other than speculative mania. People thinking about trying to get in on the Bitcoin boom should think carefully about the potential downside and not invest any money they can't afford to lose.

Bitcoin was the first truly decentralized electronic payment network

Cypherpunks have dreamed of fully decentralized electronic payment systems for decades. The potential for cryptographically secure electronic money became obvious after the invention of digital signatures using public-key cryptography in the 1970s.

But efforts to create practical digital cash schemes were bedeviled by something called the double-spending problem: how to prevent someone from sending the same digital coins to two different people. Preventing this requires a shared ledger that records all transactions. And until 2008, no one had figured out a way to do this without relying on a central authority to maintain and update the ledger.

Then someone calling himself Satoshi Nakamoto proposed an approach that initially seemed a little crazy: just have everyone on a peer-to-peer network keep a copy of every transaction, forever. Obviously, that's not the most efficient way to design a payment network, but a transaction doesn't need to take up very much space—and bandwidth and storage space get cheaper every year.

FURTHER READING

Bitcoin: inside the encrypted, peer-to-peer digital currency

The key to Nakamoto's scheme was a clever, fully decentralized way to reach a consensus about the order of transactions within the blockchain, Bitcoin's transaction ledger.

Certain nodes on Bitcoin's peer-to-peer network, known as miners, compete for the right to add the next block to the Bitcoin blockchain. Using brute force, they race to find a block whose SHA-256 hash value is below an arbitrary threshold (known as the difficulty). Once a node finds a block that meets the criteria, it announces the new block to other nodes on the network. Others incorporate the new block into their copy of the blockchain and then begin the race anew.

Occasionally, two miners discover blocks close enough together that the network doesn't agree about who was first. Only one block can be accepted by the network. But which one? The network decides by moving on to the next round of the race. Every miner starts looking for a second new block building on one of the two rival blocks in the previous round. When someone finds a new block, it will include a hash value pointing back to one of the previous blocks. Once this happens, both the newly discovered block and the preceding block its creator chose become part of the official blockchain. The other, competing block gets discarded.

In theory, this could happen multiple times—two nodes could discover blocks simultaneously in the second round, deepening uncertainty about which chain is the legitimate one. But if nodes are being honest, this situation won't last for long.

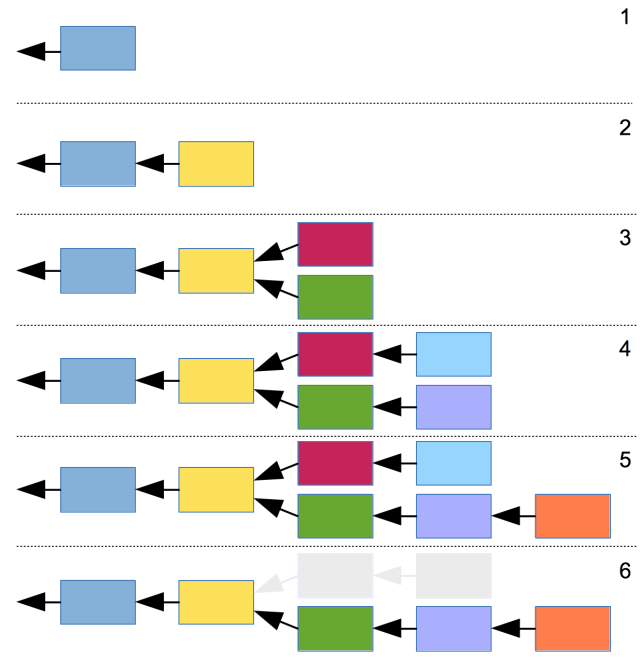

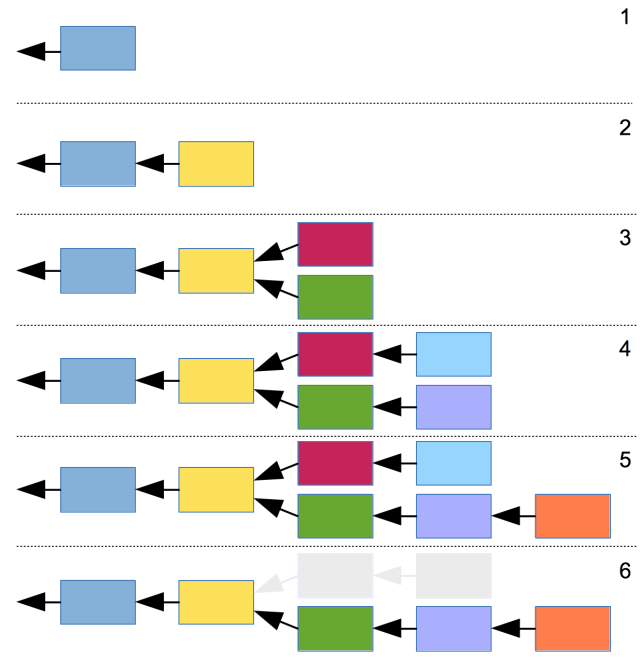

Enlarge / This diagram shows how the Bitcoin network resolves disagreements over the next block in the blockchain. The network always works from the longest chain. When a miner discovers the orange block in step 5, it points back to the green and violet nodes, cementing their status as an official part of the blockchain. Then the red and light-blue nodes are discarded by the network.

