-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Xiaomi Tops Chinese Smartphone Market

- Thread starter yellowarse

- Start date

- Joined

- Mar 17, 2009

- Messages

- 5,383

- Points

- 63

Moving forward, expect more patent lawsuits against Xiaomi as it aggressively enters foreign markets. The Indian court case is an example. Xiaomi will have to beef up its patent portfolio if it hopes to weather the IP storm as it expands.

How Xiaomi’s patent portfolio stacks up against competitors, in two charts

Paul Bischoff

16 hours ago

When an Indian high court slapped an injunction on Xiaomi, halting sales and import of all its phones, many people including us started to question whether the Chinese smartphone maker had enough intellectual property to do business outside of its home country. Ericsson, the telecommunications giant behind the injunction, alleged that Xiaomi infringed on its patents in India.

Xiaomi models that use MediaTek processors, namely the Redmi 1s, are still not for sale in India, but Xiaomi has repeatedly argued that intellectual property will not be a concern moving forward. The four-and-a-half-year-old company now sells its devices in seven Asian countries and plans aggressive expansion into many more, including some in Latin America, this year.

So should Xiaomi be worried? For each market it enters, it opens itself to more legal vulnerabilities. If it doesn’t have a patent portfolio to protect itself, it could run into further trouble like it did in India.

Patents are important for two big reasons. First, they cut licensing fees that companies like Xiaomi have to pay to companies like Ericsson for the technology used in their phones. Secondly, when tech companies get sued for patent infringement (it happens a lot in the mobile sector), handing over patents is a common way to settle the suit out of court. This use of patents as a bargaining chip is called a cross-licensing agreement, in which Xiaomi would allow the company that sued it to use some of its patents.

To give some context to Xiaomi’s situation, we dug up some data from China’s State Intellectual Property Office (SIPO) and the World Intellectual Property Organization (WIPO), both of which have public databases of patent applications. We compared Xiaomi to several other Chinese phone makers, including Oppo, Coolpad, Meizu, ZTE, and Huawei, as well as foreign competitors Apple and Samsung — best sellers in China.

The data

For each of these companies, we found the number of applications filed under the Patent Cooperation Treaty (PCT), which are internationally-recognized patents for some or all member countries, and those filed with China’s SIPO, including invention patents, design patents, and "announced" patents, which are still pending approval. SIPO patents are only recognized in China.

Smartphone brand patent comparison

As you can see, Samsung, ZTE, and Huawei dwarf Xiaomi and the rest. But it isn’t exactly fair to make that comparison because their products are not limited to smartphones. Samsung has a huge catalog ranging from smartphones to laptops to speakers to kitchen appliances. ZTE and Huawei are both major telecommunications equipment manufacturers, which build the infrastructure necessary for nationwide 4G networks to work, among other things. They are two of the biggest patenters in China across all sectors. These three companies are also much older and thus have had more time to accumulate a large patent portfolio, so a direct comparison isn’t really applicable. Let’s take out those last three.

Chinese smartphone maker patent comparison 2

That’s more like it. In this chart, we also made a change to Apple’s data. Only patents filed under Apple Inc are included. Apple changed its official name from Apple Computer Inc to Apple Inc in 2007 – the same year the first iPhone launched. That makes for a more relevant comparison to Xiaomi and other young smartphone makers.

A threat to Xiaomi?

What can we infer from the data about the legal threat for Xiaomi beyond China? If Xiaomi were to stop applying for patents today and continue expanding into more countries, then it might indeed be at risk. It has just a tiny fraction of what Apple has on the international and domestic fronts. And with just 28 patents granted in China, it’s behind smaller local companies like Oppo and Coolpad, too.

But Xiaomi isn’t resting on its laurels when it comes to intellectual property. Of Xiaomi’s 130 or so applications to the PCT, about 100 were submitted in the past year, and 19 in the last two months. That shows Xiaomi is more gung-ho than ever about building its IP portfolio.

Oppo sets an important standard to which we can compare Xiaomi because it operates in many of the same international markets and has a relatively similar line of products. Oppo has more patents in its China portfolio, both pending and granted, but it’s lagging behind Xiaomi on the international front.

On a side note, we couldn’t find any patents – Chinese or PCT – filed under OnePlus, the Xiaomi competitor that launched its first smartphone last year. We’re guessing all of its patents are held by Oppo, which claims to be a separate company but shares manufacturing resources, investors, and even an office building with OnePlus. (Note this is not confirmed and we’ve reached out to OnePlus for more details.)

Still, Xiaomi’s patent portfolio is overshadowed by most of its competitors, especially global competitors. I’m honestly surprised it made it all the way to India before someone put up a fight. Overall, though, it looks like Xiaomi is moving in the right direction on intellectual property. The only question is if it’s moving fast enough to keep up with its own expansion. In China, the patent process typically takes 18 to 24 months. By then, Xiaomi could be in dozens of countries.

Do the numbers even matter? Ed Chatterton, a partner at the intellectual property and technology practice of law firm DLA Piper in Hong Kong, assisted in fact checking this article. He says comparing companies by the number of patents in their portfolio "can give a broad indication but it should be borne in mind that simply assessing a portfolio by size does not address the quality of the portfolio." So keep that in mind as well.

In case you were wondering, Xiaomi only has two patents in the US (excluding PCT patents). One of them is for its mobile power bank. Perhaps an indicator as to what might be the first Xiaomi gadget to hit the US market? We’ll see.

Editing by Steven Millward

How Xiaomi’s patent portfolio stacks up against competitors, in two charts

Paul Bischoff

16 hours ago

When an Indian high court slapped an injunction on Xiaomi, halting sales and import of all its phones, many people including us started to question whether the Chinese smartphone maker had enough intellectual property to do business outside of its home country. Ericsson, the telecommunications giant behind the injunction, alleged that Xiaomi infringed on its patents in India.

Xiaomi models that use MediaTek processors, namely the Redmi 1s, are still not for sale in India, but Xiaomi has repeatedly argued that intellectual property will not be a concern moving forward. The four-and-a-half-year-old company now sells its devices in seven Asian countries and plans aggressive expansion into many more, including some in Latin America, this year.

So should Xiaomi be worried? For each market it enters, it opens itself to more legal vulnerabilities. If it doesn’t have a patent portfolio to protect itself, it could run into further trouble like it did in India.

