[h=2]Top 8 Shocking Facts About The Singapore CPF[/h]

November 10th, 2013 |

November 10th, 2013 |

Author: Contributions

Author: Contributions

Here’s a list of top 8 facts that some of us never knew about our

Here’s a list of top 8 facts that some of us never knew about our

CPF!

FACT #1: Your CPF interest rate used to be higher at

6.5%.

Do you know that our CPF used to earn higher returns? The interest rates had

rose to 6.5% between 1975 and 1986, before dropping again. Those were the golden

years of our CPF (Chart 1).

The CPF interest rate of 2.5% that we are getting on our Ordinary Account

(OA) now is the lowest and is what we were getting between 1955 and 1962. In

fact, from 1963 to 1986 (for more than 20 years), the interest rate that we were

earning from our CPF had been above 5% – higher than what we receive on even the

4.5% on the Special and Medisave Accounts (SMA) now.

Chart 1

FACT #2: You will earn higher retirement funds in the 10 years

between 1976 and 1985 than now.

Let’s assume that a person was earning $3,000 every month in 2004 and he

continued to earn $3,000 for the next 10 years. In the last 10 years, between

2004 and 2013, using the OA interest rates of 2.5%, a person would earn about

$142,000 by 2013. Based on the SMA interest rates of 4%, a person would earn

about $155,000 by 2013.

But do you know that in the 10 years between 1976 and 1985, a person who had

earned $3,000 every year would be able to earn $202,000 by 1985 based on the

contribution and interest rates at that time – $50,000 more than the Singaporean

living in the present time (Chart 2)!

This means that Singaporeans were obtaining better returns in the mid-1970s

to mid-1980s than today!

Chart 2

FACT #3: You are paying up to a 12.5% tax on your CPF.

Right now, Singaporeans are earning only 2.5% and 4% on our CPF. However, our

CPF is being used to invest in the GIC and Temasek Holdings, which are earning

6.5% and 16% respectively.

If we look at our the portion of our CPF OA (earning 2.5%) which is invested

in the Temasek Holdings (earning 16%), do you know that the returns of 13.5%

(16% minus 2.5%) which we are not getting back on our CPF is actually an

implicit tax that we are paying to the government? Assuming that we need to pay

an administrative charge of 1% to the CPF for managing our CPF, this means that

we are paying an implicit tax of 12.5% (Chart 3).

Because the government isn’t returning the full earnings from our CPF to us,

this 12.5% that is not returned to us is effectively what we pay to the

government as tax on our CPF.

Chart 3

FACT #4: We can only use 15.5% of our CPF funds for

retirement.

Do you know that Singaporeans

use about 75% of our CPF for housing? Up to

another 9.5% is set aside for Medisave.

This means that we are left with only 15.5% (Chart 4).

This means that we can only retire on 15.5% of our retirement funds. So,

Prime Minister Lee Hsien Loong might say that, “each poor

household has on average $200,000 of net wealth in the HDB flat“. So, what

is PM Lee’s solution for poor Singaporeans who would need the $200,000 to use

for retirement? Sell their homes? Then what would happen to the children who

live in these homes with their parents, or the parents who live with their

children? Become homeless too?

Chart 4

FACT #5: If we get the full returns back on our CPF, we would be able

to retire with 50% of our CPF.

Assuming that you would be able to obtain the 15% interest returns from the

Temasek Holdings (16% minus 1% administrative charge), and assuming that the

funds in your CPF is managed by the Temasek Holdings, do you know that you would

only need to use only about 37% of your CPF for housing, instead of the 75%

now?

The 2.5% to 4% interest that we are earning now means that we have to spend

75% of our retirement funds on housing. But if we are able to get the full

returns of our CPF back, we need to only pay as low as 37% to housing (Chart

5).

If we are able to get the full returns of our CPF back, we would be able to

retire with 50% of our CPF savings, instead of the 15.5% now!

Chart 5

FACT #6: Singaporeans earn the lowest interest rates on our CPF as

compared to the other countries.

Since 2000, Singaporeans have been earning 2.5% to 4% on our provident funds.

Some commenters had said that this interest rate is “guaranteed” and is high.

