Singapore fintech MoneyHero tumbles in trading debut after merger with US Spac

Chief executive Prashant Aggarwal (centre) said the group opted to list in the US to gain exposure to a larger and more diverse investor base. PHOTO: MONEYHERO

Kang Wan Chern

Deputy Business Editor

OCT 17, 2023

SINGAPORE – Financial products platform MoneyHero Group fell on its first day of trading on the Nasdaq stock exchange, as it joined a list of Singapore start-ups going public in the US despite poorer investor appetite for growth stocks in 2023.

Shares of MoneyHero, which is dual-headquartered in Singapore and Hong Kong, sank 42.2 per cent from their opening price of around US$5.39 to close at US$3.39 on Friday, when they began trading after the firm’s merger with Bridgetown Holdings.

Nasdaq-listed Bridgetown is a special purpose acquisition company (Spac) backed by PayPal co-founder Peter Thiel’s venture capital firm Thiel Capital and Pacific Century Group, the private investment vehicle of Mr Richard Li, son of Hong Kong tycoon Li Ka Shing.

The deal valued MoneyHero at an enterprise value, or total economic value taking into account the firm’s equity and debt, of US$310 million (S$425 million), the fintech firm said on Friday.

MoneyHero chief executive Prashant Aggarwal told The Straits Times that the company received US$100 million in gross proceeds from the merger, which it will utilise to expand its existing portfolio of products in South-east Asia and invest in new products such as insurance and rewards programmes.

The fintech firm operates online platforms that compare and recommend personal financial products such as credit cards, personal loans, mortgages and insurance.

These include personal finance websites SingSaver and Seedly in Singapore, its largest market, and other similar platforms in Hong Kong, Taiwan, Malaysia and the Philippines.

The firm earns a fee each time a consumer signs up for a service with the financial institutions through one of these platforms.

It has approximately 9.1 million unique monthly users and more than 270 commercial partner relationships with financial institutions, and in 2022 saw a total of 1.3 million product service applications, up 62.5 per cent from 2021.

MoneyHero competes with other platforms such as MoneySmart, which is aiming for an initial public offering (IPO) within the next two years.

GoBear, another Singapore-based firm offering similar services, shuttered in 2021 due to the inability to raise funds.

Mr Aggarwal said MoneyHero opted to list in the United States to gain exposure to a larger and more diverse investor base at a time when interest in South-east Asian tech companies is high.

“This can be seen from the low redemption levels of 36 per cent (in Bridgetown public shares) despite the current market conditions. In other markets, redemptions can be as high as 90 per cent, especially in this climate,” he said.

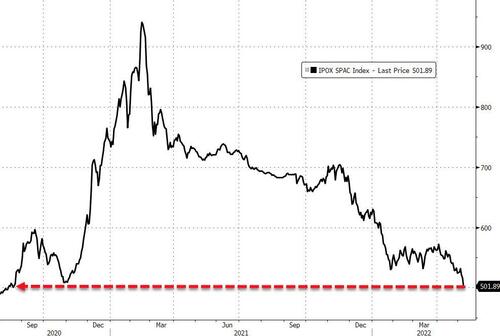

Spacs are shell companies formed to raise capital through an IPO with the intention of later acquiring or merging with an existing private company.

Share redemptions provide investors who do not agree with the acquisition target or its valuation with an option to redeem their shares and recover their initial investment in the Spac before it completes the transaction.

Mr Aggarwal added that US investors are excited about MoneyHero’s “deep understanding and growth potential in Singapore as well as other emerging markets in South-east Asia”, leading to the merger with Bridgetown.

MoneyHero is also backed by Mr Richard Li, who participated in funding rounds for the firm in the past.

MoneyHero was founded in Singapore in 2014 as CompareAsia Group.

It rebranded to Hyphen Group after acquiring product review platform Seedly from fintech firm ShopBack in 2020, and now trades under the MNY ticker following the merger with Bridgetown.

The company, which has yet to turn profitable, in 2022 implemented a restructuring to bring down costs.

This involved two rounds of layoffs – which included its then CEO of more than six years. Mr Aggarwal, who joined MoneyHero in 2016 as its chief commercial officer, took over as CEO in April 2022.

The firm now employs a total of 349 staff across five markets, 99 of whom are in Singapore. It has a headcount of 129 in the Philippines, which is its fastest-growing market.

Consequently, MoneyHero was able to bring down its adjusted operational losses to US$900,000 for the first half of 2023, compared with losses of US$5.6 million in the second half of 2022, and US$10.9 million in the first half of 2022. Revenue for the period remained flat at US$34.9 million.

This is MoneyHero’s second attempt at going public after a merger reportedly valuing it at US$1 billion with blank-cheque company Provident Acquisition Corporation in 2021 fell through.

Referring to the big difference in the company’s valuation then and now, Mr Aggarwal said: “Investors have matured in how they look at growth start-ups. Just a few years ago, valuations were all about topline growth at the expense of bottom lines, but now they expect more sustainable growth.”

The recent merger also comes three years after Mr Li and Mr Thiel first took Bridgetown public as a Spac targeting South-east Asia tech start-ups in October 2020.

The pair listed a second blank-cheque company, Bridgetown 2, on the New York Stock Exchange in January 2021.

It later merged with Singapore online real estate firm PropertyGuru in March 2022. Shares of PropertyGuru have halved since they began trading.

The other Singapore company to have gone public via a Spac in the US is Grab Holdings, which merged with Nasdaq-listed Altimeter Growth Corp in December 2021. Shares of Grab are down nearly 69 per cent since then.