-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A Singaporean's guide to living in Thailand

- Thread starter Leongsam

- Start date

- Joined

- Jul 15, 2008

- Messages

- 21,102

- Points

- 113

Not surprising, with travel drag in these parts

Thai airlines in Q3 grief

Bangkok Post Published: 17/11/2014 at 06:00 AM

Major Thai airlines plunged into a sea of red ink in the third quarter as the slowdown in international arrivals, a sluggish economy and fierce airline industry competition caused them to lose altitude.

Flag carrier Thai Airways international (THAI) could have been the biggest loser in July-Sept, but was salvaged by a huge foreign exchange gain windfall, enabling it to post a net profit of 1.09 billion baht.

Thai AirAsia (TAA), the country's largest low-cost carrier, posted 382 million baht in net loss for the period.

Bangkok Airways (BA), the 46-year-old regional airline which recently debuted on the Thai stock market, did better with a smaller net loss of 51.8 million baht. For the first nine months, the airline still posted 136 million baht in net profit, lower than the 1.22 billion in earnings a year ago.

Nok Air, the SET-listed budget airline, has yet to announce its third-quarter financial performance, but industry analysts are in consensus that it would face a similar fate as the others.

THAI reported a foreign exchange gain of 7.4 billion baht in the quarter. Excluding this gain, tax and impairment expenses, the state-controlled airline posted a loss of 5.24 billion baht versus a 3.2 billion baht loss a year earlier.

Combined losses for the first nine months of the year widened to 9.17 billion baht, 2.86 billion baht more than a year ago.

TAA singled out higher costs as the cause of its losses, which came despite a mere 1% fall in revenue to 5.55 billion baht. Its performance was reflected by the results of Asia Aviation Plc (AAV), the SET-listed firm that holds a major stake in the carrier. AAV reported a third quarter net loss of 209 million baht.

The airlines see a better outlook in the fourth quarter.

Thai airlines in Q3 grief

Bangkok Post Published: 17/11/2014 at 06:00 AM

Major Thai airlines plunged into a sea of red ink in the third quarter as the slowdown in international arrivals, a sluggish economy and fierce airline industry competition caused them to lose altitude.

Flag carrier Thai Airways international (THAI) could have been the biggest loser in July-Sept, but was salvaged by a huge foreign exchange gain windfall, enabling it to post a net profit of 1.09 billion baht.

Thai AirAsia (TAA), the country's largest low-cost carrier, posted 382 million baht in net loss for the period.

Bangkok Airways (BA), the 46-year-old regional airline which recently debuted on the Thai stock market, did better with a smaller net loss of 51.8 million baht. For the first nine months, the airline still posted 136 million baht in net profit, lower than the 1.22 billion in earnings a year ago.

Nok Air, the SET-listed budget airline, has yet to announce its third-quarter financial performance, but industry analysts are in consensus that it would face a similar fate as the others.

THAI reported a foreign exchange gain of 7.4 billion baht in the quarter. Excluding this gain, tax and impairment expenses, the state-controlled airline posted a loss of 5.24 billion baht versus a 3.2 billion baht loss a year earlier.

Combined losses for the first nine months of the year widened to 9.17 billion baht, 2.86 billion baht more than a year ago.

TAA singled out higher costs as the cause of its losses, which came despite a mere 1% fall in revenue to 5.55 billion baht. Its performance was reflected by the results of Asia Aviation Plc (AAV), the SET-listed firm that holds a major stake in the carrier. AAV reported a third quarter net loss of 209 million baht.

The airlines see a better outlook in the fourth quarter.

The air looks fresh

Where is this place located

I may want to go there when the haze returns to Spore.

- Joined

- Aug 8, 2008

- Messages

- 28,849

- Points

- 113

- Joined

- Jul 15, 2008

- Messages

- 6,814

- Points

- 113

You are right currently its not local holiday season however I do find an increase of PRC tourists into Thailand these days. Also this is a pretty exclusive spa resort so not many guests. Also today is a Sunday most Thais would have been headed for Bangkok instead of out of Bangkok.

anywhere to go in Thailand that is enjoyable to kid, easy for the elderly and wifey can shopping and most important easy on my wallet?

school holidays liao but i can only spare a couple of days.:o

- Joined

- Aug 8, 2008

- Messages

- 28,849

- Points

- 113

anywhere to go in Thailand that is enjoyable to kid, easy for the elderly and wifey can shopping and most important easy on my wallet?

school holidays liao but i can only spare a couple of days.:o

Wife's shopping and children's play ground is very different, I am sure cannot mix. Only place I can think of that has these two will be Siam Paragon where it has a big aquarium in the mall.

