-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Singapore Property prices expected to crash badly soon

- Thread starter 8::::::D

- Start date

- Joined

- Nov 9, 2012

- Messages

- 4,977

- Points

- 113

Many months ago my very dear bro @sos also said that COE would crash but it never happen and instead COE has sky rocketed

- Joined

- May 16, 2023

- Messages

- 30,313

- Points

- 113

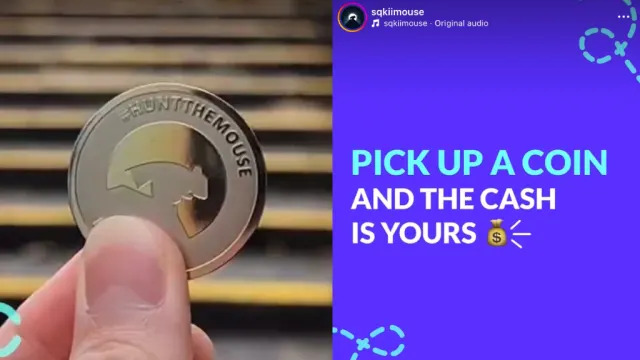

Join the free hunt for a $380,000 coin hidden somewhere in Singapore

Carl SamsonFri, 11 October 2024 at 3:07 am SGT1-min read

[Source]

A cash hunt game known as “Hunt The Mouse” returns to Singapore from Oct. 10 to Nov. 9, with its biggest-ever prize pool of 1 million Singaporean dollars ($765,000).

Dubbed the “world’s simplest million-dollar cash hunt,” the game requires players to look for a gold coin worth 500,000 Singaporean dollar ($382,500), 175 silver coins each worth 2,500 Singaporean dollars ($1,912) and 125 silver coins each worth 500 Singaporean dollars ($382.5), which are hidden progressively across the city state. Players can follow daily hints on Sqkii’s — the gamification marketing company behind the hunt — Facebook, Instagram and Telegram and use a real-time map to track coin locations.

ADVERTISEMENT

To date, over 400,000 Singaporean dollars ($306,000) in prizes has been awarded to 193 winners, CEO Kenny Choi told Mothership. The free-to-play game is open to both residents and tourists and offers additional rewards through power-ups.

- Joined

- Jun 21, 2010

- Messages

- 34,324

- Points

- 113

Those who missed the boat of the million dollar Hdb flats now become naysayers talking market down. Pap is in control they have vested interests they will never let the property market fall. It’s easy to prop up a market country like sg. Pap in full control of all the organs of state at their disposal

- Joined

- Mar 3, 2024

- Messages

- 3,282

- Points

- 113

Property won’t crash because it is the cash cow for the pap. At the end of the day, most sheeple huat also due to this scam

- Joined

- Aug 10, 2008

- Messages

- 11,669

- Points

- 113

Singapore housing won't crush ! Don't worry.

It will go down a bit lower. Not crushed !

- Joined

- Oct 5, 2018

- Messages

- 16,415

- Points

- 113

6 million population now, how to crash?

more sinkies will jump becos of rising costs, rising interest rates plus retrenchment. Buy beyond your fucking means becos must hao lian. Sinkies deserve every piece of shit that hits the fanFED U-turned from interest rate cut to berhenti and may start to increase the rate soon

inflation thus rises and it will drive up property price

- Joined

- May 16, 2023

- Messages

- 30,313

- Points

- 113

- Joined

- May 16, 2023

- Messages

- 30,313

- Points

- 113

What Is a Reverse Repurchase Agreement (RRP)? How It Works, With Example

By

James Chen

Updated May 08, 2024

Reviewed by

Thomas J. Catalano

Fact checked by

Vikki Velasquez

:max_bytes(150000):strip_icc():format(webp)/TermDefinitions_reversepurchaseagreement-9900cc299b4e4741b5b3846243e32a9a.jpg)

Jessica Olah / Investopedia

What Is a Reverse Repurchase Agreement (RRP)?

A reverse repurchase agreement (RRP), or reverse repo, is the sale of securities with the agreement to repurchase them at a higher price at a specific future date. A reverse repo refers to the seller side of a repurchase agreement (RP), or repo.These transactions, which often occur between two banks, are essentially collateralized loans. The difference between the original purchase price and the buyback price, along with the timing of the transaction (often overnight), equates to interest paid by the seller to the buyer. The reverse repo is the final step in the repurchase agreement, closing the contract.

- Joined

- May 16, 2023

- Messages

- 30,313

- Points

- 113

Key Takeaways

- A reverse repurchase agreement is a short-term agreement to sell securities in order to buy them back at a slightly higher price.

- Repurchase agreements (RPs, or repos) and reverse repos are used for short-term lending and borrowing, often overnight, for banks looking to fulfill their reserve requirements.

- Central banks use repos and reverse repos to add and remove from the money supply via open market operations.

Similar threads

- Replies

- 0

- Views

- 229

- Replies

- 2

- Views

- 214

- Replies

- 4

- Views

- 510

- Replies

- 15

- Views

- 1K