Timothy B. Lee / Ars Technica

Nodes are programmed to always build on top of the longest chain—on the block with the largest number of predecessors. So as soon as someone discovers a block that makes its chain longer than other, rival chains, everyone else has a financial incentive to abandon other chains and work from the longest one. In the image above, nodes will abandon the red and light-blue blocks as soon as the orange block is announced in step five, making the green and violet blocks into consensus picks.

Everyone has an incentive to always work from the current longest block because the creator of a block gets to award itself a fixed number of newly created bitcoins—currently 12.5 bitcoins per block. But this reward only becomes official if the block becomes part of the consensus blockchain. If a miner tries to build on a block further back in the chain, any new block they discover won't be on the longest chain. The miner, therefore, won't get a reward.

Bitcoin charms Washington

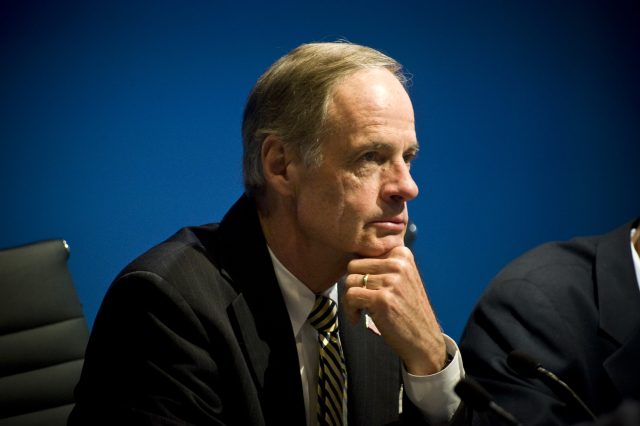

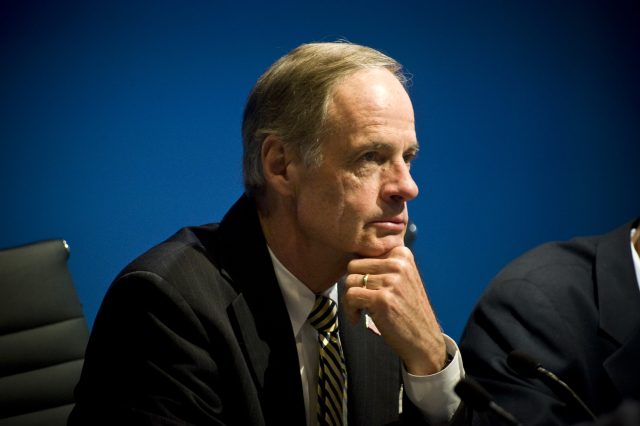

Enlarge / Sen. Tom Carper (D-Del.) hosted one of the Senate's first Bitcoin hearings, and it was surprisingly favorable to the technology.

Third Way Think Tank

In the early months of 2011, Satoshi Nakamoto gradually became less involved in the Bitcoin project. He turned over official leadership of the project to developer Gavin Andresen and disappeared from public view. Bitcoin had gained enough momentum to continue without him.

Bitcoin started getting mainstream attention in 2011, and much of it wasn't positive. One of the earliest applications of Bitcoin was for a website called Silk Road, a Tor hidden service that operated as a kind of eBay for illegal drugs. The existence of Silk Road came to the attention of Sen. Chuck Schumer (D-N.Y.), one of the first elected officials to comment on the technology. And he wasn't happy.

Silk Road,

he said, "represents the most brazen attempt to peddle drugs online that we have ever seen." Bitcoin, in Schumer's view, was "an online form of money laundering used to disguise the source of money."

FURTHER READING

Stealing bitcoins with badges: How Silk Road’s dirty cops got caught

It's easy to imagine things continuing like that, with federal officials moving to shut down the Bitcoin network the same way they'd shut down previous electronic money schemes that had been too accommodating of illicit transactions. But savvy lobbying by Bitcoin insiders and their supporters in the libertarian think-tank world convinced officials to take another path.

