So why are we using gold as the yardstick? Because it’s the most reliable monetary yardstick in history.

For over 6,000 years, gold has served humanity as the premier form of money and store of value. While it temporarily fell out of favor starting in the 1970s, it’s now making a powerful comeback as the world begins to recognize the deep flaws in our fiat money and monetary system—flaws that have led to rampant inflation and terrifying financial instability.

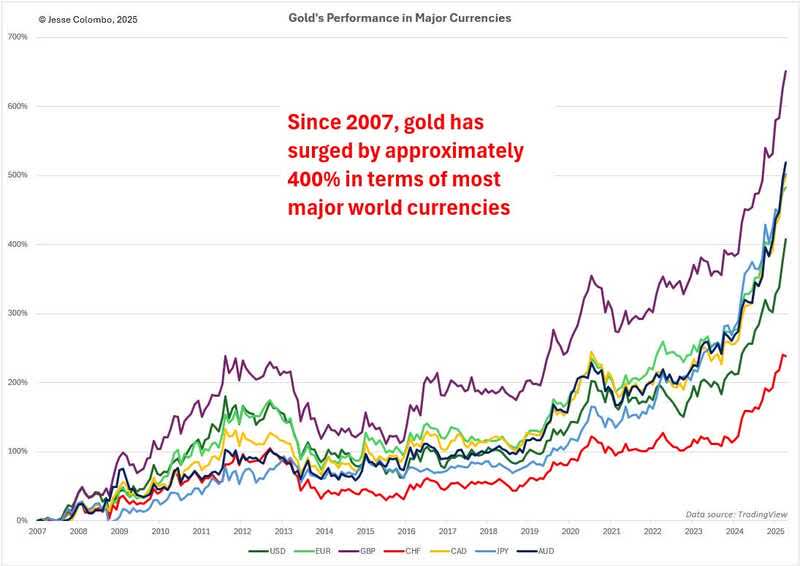

That’s why people around the globe are turning back to gold in increasing numbers, helping drive its price to nearly double over the past five years. And in my view, this move is still in its early stages.

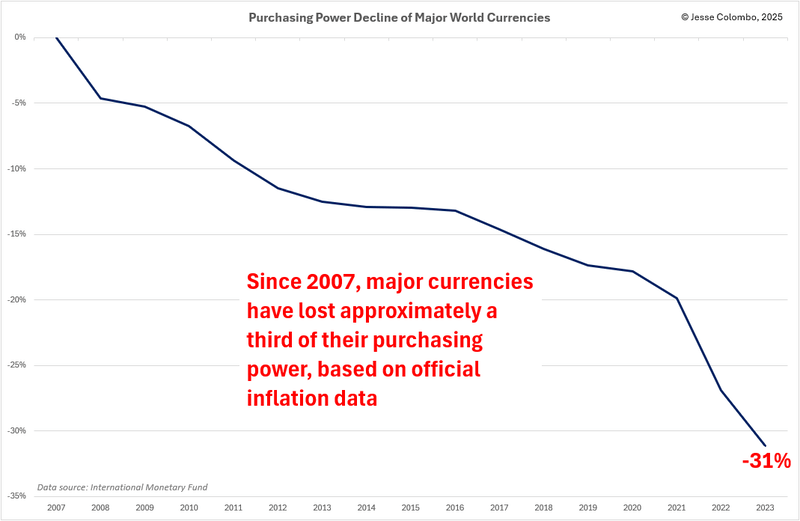

If you're skeptical about using gold as a yardstick for measuring currency purchasing power, rest assured—its decline is confirmed by other metrics as well. The most widely used is the Consumer Price Index (CPI), which tracks the average change in prices over time for a fixed basket of goods and services.

I calculated the average CPI for the major world currencies referenced throughout this article and found that, on average, they’ve lost 31% of their purchasing power since 2007.

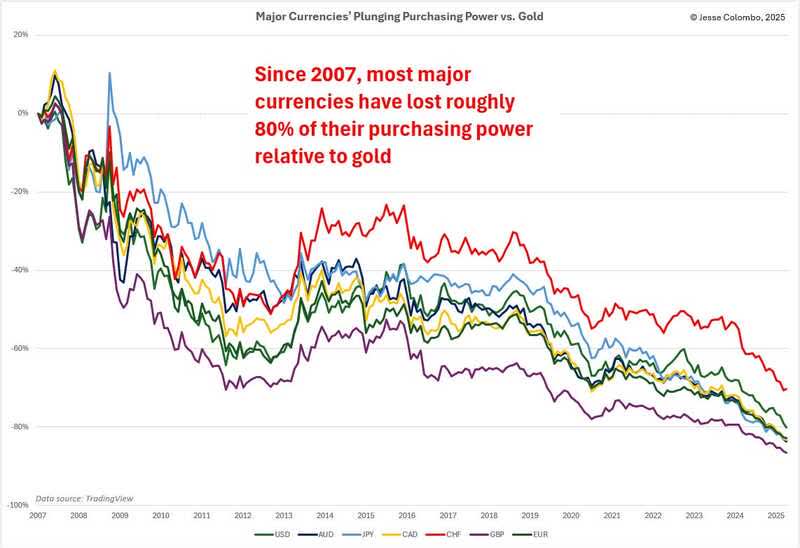

The resulting chart closely mirrors the gold-based purchasing power chart shown earlier, with the steepest declines occurring during two key periods: 2007 to 2012 and 2020 to 2023—both of which were periods of heavy monetary expansion during recessions.

Now, I realize there’s a noticeable discrepancy between the roughly 80% loss of purchasing power in terms of gold and the 31% loss according to official CPI data.