Let’s take a look at the “guaranteed” interest rates of the other countries.

Do you know that when compared to the other countries with social security or

provident funds, we actually earn the lowest average returns since 2000 (Chart

6).

Quite obviously, 2.5% to 4% can hardly be considered high at all! The

commenters who had championed the high “guaranteed” interest rates might need to

check their facts again.

Chart 6: The

Heart Truths SHOCKING Facts About Our CPF in Singapore! (Part 2)

FACT #7: Singaporeans earn the lowest CPF returns because we start

off on a lower base – we earn the lowest wages.

Also, some commenters had said that CPF is “your money” because it’s money

that we earn and keep for ourselves.

But as I’ve mentioned above, we earn the lowest interest rates on our CPF,

and because interest rates are the lowest now in Singapore’s history, we

actually earn a lower amount than what we would used to be able to earn in the

early 1980s.

So, because we

pay the highest contribution rates but earn the lowest interest rates, we have

one of the least adequate retirement funds in the world.

Simply put, the government is not returning to us into our CPF what we should

rightfully earn from our CPF.

But more importantly, do you also know why our CPF can hardly grow as much as

it should?

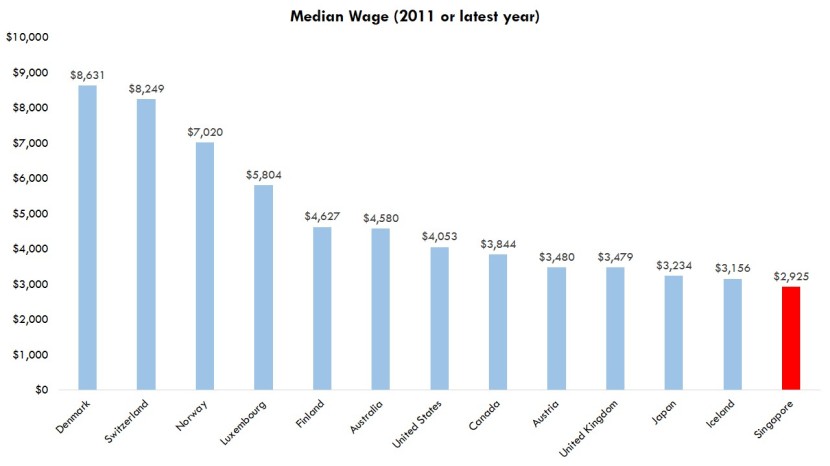

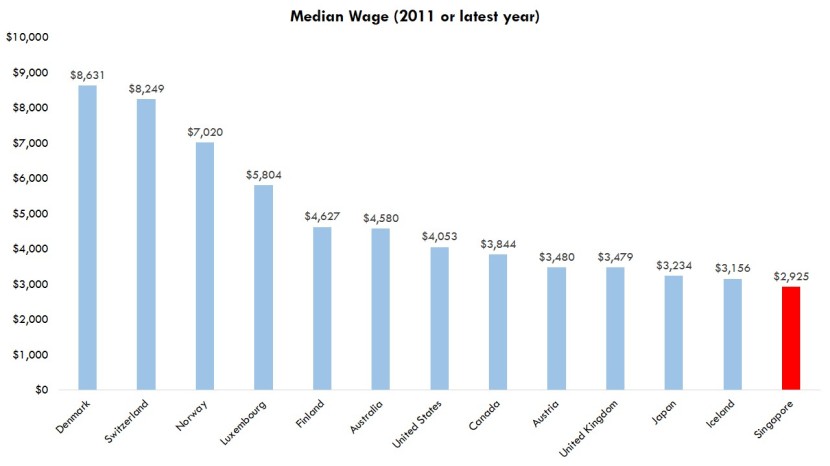

Do you know that even though Singapore is the richest, if not, one of the

richest countries in the world, and do you know that even though we have one of

the highest prices in the world, Singaporeans

are actually paid the lowest wages among the high-income countries (Chart

7).

Chart 7: The

Heart Truths Singaporeans Earn The LOWEST Wages Among The High-Income

Countries

If our wages are on par with other countries with a similar level of income

and price level, the median wage in Singapore at this moment should be about

$4,500, instead

of the $3,000 now.

