Join the free hunt for a $380,000 coin hidden somewhere in Singapore

Carl Samson

Fri, 11 October 2024 at 3:07 am SGT1-min read

[

Source]

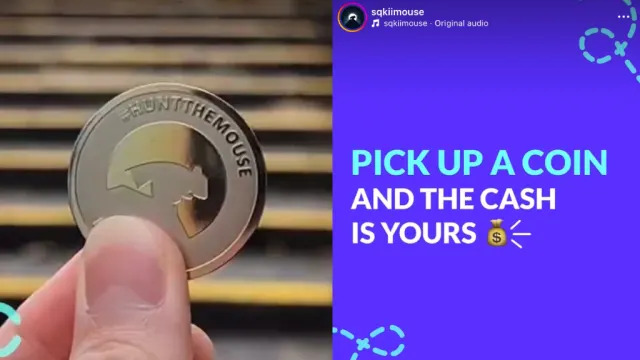

A cash hunt game known as “Hunt The Mouse” returns to Singapore from Oct. 10 to Nov. 9, with its biggest-ever prize pool of 1 million Singaporean dollars ($765,000).

Dubbed the “world’s simplest million-dollar cash hunt,” the

game requires players to look for a gold coin worth 500,000 Singaporean dollar ($382,500), 175 silver coins each worth 2,500 Singaporean dollars ($1,912) and 125 silver coins each worth 500 Singaporean dollars ($382.5), which are hidden progressively across

the city state. Players can follow daily hints on

Sqkii’s — the gamification marketing company behind the hunt —

Facebook,

Instagram and

Telegram and use a real-time map to track coin locations.

ADVERTISEMENT

To date, over 400,000 Singaporean dollars ($306,000) in prizes has been awarded to 193 winners, CEO Kenny Choi told

Mothership. The free-to-play game is open to both residents and tourists and offers additional rewards through power-ups.

:max_bytes(150000):strip_icc():format(webp)/TermDefinitions_reversepurchaseagreement-9900cc299b4e4741b5b3846243e32a9a.jpg)