A fun trip for the kids will be to visit the http://www.safariworld.com/ where visitors can be very close to the animals, this beats Singapore's night safari. This Safari World one could see the animals very clearly and close up, the Night Safari you practically must look for the animals as its fucking dark, the fucking zoo said the animals are nocturnal and active only at night but truth be told the same animals are displayed in the zoo in the day time and night time "recycled" and moved to the night safari to make more money from them, fucking PAP I tell you.

Bangkok has a theme park Dream World http://www.dreamworld.co.th/en/ kids will love it, go with an open mind and don't think this is a copy of Disney although it shares some similarities, go take those great rides.

There are many great areas outside Bangkok that one can go spend a weekend like Khao Yai, cold and frresh air just 2hrs away. Also lots of natural activities to do.

- Joined

- Jul 15, 2008

- Messages

- 21,102

- Points

- 113

Yet another rogue monk (or on a high?) :p

Monk caught with 120,000 meth pills

Bangkok Post Published: 17/11/2014 at 11:49 AM

A monk was arrested on Sunday night with 120,000 methemphetamine pills in his possession while travelling on a tour bus heading for Bangkok from Chiang Mai's Chom Thong district, police said.

Police and soldiers making a routine search of the Transport Company tour bus at a checkpoint at Ban Wang Din in Lamphun's Li district about 9.45pm spotted a monk acting suspiciously.

In a search of the monk's two cloth bags they found 60 packs containing 120,000 methemphetamine pills, a mobile phone and 2,200 baht cash.

The monk, identified as Phra Thanayuth Polsen, 47, of Wat Phromburi in Sing Buri province, allegedly confessed to having been hired by another monk, named Daeng, for 50,000 baht to deliver the drugs from Chom Thong district in Chiang Mai to a recipient at Wat Phromburi. He had been paid 10,000 baht in advance and would get the rest on completing the delivery.

Monk caught with 120,000 meth pills

Bangkok Post Published: 17/11/2014 at 11:49 AM

A monk was arrested on Sunday night with 120,000 methemphetamine pills in his possession while travelling on a tour bus heading for Bangkok from Chiang Mai's Chom Thong district, police said.

Police and soldiers making a routine search of the Transport Company tour bus at a checkpoint at Ban Wang Din in Lamphun's Li district about 9.45pm spotted a monk acting suspiciously.

In a search of the monk's two cloth bags they found 60 packs containing 120,000 methemphetamine pills, a mobile phone and 2,200 baht cash.

The monk, identified as Phra Thanayuth Polsen, 47, of Wat Phromburi in Sing Buri province, allegedly confessed to having been hired by another monk, named Daeng, for 50,000 baht to deliver the drugs from Chom Thong district in Chiang Mai to a recipient at Wat Phromburi. He had been paid 10,000 baht in advance and would get the rest on completing the delivery.

- Joined

- Jul 15, 2008

- Messages

- 21,102

- Points

- 113

Business and exports in slooooow lane in LOS

Thai exports slump as neighbours' rise

Bangkok Post Published: 17/11/2014 at 11:53 AM

Thailand is heading for a second straight year of slumping exports, something the one-time tiger economy hasn’t experienced in at least two decades and a loss that magnifies challenges for the military-run government.

Local and public spending has to take the front seat now that exports have lost their momentum. — Seksan Rojjanametakun

Shipments abroad, which make up the equivalent of about 70% of the economy, have shrunk in six out of nine months this year and will probably contract in 2014, according to the central bank. That’s in comparison to an annual average pace of growth of about 13% in the period 2002 to 2012.

While Thailand has grappled with political instability and record flooding in recent years, rivals including Vietnam and the Philippines have seen exports climb. Investment proposals for infrastructure have been delayed for months by violent unrest that ended when Prayuth Chan-Ocha, the former military chief, seized power in a May coup.