Assuming that we had used the example in Fact #2, if Singaporeans are to earn

a wage that is on par to that of a high-income country and we are able to earn

the full returns on our CPF, Singaporeans would have accumulated a CPF savings

of up to $500,000, or more than 3 times as much as what we are getting now

(Chart 8).

Chart 8: The

Heart Truths Singaporeans Earn The LOWEST Wages Among The High-Income

Countries

FACT #8: Our CPF of $230 billion has helped to earn $1

trillion.

Do you know that in 2012, the

total CPF members’ balances is $230 billion? The

Singapore Financial Reserves is close to $1 trillion dollars, or $1,000

billion.

Do you know that our CPF of $230 billion has helped to earn $1,000

billion?

And do you know that this $1 trillion is more than 4 times what we have in

our CPF?

If so, where is the rest of the $770 billion that our CPF has helped to earn,

if the money we helped to earn is not coming back to us (Chart 9)?

Chart 9

So, finally, if you can pull back and see the bigger picture – if you can see that Singaporeans are paid the lowest wages among the developed countries, we have to pay for one of the highest prices in the world, our retirement funds earn the lowest interest rates, and we have one of the least adequate retirement funds in the world, then you will understand why Singaporeans are trapped in a poverty and disempowerment cycle (Chart 10).

We are simply squeezed on all sides and Singaporeans genuinely have to

struggle to make ends meet!

Chart 10

This is no wonder why Singapore has the highest poverty rate among the

high-income countries and even when compared to the middle-income countries in

the region (Chart 11).

Chart 11: The

Heart Truths Poverty in Singapore Grew from 16% in 2002 to 28% in

2013

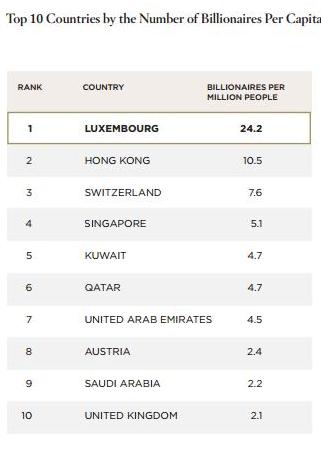

Does it thus make you wonder why even though Singapore has such a high rate

of poverty that we have the 18th largest billionaire population in the world

(Chart 12)?

Chart 12: Wealth-X

and UBS Billionaire Census 2013

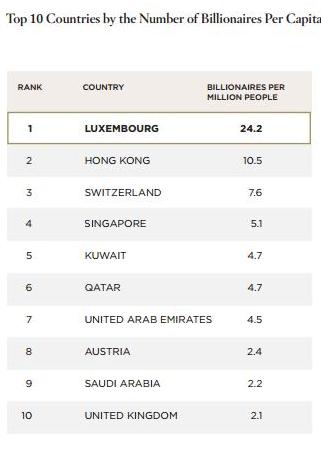

And that we have the 5th largest billionaire per capita population in the

world (Chart 13)?

