Putin scraps plans to build major gas pipeline to Europe

With oil prices down, president says smaller one to Turkey will be built

PUBLISHED : Wednesday, 03 December, 2014, 4:07am

UPDATED : Wednesday, 03 December, 2014, 4:07am

The Washington Post in Moscow

Russian President Vladimir Putin has scrapped plans for a major new natural gas pipeline to Europe. Photo: Reuters

In a measure of the dramatically reshaped relations between Russia and the West, Russian President Vladimir Putin has scrapped plans for a major new natural gas pipeline to Europe.

The surprise move on Monday deprives the Kremlin of a tool that would have increased Russian political influence over southeastern Europe and detoured natural gas around Ukraine, leaving it more vulnerable to Russia. Putin’s decision came after European Union leaders intensified their opposition to the plans because of the grinding conflict in Ukraine.

Putin said Russia would build a smaller pipeline to Turkey instead of the bigger project, for which construction started two years ago, to funnel large quantities of Russian gas underneath the Black Sea to Europe. The cancellation appeared to end an era, at least for now, in which Russia pursued grand, expensive infrastructure projects in Europe that gave it political clout through energy supplies.

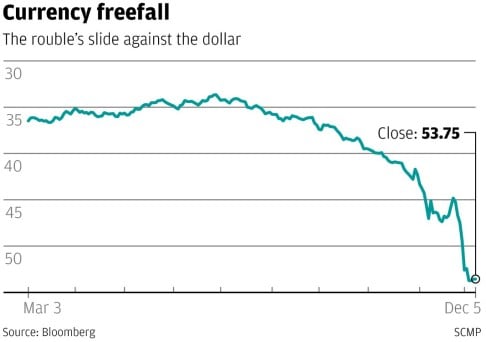

The decision follows a drop in the price of oil by more than 30 per cent since the summer, starving Russia of revenue and forcing it to curtail its economic ambitions. “If Europe does not want to implement the project, then it won’t be implemented. We will refocus our energy resources to other parts of the world,” Putin said in the Turkish capital, Ankara, after a meeting with Turkish President Recep Tayyip Erdogan.

“It would be ridiculous for us to spend hundreds of millions of dollars on the project, go all the way through the Black Sea and then stand in front of the Bulgarian border,” since Bulgaria’s new government has opposed the project.

The decision capped seven years of planning and billions of dollars of Russian investment laying the groundwork for the US$19 billion project, which would have bypassed Ukraine in a new route for Russian gas into Europe. As recently as a few weeks ago, Russian officials said construction on the underwater Black Sea section of the pipeline would begin within months.

Russian leaders had argued that the new southern gas route to Europe would have shielded EU consumers from energy disputes between Ukraine and Russia. Before this year, Russia twice cut off gas to Ukraine in deep winters, in 2006 and 2009.

But European leaders this year have concentrated more on decreasing their dependence on Russian energy rather than consuming more of it. EU countries rely on Russia for about 30 per cent of their natural gas. Lithuania just unveiled a vast liquefied natural gas terminal that will allow Europe to diversify its suppliers. And after Russia cut gas flows to Ukraine in June, Ukraine’s neighbours tried to help by sending gas through pipelines that usually flow in the opposite direction.

The South Stream pipeline, which Putin cancelled on Monday, had been intended as a southern complement to the Nord Stream pipeline, which links Russia and Germany, bypassing the Baltic states.