These supporters pointed out that shutting down Bitcoin altogether would likely prove impossible. Banning it in the US would merely push it overseas. And if Bitcoin activity was centered in a jurisdiction hostile to the United States, then law enforcement would lose the power to subpoena Bitcoin companies that might have valuable information about illicit uses of the Bitcoin network.

Meanwhile, advocates argued that Bitcoin had the potential to be a major new source of technological innovation.

Over the course of 2013, law enforcement officials and members of Congress became convinced of these arguments. The Senate's first hearings on Bitcoin, held in November 2013, turned out to be

Bitcoin lovefests, with the nation's top money-laundering official emphasizing that "innovation is a very important part of our economy."

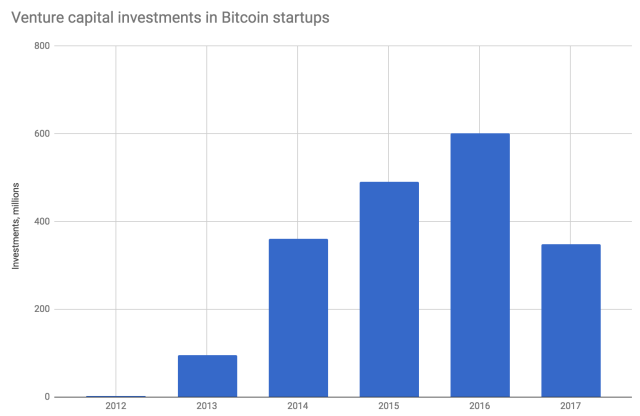

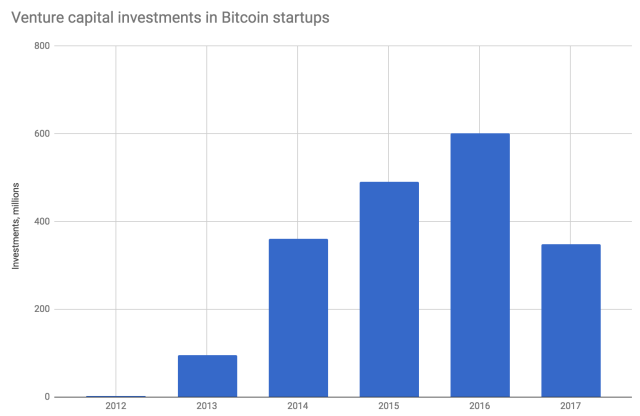

Enlarge / Venture capital data compiled by Coindesk.

Washington's

de facto endorsement accelerated a wave of Silicon Valley investment that had already been underway. Bitcoin investment rose from $2 million in 2012 to $95 million in 2013 and $361 million in 2014, according to

statistics collected by Coindesk.

Many of these early investments aimed to help consumers use Bitcoin to make everyday payments. "There's a tremendous opportunity to make payments easier, more secure, and less costly for consumers and businesses," said Jeremy Allaire, co-founder of a Bitcoin startup called Circle, in October 2013. The company had just raised $9 million from venture capitalists.

But, unsurprisingly, hardly any consumers were interested in swapping out their credit cards for Bitcoin wallets. The process of acquiring, storing, and spending Bitcoins is cumbersome. The Bitcoin network doesn't offer the kind of fraud protections available on conventional financial networks. And the volatility of Bitcoin means that you could fill up your Bitcoin wallet one day and then discover that 10 percent of its value had evaporated overnight.

Circle ultimately gave up on Bitcoin and pivoted to offering a more conventional electronic payment service. "We no longer offer the ability to buy and sell Bitcoin," the company says on its

help page.

ICO mania sparks another Bitcoin boom

Ethereum creator Vitalik Buterin.

TechCrunch

No one has managed to build mainstream products on top of Bitcoin the way companies like Amazon and Google made the Internet useful to ordinary people. The companies that have thrived either focus on building infrastructure for the Bitcoin network or catering to Bitcoin power users. There are now well-established companies that help sophisticated and wealthy customers acquire, store, and manage bitcoins.

And the maturity of the Bitcoin ecosystem has helped spur the development of other cryptocurrencies. People have been creating new cryptocurrencies since Bitcoin's early years. Ars even

created one of our own back in 2014. But the most important Bitcoin competitor today is Ethereum. Founder Vitalik Buterin generalized the concepts behind Bitcoin's blockchain to create a network capable of executing arbitrarily complex computer programs known as smart contracts.

FURTHER READING

Behold Arscoin, our own custom cryptocurrency!

Ethereum launched in 2015, and its currency ("ether") quickly became the second most valuable after bitcoin. Ethereum has proven to be a good platform for quickly and easily building new blockchain-based systems.

