Even AMDKs know it is known as CECA Business Park lol!

Changi Business Park emptying out as global tech, finance layoffs take toll

[IMG alt="Changi Business Park Photographer: Aparna Nori/Bloomberg

"]

https://cassette.sphdigital.com.sg/...5b0dd66fdded3586785?q=20&w=3&h=2&f=webp[/IMG]

SINGAPORE’S commercial real estate market has been a standout amid a global downturn, with one major exception.

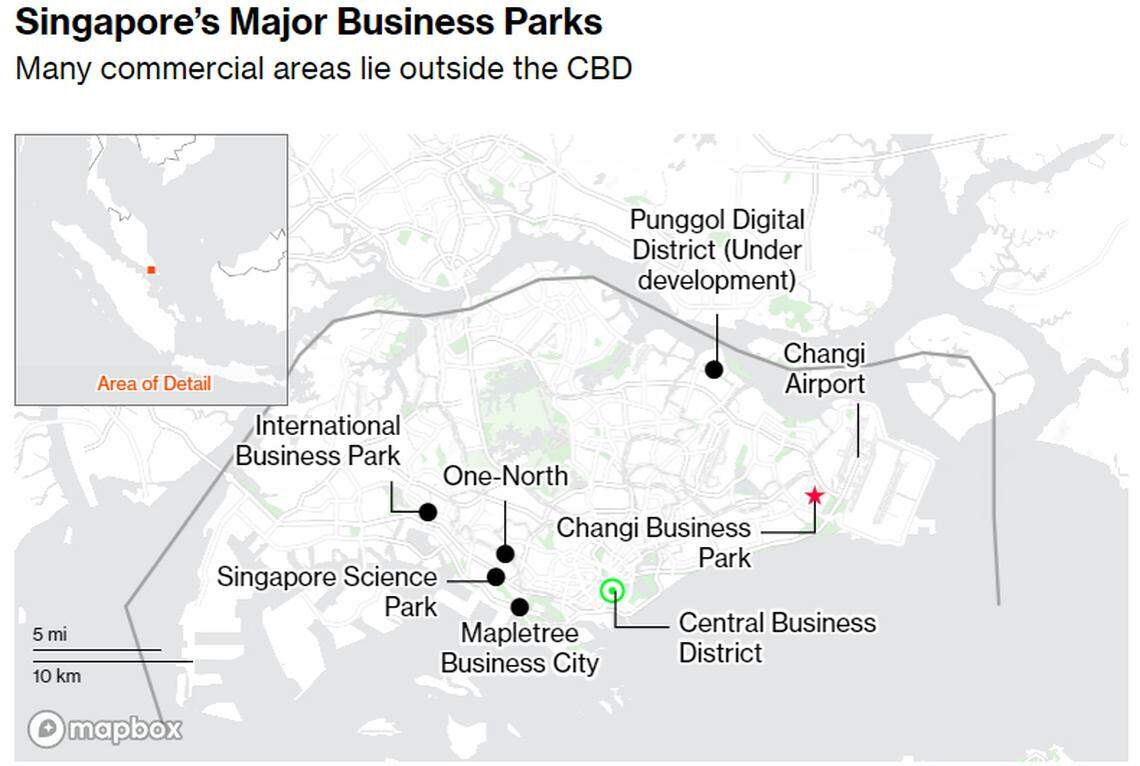

Just nine miles from the gleaming skyscrapers that crowd the country’s Central Business District sits a 71-hectare (175-acre), billion-dollar example of the city-state’s push to create alternative business hubs. Changi Business Park dubbed the “CBD of the East” was a big draw for tech giants including International Business Machines (IBM) and Advanced Micro Devices. Global banks from JPMorgan Chase to Citigroup have also situated their back-end staff there.

The business park is now rapidly emptying out, dealing a blow to the Singapore government’s meticulous urban planning and efforts to get foreign businesses to expand their regional operations in the South-east Asian island nation. Overall vacancy rates across 10 commercial properties there tracked by property consultancy Cushman & Wakefield have more than doubled in the past three years to nearly 40 per cent.

The development’s woes show how global tech and finance layoffs, together with the push to work from home since the pandemic, are even overpowering a project with powerful government support in one of the world’s most desirable financial hubs. Changi’s struggles contrast with Singapore’s packed downtown, where prime office rents soared to a 15-year high earlier this year and buildings are almost full.