Patents are important for two big reasons. First, they cut licensing fees that companies like Xiaomi have to pay to companies like Ericsson for the technology used in their phones. Secondly, when tech companies get sued for patent infringement (it happens a lot in the mobile sector), handing over patents is a common way to settle the suit out of court. This use of patents as a bargaining chip is called a cross-licensing agreement, in which Xiaomi would allow the company that sued it to use some of its patents.

To give some context to Xiaomi’s situation, we dug up some data from China’s State Intellectual Property Office (SIPO) and the World Intellectual Property Organization (WIPO), both of which have public databases of patent applications. We compared Xiaomi to several other Chinese phone makers, including Oppo, Coolpad, Meizu, ZTE, and Huawei, as well as foreign competitors Apple and Samsung — best sellers in China.

The data

For each of these companies, we found the number of applications filed under the Patent Cooperation Treaty (PCT), which are internationally-recognized patents for some or all member countries, and those filed with China’s SIPO, including invention patents, design patents, and "announced" patents, which are still pending approval. SIPO patents are only recognized in China.

Smartphone brand patent comparison

As you can see, Samsung, ZTE, and Huawei dwarf Xiaomi and the rest. But it isn’t exactly fair to make that comparison because their products are not limited to smartphones. Samsung has a huge catalog ranging from smartphones to laptops to speakers to kitchen appliances. ZTE and Huawei are both major telecommunications equipment manufacturers, which build the infrastructure necessary for nationwide 4G networks to work, among other things. They are two of the biggest patenters in China across all sectors. These three companies are also much older and thus have had more time to accumulate a large patent portfolio, so a direct comparison isn’t really applicable. Let’s take out those last three.

Chinese smartphone maker patent comparison 2

That’s more like it. In this chart, we also made a change to Apple’s data. Only patents filed under Apple Inc are included. Apple changed its official name from Apple Computer Inc to Apple Inc in 2007 – the same year the first iPhone launched. That makes for a more relevant comparison to Xiaomi and other young smartphone makers.

A threat to Xiaomi?

What can we infer from the data about the legal threat for Xiaomi beyond China? If Xiaomi were to stop applying for patents today and continue expanding into more countries, then it might indeed be at risk. It has just a tiny fraction of what Apple has on the international and domestic fronts. And with just 28 patents granted in China, it’s behind smaller local companies like Oppo and Coolpad, too.

But Xiaomi isn’t resting on its laurels when it comes to intellectual property. Of Xiaomi’s 130 or so applications to the PCT, about 100 were submitted in the past year, and 19 in the last two months. That shows Xiaomi is more gung-ho than ever about building its IP portfolio.

Oppo sets an important standard to which we can compare Xiaomi because it operates in many of the same international markets and has a relatively similar line of products. Oppo has more patents in its China portfolio, both pending and granted, but it’s lagging behind Xiaomi on the international front.

On a side note, we couldn’t find any patents – Chinese or PCT – filed under OnePlus, the Xiaomi competitor that launched its first smartphone last year. We’re guessing all of its patents are held by Oppo, which claims to be a separate company but shares manufacturing resources, investors, and even an office building with OnePlus. (Note this is not confirmed and we’ve reached out to OnePlus for more details.)

Still, Xiaomi’s patent portfolio is overshadowed by most of its competitors, especially global competitors. I’m honestly surprised it made it all the way to India before someone put up a fight. Overall, though, it looks like Xiaomi is moving in the right direction on intellectual property. The only question is if it’s moving fast enough to keep up with its own expansion. In China, the patent process typically takes 18 to 24 months. By then, Xiaomi could be in dozens of countries.

Do the numbers even matter? Ed Chatterton, a partner at the intellectual property and technology practice of law firm DLA Piper in Hong Kong, assisted in fact checking this article. He says comparing companies by the number of patents in their portfolio "can give a broad indication but it should be borne in mind that simply assessing a portfolio by size does not address the quality of the portfolio." So keep that in mind as well.

In case you were wondering, Xiaomi only has two patents in the US (excluding PCT patents). One of them is for its mobile power bank. Perhaps an indicator as to what might be the first Xiaomi gadget to hit the US market? We’ll see.

Editing by Steven Millward

- Joined

- Aug 8, 2008

- Messages

- 28,849

- Points

- 113

Why Xiaomi Terrifies the Rest of the Tech World

Kevin Kelleher@kpkelleher March 11, 2015

China's top smartphone maker has set its sights on tech's biggest companies

You can tell a lot about the state of the tech industry by looking at the company that’s currently scaring the crap out of everybody. A decade ago, it was Google. More recently, Facebook became the 800-pound gorilla in social media and photo sharing. This year, the heavy is one that was unknown in the US until a year or so ago: Xiaomi.

Out of countless smartphone makers that have emerged to build on the Android mobile operating system, Xiaomi has not only broken apart from the herd, it’s quickly given other smartphone manufacturers a run for their money. Xiaomi’s share of the global smartphone market rose to 5.3% in late 2014 from 2.1% a year earlier, according to Statista.

A big reason for Xiaomi’s sudden success is that it designs its own hardware as well as the firmware that rides on top of Android’s open-source software. Xiaomi’s MIUI interface evokes the speed and sleekness of an iPhone or a high-end Samsung phone, but often retails for half the price. Most Android phone sellers, by contrast, rely on similar design templates offered by third-party manufacturers like Foxconn.

Xiaomi’s simple strategy of high-quality gadgets at lower prices is threatening the business models of some of the biggest names in technology, including:

Samsung. In China, where the bulk of Xiaomi’s phones have been sold to date, the company’s market share has risen to 15% from 5% a year earlier. Samsung’s, meanwhile, has fallen to 12% from 19%. According to IDC, Samsung’s smartphone shipments in China declined by 22% in 2014, while Xiaomi’s surged 187%.

Samsung has been a big presence in other emerging economies, but Xiaomi announced in January that it would be pushing aggressively into Brazil, Russia and other emerging markets. After launching in India in July, Xiaomi already has a 4% market share. And the company raised $1.1 billion in December, proceeds that could go to building manufacturing and marketing presences in new countries.

