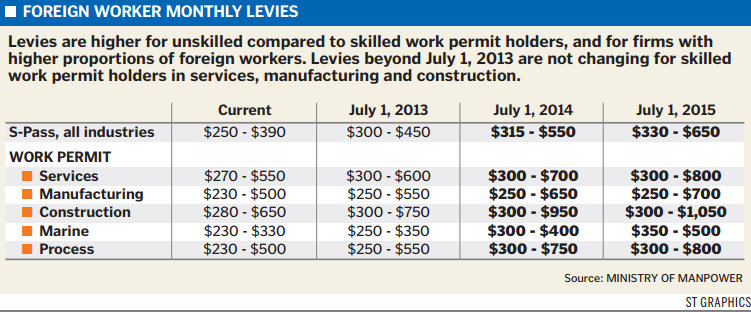

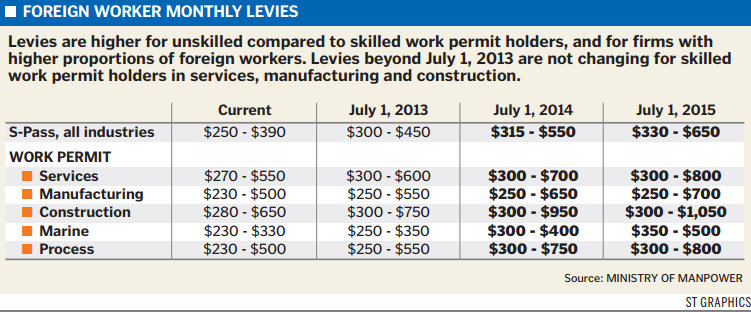

Work permit levies are optimised to what can bring MOM maximum collection of revenues/ profit; little/ nothing to do with protecting Singaporean jobs

(IMG URL)

(IMG URL)

The MOM knows that if it charges high levies for marine sector employees, the oil rigs that Sembcorp Marine, Kepple Offshore Marine builds locally for export etc will be overpriced and this internationally uncompetitive: thus it allows marine related companies to hire foreign work permit holders for a relatively lower levy (<$500 p.m.).

In the construction sector, MOM knows that due to Singaporeans fettish for owning property, people are willing to pay a bomb for property and so opportunistically set the work permit levy for the property sector at the maximum ($1050 p.m. per work permit holder) to reap MAXIMUM tax dollar returns.

Whilst I will not venture out into discussing the manifold consequence of MOM's manipulation of fiscal policy (e.g. taxes and gahmen investment), one can probably conclude that Singapore is being run like an MNC and the citizens of Singapore are simply employees of such an MNC. Singapore is not a country, Singapore is an MNC and owned by shareholders in the likes of the PAP who earn dividends from their 'investment' in the likes of stratospheric annual salary and bonuses amounting to multiples of their annual salary.

Any mention of protecting Singaporean jobs is probably secondary if not tertiary to how foreign worker levys are tiered and calculated and unfortunately too, Singaporeans who are cheapo/ low-skilled sense nothing amiss since many of such types would spend their time lazing around, receiving some easy stipend from phantom employment (due to dependency ratio scheme is inter woven into work permit price calculations): the gahmen's knee jerk scheme to keep lower class cheapo Singaporeans quiet and thinking that their citizenship is worth much.

The whole consequence of all this is that the Singapore economy is run of thin ice as ambitious Singaporeans are demoralised by employment pass (EP) holding foreigners whose employment (salary S$3000 p.m. onwards) attracts zero levy surchargem and are thus pushed to driving taxis if they have dignity NOT tomaccept phantom jobs to survive. (The levy payable by companies hiring Singaporeans is 17% of base salary which companies have to pay to CPF board for citizen's future pension allowance; no such requirement exist in the employment of EP holding foreigner PMETs).

Very soon, all NSmen-PMETs will smell a rat in the current economic plan and if the effectively autocratic/ mercinery gahmen continues on its old path, than Singapore will certainly be in invaded by foreigners either through jobs or militarily. But then, it will be already too late...

-+-+-+-+-+-+-+-+-+-+-+-+-++

References:

Letter of remorse from Sinkie finance-controler/ HR mgr who has since morally regretted the error of his ways for helping company cut costs by accepting cost savings EP first scheme at the expense of Singaporean PMET jobs: for personal $$$ gains (annual 'performance' bonus)...

Dependent's pass holders (spouse of EP) can get Singaporean jobs, no levy needed, employer 17% CPF surcharge waived even (just get MOM 'letter of consent') ...

The following 2 clowns are quite happy with the status quo I would guess...

She walks in on coat tails:

And so does he, but by defending their 'dividends', U 'earn' more $$$...

The Godfather of them all...

The MOM knows that if it charges high levies for marine sector employees, the oil rigs that Sembcorp Marine, Kepple Offshore Marine builds locally for export etc will be overpriced and this internationally uncompetitive: thus it allows marine related companies to hire foreign work permit holders for a relatively lower levy (<$500 p.m.).

In the construction sector, MOM knows that due to Singaporeans fettish for owning property, people are willing to pay a bomb for property and so opportunistically set the work permit levy for the property sector at the maximum ($1050 p.m. per work permit holder) to reap MAXIMUM tax dollar returns.

Whilst I will not venture out into discussing the manifold consequence of MOM's manipulation of fiscal policy (e.g. taxes and gahmen investment), one can probably conclude that Singapore is being run like an MNC and the citizens of Singapore are simply employees of such an MNC. Singapore is not a country, Singapore is an MNC and owned by shareholders in the likes of the PAP who earn dividends from their 'investment' in the likes of stratospheric annual salary and bonuses amounting to multiples of their annual salary.