Buterin launched Ethereum with a presale: people had the chance to buy ether ahead of the launch of the Ethereum network. These tokens proved to be a good investment, and Ethereum inspired a new speculative frenzy of initial coin offerings. Dozens of new cryptocurrencies were created, and people were given the opportunity to buy them—in many cases before the software to run the networks had even been finished. By 2017, the ICO market had become huge, with several offerings raising more than $100 million.

The ICO boom helped to drive a corresponding boom in Bitcoin's value. To participate in an ICO, people need a way to convert conventional cash into the new currency. And it's not easy to set up a new exchange for converting dollars or euros to an exotic new cryptocurrency. Instead, existing Bitcoin (and, to a lesser extent, Ethereum) exchanges have become the main way people inject new cash into the blockchain ecosystem.

In this way, Bitcoin's function in the blockchain economy is similar to the function the US dollar serves in international trade. The US dollar is known as the world's reserve currency because it's the most popular currency for international trade. When two small countries trade with one another, they often deal in dollars because the global financial system is organized to make this convenient.

A similar dynamic has emerged for the blockchain economy. If you have some ZCash, for instance, and you want to convert it into Ethereum Classic, finding someone willing to make that trade for you might be a challenge. But you can easily convert your ZCash into bitcoins and then convert the bitcoins into classic ether.

FURTHER READING

Bitcoin is hitting new highs—here’s why it might not be a bubble

The United States government has benefitted from the dollar's status as the world's reserve currency. Foreign demand for dollars pushes down borrowing costs and makes it easier for US businesses to trade. The dollar has also become a popular way to discreetly store cash. There are billions of $100 bills stuffed in safes and under floorboards around the world.

Bitcoin's status as the default medium of exchange in the blockchain world pushes its value upward in a similar way. Bitcoin is a popular medium of exchange for cryptocurrency-to-cryptocurrency transactions. And for people who want to make a long-term bet on the cryptocurrency economy, buying Bitcoin is as good a choice as any other.

This helps to explain why Bitcoin's price started to soar in early 2017 at the same time as the larger blockchain ecosystem was booming. People needed bitcoins to participate in other cryptocurrency offerings, and Bitcoin became caught up in the general cryptocurrency euphoria. The value of ether, the second most valuable cryptocurrency, has risen more than 50-fold this year at the same time bitcoin's value has increased by a factor of 10.

Bitcoin faces some big challenges

Enlarge

Thomas Trutschel / Getty Images News

Bitcoin is by far the most valuable cryptocurrency. The value of all bitcoins is around $170 billion, considerably more than the $45 billion for second-place Ethereum. But the Bitcoin community faces some big challenges ahead.

One problem is a looming regulatory crackdown. Bitcoin has already been hit by a crackdown from Chinese officials who have been severely restricting the use of cryptocurrencies. In the United States, there's little risk of a direct crackdown on Bitcoin, but there's a real risk that

the Securities and Exchange Commission will crack down on the ICOs that have pushed Bitcoin's price upward. ICOs look a lot like conventional securities offerings, and US law requires companies to file elaborate paperwork with the SEC before offering securities to the public. If the SEC begins shutting down ICOs—or even prosecuting their promoters—that could put a damper on ICO-fueled demand for Bitcoin.

FURTHER READING

It looks like China is shutting down its blockchain economy

Bitcoin also has a congestion problem and a

dysfunctional culture that makes it difficult for the Bitcoin community to address that problem effectively. A hard-coded limit in the Bitcoin source code prevents the network from processing more than about a dozen transactions per second. Efforts to expand its capacity have triggered a bitter debate within the Bitcoin world.

We've

covered this debate in detail elsewhere, so we won't rehash the issue here. But the bottom line is that the Bitcoin network is increasingly congested, which has led to soaring transaction fees. Developers are working on solutions—most importantly, a related network called Lightning that could enable small, fast transactions without cluttering up the main Bitcoin blockchain. But that technology is still in its experimental stages, and it's not clear how well it will work.

Meanwhile, classic Bitcoin faces a challenge from

Bitcoin Cash, a Bitcoin clone that is more focused on addressing Bitcoin's scaling challenges. There's a danger that users will grow frustrated with the congested, expensive network surrounding classic Bitcoin and switch to rivals like Bitcoin Cash.

All of which is to say that continued appreciation is far from a sure thing. We're not foolish enough to predict whether bitcoins will go up or down. But we will emphasize that there are huge risks to investing Bitcoin. Please,

please don't do it with money you can't afford to lose.

TIMOTHY B. LEETimothy is a senior reporter covering tech policy, blockchain technologies and the future of transportation. He lives in Washington DC.

EMAIL

[email protected] // TWITTER

@binarybits