Apple has emerged as the predominant smartphone company at the high end of the market. So with Xiaomi offering stylish phones at lower prices, Samsung may find itself pinched between iPhones and low-cost commodity Android phones. Now Xiaomi is gunning for another core Samsung market: TV sets. In November, Xiaomi paid$200 million for Midea Group, a maker of consumer electronics, and said it would spend $1 billion to build out its TV ecosystem.

GoPro. Xiaomi is also planning on launching a site to sell its goods in the US. But for various reasons like the complex subsidies US carriers pay to offset sticker prices, Xiaomi won’t sell smartphones here but instead will sell its fitness tracker, headphones and other accessories.

Earlier this month, Xiaomi said it would also start selling the Yi Camera, a 1080p high-definition action camera that sounds a lot like the best-selling Hero sold by GoPro. Only the Yi will sell for $64, or about half the price of the Hero. The Yi even improves on the Hero with a 16-megapixel camera shooting 60 frames a second. So again, high-end quality at half the price.

GoPro’s brand is much stronger in the US than Xiaomi’s. If that changes, GoPro faces a tough choice between slashing the Hero’s price or watching its market share erode. GoPro’s stock has already lost 39% this year amid concerns about whether it can maintain its torrid growth pace. The bigger the splash that Xiaomi’s camera makes in the US, the more those concerns will grow.

Google. As a thriving smartphone company built on Android, you’d think Xiaomi’s success would be a positive for Google, which still makes the vast bulk of its revenue from online ads. But Google’s services and mobile apps are either blocked or hamstrung in China, so local companies like Alibaba and Baidu have long since learned to work on Android phones without Google’s API.

Google has never had a strong footprint in China. What isn’t clear is what role Google apps will play on Xiaomi’s phones sold outside of China. On the one hand, Google takes a hard line on companies that use Android without its services. On the other, Xiaomi VP (and former Googler) Hugo Barra indicated last week that Xiaomi may not export to new markets the app store it uses for its Chinese customers.

Apple. Given the popularity of the iPhone 6 in China and across the globe, Apple seems to be immune for now to any threat posed by Xiaomi. But glance a few years down the road and it’s not hard to imagine the Chinese manufacturer competing with the best products offered by the reigning king of Silicon Valley.

Xiaomi’s MIUI is several years younger than Apple’s iOS. But despite Apple’s early lead, Xiaomi has quickly created an interface that is not only drawing more comparisons with the look and feel of iOS, it’s designed to be used on a wide array of devices from phones to tablets to wearables.

Xiaomi’s expansion trajectory also looks a lot like Apples: a smart TV console that streams digital content, a fitness tracker that could easily mature into a smartwatch, headphones that offer stylish looks and gold-colored metal. There were even reports this week of a Xiaomi electric car–spurious, to be sure, but it fits the idea that the most innovative companies are interested in the car market.

Apple’s earlier iPhones suffered phases when their features weren’t terribly distinctive from other top phones on the market. If that happens again, and Mi’s user experience comes closer to that of the iPhone, Xiaomi could steal some of Appple’s market share. In the meantime, the two emerging rivals have already taken tothrowing shade on each other.

Xiaomi is sure to face speed bumps as it races forward, like the patent suits it’s already facing in India. Competitors may use patent litigation to slow Xiaomi’s global expansion, but then again, a company worth $45 billion and planning an IPO can easily raise enough cash to buy a substantial patent portfolio of its own. Beyond that, it’s hard to see what will slow Xiaomi’s steady march ahead.

Kevin Kelleher@kpkelleher March 11, 2015

China's top smartphone maker has set its sights on tech's biggest companies

You can tell a lot about the state of the tech industry by looking at the company that’s currently scaring the crap out of everybody. A decade ago, it was Google. More recently, Facebook became the 800-pound gorilla in social media and photo sharing. This year, the heavy is one that was unknown in the US until a year or so ago: Xiaomi.

Out of countless smartphone makers that have emerged to build on the Android mobile operating system, Xiaomi has not only broken apart from the herd, it’s quickly given other smartphone manufacturers a run for their money. Xiaomi’s share of the global smartphone market rose to 5.3% in late 2014 from 2.1% a year earlier, according to Statista.

A big reason for Xiaomi’s sudden success is that it designs its own hardware as well as the firmware that rides on top of Android’s open-source software. Xiaomi’s MIUI interface evokes the speed and sleekness of an iPhone or a high-end Samsung phone, but often retails for half the price. Most Android phone sellers, by contrast, rely on similar design templates offered by third-party manufacturers like Foxconn.

Xiaomi’s simple strategy of high-quality gadgets at lower prices is threatening the business models of some of the biggest names in technology, including:

Samsung. In China, where the bulk of Xiaomi’s phones have been sold to date, the company’s market share has risen to 15% from 5% a year earlier. Samsung’s, meanwhile, has fallen to 12% from 19%. According to IDC, Samsung’s smartphone shipments in China declined by 22% in 2014, while Xiaomi’s surged 187%.

Samsung has been a big presence in other emerging economies, but Xiaomi announced in January that it would be pushing aggressively into Brazil, Russia and other emerging markets. After launching in India in July, Xiaomi already has a 4% market share. And the company raised $1.1 billion in December, proceeds that could go to building manufacturing and marketing presences in new countries.

Apple has emerged as the predominant smartphone company at the high end of the market. So with Xiaomi offering stylish phones at lower prices, Samsung may find itself pinched between iPhones and low-cost commodity Android phones. Now Xiaomi is gunning for another core Samsung market: TV sets. In November, Xiaomi paid$200 million for Midea Group, a maker of consumer electronics, and said it would spend $1 billion to build out its TV ecosystem.

GoPro. Xiaomi is also planning on launching a site to sell its goods in the US. But for various reasons like the complex subsidies US carriers pay to offset sticker prices, Xiaomi won’t sell smartphones here but instead will sell its fitness tracker, headphones and other accessories.

Earlier this month, Xiaomi said it would also start selling the Yi Camera, a 1080p high-definition action camera that sounds a lot like the best-selling Hero sold by GoPro. Only the Yi will sell for $64, or about half the price of the Hero. The Yi even improves on the Hero with a 16-megapixel camera shooting 60 frames a second. So again, high-end quality at half the price.

GoPro’s brand is much stronger in the US than Xiaomi’s. If that changes, GoPro faces a tough choice between slashing the Hero’s price or watching its market share erode. GoPro’s stock has already lost 39% this year amid concerns about whether it can maintain its torrid growth pace. The bigger the splash that Xiaomi’s camera makes in the US, the more those concerns will grow.