Any mention of protecting Singaporean jobs is probably secondary if not tertiary to how foreign worker levys are tiered and calculated and unfortunately too, Singaporeans who are cheapo/ low-skilled sense nothing amiss since many of such types would spend their time lazing around, receiving some easy stipend from phantom employment (due to dependency ratio scheme is inter woven into work permit price calculations): the gahmen's knee jerk scheme to keep lower class cheapo Singaporeans quiet and thinking that their citizenship is worth much.

The whole consequence of all this is that the Singapore economy is run of thin ice as ambitious Singaporeans are demoralised by employment pass (EP) holding foreigners whose employment (salary S$3000 p.m. onwards) attracts zero levy surchargem and are thus pushed to driving taxis if they have dignity NOT tomaccept phantom jobs to survive. (The levy payable by companies hiring Singaporeans is 17% of base salary which companies have to pay to CPF board for citizen's future pension allowance; no such requirement exist in the employment of EP holding foreigner PMETs).

Very soon, all NSmen-PMETs will smell a rat in the current economic plan and if the effectively autocratic/ mercinery gahmen continues on its old path, than Singapore will certainly be in invaded by foreigners either through jobs or militarily. But then, it will be already too late...

-+-+-+-+-+-+-+-+-+-+-+-+-++

References:

Letter of remorse from Sinkie finance-controler/ HR mgr who has since morally regretted the error of his ways for helping company cut costs by accepting cost savings EP first scheme at the expense of Singaporean PMET jobs: for personal $$$ gains (annual 'performance' bonus)...

Local PMEs don't have it easy

Published on May 31, 2014 1:22 AM

I REFER to the report ("MPs want more protection, support for local PMEs"; Tuesday)

When I was the general manager of a local IT company and, subsequently, a financial controller for a Dutch multinational corporation, I preferred hiring foreign mid-level staff for the following reasons:

- The company did not need to pay CPF contributions for them;

- Their salary expectations were lower than Singaporeans'; and

- Their skill sets and experiences were on a par with those of Singaporeans.

The total cost differential between local and foreign professionals, managers and executives (PMEs) was 20 to 40 per cent.

An Asian foreign employee with a degree and work experience can easily afford a city apartment and family sedan in his home country if he makes $200,000 during his stint here.

In Singapore, $200,000 would allow a Singaporean with the same qualifications to buy only a three-room HDB flat in outlying regions like Woodlands or Jurong. A family car would set him back by $120,000.

An Asian foreigner's cost of living back home is so much lower than ours. Hence, he is more willing to work for $3,000 to $5,000 a month. But a Singaporean graduate earning $4,000 a month will be trying to keep up with inflation.

It does not make sense that a foreign PME working here has a bright future, while his Singaporean counterparts are struggling with their living expenses, unless they are in strong sectors like banking and health care, where pay is high.

A levy is imposed when one hires a maid, but there is no such tax for hiring foreign PMEs. No wonder foreign PMEs were replacing local ones at an increasing rate until tighter restrictions were imposed last year.

At the moment, the local PME retrenchment rate is still high as employers are hiring foreigners for the cost savings.

Over the medium to long term, this will weaken Singapore's economy as local PMEs will become structurally unemployed as they lose their skills and employability.

Lim Kay Soon

Local PMEs don't have it easy

Employment Pass (P1, P2, Q1)

Employment Passes are for hiring foreign professionals, managers and specialists

What Are The Criteria?

There are 3 categories of Employment Passes: P and Q.

For all Employment Passes, there are no restrictions on the nationality of the foreign employee.

The criteria for each category are in the table below:

Category Sub-Category Criteria Basic Monthly Salary

P1 Holds a professional, managerial or specialist job At least S$8,000

P2 Acceptable tertiary qualification/ Holds a professional, managerial or specialist job, At least S$4,500

Q1. Acceptable tertiary qualification, Holds a professional, managerial or specialist job, At least S$3,000

What Are The Privileges?

Dependant's Pass

P1, P2 and Q1 Employment Pass holders can apply the pass for their spouse and children (under the age of 21).

Long-Term Social Visit Pass

P1 and P2 Employment Pass holders can apply the pass for the following:

parents (for P1 holders only)

step children under the age of 21, spouse, handicapped children aged above 21

What Levies Do I Need To Pay

There is no Foreign Worker Levy for Employment Pass holders.

As the employer, you have to pay Skills Development Levy (SDL) for Employment Pass holders.

Is There A Quota?

There is no dependency ceiling for Employment Pass. You can apply for any number of Employment Passes.

Where Do I Apply?

You need to apply to the Ministry of Manpower (MOM).

EnterpriseOne - Employment Pass (P1, P2, Q1)

Dependent's pass holders (spouse of EP) can get Singaporean jobs, no levy needed, employer 17% CPF surcharge waived even (just get MOM 'letter of consent') ...

The following 2 clowns are quite happy with the status quo I would guess...

She walks in on coat tails:

'Without some assurance of a good chance of winning at least their first election, many able and successful young Singaporeans may not risk their careers to join politics,' Mr Goh Chok Tong, June 2006 ['GRCs make it easier to find top talent: SM'].

[Pict= [URL=http://www.theonlinecitizen.com/2012/04/disassembling-grc-benefits-pap-1/]Disassembling GRC system benefits PAP (Part 1 of 3)[/URL]]

And so does he, but by defending their 'dividends', U 'earn' more $$$...

"If the annual salary of the Minister of Information, Communication and Arts is only $500,000, it may pose some problems when he discuss policies with media CEOs who earn millions of dollars because they need not listen to the minister's ideas and proposals. Hence, a reasonable payout will help to maintain a bit of dignity."

- MP Lim Wee Kiak apologises for comments on pay

[IMG URL]

The Godfather of them all...