Chart 13: Wealth-X

and UBS Billionaire Census 2013

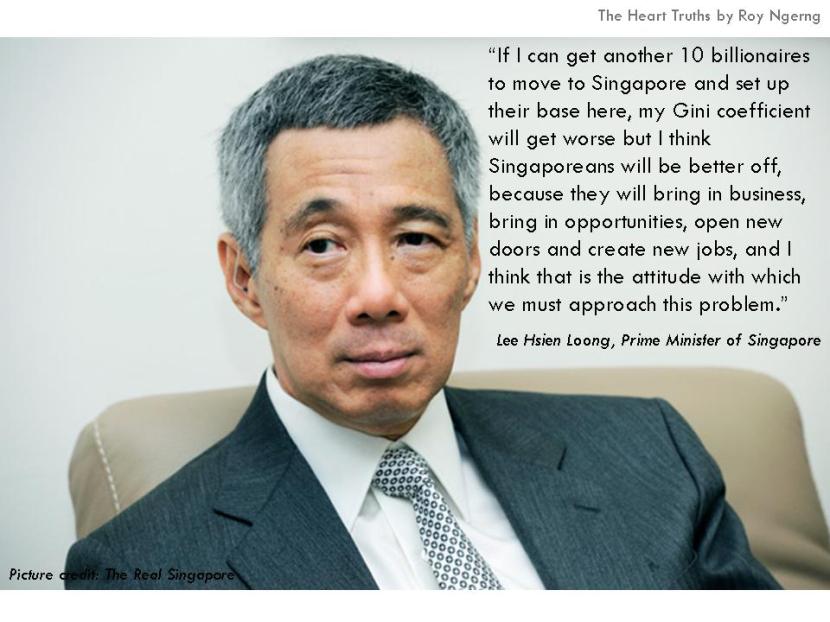

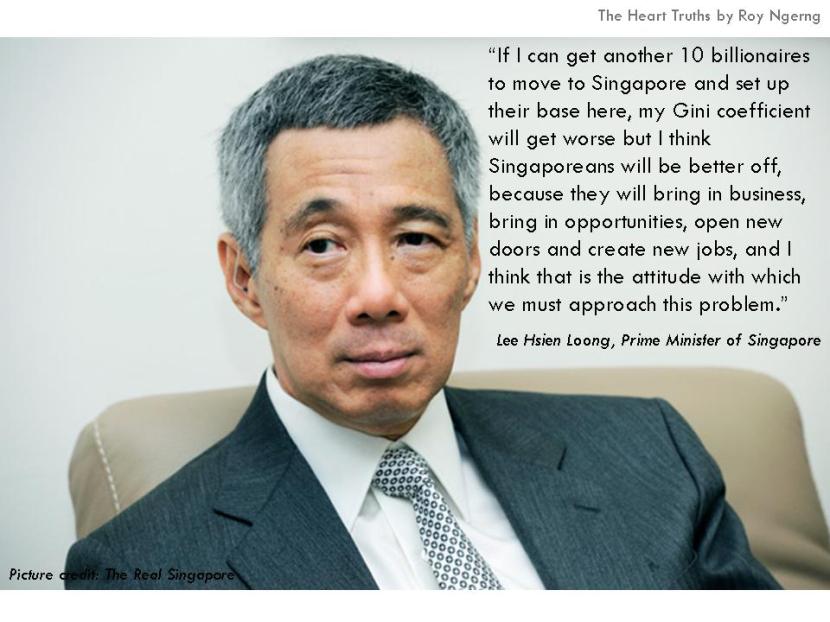

After knowing all these, do you agree with PM Lee when he said had said that,

“if

I can get another 10 billionaires to move to Singapore and set up their base

here, my Gini coefficient will get worse but I think Singaporeans will be better

off, because they will bring in business, bring in opportunities, open new doors

and create new jobs, and I think that is the attitude with which we must

approach this problem.“?

Can you agree with PM Lee when 69% of Singaporeans had said that they would

“expect

to continue in full-time or part-time work during so-called retirement” –

which is the highest in the region and higher than the average of the 55% in

this region.

Do you think this is right when Singapore is also the richest country, if

not, one of the richest country in the world, with one of the highest reserves,

the highest reserves per capita and one of the largest surpluses in the world?

Do you think this is right that there is still so much poor and where people

cannot afford to retire because they earn the lowest on their retirement

funds?

Many Singaporeans feel helpless at knowing this information. Some of them

ask, “but what can we do?”.

The question you need to ask is this – if the situation is already so stark

in Singapore, will another government be able to do better? If so, what can you

do?

This article is written as a third-parter to the first two parts of this

article. You can read Part 1 and Part 2 of the articles here

(Part 1) and here

(Part 2).

.

Roy Ngerng

* The author blogs at [url]http://thehearttruths.com/[/URL]

.

CPF!

FACT #1: Your CPF interest rate used to be higher at

6.5%.

Do you know that our CPF used to earn higher returns? The interest rates had

rose to 6.5% between 1975 and 1986, before dropping again. Those were the golden

years of our CPF (Chart 1).

The CPF interest rate of 2.5% that we are getting on our Ordinary Account

(OA) now is the lowest and is what we were getting between 1955 and 1962. In

fact, from 1963 to 1986 (for more than 20 years), the interest rate that we were

earning from our CPF had been above 5% – higher than what we receive on even the

4.5% on the Special and Medisave Accounts (SMA) now.