Google. As a thriving smartphone company built on Android, you’d think Xiaomi’s success would be a positive for Google, which still makes the vast bulk of its revenue from online ads. But Google’s services and mobile apps are either blocked or hamstrung in China, so local companies like Alibaba and Baidu have long since learned to work on Android phones without Google’s API.

Google has never had a strong footprint in China. What isn’t clear is what role Google apps will play on Xiaomi’s phones sold outside of China. On the one hand, Google takes a hard line on companies that use Android without its services. On the other, Xiaomi VP (and former Googler) Hugo Barra indicated last week that Xiaomi may not export to new markets the app store it uses for its Chinese customers.

Apple. Given the popularity of the iPhone 6 in China and across the globe, Apple seems to be immune for now to any threat posed by Xiaomi. But glance a few years down the road and it’s not hard to imagine the Chinese manufacturer competing with the best products offered by the reigning king of Silicon Valley.

Xiaomi’s MIUI is several years younger than Apple’s iOS. But despite Apple’s early lead, Xiaomi has quickly created an interface that is not only drawing more comparisons with the look and feel of iOS, it’s designed to be used on a wide array of devices from phones to tablets to wearables.

Xiaomi’s expansion trajectory also looks a lot like Apples: a smart TV console that streams digital content, a fitness tracker that could easily mature into a smartwatch, headphones that offer stylish looks and gold-colored metal. There were even reports this week of a Xiaomi electric car–spurious, to be sure, but it fits the idea that the most innovative companies are interested in the car market.

Apple’s earlier iPhones suffered phases when their features weren’t terribly distinctive from other top phones on the market. If that happens again, and Mi’s user experience comes closer to that of the iPhone, Xiaomi could steal some of Appple’s market share. In the meantime, the two emerging rivals have already taken tothrowing shade on each other.

Xiaomi is sure to face speed bumps as it races forward, like the patent suits it’s already facing in India. Competitors may use patent litigation to slow Xiaomi’s global expansion, but then again, a company worth $45 billion and planning an IPO can easily raise enough cash to buy a substantial patent portfolio of its own. Beyond that, it’s hard to see what will slow Xiaomi’s steady march ahead.

Last edited:

- Joined

- Aug 8, 2008

- Messages

- 28,849

- Points

- 113

Found something interesting about Xiaomi's action camera - http://www.sporttechie.com/2015/04/08/comparing-the-xiaomi-yi-action-camera-to-gopros/

Comparing the Xiaomi Yi Action Camera To GoPros

Xiaomi Incorporated, a Chinese electronics company based in Beijing, recently released a new device that will give GoPro some stiff competition. More commonly known for its smartphones, Xiaomi is trying its hand at the sport camera market.

Named the Xiaomi Yi Action Camera, this product is practically the cheap alternative to the GoPro Hero. While the GoPro Hero line retails from several to many dollars more, the new camera from Xiaomi is listed on their website for just $99.

The Yi Action Camera offers consumers decent features considering the low-cost they will pay for it. Weighing only 72 grams, roughly 2.5 ounces, the Yi Action Camera, boasting an Ambarella A7LS processor, can record 1080p video in 60 frames per second (FPS) and Full HD video in 30 FPS.

It has a Sony 16 MP camera with an ultra-angle lens measuring 155° which can be set to take a time-lapse photo or a single photo in traditional or timed mode.

Those in the pool or ocean will enjoy its water-resistant housing and ability to be taken to depths up to 40 meters, or 131 feet. The Yi Sports Camera can also be mounted and combined with numerous accessories offered by Xiaomi.

The device is also able to connect via Wi-Fi or Bluetooth to Android devices courtesy a dedicated app. Xiaomi’s website claims that iOS devices will likely be compatible as early as April of this year. Still, users can upload their videos and photos to social media or store them to micro SD card up to 64 GB in size.

But how does the Xiaomi Yi Action Camera stack up against competing gadgets? Its direct competitor would be the GoPro HERO which can be purchased from GoPro’s official website for $129.

At a weight a little heavier than its Xiaomi competitor, 111 grams (3.9 oz.), the GoPro HERO can record 30 FPS video in 1080p or 60 FPS video in 720p. The photo resolution is just 5MP, unlike like the Yi Sports Camera, yet both products yield a 2.8 aperture and an ultra-wide field of view.

One of the unique features of the GoPro HERO is SuperView which “takes a 4:3 aspect ratio and dynamically stretches it to a 16:9 ratio.” This reportedly allows the camera’s sensor to record more of the surrounding setting without interfering with the original shot.

There are some drawbacks of the GoPro HERO in comparison to the Yi Sports Camera. In addition to the lack of MP and inability to record in Full HD, the GoPro HERO is not as convenient when it comes to sharing recorded content. The GoPro HERO is not directly supported by any apps and is not Wi-Fi capable. Therefore, users must rely on photo and video playback through capable TV’s via USB or take the conventional route of uploading content onto a computer from the removable micro SD card. Even at that, the maximum capacity SD card the GoPro HERO can support is 32 GB, half the size of its competitor.

Overall, it would not be surprising to see consumers leaning in favor of the Xiaomi Yi Sports Camera. It contains marginally superior features to those found in the GoPro HERO. With its features and lower price than its competing product, it looks like the cell phone-heavy manufacturer of Xiaomi Incorporated has made its mark with a new piece of hardware.

Comparing the Xiaomi Yi Action Camera To GoPros

Xiaomi Incorporated, a Chinese electronics company based in Beijing, recently released a new device that will give GoPro some stiff competition. More commonly known for its smartphones, Xiaomi is trying its hand at the sport camera market.

Named the Xiaomi Yi Action Camera, this product is practically the cheap alternative to the GoPro Hero. While the GoPro Hero line retails from several to many dollars more, the new camera from Xiaomi is listed on their website for just $99.

The Yi Action Camera offers consumers decent features considering the low-cost they will pay for it. Weighing only 72 grams, roughly 2.5 ounces, the Yi Action Camera, boasting an Ambarella A7LS processor, can record 1080p video in 60 frames per second (FPS) and Full HD video in 30 FPS.

It has a Sony 16 MP camera with an ultra-angle lens measuring 155° which can be set to take a time-lapse photo or a single photo in traditional or timed mode.