IBM, which occupied two namesake buildings with a total of 12 floors at Changi, has reduced its presence to two floors, according to sources familiar with the situation, who asked not to be identified discussing private matters. UBS Group has cut the more than 110,000 square feet (10,220 square metres) of space it occupied by more than half. Standard Chartered, which owns two buildings in the park, has been seeking to lease out two floors with at least 58,000 square feet of office space, according to a property listing.

During a recent visit to Changi, several buildings had “For Rent” signs plastered outside their modern glass facades, including the space IBM formerly occupied, which is owned by government agency JTC. PHOTO: BLOOMBERG

During a recent visit to Changi, several buildings had “For Rent” signs plastered outside their modern glass facades, including the space IBM formerly occupied, which is owned by government agency JTC. Hansapoint, a seven-storey development with landscaped gardens and a gym, was only 36.5 per cent occupied at the end of 2023 following UBS’s downsizing. It was close to full previously. The Swiss bank declined to comment.

A NEWSLETTER FOR YOU

Tuesday, 12 pm

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

Hansapoint is owned by CapitaLand Ascendas Reit, one of Singapore’s largest commercial landlords. The overall occupancy of the real estate investment trust’s more than 2.3 million square feet of lettable space in the park has dropped to about 76 per cent at end-2023, from nearly 94 per cent four years earlier. Some of its under-performing business park units in Changi and elsewhere are being offered at a “three-for-two” rate – meaning that tenants can get one year’s rent free if they sign a new three-year lease, according to sources familiar with the matter and a promotional campaign online.

A spokesperson for the Reit said it is in discussions with prospects for Changi Business Park, and that it employs a wide range of incentives to engage with potential clients and existing tenants. The firm’s overall business space and life sciences portfolio occupancy exceeds the industrial average in the country, the spokesperson said.

Singapore remains a critical global hub for Standard Chartered, where over 80 per cent of its staff here have adopted flexible work arrangements, a spokesperson for the British lender said. The bank retains a significant presence at Changi Business Park and the downtown Marina Bay Financial Centre, he said. IBM, which also retains three floors at MBFC, said it remains committed to its local operations, and its “optimisation” of space at Changi in recent years has been shaped in part by its hybrid working model and the spin-off of its managed infrastructure services business.

‘Changalore’

While the challenges faced by Singapore’s business park landlords mirror those in other parts of the world, there are also some uniquely local issues that make marketing the properties an uphill effort.

Conceptualised in the early 1990s, Changi Business Park is part of a decades-long decentralisation drive by authorities, which include plans to develop a new CBD in the island’s west. The park is situated between Changi Airport – one of the world’s busiest aerodromes – and the country’s largest exhibition venue.

But for Singapore, white-collar workers who prefer being in the central district, the business park is still a prohibitively far-out location. A bank employee who asked not to be named said she spends at least 90 minutes commuting each way via public transport, which costs around US$2. A taxi or a ride-hailing service would take less than half the time, but can cost as much as US$45 during peak hours, she added.

To make the commute easier, companies such as Standard Chartered have arranged for shuttle buses to ferry staffers from their downtown locations or subway stations to Changi. PHOTO: BLOOMBERG

To make the commute easier, companies such as Standard Chartered have arranged for shuttle buses to ferry staffers from their downtown locations or subway stations to Changi. Singapore is building a new underground subway line to slash travelling times from one end of the island to the other, but it is years away from completion.

Changi Business Park has also become a lightning rod for citizens’ anxieties about the city-state’s wooing of foreign labour to meet business needs. The predominance of technical operations there has led to what a minister once said was a “concentration” of Indian expatriate workers, with some locals calling the area “Chennai Business Park” or “Changalore”.

Note: Approximate location shown for developments with multiple buildings. Not all business park areas shown.SOURCE: JTC

Singapore authorities have tightened immigration policies in recent years, such as by hiking minimum salary thresholds for work visa holders. That has pushed up hiring costs for businesses, making them consider basing their regional back-end staff in cheaper countries such as neighbouring Malaysia. Some banks are using the threat of moving there as a negotiating tactic to get landlords to cut their rents in business spaces, according to a source familiar with discussions on rental renewals.