“It’s possible that exports will lag behind other countries in the region like Vietnam, Malaysia and the Philippines which used to trail us in the past,” said Santitarn Satirathai, a Singapore-based economist at Credit Suisse Group AG. “We have obsolete technology and other structural problems that we must fix. The question is, can Thailand do enough to keep attracting foreign and domestic investment. It is quite worrisome.”

Gross domestic product expanded 0.6% in the three months through September from a year earlier, the National Economic and Social Development Board said today. That is slower than a median estimate of 1% in a Bloomberg News survey. The economy grew 1.1% from the second quarter, compared with a median estimate of 1.5%.

Innovation slide

The economy is forecast to grow this year at the slowest pace since 2011, when thousands of factories were inundated by the worst floods in 70 years. The NESDB today said it expects GDP growth of 1% for the full year.

Thailand has been losing its export competitiveness in electronics in the last three years, especially in the manufacture of hard disk drives as companies failed to adjust production to meet shifts in consumer preferences, the central bank said in a report in June. Investment in research and development has lagged that of countries such as Singapore, Malaysia and Indonesia, while local firms have invested more overseas because of tax incentives and higher wages, it said.

Thailand’s ranking for innovation in the World Economic Forum’s Global Competitiveness Index fell to 67 in 2014 from 33 in 2007, even as the Philippines, Indonesia and Malaysia rose.

Electronics, which made up 14% of total Thai exports in 2013, have risen 3.8% so far this year compared with an increase of almost 10% in 2007.

Production hub

“Thailand positioned itself as a production hub for hard disk drives for so long, but didn’t do anything to get foreign companies to invest in modern technology,” said Thanomsri Fongarunrung, an economist at Phatra Securities Plc in Bangkok. “Demand for PCs has fallen with increased demand for smartphones, and we never fully recovered the share lost to other markets after the 2011 floods.”

The NESDB today said export value this year will probably be flat, and that it expects the value to grow 4% next year. The economy may expand 3.5% to 4.5% in 2015, the agency said.

The monetary authority kept its policy rate unchanged at 2% earlier this month, and governor Prasarn Trairatvorakul said last week that while the current rate is accommodative for growth, it can be eased further if the economy fails to recover.

“The soft 3Q GDP print raises the odds of a more dovish monetary policy statement,” said Weiwen Ng, a Singapore-based economist at Australia & New Zealand Banking Group Ltd. “If this sluggish pace of growth persists, the window for easing could potentially be opened,” he said, adding that exports aren’t likely to provide a material boost to growth.

Still interested

The baht was little changed at 32.786 against the US dollar as of 10.34am in Bangkok. It has slipped almost 3% against the US dollar in the past three months.

The government has unveiled a stimulus package of about $11 billion to provide cash handouts to farmers and pledged to accelerate budget spending to boost consumption. The finance ministry last month cut its GDP growth forecast for the year to 1.4%

.

Foreign direct investment applications approved from January to October fell 38% from a year earlier, according to the Board of Investment.

“I have met with executives of big corporations, and they are still interested in investing here for exports,” said Supant Mongkolsuthree, chairman of the Federation of Thai Industries, an association of manufacturers. “With the government’s increased spending on infrastructure, we expect more investments from foreign companies in the future.”

Thailand will need to do more to attract investors, as there are other options in the region now, said Ms Thanomsri.

“We have to add value and make ourselves attractive as there are many competitors now,” said Ms Thanomsri. “We need to give more incentives, solve the problems with labour and infrastructure. We can’t just sit here and wait for investors to choose us.”

Thai exports slump as neighbours' rise

Bangkok Post Published: 17/11/2014 at 11:53 AM

Thailand is heading for a second straight year of slumping exports, something the one-time tiger economy hasn’t experienced in at least two decades and a loss that magnifies challenges for the military-run government.

Local and public spending has to take the front seat now that exports have lost their momentum. — Seksan Rojjanametakun

Shipments abroad, which make up the equivalent of about 70% of the economy, have shrunk in six out of nine months this year and will probably contract in 2014, according to the central bank. That’s in comparison to an annual average pace of growth of about 13% in the period 2002 to 2012.

While Thailand has grappled with political instability and record flooding in recent years, rivals including Vietnam and the Philippines have seen exports climb. Investment proposals for infrastructure have been delayed for months by violent unrest that ended when Prayuth Chan-Ocha, the former military chief, seized power in a May coup.