Those in the pool or ocean will enjoy its water-resistant housing and ability to be taken to depths up to 40 meters, or 131 feet. The Yi Sports Camera can also be mounted and combined with numerous accessories offered by Xiaomi.

The device is also able to connect via Wi-Fi or Bluetooth to Android devices courtesy a dedicated app. Xiaomi’s website claims that iOS devices will likely be compatible as early as April of this year. Still, users can upload their videos and photos to social media or store them to micro SD card up to 64 GB in size.

But how does the Xiaomi Yi Action Camera stack up against competing gadgets? Its direct competitor would be the GoPro HERO which can be purchased from GoPro’s official website for $129.

At a weight a little heavier than its Xiaomi competitor, 111 grams (3.9 oz.), the GoPro HERO can record 30 FPS video in 1080p or 60 FPS video in 720p. The photo resolution is just 5MP, unlike like the Yi Sports Camera, yet both products yield a 2.8 aperture and an ultra-wide field of view.

One of the unique features of the GoPro HERO is SuperView which “takes a 4:3 aspect ratio and dynamically stretches it to a 16:9 ratio.” This reportedly allows the camera’s sensor to record more of the surrounding setting without interfering with the original shot.

There are some drawbacks of the GoPro HERO in comparison to the Yi Sports Camera. In addition to the lack of MP and inability to record in Full HD, the GoPro HERO is not as convenient when it comes to sharing recorded content. The GoPro HERO is not directly supported by any apps and is not Wi-Fi capable. Therefore, users must rely on photo and video playback through capable TV’s via USB or take the conventional route of uploading content onto a computer from the removable micro SD card. Even at that, the maximum capacity SD card the GoPro HERO can support is 32 GB, half the size of its competitor.

Overall, it would not be surprising to see consumers leaning in favor of the Xiaomi Yi Sports Camera. It contains marginally superior features to those found in the GoPro HERO. With its features and lower price than its competing product, it looks like the cell phone-heavy manufacturer of Xiaomi Incorporated has made its mark with a new piece of hardware.

- Joined

- Aug 8, 2008

- Messages

- 28,849

- Points

- 113

(Update: it’s a Guinness World Record) Xiaomi just sold 2.11 million smartphones in 12 hours

By Jimmy Westenberg April 8, 2015

Chinese smartphone manufacturer Xiaomi may not be the most prominent device maker in the world, but they’re sure trying to change that. At the company’s Mi Fan Festival 2015 in celebration of its 5th anniversary, Xiaomi discounted quite a few popular smartphones and accessories in hopes to achieve record-breaking numbers. As it turns out, they did just that.

By the end of the 12-hour long festival, Xiaomi sold a total of 2.12 million smartphones and recorded a total revenue of RMB 2.08 billion (~$335 million US). This is compared to the 1.3 million phones sold at last year’s festival. In addition, the company sold over 38,000 Mi TVs, 200,000 Mi Bands and 247,000 Mi Power Strips. Xiaomi says total revenue from accessories alone totaled roughly RMB 190 million.

Xiaomi sold devices in seven different regions this year, with Malaysia, India and Indonesia being added to the list this time around.

In 2014 alone, Xiaomi sold a little over 61 million smartphones worldwide, which bumped them up to the third largest smartphone manufacturer in the world. Obviously the company won’t produce results like this every day, but boasting 2.12 million devices in a mere 12 hours is a feat that not many OEMs could accomplish.

With Xiaomi’s anticipated growth of 30% overall this year, the company may be well on their way to achieving that goal.

http://www.androidauthority.com/xiaomi-just-sold-2-12-million-smartphones-in-12-hours-599571/

By Jimmy Westenberg April 8, 2015

Chinese smartphone manufacturer Xiaomi may not be the most prominent device maker in the world, but they’re sure trying to change that. At the company’s Mi Fan Festival 2015 in celebration of its 5th anniversary, Xiaomi discounted quite a few popular smartphones and accessories in hopes to achieve record-breaking numbers. As it turns out, they did just that.

By the end of the 12-hour long festival, Xiaomi sold a total of 2.12 million smartphones and recorded a total revenue of RMB 2.08 billion (~$335 million US). This is compared to the 1.3 million phones sold at last year’s festival. In addition, the company sold over 38,000 Mi TVs, 200,000 Mi Bands and 247,000 Mi Power Strips. Xiaomi says total revenue from accessories alone totaled roughly RMB 190 million.

Xiaomi sold devices in seven different regions this year, with Malaysia, India and Indonesia being added to the list this time around.

In 2014 alone, Xiaomi sold a little over 61 million smartphones worldwide, which bumped them up to the third largest smartphone manufacturer in the world. Obviously the company won’t produce results like this every day, but boasting 2.12 million devices in a mere 12 hours is a feat that not many OEMs could accomplish.

With Xiaomi’s anticipated growth of 30% overall this year, the company may be well on their way to achieving that goal.

http://www.androidauthority.com/xiaomi-just-sold-2-12-million-smartphones-in-12-hours-599571/

- Joined

- Mar 17, 2009

- Messages

- 5,383

- Points

- 63

Xiaomi Mi 5 release date: Handset to launch with MIUI 7

Snooky Grawls 09 April 2015

The Mi4. Reports say that the next in line Mi5 will have

upgraded features and will be released before the year ends.

The Xiaomi Mi5 is expected to make its debut anytime soon, especially since this will be the fifth anniversary of the company. And while consumers await for the coming of the Mi5 device, word has it that the device will already come equipped with the MIUI 7, the Android 5.1 Lollipop version of MIUI.

This was actually confirmed via AOKP's official blog, baring that Xiaomi and Team Kang were in close collaboration for the MIUI 7 which is expected to debut with the Xiaomi Mi5. The codename for MIUI 7 is said to be MiKangy.

The said Mikangy OS will carry popular features from top ROMS that include CyanogenMod, ParanoidAndroid, Omni, and AOKP. Further, the upcoming UI for the Mi5 is said to be something that is expected to evolve with the users after some time of getting used to it, eventually providing each Mi5 user with their own set of personalized features.

The highly anticipated Xiaomi Mi5 is expected to be pursued by many. Among the features that the Xiaomi Mi5 carries include an expected 5.5-inch IPS LCD capacitive touchscreen display, a quad core 2.7 GHz Krait 450 process on a Qualcomm Snapdragon 805 chipset and 3GB of RAM. It will also have 32GB of internal storage and a rear 16MP camera.