Chart 1

FACT #2: You will earn higher retirement funds in the 10 years

between 1976 and 1985 than now.

Let’s assume that a person was earning $3,000 every month in 2004 and he

continued to earn $3,000 for the next 10 years. In the last 10 years, between

2004 and 2013, using the OA interest rates of 2.5%, a person would earn about

$142,000 by 2013. Based on the SMA interest rates of 4%, a person would earn

about $155,000 by 2013.

But do you know that in the 10 years between 1976 and 1985, a person who had

earned $3,000 every year would be able to earn $202,000 by 1985 based on the

contribution and interest rates at that time – $50,000 more than the Singaporean

living in the present time (Chart 2)!

This means that Singaporeans were obtaining better returns in the mid-1970s

to mid-1980s than today!

Chart 2

FACT #3: You are paying up to a 12.5% tax on your CPF.

Right now, Singaporeans are earning only 2.5% and 4% on our CPF. However, our

CPF is being used to invest in the GIC and Temasek Holdings, which are earning

6.5% and 16% respectively.

If we look at our the portion of our CPF OA (earning 2.5%) which is invested

in the Temasek Holdings (earning 16%), do you know that the returns of 13.5%

(16% minus 2.5%) which we are not getting back on our CPF is actually an

implicit tax that we are paying to the government? Assuming that we need to pay

an administrative charge of 1% to the CPF for managing our CPF, this means that

we are paying an implicit tax of 12.5% (Chart 3).

Because the government isn’t returning the full earnings from our CPF to us,

this 12.5% that is not returned to us is effectively what we pay to the

government as tax on our CPF.

Chart 3

FACT #4: We can only use 15.5% of our CPF funds for

retirement.

Do you know that Singaporeans

use about 75% of our CPF for housing? Up to

another 9.5% is set aside for Medisave.

This means that we are left with only 15.5% (Chart 4).

This means that we can only retire on 15.5% of our retirement funds. So,

Prime Minister Lee Hsien Loong might say that, “each poor

household has on average $200,000 of net wealth in the HDB flat“. So, what

is PM Lee’s solution for poor Singaporeans who would need the $200,000 to use

for retirement? Sell their homes? Then what would happen to the children who

live in these homes with their parents, or the parents who live with their

children? Become homeless too?

Chart 4

FACT #5: If we get the full returns back on our CPF, we would be able

to retire with 50% of our CPF.

Assuming that you would be able to obtain the 15% interest returns from the

Temasek Holdings (16% minus 1% administrative charge), and assuming that the

funds in your CPF is managed by the Temasek Holdings, do you know that you would

only need to use only about 37% of your CPF for housing, instead of the 75%

now?

The 2.5% to 4% interest that we are earning now means that we have to spend

75% of our retirement funds on housing. But if we are able to get the full

returns of our CPF back, we need to only pay as low as 37% to housing (Chart

5).

If we are able to get the full returns of our CPF back, we would be able to

retire with 50% of our CPF savings, instead of the 15.5% now!

Chart 5

FACT #6: Singaporeans earn the lowest interest rates on our CPF as

compared to the other countries.

Since 2000, Singaporeans have been earning 2.5% to 4% on our provident funds.

Some commenters had said that this interest rate is “guaranteed” and is high.

Let’s take a look at the “guaranteed” interest rates of the other countries.

Do you know that when compared to the other countries with social security or

provident funds, we actually earn the lowest average returns since 2000 (Chart

6).

Quite obviously, 2.5% to 4% can hardly be considered high at all! The

commenters who had championed the high “guaranteed” interest rates might need to

check their facts again.

Chart 6: The

Heart Truths SHOCKING Facts About Our CPF in Singapore! (Part 2)

FACT #7: Singaporeans earn the lowest CPF returns because we start

off on a lower base – we earn the lowest wages.

Also, some commenters had said that CPF is “your money” because it’s money

that we earn and keep for ourselves.