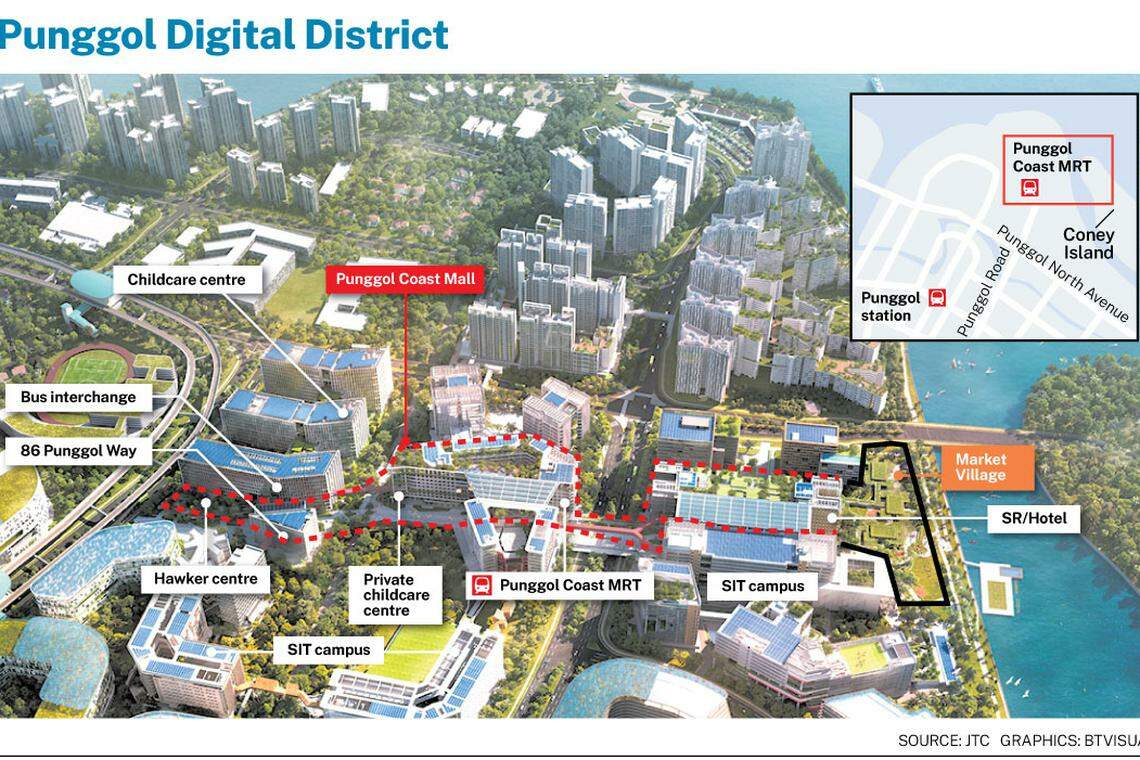

Elsewhere, new supply is set to further challenge the market. Punggol Digital District, a 50-hectare business park developed by JTC in Singapore’s northeast, will start opening in stages from later this year. One source involved in marketing Changi’s properties described the effect of the new space as killing an already dying patient.

JTC said the Punggol project is an example of its efforts to keep business parks attractive. “While there appears to be increasing vacancies in older estates, we do not see this as a reflection of inherent weakness in any specific sector,” the agency said.

Souring investors

Overall business park vacancies in Singapore rose to about 22 per cent during the first quarter, the highest level in over a decade, according to government data compiled by property consultancy Colliers International Group. Google parent Alphabet has given up about 60,000 square feet of space at Mapletree Business City, a business park on the fringes of the city centre. A Google spokesperson said the firm is working to ensure its real estate investments match the current and future needs of its hybrid workforce.

Investor confidence has been hit. Since last year, another Reit, Mapletree Industrial Trust, has been seeking to divest three of its Singapore business park assets worth S$533 million, including a nine-storey building called The Signature in Changi, sources familiar with the matter said. A spokesperson for the Reit, which is backed by state investor Temasek Holdings, declined to comment.

Local developer Frasers Property recently reached a deal to sell a serviced apartment and hotel complex in the heart of the park, which chief executive officer Panote Sirivadhanabhakdi attributed partly to the “structural challenge” industrial and business parks are now facing.

To be sure, Changi recently recorded some success. Julius Baer Group in April said it relocated close to 700 staff from Mapletree Business City to a larger space spanning over 75,000 square feet in the business park. The Swiss wealth-management firm also has an office in Singapore’s Marina Bay area.

For the remaining vacant areas, the search for tenants continues. The once-occupied floors of the IBM building have fallen silent. One floor displays a dusty sign asking staff to move out by end-2022, while another still has cubicles and furniture, but no people. BLOOMBERG