With regards to its predecessor, Xiaomi has announced price cuts for the Xiaomi Mi4 which further amplifies that possibility of the Xiaomi Mi5's impending release.

As far as pricing is concerned, the Xiaomi Mi4 is expected to retail for about CNY 1,799 (originally CNY 1,999) for the 16GB variants. As far as the Xiaomi Mi4 lite version (2GB only) is concerned, it will now retail CNY 1,699 (orgiinally CNY 1,799). All price offs will be effective starting April 8 over in China.

Could that mean the Xiaomi Mi5 is expected to come out on or before that date?

Snooky Grawls 09 April 2015

The Mi4. Reports say that the next in line Mi5 will have

upgraded features and will be released before the year ends.

The Xiaomi Mi5 is expected to make its debut anytime soon, especially since this will be the fifth anniversary of the company. And while consumers await for the coming of the Mi5 device, word has it that the device will already come equipped with the MIUI 7, the Android 5.1 Lollipop version of MIUI.

This was actually confirmed via AOKP's official blog, baring that Xiaomi and Team Kang were in close collaboration for the MIUI 7 which is expected to debut with the Xiaomi Mi5. The codename for MIUI 7 is said to be MiKangy.

The said Mikangy OS will carry popular features from top ROMS that include CyanogenMod, ParanoidAndroid, Omni, and AOKP. Further, the upcoming UI for the Mi5 is said to be something that is expected to evolve with the users after some time of getting used to it, eventually providing each Mi5 user with their own set of personalized features.

The highly anticipated Xiaomi Mi5 is expected to be pursued by many. Among the features that the Xiaomi Mi5 carries include an expected 5.5-inch IPS LCD capacitive touchscreen display, a quad core 2.7 GHz Krait 450 process on a Qualcomm Snapdragon 805 chipset and 3GB of RAM. It will also have 32GB of internal storage and a rear 16MP camera.

With regards to its predecessor, Xiaomi has announced price cuts for the Xiaomi Mi4 which further amplifies that possibility of the Xiaomi Mi5's impending release.

As far as pricing is concerned, the Xiaomi Mi4 is expected to retail for about CNY 1,799 (originally CNY 1,999) for the 16GB variants. As far as the Xiaomi Mi4 lite version (2GB only) is concerned, it will now retail CNY 1,699 (orgiinally CNY 1,799). All price offs will be effective starting April 8 over in China.

Could that mean the Xiaomi Mi5 is expected to come out on or before that date?

- Joined

- Jun 21, 2010

- Messages

- 34,613

- Points

- 113

They can rave all they want....

If they do a survey of these xiaomi owners/buyers......almost all will say an iPhone is their ultimate dream phone. That is the FACT.

If they do a survey of these xiaomi owners/buyers......almost all will say an iPhone is their ultimate dream phone. That is the FACT.

- Joined

- Mar 17, 2009

- Messages

- 5,383

- Points

- 63

If they do a survey of these xiaomi owners/buyers......almost all will say an iPhone is their ultimate dream phone. That is the FACT.

Truth be told, Xiaomi is not doing battle with iPhone and those in the >$1,000 segment (Samsung S5, HTC One, etc.). At least not yet.

The strategy is to tap the middle and lower segments – the masses – by giving them phones with impressive specs at less than half the price of their competitors' similarly-specced models. (The Mi 4 is higher specced than the iPhone 6 but goes for 1/3 the price.) Sell online to save rental and inventory costs. Use social media instead of print and broadcast media to spread the word to save on advertising. Go for volume at the expense of profit margins. And target huge emerging economies like China, India and Brazil.

The strategy has been working well so far. How they'll make the next step from selling mid- to high-end phones at low-end prices to competing on innovation and prestige (like Apple) would be crucial for the future growth of the company, once the emerging markets get saturated.

- Joined

- Aug 8, 2008

- Messages

- 28,849

- Points

- 113

Xiaomi To Make Things Even Harder For Apple In India

Xiaomi vice president of global operations Hugo Barra holds up a Mi Note after a presentation in San Francisco, Thursday, Feb. 12, 2015. While stopping short of declaring plans to sell phones in the United States, Xiaomi said Thursday that it will dip its toes in the U.S. market by selling headphones and other accessories online, through an Internet-based, fan-friendly model that has helped make the company one of the leading smartphone suppliers in China. Meanwhile, the company is expanding its smartphone base in India, its main market off the mainland. (Photo by Jeff Chiu/AP)

China’s privately held smartphone maker Xiaomi is going after the big guns. It’s beat Samsung in China. It is neck and neck with Apple. And now it is going to India on its first stop abroad.

The company said this week that it will unveil its first handset designed for exclusively for the Indian market on April 23. The phone is rumored to be called the Mi 4i.

India’s market is low cost. Their locally made Micromax Informatics name brand is currently the most sold smartphone in India, outselling Samsung last year, according to Indian research firm Canalys. Micromax has a 22% share while Samsung has a 20% share. Apple is ranked eight in terms of market share as it struggles on the price size. Now that Xiaomi is coming to town, India will be even more of a challenge in India, the world’s fastest growing smartphone market.

Indians bought 21.6 million smartphones in the fourth quarter of 2014, making it the world’s third-largest smartphone market in terms of the number devices sold. The country sold over 53 million smartphones in 2014, according to estimates from market pollsters at GfK.

According to Canalys, 23% of the smartphones sold in India were of devices priced under $100, while 41% were of devices sold were in the $100 to $200 price bracket. That isn’t exactly Xiaomi’s current sweet spot. The Mi 3 sells for 13,999 rupees on Flipkart, India’s premier e-commerce website. That’s currently $225. A 16 gigabyte Mi4 is selling for $290. Compared to Apple, that’s flea market pricing. In India, a 16 gigabyte iPhone 6 is priced at 48,500 rupee, or $782. Mind you, the GDP per capita in India is around $2,000, making the iPhone 6 worth about four months of work.

China already has a presence in India’s smartphone market. ZTE and Huawei are there. Their pricing is about the same, with older models selling for under 10,000 rupees.

Beijing-based Xiaomi is a relative new entrant to the Chinese handheld market. To drum up interest for its India launch this week, they are attacking India’s social media to post teasers on its phone features.