“It’s possible that exports will lag behind other countries in the region like Vietnam, Malaysia and the Philippines which used to trail us in the past,” said Santitarn Satirathai, a Singapore-based economist at Credit Suisse Group AG. “We have obsolete technology and other structural problems that we must fix. The question is, can Thailand do enough to keep attracting foreign and domestic investment. It is quite worrisome.”

Gross domestic product expanded 0.6% in the three months through September from a year earlier, the National Economic and Social Development Board said today. That is slower than a median estimate of 1% in a Bloomberg News survey. The economy grew 1.1% from the second quarter, compared with a median estimate of 1.5%.

Innovation slide

The economy is forecast to grow this year at the slowest pace since 2011, when thousands of factories were inundated by the worst floods in 70 years. The NESDB today said it expects GDP growth of 1% for the full year.

Thailand has been losing its export competitiveness in electronics in the last three years, especially in the manufacture of hard disk drives as companies failed to adjust production to meet shifts in consumer preferences, the central bank said in a report in June. Investment in research and development has lagged that of countries such as Singapore, Malaysia and Indonesia, while local firms have invested more overseas because of tax incentives and higher wages, it said.

Thailand’s ranking for innovation in the World Economic Forum’s Global Competitiveness Index fell to 67 in 2014 from 33 in 2007, even as the Philippines, Indonesia and Malaysia rose.

Electronics, which made up 14% of total Thai exports in 2013, have risen 3.8% so far this year compared with an increase of almost 10% in 2007.

Production hub

“Thailand positioned itself as a production hub for hard disk drives for so long, but didn’t do anything to get foreign companies to invest in modern technology,” said Thanomsri Fongarunrung, an economist at Phatra Securities Plc in Bangkok. “Demand for PCs has fallen with increased demand for smartphones, and we never fully recovered the share lost to other markets after the 2011 floods.”

The NESDB today said export value this year will probably be flat, and that it expects the value to grow 4% next year. The economy may expand 3.5% to 4.5% in 2015, the agency said.

The monetary authority kept its policy rate unchanged at 2% earlier this month, and governor Prasarn Trairatvorakul said last week that while the current rate is accommodative for growth, it can be eased further if the economy fails to recover.

“The soft 3Q GDP print raises the odds of a more dovish monetary policy statement,” said Weiwen Ng, a Singapore-based economist at Australia & New Zealand Banking Group Ltd. “If this sluggish pace of growth persists, the window for easing could potentially be opened,” he said, adding that exports aren’t likely to provide a material boost to growth.

Still interested

The baht was little changed at 32.786 against the US dollar as of 10.34am in Bangkok. It has slipped almost 3% against the US dollar in the past three months.

The government has unveiled a stimulus package of about $11 billion to provide cash handouts to farmers and pledged to accelerate budget spending to boost consumption. The finance ministry last month cut its GDP growth forecast for the year to 1.4%

.

Foreign direct investment applications approved from January to October fell 38% from a year earlier, according to the Board of Investment.

“I have met with executives of big corporations, and they are still interested in investing here for exports,” said Supant Mongkolsuthree, chairman of the Federation of Thai Industries, an association of manufacturers. “With the government’s increased spending on infrastructure, we expect more investments from foreign companies in the future.”

Thailand will need to do more to attract investors, as there are other options in the region now, said Ms Thanomsri.

“We have to add value and make ourselves attractive as there are many competitors now,” said Ms Thanomsri. “We need to give more incentives, solve the problems with labour and infrastructure. We can’t just sit here and wait for investors to choose us.”

Sin Hoi San is stillone of my favorite places to eat

Bro Joetys, I passed by Tiong Bahru Road yesterday and Sin Hoi San is no more. All Boarded up!

- Joined

- Jul 19, 2008

- Messages

- 30,580

- Points

- 0

Took this last year.

Famous mass murderer see quay who most likely was a psycho.

Was executed and his body preserved to be seen in the siriraj hospital museum.

He came from china btw

Famous mass murderer see quay who most likely was a psycho.

Was executed and his body preserved to be seen in the siriraj hospital museum.