But as I’ve mentioned above, we earn the lowest interest rates on our CPF,

and because interest rates are the lowest now in Singapore’s history, we

actually earn a lower amount than what we would used to be able to earn in the

early 1980s.

So, because we

pay the highest contribution rates but earn the lowest interest rates, we have

one of the least adequate retirement funds in the world.

Simply put, the government is not returning to us into our CPF what we should

rightfully earn from our CPF.

But more importantly, do you also know why our CPF can hardly grow as much as

it should?

Do you know that even though Singapore is the richest, if not, one of the

richest countries in the world, and do you know that even though we have one of

the highest prices in the world, Singaporeans

are actually paid the lowest wages among the high-income countries (Chart

7).

Chart 7: The

Heart Truths Singaporeans Earn The LOWEST Wages Among The High-Income

Countries

If our wages are on par with other countries with a similar level of income

and price level, the median wage in Singapore at this moment should be about

$4,500, instead

of the $3,000 now.

Assuming that we had used the example in Fact #2, if Singaporeans are to earn

a wage that is on par to that of a high-income country and we are able to earn

the full returns on our CPF, Singaporeans would have accumulated a CPF savings

of up to $500,000, or more than 3 times as much as what we are getting now

(Chart 8).

Chart 8: The

Heart Truths Singaporeans Earn The LOWEST Wages Among The High-Income

Countries

FACT #8: Our CPF of $230 billion has helped to earn $1

trillion.

Do you know that in 2012, the

total CPF members’ balances is $230 billion? The

Singapore Financial Reserves is close to $1 trillion dollars, or $1,000

billion.

Do you know that our CPF of $230 billion has helped to earn $1,000

billion?

And do you know that this $1 trillion is more than 4 times what we have in

our CPF?

If so, where is the rest of the $770 billion that our CPF has helped to earn,

if the money we helped to earn is not coming back to us (Chart 9)?

Chart 9

So, finally, if you can pull back and see the bigger picture – if you can see that Singaporeans are paid the lowest wages among the developed countries, we have to pay for one of the highest prices in the world, our retirement funds earn the lowest interest rates, and we have one of the least adequate retirement funds in the world, then you will understand why Singaporeans are trapped in a poverty and disempowerment cycle (Chart 10).

We are simply squeezed on all sides and Singaporeans genuinely have to

struggle to make ends meet!

Chart 10

This is no wonder why Singapore has the highest poverty rate among the

high-income countries and even when compared to the middle-income countries in

the region (Chart 11).

Chart 11: The

Heart Truths Poverty in Singapore Grew from 16% in 2002 to 28% in

2013

Does it thus make you wonder why even though Singapore has such a high rate

of poverty that we have the 18th largest billionaire population in the world

(Chart 12)?

Chart 12: Wealth-X

and UBS Billionaire Census 2013

And that we have the 5th largest billionaire per capita population in the

world (Chart 13)?

Chart 13: Wealth-X

and UBS Billionaire Census 2013

After knowing all these, do you agree with PM Lee when he said had said that,

“if

I can get another 10 billionaires to move to Singapore and set up their base

here, my Gini coefficient will get worse but I think Singaporeans will be better

off, because they will bring in business, bring in opportunities, open new doors

and create new jobs, and I think that is the attitude with which we must

approach this problem.“?

Can you agree with PM Lee when 69% of Singaporeans had said that they would

“expect

to continue in full-time or part-time work during so-called retirement” –

which is the highest in the region and higher than the average of the 55% in

this region.

Do you think this is right when Singapore is also the richest country, if

not, one of the richest country in the world, with one of the highest reserves,

the highest reserves per capita and one of the largest surpluses in the world?

Do you think this is right that there is still so much poor and where people

cannot afford to retire because they earn the lowest on their retirement

funds?

Many Singaporeans feel helpless at knowing this information. Some of them

ask, “but what can we do?”.

The question you need to ask is this – if the situation is already so stark

in Singapore, will another government be able to do better? If so, what can you

do?

This article is written as a third-parter to the first two parts of this

article. You can read Part 1 and Part 2 of the articles here

(Part 1) and here

(Part 2).

.

Roy Ngerng

* The author blogs at [url]http://thehearttruths.com/[/URL]

.