Xiaomi’s selling point? Supposedly a longer battery life, the usual mid-range handset’s high-resolution display in a form factor that’s comfortable to use one-handed.

While there’s no indication as to the hardware the device will feature, recent leaks suggest that the Mi 4i will feature a 4.9-inch full-high-def screen, 64-bit 1.65GHz octa-core Snapdragon 615 SoC, 16GB, a 12 mega pixel camera, and also Android 5.0.2 out of the box. Given that the latest iteration of MIUI 6 is based on Android 4.4.4 KitKat, it is likely we’ll see the global debut of a new version of MIUI at the launch event as well. MIUI has gained traction worldwide as a custom read-only-memory, with Xiaomi announcing earlier this year that there are over 100 million users of the ROM worldwide, VR World reported on Tuesday.

Xiaomi debuted in India last year. It’s taken a cue from Apple and is setting up “experience stores” across India, which will have their own in-house geek squad to fix broken phones.

Also this month, Xiaomi said that it is partnering now with Amazon and Snapdeal rather than be exclusively with Flipkart.

Apple is Xiaomi’s biggest rival in China, at least based on this current year’s data.

From December to February 2015, the latest number for smartphone sales in China, Apple’s market share hit 27.6% versus the 25% in the November to January period, according to consumer research firm Kantar Worldpanel.

Last year, only 40% of China’s mobile phone customers even had a smartphone, according to IDC. There is ample room for growth as China moves up the middle income scale, and domestic brands discover new ways to make cheaper devices to bring in the newcomers. Apple sales have been immune to lower cost rivals in China, but India will be a different story.

Apple remains a favorite among India’s tech nerds, however.

Digit magazine put Apple’s iPhone 6 as its fourth most recommended smartphone. These guys have expensive tastes, however. Their leader was the Moto Turbo, priced at a whopping 41,999 rupee on Flipkart. The Xiaomi Mi4 was ranked tenth.

Xiaomi vice president of global operations Hugo Barra holds up a Mi Note after a presentation in San Francisco, Thursday, Feb. 12, 2015. While stopping short of declaring plans to sell phones in the United States, Xiaomi said Thursday that it will dip its toes in the U.S. market by selling headphones and other accessories online, through an Internet-based, fan-friendly model that has helped make the company one of the leading smartphone suppliers in China. Meanwhile, the company is expanding its smartphone base in India, its main market off the mainland. (Photo by Jeff Chiu/AP)

China’s privately held smartphone maker Xiaomi is going after the big guns. It’s beat Samsung in China. It is neck and neck with Apple. And now it is going to India on its first stop abroad.

The company said this week that it will unveil its first handset designed for exclusively for the Indian market on April 23. The phone is rumored to be called the Mi 4i.

India’s market is low cost. Their locally made Micromax Informatics name brand is currently the most sold smartphone in India, outselling Samsung last year, according to Indian research firm Canalys. Micromax has a 22% share while Samsung has a 20% share. Apple is ranked eight in terms of market share as it struggles on the price size. Now that Xiaomi is coming to town, India will be even more of a challenge in India, the world’s fastest growing smartphone market.

Indians bought 21.6 million smartphones in the fourth quarter of 2014, making it the world’s third-largest smartphone market in terms of the number devices sold. The country sold over 53 million smartphones in 2014, according to estimates from market pollsters at GfK.

According to Canalys, 23% of the smartphones sold in India were of devices priced under $100, while 41% were of devices sold were in the $100 to $200 price bracket. That isn’t exactly Xiaomi’s current sweet spot. The Mi 3 sells for 13,999 rupees on Flipkart, India’s premier e-commerce website. That’s currently $225. A 16 gigabyte Mi4 is selling for $290. Compared to Apple, that’s flea market pricing. In India, a 16 gigabyte iPhone 6 is priced at 48,500 rupee, or $782. Mind you, the GDP per capita in India is around $2,000, making the iPhone 6 worth about four months of work.

China already has a presence in India’s smartphone market. ZTE and Huawei are there. Their pricing is about the same, with older models selling for under 10,000 rupees.

Beijing-based Xiaomi is a relative new entrant to the Chinese handheld market. To drum up interest for its India launch this week, they are attacking India’s social media to post teasers on its phone features.

Xiaomi’s selling point? Supposedly a longer battery life, the usual mid-range handset’s high-resolution display in a form factor that’s comfortable to use one-handed.

While there’s no indication as to the hardware the device will feature, recent leaks suggest that the Mi 4i will feature a 4.9-inch full-high-def screen, 64-bit 1.65GHz octa-core Snapdragon 615 SoC, 16GB, a 12 mega pixel camera, and also Android 5.0.2 out of the box. Given that the latest iteration of MIUI 6 is based on Android 4.4.4 KitKat, it is likely we’ll see the global debut of a new version of MIUI at the launch event as well. MIUI has gained traction worldwide as a custom read-only-memory, with Xiaomi announcing earlier this year that there are over 100 million users of the ROM worldwide, VR World reported on Tuesday.

Xiaomi debuted in India last year. It’s taken a cue from Apple and is setting up “experience stores” across India, which will have their own in-house geek squad to fix broken phones.

Also this month, Xiaomi said that it is partnering now with Amazon and Snapdeal rather than be exclusively with Flipkart.

Apple is Xiaomi’s biggest rival in China, at least based on this current year’s data.

From December to February 2015, the latest number for smartphone sales in China, Apple’s market share hit 27.6% versus the 25% in the November to January period, according to consumer research firm Kantar Worldpanel.

Last year, only 40% of China’s mobile phone customers even had a smartphone, according to IDC. There is ample room for growth as China moves up the middle income scale, and domestic brands discover new ways to make cheaper devices to bring in the newcomers. Apple sales have been immune to lower cost rivals in China, but India will be a different story.

Apple remains a favorite among India’s tech nerds, however.

Digit magazine put Apple’s iPhone 6 as its fourth most recommended smartphone. These guys have expensive tastes, however. Their leader was the Moto Turbo, priced at a whopping 41,999 rupee on Flipkart. The Xiaomi Mi4 was ranked tenth.