He came from china btw

- Joined

- Jul 19, 2008

- Messages

- 30,580

- Points

- 0

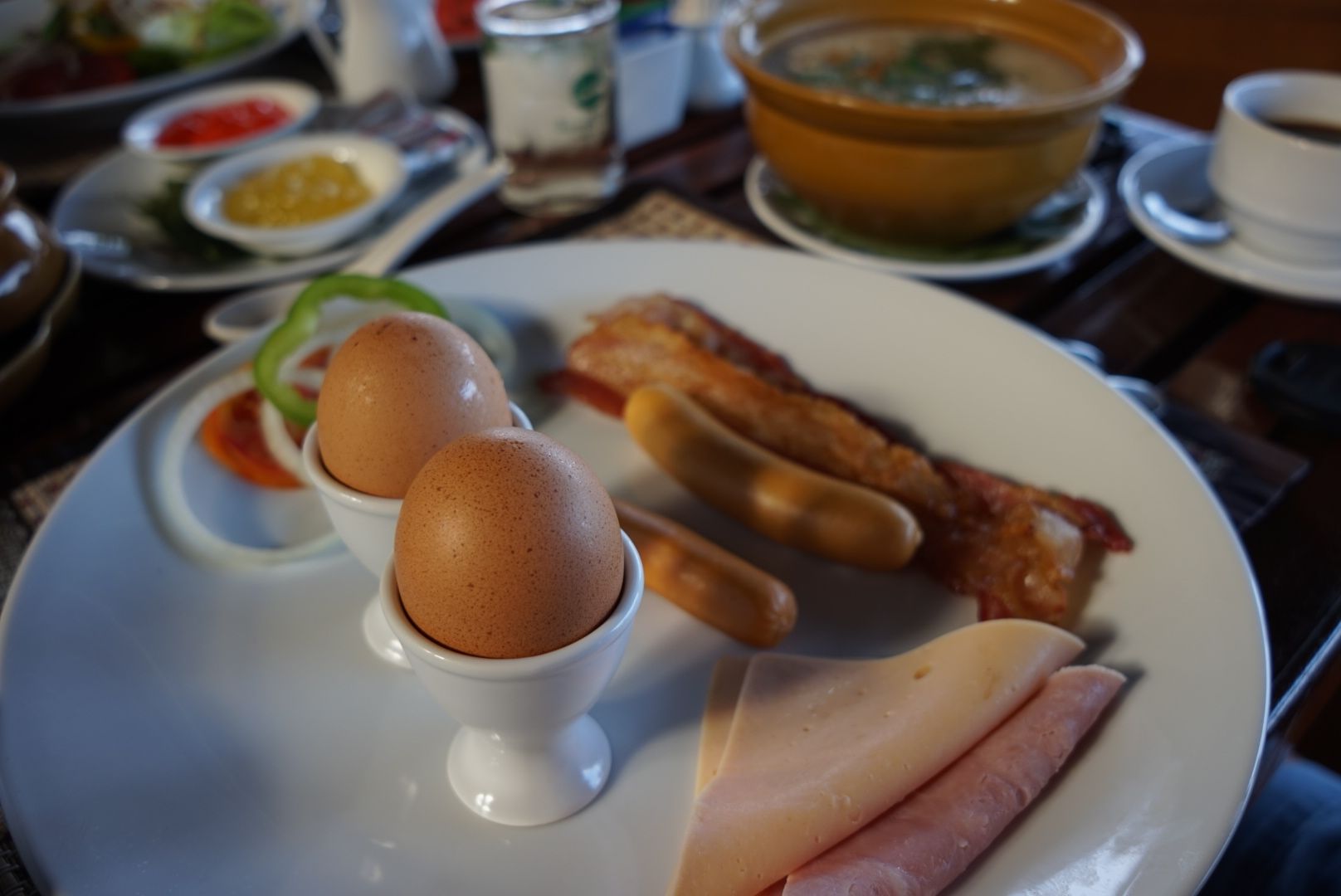

lunch

- Joined

- Jul 15, 2008

- Messages

- 21,102

- Points

- 113

Scrumptious, but sinful :p Is that side potato rings or?lunch

- Joined

- Jul 19, 2008

- Messages

- 30,580

- Points

- 0

Scrumptious, but sinful :p Is that side potato rings or?

Those are onion rings, coleslaw and baked potato covered in cream.

- Joined

- Aug 8, 2008

- Messages

- 28,849

- Points

- 113

Similar threads

- Replies

- 0

- Views

- 191

- Replies

- 2

- Views

- 157

- Replies

- 2

- Views

- 198