- Joined

- Aug 8, 2008

- Messages

- 28,849

- Points

- 113

- Joined

- Mar 17, 2009

- Messages

- 5,383

- Points

- 63

The Mi 4i is the budget version of the Mi4, which is not yet available in Singapore. I got the Mi4 LTE from HK for my kid for about US$370. Awesome – outspecced the iPhone 6 but less than half the price.

- Joined

- Aug 8, 2008

- Messages

- 28,849

- Points

- 113

The Mi 4i is the budget version of the Mi4, which is not yet available in Singapore. I got the Mi4 LTE from HK for my kid for about US$370. Awesome – outspecced the iPhone 6 but less than half the price.

MI Note will be a great phone.

- Joined

- Jul 25, 2008

- Messages

- 59,817

- Points

- 113

xiaomi is selling well in india, but indians call it "eleven aomi".

- Joined

- Mar 17, 2009

- Messages

- 5,383

- Points

- 63

Local Mi note have one sim slot but export set seems to have 2 sim slots

Yes the local Mi Note 4G has only one SIM slot (previous 3G version had 2), which I feel is the wrong move by Xiaomi. Maybe they figured that Singaporeans are not into dual SIM phones.

- Joined

- Jun 21, 2010

- Messages

- 34,613

- Points

- 113

Truth be told, Xiaomi is not doing battle with iPhone and those in the >$1,000 segment (Samsung S5, HTC One, etc.). At least not yet.

The strategy is to tap the middle and lower segments – the masses – by giving them phones with impressive specs at less than half the price of their competitors' similarly-specced models. (The Mi 4 is higher specced than the iPhone 6 but goes for 1/3 the price.) Sell online to save rental and inventory costs. Use social media instead of print and broadcast media to spread the word to save on advertising. Go for volume at the expense of profit margins. And target huge emerging economies like China, India and Brazil.

The strategy has been working well so far. How they'll make the next step from selling mid- to high-end phones at low-end prices to competing on innovation and prestige (like Apple) would be crucial for the future growth of the company, once the emerging markets get saturated.

That's what I've been saying....

They are in different leagues targeting different users.

Iphone owners dun choose an iPhone sorely based on specs.

Creative MP3s used to outspec the iPod and look what happened after it went head to head with apple.

It's like comparing a GTR with a Ferrari....the GTR can have its cult following and even outrun the Italian......but most people aren't bothered as at end of the day it's is still just a NISSAN. And Ferrari will always be the coveted Ferrari.

- Joined

- Mar 17, 2009

- Messages

- 5,383

- Points

- 63

Re: Xiaomi to rival iPhone 6 Plus with new Mi Note smartphone

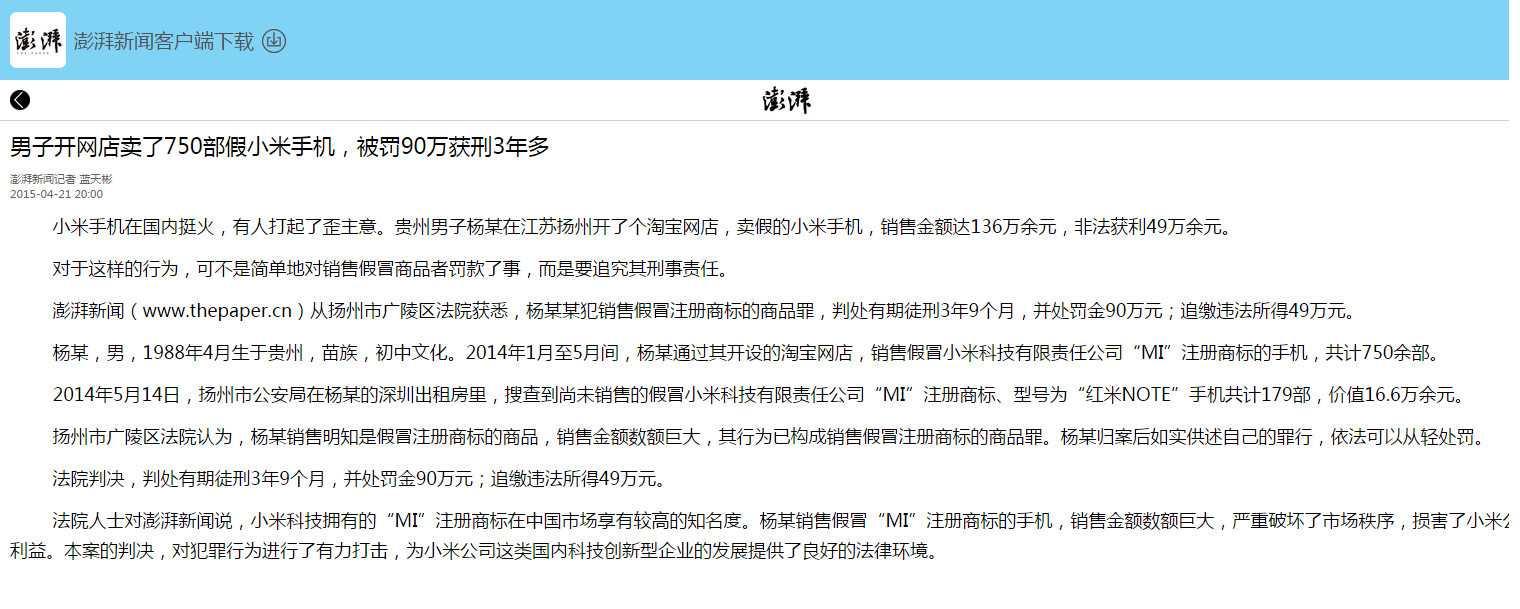

It's an ironic compliment to Xiaomi that the Chinese are now counterfeiting their own native brands after years of faking foreign products. Fake Xiaomi power banks and cellphones are now flooding the market. Beware.

[video=youtube;xPbedkkiDEM]https://www.youtube.com/watch?v=xPbedkkiDEM[/video]

It's an ironic compliment to Xiaomi that the Chinese are now counterfeiting their own native brands after years of faking foreign products. Fake Xiaomi power banks and cellphones are now flooding the market. Beware.

[video=youtube;xPbedkkiDEM]https://www.youtube.com/watch?v=xPbedkkiDEM[/video]

Similar threads

- Replies

- 0

- Views

- 793

- Replies

- 30

- Views

- 2K

- Replies

- 0

- Views

- 808

- Replies

- 5

- Views

- 533